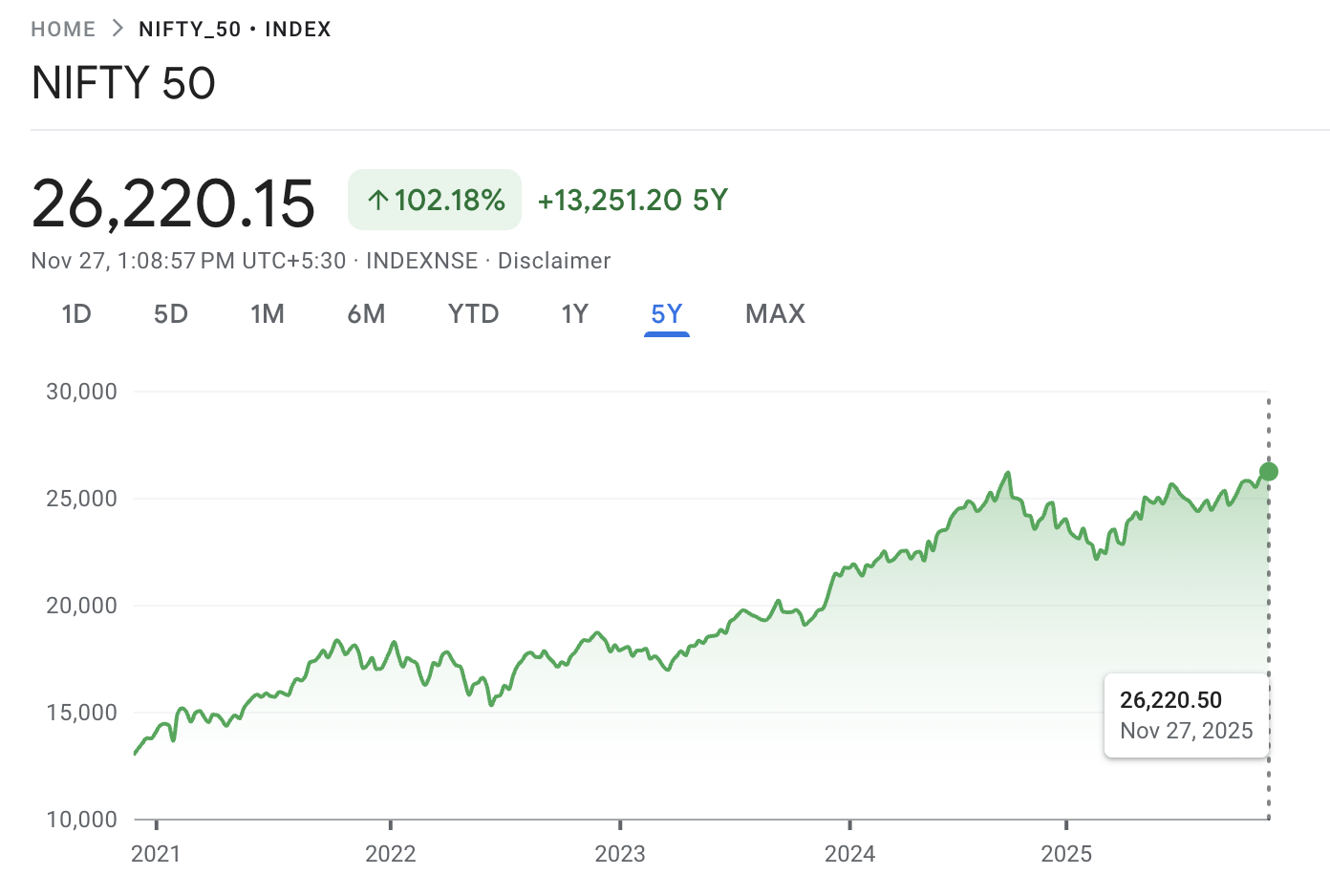

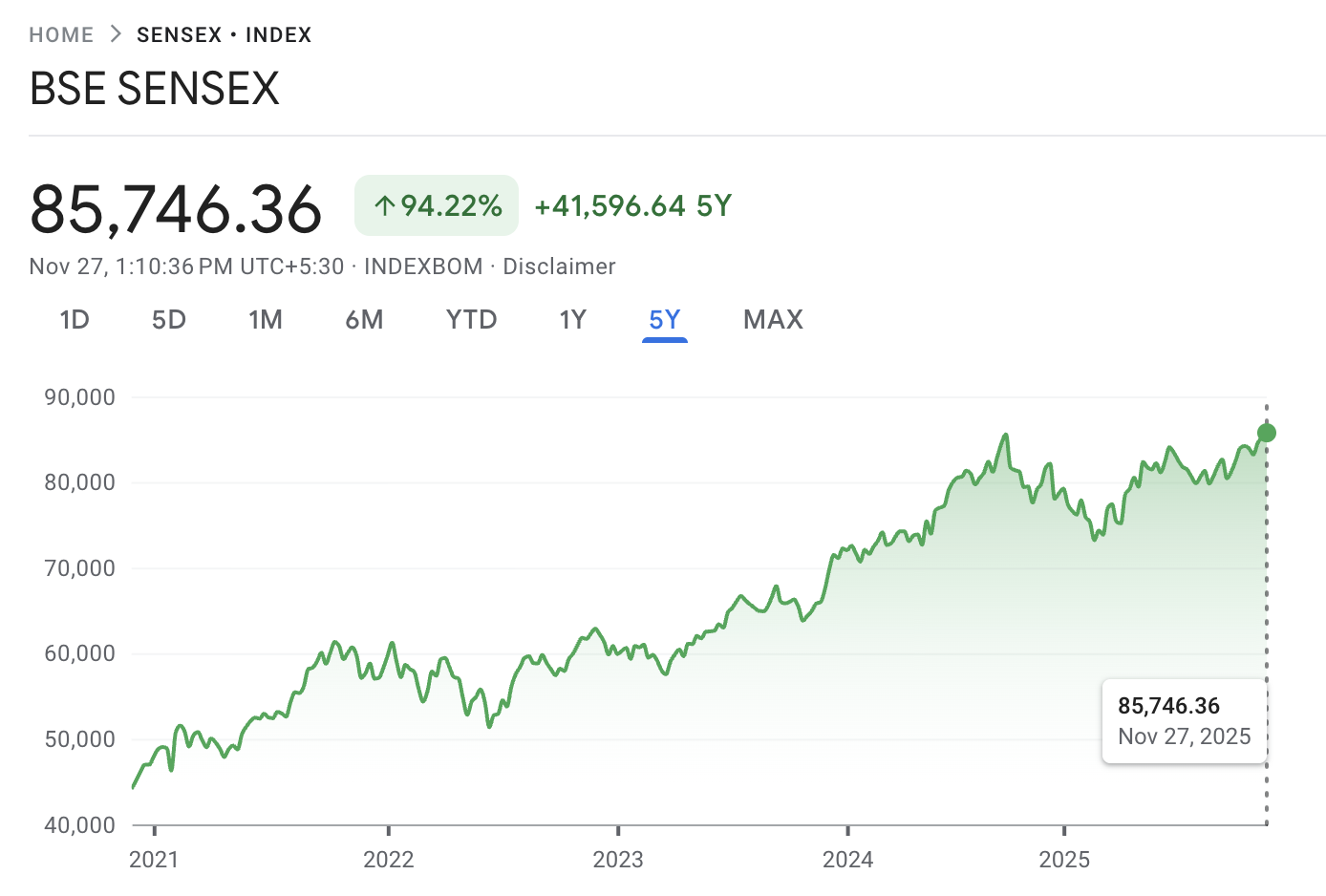

