In 2025. investing in NASDAQ ETFs has become one of the most accessible ways for individuals to gain exposure to leading technology and growth companies in the United States. Whether you're planning to diversify your portfolio or get started with low-cost index investing, understanding how NASDAQ ETFs work can help you invest more confidently and avoid common pitfalls. Here's a detailed guide tailored for beginners.

What is a NASDAQ ETF and How Does It Work?

A NASDAQ ETF, or exchange-traded fund, is a basket of securities designed to track the performance of a specific index related to the NASDAQ stock exchange—most commonly, the NASDAQ-100. This index includes 100 of the largest non-financial companies listed on the NASDAQ, with a heavy weighting towards technology and innovation-focused firms such as Apple, Microsoft, Nvidia, Amazon, and Alphabet (Google's parent company).

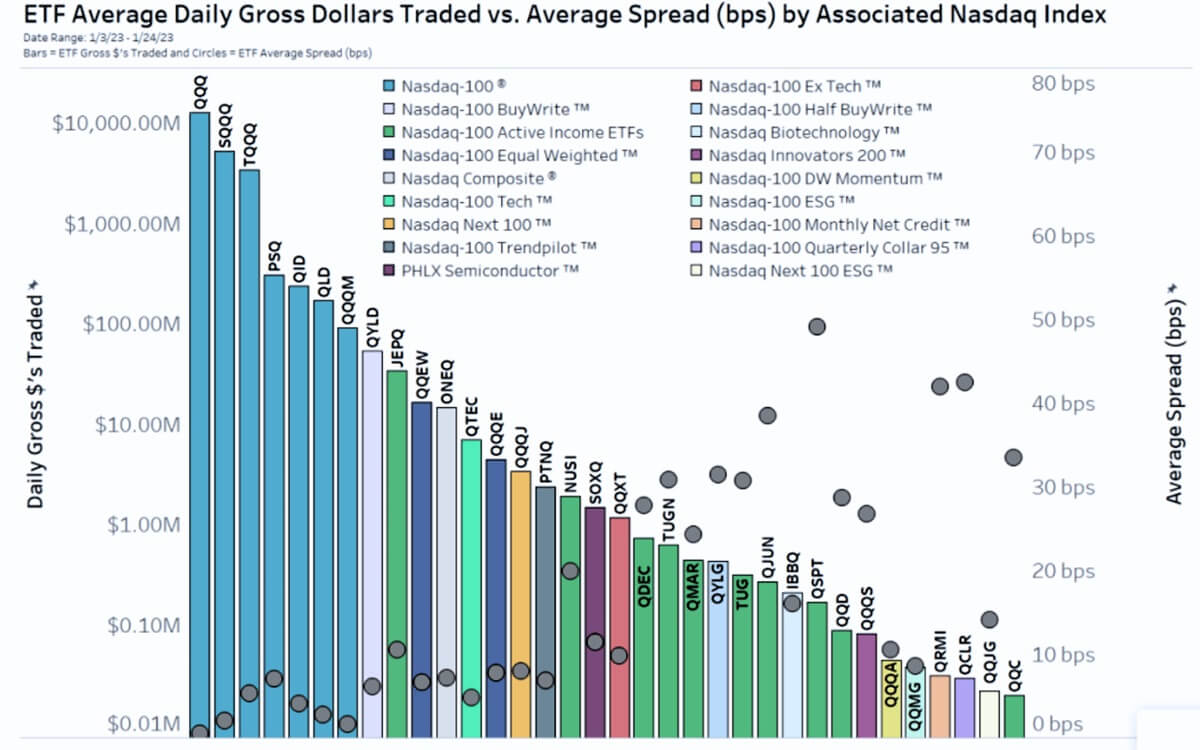

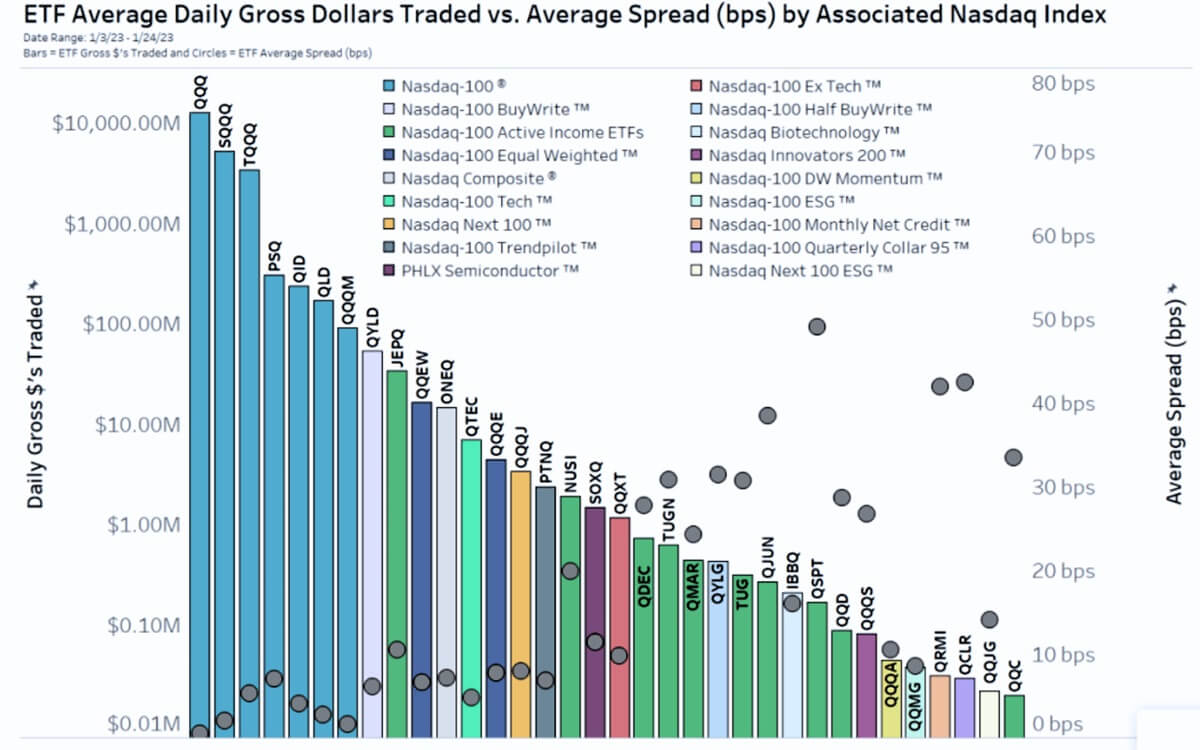

ETFs are traded on the stock exchange, just like individual shares. This means traders can buy and sell them throughout the trading day at market prices. Unlike mutual funds, which are priced at the end of the day, ETFs offer real-time liquidity. The most well-known NASDAQ ETF is the Invesco QQQ Trust (QQQ), which tracks the NASDAQ-100 Index. Other options include QQQM (a cheaper version of QQQ) and QQQJ, which tracks mid-cap companies in the NASDAQ Next Generation 100.

When you buy a NASDAQ ETF, you're essentially purchasing a small stake in all the companies it holds. This allows for instant diversification, reducing the risks associated with buying individual stocks.

Step-by-Step Guide to Buying Your First NASDAQ ETF

Getting started with NASDAQ ETFs is simpler than many first-time traders expect. Here's how to do it step by step:

Step 1: Choose a Trading Platform

Start by selecting a regulated broker that offers access to U.S. markets. Look for platforms with low fees, user-friendly interfaces, and educational resources if you're a beginner.

Step 2: Open and Fund Your Account

Provide identification documents and complete the onboarding process. Once verified, deposit funds in your preferred currency. Many brokers now support currency conversion tools to help you buy U.S. ETFs with non-USD accounts.

Step 3: Research Available NASDAQ ETFs

While QQQ is the most widely traded, compare options based on factors like the expense ratio, performance history, sector allocation, and the size of assets under management (AUM). Tools on your broker's platform or financial news websites can help.

Step 4: Place Your First Order

Search for the ETF's ticker symbol (e.g. "QQQ") and choose the number of shares you want to buy. Decide between a market order (executed immediately at the current price) or a limit order (executed only at a specific price).

