The S&P 500 is widely regarded as the premier benchmark of the U.S. large-cap equity market. Comprising roughly 500 of the largest publicly traded companies in the United States, it offers broad exposure to many sectors of the economy.

For many individual and institutional investors, buying into the S&P 500 represents a simple and effective way to participate in the growth of major U.S. corporations without picking individual stocks.

What Is the S&P 500 Index?

The S&P 500 (Standard & Poor's 500) is a stock market index that tracks the performance of approximately 500 of the largest U.S. companies by market capitalisation. It is maintained by S&P Dow Jones Indices and is commonly used as a barometer for the overall health of the U.S. equity market.

Key Characteristics of the S&P 500

Market‑Cap Weighted:

Companies with larger market capitalisations hold a greater weight in the index, meaning big tech firms often dominate.

Sector Diversification:

The index spans multiple sectors, including Technology, Health Care, Financials, Consumer Discretionary, and more, although the weights are uneven.

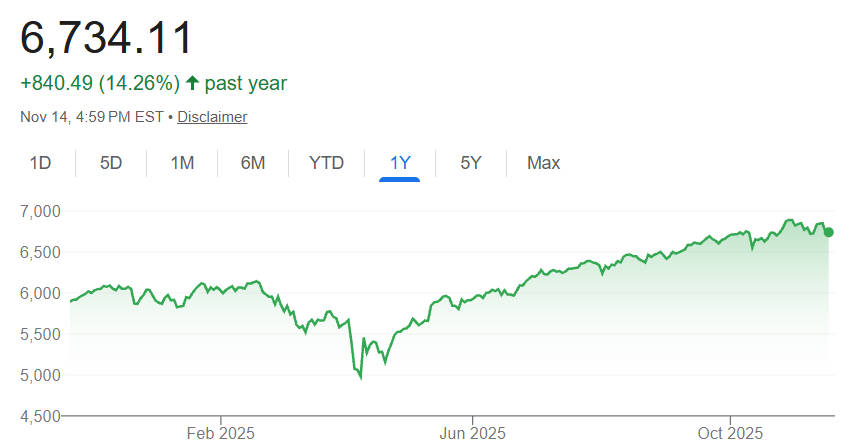

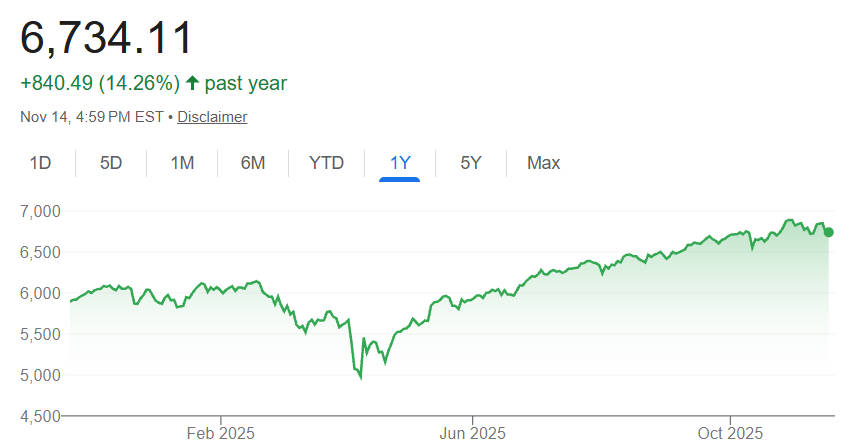

Historical Performance:

Over long horizons, the S&P 500 has delivered solid compounded returns, though with periods of volatility.

Why Invest in the S&P 500

1. Diversification Benefits

Investing in the S&P 500 gives you instant access to a diversified set of 500 large-cap companies. This diversification reduces the risk you take on compared with holding a few individual stocks.

2. Cost Efficiency

Many S&P 500 tracking ETFs and index funds charge very low expense ratios. For example, some leading ETFs charge as little as 0.03 percent per year. Over time, low costs help preserve more of your returns.

3. Simplicity and Accessibility

Rather than analysing and selecting individual stocks, you can gain broad market exposure in a single transaction. This makes the S&P 500 particularly attractive to those who prefer a passive, "buy and hold" approach.

4. Long-Term Growth Potential

Historically, reinvesting dividends and holding for the long term has allowed investors to benefit from compounding. While past performance does not guarantee future results, the S&P 500 has delivered meaningful growth over decades.