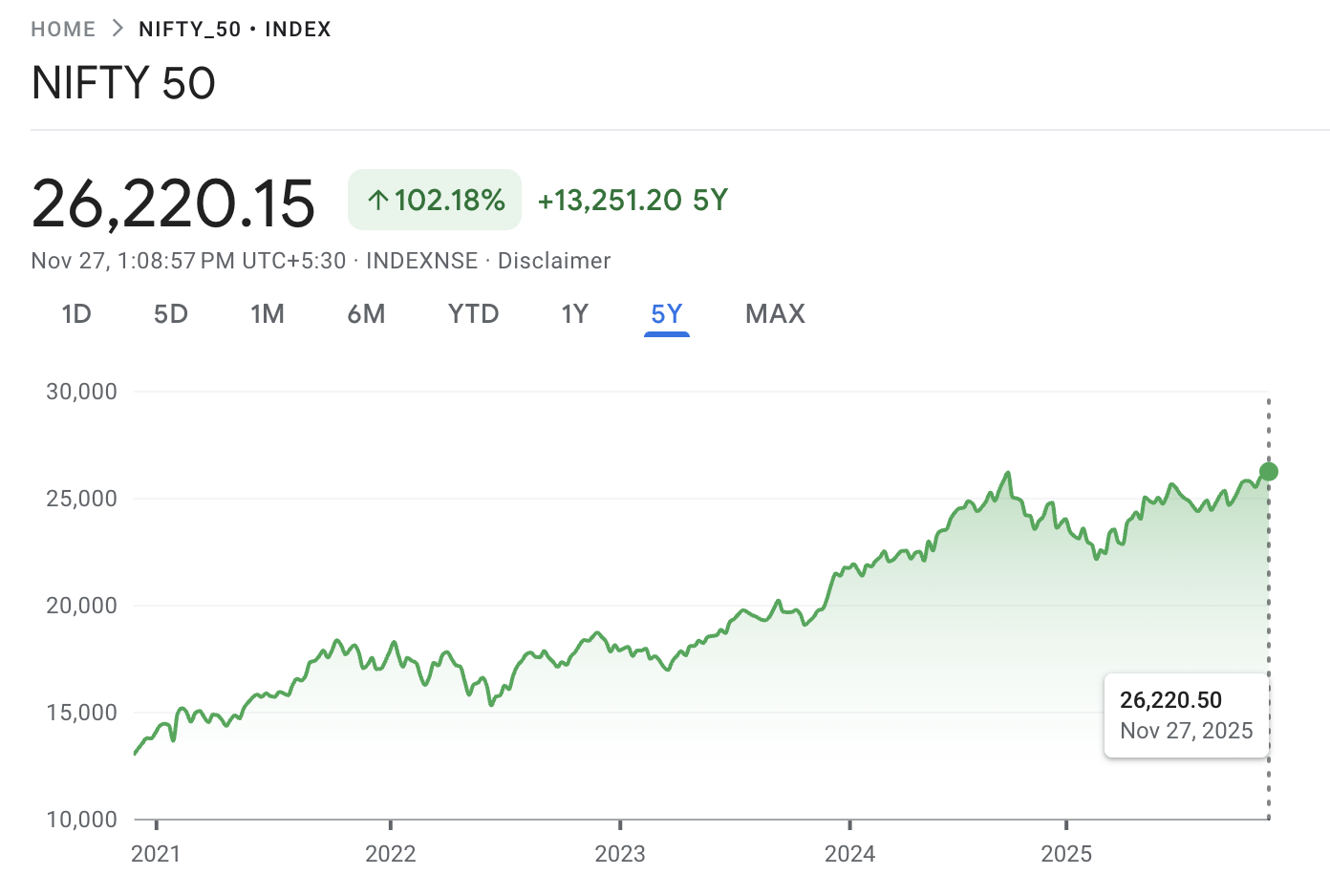

Sensex 86K, Nifty 26K: India Stocks Hit All-Time Highs

After more than a year of consolidation, the bulls are back in charge on Dalal Street.

