The Dow Jones Industrial Average—more casually known as the Dow—is one of those names that often pops up in the financial news, especially during big market moves. But what exactly is it measuring?

At its core, the Dow tracks the share prices of 30 large, publicly traded companies based in the United States. These firms span a range of sectors—from finance and pharmaceuticals to technology and consumer goods—and are seen as representative of the broader economy. So, when you hear that "the Dow is up 300 points", it generally means that traders are feeling upbeat about these big players and, by extension, the economic outlook.

But unlike broader indices like the S&P 500. which includes hundreds of companies, the Dow keeps it simple. Just thirty. That simplicity, however, doesn't mean it's irrelevant—it's more like a barometer for how the most established parts of the U.S. economy are doing.

How the Dow Is Put Together

Now you might wonder, how are those thirty companies chosen, and why only thirty? The selection isn't random. The list is managed by a committee, and companies are picked based on their reputation, consistent earnings, and significance to the American economy. It's less about strict rules and more about maintaining a good mix of industries that reflect the market's key movers.

Interestingly, the Dow is a price-weighted index. That means companies with higher Stock Prices have a greater influence on the overall index, regardless of their size. So, a company with a £500 share price will affect the Dow more than a £100 company—even if the latter is much larger in market value. This setup can lead to quirks in how the index moves, and it's one reason why some traders prefer other indices for a more balanced view. Still, the Dow remains iconic and widely followed.