Step 5: Monitor and Rebalance as Needed

After purchase, review your investment periodically. Depending on your strategy, you may want to add more shares, switch to a different ETF, or rebalance your overall portfolio to maintain target allocations.

Dollar-Cost Averaging vs. Lump-Sum Investing in NASDAQ ETFs

When investing in NASDAQ ETFs, two popular strategies are lump-sum investing and dollar-cost averaging (DCA). Each approach has its own pros and cons.

Lump-Sum Investing

This involves investing all your available capital in one go. Historically, this method tends to outperform DCA over the long term, especially in bull markets. However, it carries higher short-term risk, particularly if markets dip right after you invest.

Dollar-Cost Averaging

DCA involves investing a fixed amount at regular intervals (e.g. monthly), regardless of market conditions. This method reduces the impact of market volatility and lowers the risk of buying at a peak. It's especially useful for new traders who are cautious about timing the market or those with limited capital.

Which Should You Choose?

If you've received a windfall or bonus and are comfortable with market risk, lump-sum investing might be suitable. If you prefer a more gradual approach or want to build the habit of investing consistently, DCA is a reliable strategy—particularly when investing in volatile tech-focused ETFs like QQQ.

Tax Implications & Dividend Treatment of NASDAQ ETFs

Understanding how your investment is taxed can help you avoid surprises at the end of the financial year.

Dividends from NASDAQ ETFs

Some NASDAQ ETFs, such as QQQ, do pay quarterly dividends. These dividends are typically composed of payouts received from the underlying companies. While they're not especially high (tech companies often reinvest profits rather than distribute them), they can still be meaningful over time.

Tax Considerations for Non-U.S. Traders

If you're based outside the United States, you may be subject to a 30% withholding tax on dividends unless a tax treaty reduces this amount (for example, to 15% for UK traders). U.S. estate tax laws can also apply, so some traders prefer Irish-domiciled ETFs like CSPX or IQQQ, which offer similar exposure with more favourable tax treatment in certain jurisdictions.

Capital Gains Tax

You'll also be taxed on any profits made when selling your ETF at a higher price than you bought it for. The rate depends on your local tax laws, holding period, and income bracket.

Tax Wrappers

Using tax-efficient accounts such as ISAs (in the UK) or Roth IRAs (in the US) can help shield gains and dividends from taxation.

Common Mistakes to Avoid When Investing in NASDAQ ETFs

Even with a simple product like an ETF, traders can fall into traps. Here are the most common mistakes to watch out for:

Overconcentration in One Sector

While the NASDAQ-100 offers diversification, it's heavily weighted towards tech and communications. Overexposure to this single index means your portfolio could suffer in a sector-specific downturn.

Ignoring Fees and Taxes

Low-cost ETFs are appealing, but don't overlook other charges like currency conversion fees, platform charges, or taxes. These can eat into your returns, especially over time.

