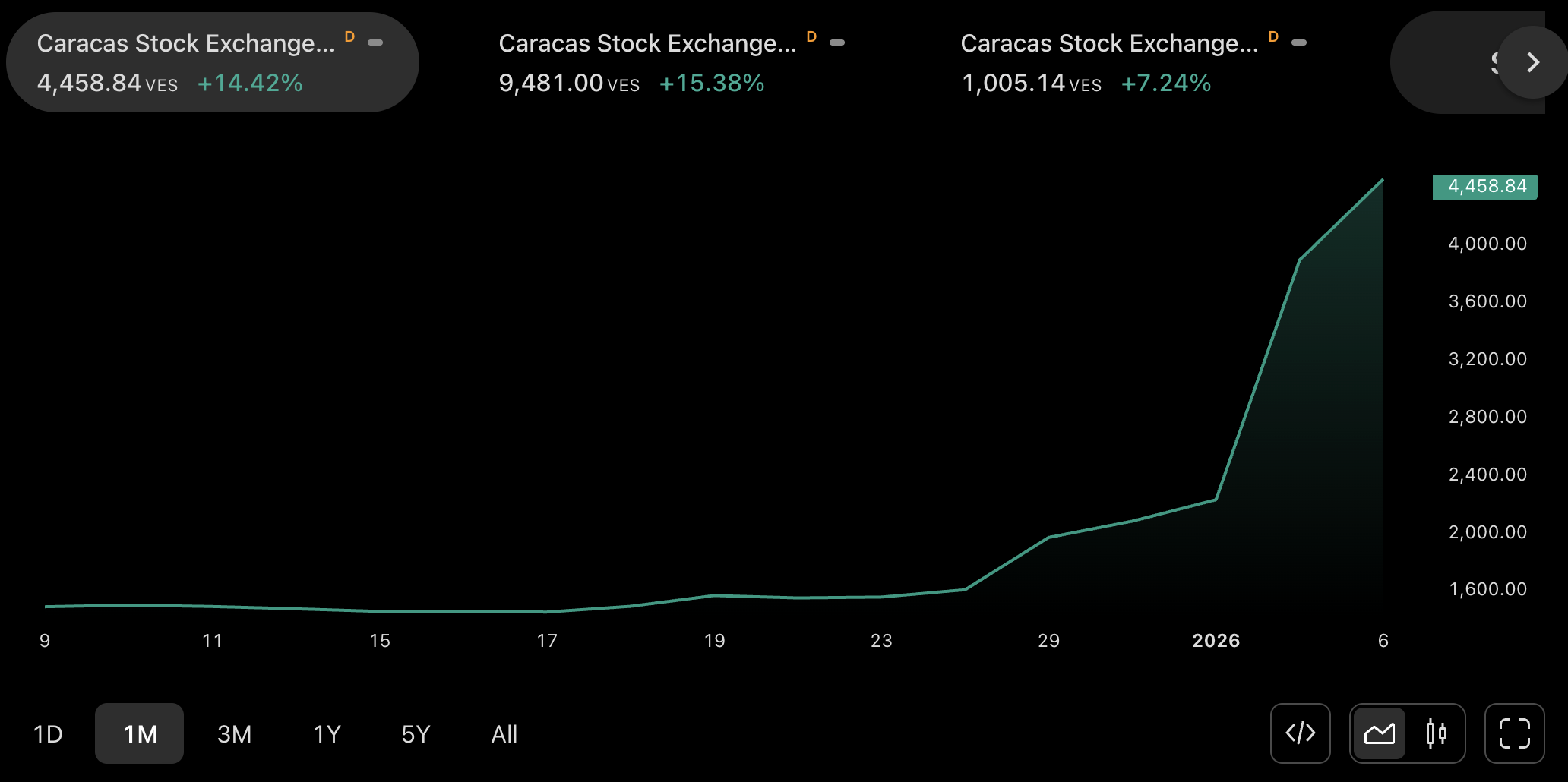

Venezuelan stock indices surged to historic, record-breaking highs in the opening week of 2026, headlined by an unprecedented 50% single-session jump on January 6.

While the rally inherited momentum from the hyperinflationary defence strategies of late 2025, it has been radically transformed by the seismic political shift following the capture of Nicolás Maduro and the installation of a caretaker administration.