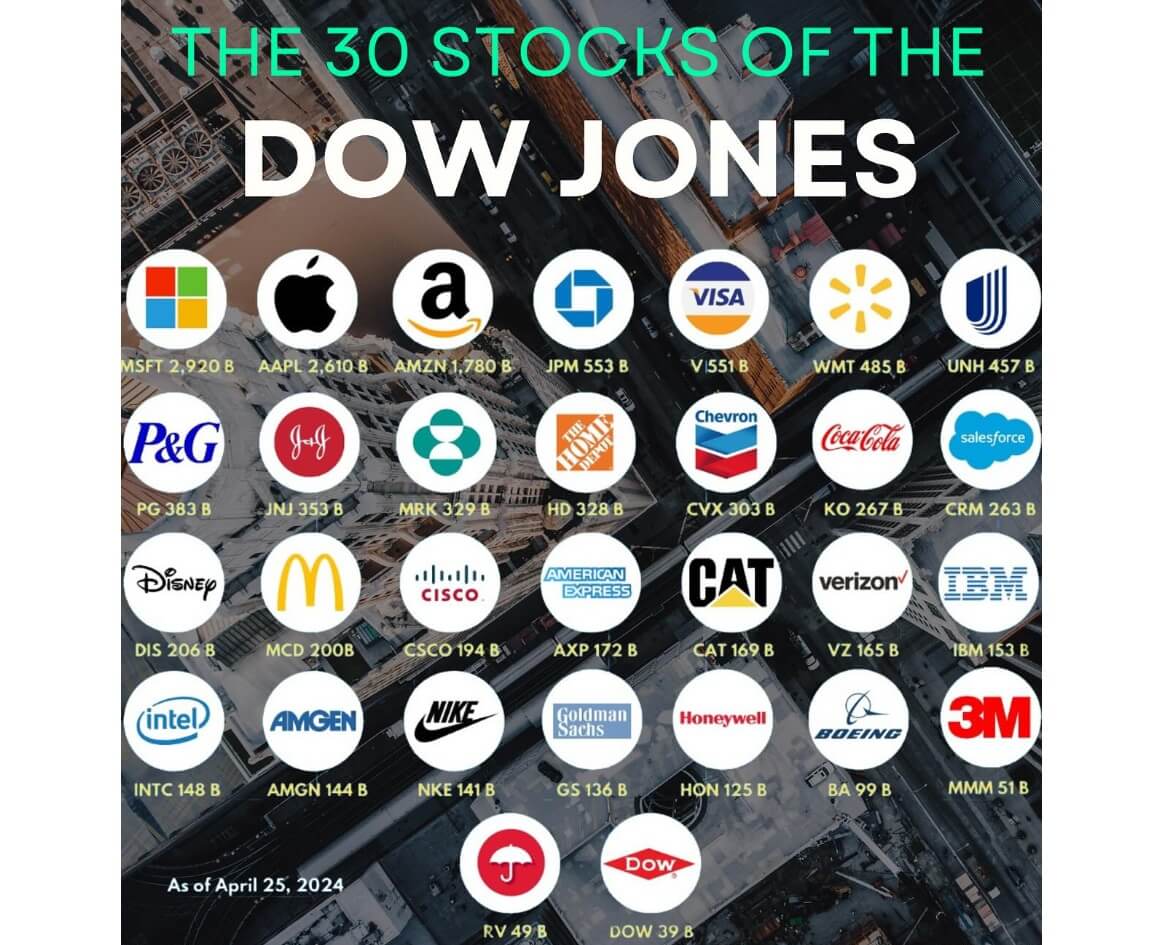

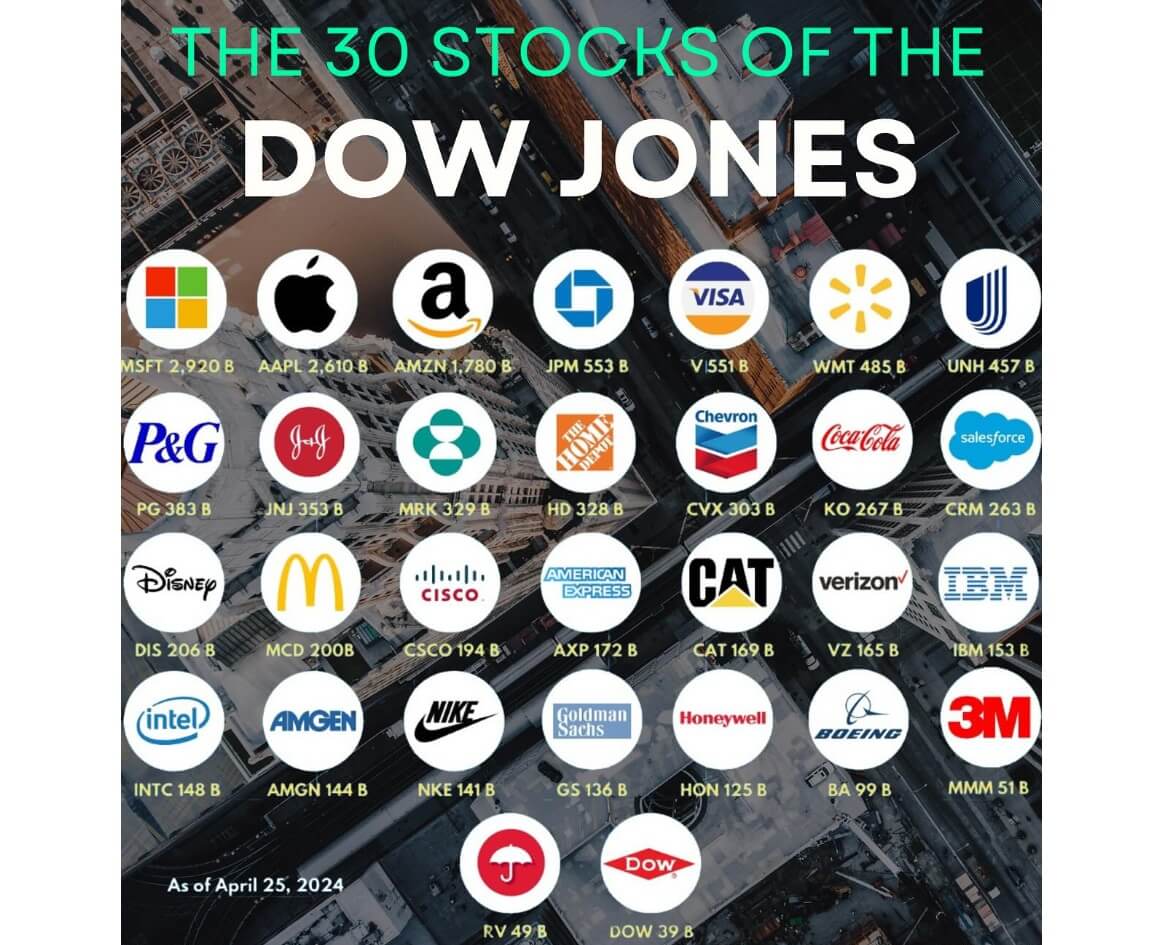

The Companies Behind the Dow

You might expect the Dow to be full of industrial firms, given its name. And while that was true back in the 1890s when it was first created, times have changed. Today, the Dow includes companies like Apple, Microsoft, Johnson & Johnson, McDonald's, and Visa. So, despite its old-school reputation, it actually covers a good spread of modern industries.

That said, you won't find every tech giant here—some major names, like Alphabet (Google's parent company), are absent, in part due to their high share prices not fitting neatly into the index's price-weighted method. Still, the Dow gives a decent sense of how the major players are performing, especially those with a long track record of stability and influence.

Why the Dow Matters for Everyday Traders

Even if you're not actively trading stocks, the Dow still matters. It's a headline figure that reflects how confident or cautious traders are feeling. If the Dow's climbing steadily, it usually signals strong corporate earnings or optimistic economic data. If it's falling sharply, people may be worried about inflation, interest rates, or geopolitical risks.

For beginner traders, the Dow can serve as a useful benchmark. You might not invest in all 30 companies directly, but there are funds—like ETFs—that track the Dow's performance, offering a simple way to gain exposure to some of the most established firms in the market.

And let's not forget the psychological aspect. Big moves in the Dow often grab headlines and influence broader trader behaviour, even beyond those thirty companies. It's a bit like a mood ring for the markets.

Limitations and Criticisms of the DJIA

Despite its popularity, the Dow isn't without its flaws. One of the main criticisms is its narrow scope – it only includes 30 companies, which isn't a lot when you consider how many major firms operate in the U.S. market.

Another issue is its price-weighted nature. Most other major indices, like the S&P 500. use market capitalisation – which reflects the total value of a company's shares – as a basis for weighting. Critics argue that price weighting can give an outsized influence to companies with high stock prices, even if they're not the biggest players in the market.

And while the Dow tries to represent a cross-section of the economy, it may not always reflect newer sectors like tech as accurately as broader indices do. It also changes slowly – companies are only swapped in and out occasionally, meaning it might lag behind more dynamic parts of the market.

Still, for many people, the DJIA remains a useful tool. It may not be perfect, but it gives a quick sense of where things stand, and it's backed by over a century of history.

In summary, the Dow Jones Industrial Average is more than just a number scrolling across your screen on the evening news. It's a historical index that tracks some of the most influential companies in the United States, offering insight into the state of the market and, to some degree, the economy itself. While it has its shortcomings, understanding how the Dow works – and why it matters – is a useful step for anyone interested in getting to grips with the world of investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.