Chasing Past Performance

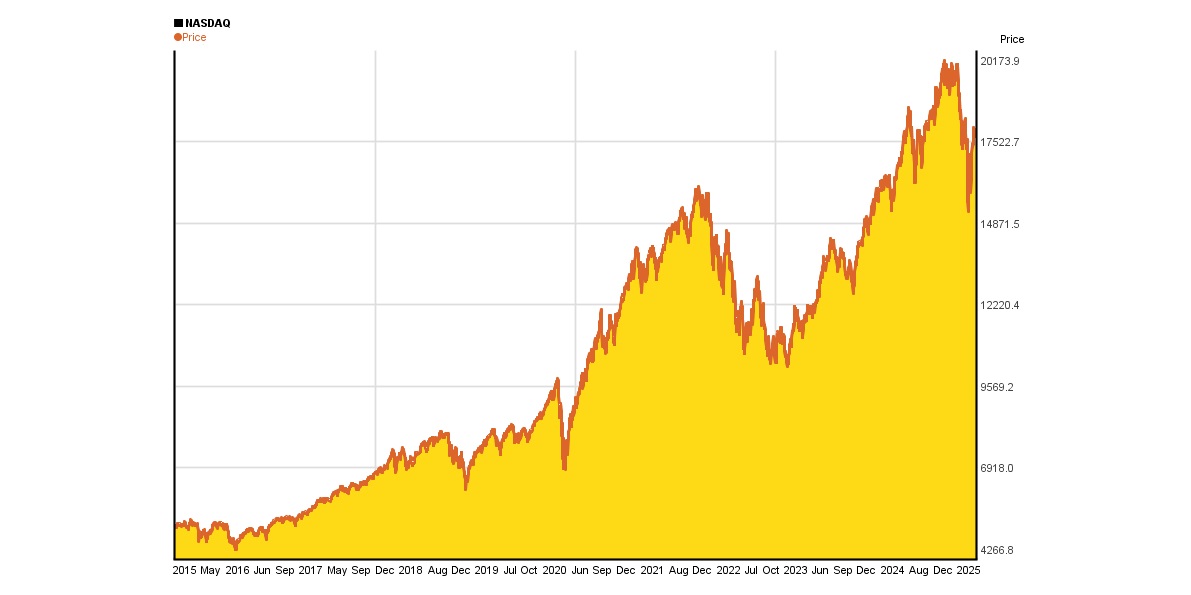

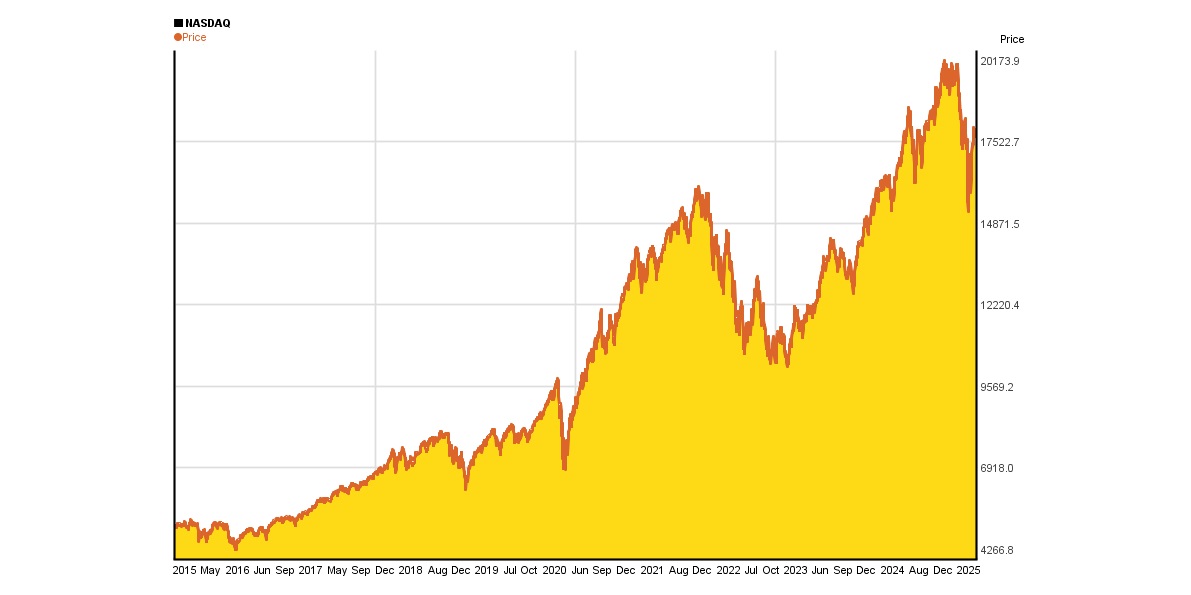

Just because QQQ has delivered strong gains in the past doesn't mean it will continue to do so indefinitely. Investing based solely on recent charts can lead to disappointment.

Poor Timing or Emotional Trading

Buying high during hype or selling low during panic are common behavioural pitfalls. Stick to your long-term plan and avoid reacting emotionally to market movements.

Neglecting to Rebalance

Over time, NASDAQ ETFs may become too large a share of your portfolio, especially during market rallies. Regularly rebalancing helps maintain your risk level and investment goals.

Final Thoughts

NASDAQ ETFs offer an efficient and transparent way to invest in the world's most innovative companies. Whether you're interested in long-term growth, passive investing, or sector-specific exposure, they can be a powerful tool in your portfolio. By starting with a clear plan, understanding your options, and avoiding common mistakes, you'll be well on your way to building wealth through NASDAQ ETFs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.