Trading in Caracas currently reflects an aggressive, high-conviction bet on regime-change dividends. The persistent demand for banks and heavy industrial groups is no longer just a "pragmatic move" to hedge against the bolívar’s erosion; it is a speculative re-pricing of Venezuela’s entire economic future. Investors are positioning for a "reconstruction era," anticipating the removal of international sanctions and the return of global energy majors to the country's oil fields.

While the market's structural illiquidity continues to magnify these price moves, the current surge is far from a "measured repositioning."

It represents a violent and purposeful re-rating of sovereign risk. In this new context, the Caracas exchange has transitioned from a narrow outlet for capital preservation into a high-stakes arena for betting on Venezuela’s reintegration into the global financial system.

Key Market Indicators (As of Jan 2026)

| Indicator |

Prior Context |

Early 2026 Change |

| IBC Index (Nominal) |

+1,644% (2025) |

+125% YTD |

| Two-Day Post-Raid Rally |

N/A |

+87% |

| Sovereign / PDVSA Bonds |

Distressed, illiquid |

+30% surge |

| Market Sentiment |

Inflation hedge |

Speculative growth |

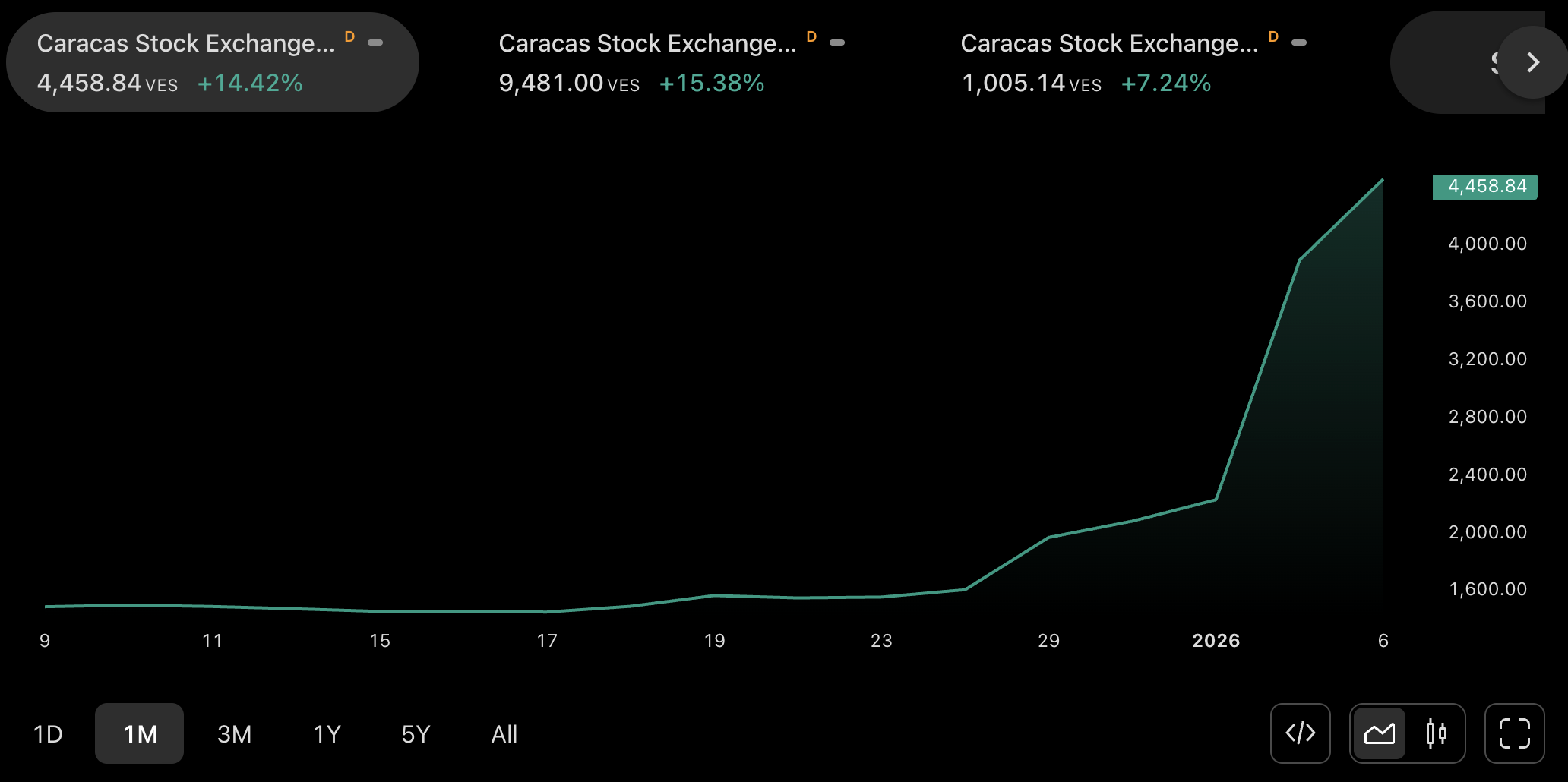

Venezuelan Stock Indices Extend Their Early-2026 Rally

The IBVC, Caracas Stock Exchange’s benchmark, leads the rally. The index hit new highs in early 2026, confirming the surge in Venezuelan stocks. In local currency, the IBVC’s rise shows equities are one of the few ways to preserve capital in Venezuela.

International investors are not driving the market’s performance. Capital controls, settlement constraints, and sanctions continue to limit cross-border participation, leaving domestic investors as the primary source of demand as capital shifts out of cash holdings and low-yield deposits into equities.

Below is a historical snapshot of Venezuela’s main stock market benchmark, showing how domestic equities have evolved over time in nominal terms and highlighting the context behind the recent surge.

| Date / Year-End |

IBC / IBVC Level (approx.) |

Notes |

| 2018 (year-end) |

~1,605 points |

Post-hyperinflation adjustment phase begins; index underwent re-baselining |

| 2019 (year-end) |