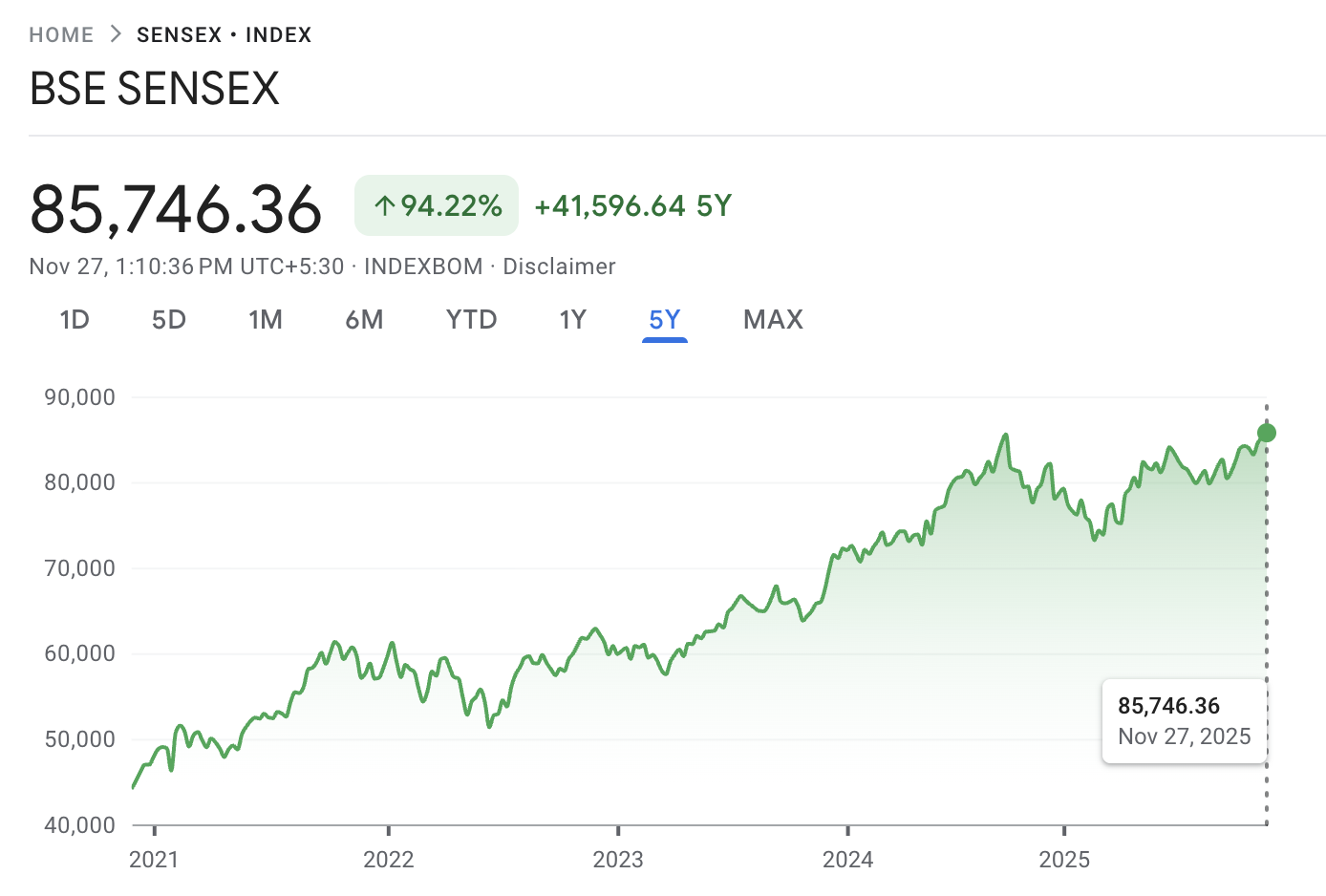

On 27 November 2025, Indian benchmark indices finally shattered their previous ceilings. The Nifty 50 scaled a fresh lifetime high of 26,307, while the Sensex crossed the historic 86,000 mark for the first time, reaching an intraday peak of 86,026.

This breakout ends a frustrating 14-month wait for investors. Since the previous peak in September 2024, the market had been stuck in a broad range, digesting high valuations and global volatility.

The catalyst? A "perfect storm" of positive signals: renewed foreign inflows, a dovish pivot from global central banks, and strong domestic GDP forecasts that reassert India’s status as the fastest-growing major economy.

This article is for information only and is not investment advice.

Nifty enters "Blue Sky" territory

With the close above 26,250, the Nifty has entered uncharted territory, meaning there is no overhead resistance left from historical price action.

Momentum: The Relative Strength Index (RSI) on the daily chart has climbed above 65, indicating strong momentum but not yet at "extreme overbought" levels (typically 75-80).

Support: The previous resistance at 26,000 now flips to become a critical support floor. As long as the index stays above this psychological mark, the "buy on dips" texture remains intact.

Targets: Fibonacci extension levels suggest the next technical targets could be 26,500 followed by 26,800.

Sensex

The break of 86,000 is a psychological victory. Traders will watch for a weekly close above this level to confirm that the breakout is not a "bull trap."

Fed Pivot And GDP Upgrades Fuel The Rally

Fed Pivot And GDP Upgrades Fuel The Rally

The primary engine for this move is global liquidity. With markets now pricing in an 85% chance of a US Federal Reserve rate cut in December, the US dollar has softened, prompting risk capital to flow back into Emerging Markets (EMs).

India is a prime beneficiary. After months of selling, Foreign Institutional Investors (FIIs) have turned decisive buyers, pouring in over ₹4,778 crore in a single session on November 26.

Domestically, the fundamental picture remains robust:

GDP Growth: The IMF projects India’s growth at 6.6% for FY2026, while ICICI Bank forecasts a robust 7.6% for the first half of the fiscal year.

Inflation: Headline inflation is described as "well contained," giving the Reserve Bank of India (RBI) room to potentially cut rates by 25 basis points in its upcoming December meeting.

Sector Watch: Financials and Industrials Lead The Charge

Unlike previous rallies driven by niche themes, this breakout is broad-based, with heavyweights doing the lifting.

1. Financials Wake Up

Banking stocks, which had underperformed for much of 2025, are leading the breakout. HDFC Bank and ICICI Bank fueled the Nifty’s rise, supported by Non-Banking Financial Companies (NBFCs).

The market is betting that rate cuts will lower the cost of funds and boost credit demand.

2. Consumption Plays

Despite mixed earnings earlier in the year, stocks like Asian Paints and Titan joined the rally, driven by hopes that a good monsoon and wedding season demand will revive rural consumption.