— |

Limited official series; index volatile amid inflation dynamics |

| 2020 (year-end) |

— |

Data sparse; market driven largely by hyperinflation and currency effects |

| 2021 (year-end) |

— |

Local series fragmented; reliable annual level not widely published |

| 2022 (year-end) |

— |

Market remained illiquid with scattered reporting |

| 2023 (year-end) |

— |

Official published history limited, though returns suggest strong nominal gains |

| 2024 (year-end) |

— |

Index continued recovering from a very low base |

| Nov 2025 |

~1,744 points (high) |

Pre-January run; IBVC reached ~1,744 before early-2026 surge |

| 30 Dec 2025 |

~2,082 points |

Final close before the 2026 rally |

| 2 Jan 2026 |

~2,230 points |

Index jumped about 7% at the start of the year |

| Early Jan 2026 (peak) |

~2,231–2,231.35 points |

Recorded all-time nominal peak around this level |

Key Drivers For Surge in Venezuelan Stock Indices

1) Speculative "Regime Change" Premium

The primary driver of the current 87% rally in the first two sessions of 2026 is the capture of Nicolás Maduro. Markets are pricing in a total pivot from a sanctioned, isolated economy to one managed under temporary U.S. oversight. This is no longer just a "protective" move; it is a high-conviction bet on the mass lifting of sanctions and the return of multinational energy giants. [1]

2) The "Oil Pivot" and Expected Infrastructure Billions

Unlike previous years, where gains were purely nominal (inflation-driven), the 2026 surge is tied to specific resource expectations. Following the U.S. intervention, President Trump announced that U.S. oil majors would "spend billions" to fix broken infrastructure. Consequently, the index surge is being led by energy-adjacent and industrial stocks that stand to benefit from a $50B+ reconstruction effort. [2]

3) Anticipated Reintegration into Global Finance

Venezuela has been a "financial pariah" for years. The recent surge reflects an "arbitrage of isolation": investors are buying local equities on the expectation that Venezuela will soon be re-indexed into frontier and emerging market funds. This "anticipatory flow" is driving prices up before institutional liquidity can even officially enter the market.

4) Structural Illiquidity Magnifying Global Volatility

Because the Caracas Stock Exchange (BVC) is so shallow, the sudden influx of speculative capital, sparked by the $2 billion U.S.-Venezuela oil deal, has caused a "vertical" price move. Relatively small buy orders from hedge funds targeting distressed assets are pushing the IBC Index to record highs of 4,500+ because there are simply not enough sellers at current levels. [2]

Market Snapshot: Venezuelan Equities in Early 2026

| Metric |

Latest read |

Market implication |

| IBVC trend |

Rising to multi-year highs |

Confirms durability of the surge in Venezuelan stock indices |

| Market breadth |

Improving |

Signals participation beyond a narrow group |

| Liquidity |

Thin but steady |

Enhances momentum-driven price action |

| Investor base |

Predominantly domestic |

Limits exposure to global risk-off events |

The data confirm that the surge in Venezuelan stock indices is driven by internal factors, with dynamics different from global emerging-market cycles.

A Distinctive Feature: Equities as a Monetary Tool

Unlike developed markets, where stocks primarily discount future earnings, Venezuelan equities increasingly function as monetary instruments. Prices adjust to inflation expectations, currency risk, and policy uncertainty. From this perspective, this surge represents an adaptive financial response rather than a conventional bull market.

Nominal gains can be substantial even if real economic activity remains constrained. Without adjusting for inflation and currency effects, the index increase can appear misleadingly strong to outside observers.

Despite the "euphoria," analysts warn that this is a high-volatility environment.

Infrastructure: Experts estimate that returning Venezuela to its former oil production glory could take $50 billion to $60 billion in investment and over a decade of work.

Stability: The U.S. has stated it will temporarily oversee the country, but the path to a stable, democratic government remains uncertain.

Key Risks That Could Interrupt the Surge in Venezuelan Stock Indices

| Risk factor |

Probability |

Potential impact |

Signal to watch |

| Policy intervention |

Medium |

High |

Sudden regulatory or trading changes |

| Inflation resurgence |

Medium |

Medium |

Acceleration in parallel FX markets |

| Liquidity shock |

Low–Medium |

High |

Large price gaps on minimal volume |

| Earnings pressure |

Medium |

Medium |

Rising costs without pricing power |

Note: These risks remain largely domestic in nature. Global market volatility has so far had limited influence on Venezuelan equities, with price action driven primarily by political developments, liquidity conditions, and expectations around sanctions relief.

Frequently Asked Questions (FAQ)

1. What is actually driving the surge in Venezuelan stock indices in early 2026?

The rally is being driven less by inflation hedging and more by a sudden repricing of political and sovereign risk following the removal of Nicolás Maduro. Investors are positioning for sanctions relief, a reopening of oil exports, and large-scale reconstruction spending, triggering a speculative re-rating across domestic equities.

2. Which index best captures this market move?

The Índice Bursátil de Capitalización is the primary benchmark reflecting the rally. It tracks the most liquid and capitalised stocks listed on the Bolsa de Valores de Caracas, making it the clearest gauge of sentiment in local equities.

3. Are foreign investors participating in this rally?

Direct foreign participation remains limited due to capital controls, settlement barriers, and legal uncertainty. However, expectations of future foreign inflows, particularly from energy companies and frontier-market funds, are a key driver of current speculative demand by domestic and regional investors.

4) Why have Venezuelan bonds and equities risen at the same time?

Both markets are repricing the same catalyst: a perceived reduction in default and sanctions risk. Government and PDVSA bonds have rallied sharply as investors reassess recovery values, while equities are moving on expectations of economic normalisation and infrastructure investment tied to oil-sector rehabilitation.

5) Does this rally signal a genuine economic recovery?

Not yet. While markets are pricing in a more favourable future path, Venezuela’s economy still faces severe structural constraints, including damaged infrastructure, weak institutions, and funding gaps. The current gains reflect expectations of change rather than evidence that growth has already materialised.

Conclusion

The surge in Venezuelan stock indices at the start of 2026 is not an anomaly. It reflects rational behaviour within a constrained financial environment where inflation risk, dollarisation, and limited investment options dominate decision-making.

As long as these structural conditions persist, this phenomenon is likely to remain a defining feature of Venezuela’s financial landscape, even as volatility and policy risk continue to shape day-to-day trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1]https://www.war.gov/News/News-Stories/Article/Article/4370431/trump-announces-us-militarys-capture-of-maduro/

[2]https://www.energy.gov/articles/fact-sheet-president-trump-restoring-prosperity-safety-and-security-united-states-and