3. Industrials & Capex

Larsen & Toubro (L&T) continues to attract flows, serving as a proxy for the government's infrastructure push, which remains aggressive despite fiscal consolidation efforts.

Market Snapshot: The Breakout in Numbers

To put today's move in context, here is where the key indices stand as of 27 November 2025:

| Index |

Spot Level (Approx) |

Intraday High |

Key Milestone |

Status |

| Nifty 50 |

26,295 |

26,307 |

Breaks Sept 2024 Record |

Breakout |

| BSE Sensex |

85,920 |

86,026 |

Crosses 86k |

Breakout |

| Bank Nifty |

52,400 |

52,550 |

Approaches Record |

Bullish |

Key Takeaway: The "14-month breakout" is technically significant. The longer a market consolidates (moves sideways), the more explosive the eventual breakout tends to be. This suggests the rally could have legs if it holds above the breakout zone.

What Investors Are Watching Next

The sustainability of this rally depends on three upcoming triggers:

RBI MPC Meeting (Dec 3-5): Markets are pricing in a dovish tone. If the RBI holds rates and sounds hawkish on inflation, it could trigger a sharp profit-booking session.

US Non-Farm Payrolls: Weak US jobs data would cement the case for a Fed cut, weakening the dollar further and boosting inflows into India.

FII Consistency: One or two days of buying is positive, but for a sustained bull run, FIIs need to remain net buyers for several weeks to reverse the outflows seen earlier in 2025.

Investors Insight

The breakout changes the strategy from "range trading" to "trend following."

1. The "Wait and Watch" is Over

Investors who were sitting on cash waiting for a correction may now face "FOMO" (Fear Of Missing Out). The breakout confirms that the primary trend is up.

Strategy: Chasing gap-ups is risky. A better approach is to look for quality large-caps that haven't fully participated yet (like select IT or private bank stocks) or wait for a retest of the 26,000 support level to enter.

2. Rotation into High Beta

In a breakout phase, "high beta" sectors (like Realty, Metals, and PSU Banks) often outperform defensive sectors (like FMCG and Pharma). Investors might consider slightly increasing risk exposure if their portfolio is too defensive.

3. Valuation Disconnect

While price action is bullish, valuations remain high relative to historical averages. The Nifty trades at a premium to emerging market peers.

Caution: This is a liquidity-driven rally, not purely an earnings-driven one. If global flows dry up, the correction could be sharp. Stick to companies with visible earnings growth to justify the premium.

Trading India Markets with EBC Financial Group

The record-breaking volatility offers multiple avenues for active traders.

With EBC Financial Group, traders can:

Trade Indices: Access the broader market sentiment through indices that track Indian equity performance.

Hedge with USD/INR: The Indian Rupee is also reacting to these flows. Trade the currency pair to hedge equity portfolio risk.

Global Correlations: Trade Gold (XAU/USD) or US Oil, which often have inverse correlations to Indian equity sentiment, allowing for diversified strategies.

Note: Trading leveraged products involves a high level of risk and may not be suitable for all investors. You can lose more than your initial investment. Always consider your objectives and risk tolerance, and seek independent advice if needed.

Frequently Asked Questions (FAQ)

1. Why did the stock market hit a record high today?

The rally was driven by a combination of renewed foreign investor (FII) inflows, expectations of interest rate cuts by the US Fed and RBI, and strong GDP growth forecasts for India.

2. Is the market overvalued at Sensex 86,000?

Traditional valuation metrics (like P/E ratio) suggest the market is expensive compared to historical averages. However, markets can stay "expensive" for long periods during strong liquidity cycles.

3. What sectors are leading this rally?

Financials (Banks and NBFCs) are the primary leaders, followed by Industrials and select Consumer Discretionary stocks.

4. What is the next target for Nifty?

Technically, now that Nifty is in uncharted territory, analysts are looking at 26,500 and 26,800 as potential near-term targets based on Fibonacci extensions.

5. Should I buy Nifty now or wait?

Buying at all-time highs carries risk. Conservative investors often wait for a "retest" of the breakout level (around Nifty 26,000) to enter, while aggressive traders may ride the current momentum with strict stop-losses.

Conclusion

The "14-month curse" is broken. India’s stock market has successfully digested a year of global uncertainty to emerge at fresh record highs.

With the Nifty at 26,300 and Sensex above 86,000, the bulls have regained control, backed by the potent dual fuel of FII liquidity and domestic growth. While high valuations remain a concern for the long term, the immediate path of least resistance appears to be higher.

Investors should now focus on the upcoming central bank meetings in December, which will decide if this breakout turns into a sustained multi-month rally or a short-lived spike.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.