Common Ways to Buy the S&P 500

1. Through Index Funds

S&P 500 index funds mirror the index by holding the same (or a very similar) basket of stocks in the same weights. Mutual funds and unit trusts are common vehicles. These funds usually have very low cost and are ideal for long-term investors.

2. Through ETFs (Exchange-Traded Funds)

ETFs are perhaps the most straightforward way for individual investors to access the S&P 500. You buy shares of the ETF just like you would a stock. Major S&P 500 ETFs include:

VOO (Vanguard S&P 500 ETF) — very low expense ratio of 0.03%.

SPY (SPDR S&P 500 ETF Trust) — more liquid, but with a higher expense ratio (around 0.09 percent).

IVV (iShares Core S&P 500 ETF) — also about 0.03 percent.

These ETFs differ in cost, liquidity, and structure, so it is important to compare them carefully.

3. Through Derivatives (Futures or Options)

Sophisticated investors may use S&P 500 futures or options to gain exposure. This method requires more knowledge and comes with higher risk, including margin requirements and leverage.

4. Direct Indexing

Through direct indexing, you can replicate the S&P 500 by buying all (or most) of the 500 companies in the index yourself. This approach can offer tax advantages (for example, through tax-loss harvesting), but it requires more capital and maintenance.

Step‑by‑Step Process to Buy the S&P 500 via ETF or Index Fund

Select a brokerage that supports U.S. equities or ETFs. Important factors include:

Commissions and trading fees

Support for fractional shares (if you are investing small amounts)

Ease of funding (local currency conversion, deposit methods)

2. Open and Fund Your Account

Once you have chosen a broker, open an account and deposit funds. If you invest in U.S.-domiciled ETFs, be mindful of currency conversion and potential foreign exchange costs.

3. Select Your S&P 500 Fund or ETF

Compare options using metrics like:

Expense ratio (how much you pay annually)

Tracking error (how closely the fund follows the index)

Assets under management (AUM) and liquidity

Dividend policy

Here is a comparison of some major ETFs:

| ETF |

Expense Ratio |

Liquidity / Key Strengths |

| VOO |

0.03 percent |

Extremely low cost, ideal for long-term investors |

| SPY |

~0.09 percent |

Very high trading volume and liquidity |

| IVV |

0.03 percent |

Low cost, trusted by many investors |

4. Place Your Order

Decide whether to place a market order (executed immediately at current market price) or a limit order (executed only if price reaches a level you choose). If your broker supports fractional shares, you can invest any dollar amount rather than a fixed number of shares.

5. Set Up a Recurring Investment Strategy

To reduce the risk of mistiming the market, consider dollar‑cost averaging (DCA), where you invest a fixed amount at regular intervals (for example, monthly).

Managing Your S&P 500 Investment

1. Monitoring Performance

Use your broker's dashboard or third-party tools (such as financial websites or portfolio trackers) to keep an eye on how your S&P 500 investment is performing. Check for tracking error, fund drift, and other anomalies.

2. Rebalancing

If the S&P 500 part of your portfolio grows disproportionately compared to other assets, you may wish to rebalance. For example, you could sell some S&P exposure and reinvest in other asset classes to maintain your target allocation.

3. Tax Considerations

Dividends: Most S&P 500 ETFs pay dividends. These can be subject to withholding or local taxes depending on your jurisdiction.

Capital Gains: Selling shares may incur capital gains tax.

Non‑U.S. Investors: If you are outside the U.S., check local tax laws and whether your broker withholds U.S. dividend tax.

4. Risk Management

Be aware of concentration risk: a few large companies (particularly in technology) account for a large portion of the S&P 500.

Maintain a diversified portfolio across asset classes so that you are not overexposed to U.S. large-cap equities alone.

Alternative S&P‑500‑Based Strategies

1. Equal‑Weight S&P 500 Funds

An equal-weight S&P 500 fund gives each of the 500 companies roughly the same weight, rather than weighting by market capitalisation. This reduces the dominance of mega-cap tech firms.

2. S&P 500 Options and Derivatives

Options strategies (such as covered calls or protective puts) can be used to generate income or hedge. These are more advanced and involve greater risk.

3. Factor or Thematic Investing via S&P Exposure

You can combine S&P 500 exposure with factor tilts (for example, value, momentum) or theme-based overlays. Some direct-indexing platforms allow you to customise your holdings to reflect these strategies.

Case Study: Hypothetical Long-Term Investment

Using a dollar‑cost averaging strategy, you invest USD 12.000 every year.

Assuming a historical annualised return (for illustration) of around 10 percent, your portfolio could grow substantially due to compounding.

Even if you face market volatility, monthly contributions help smooth out costs and reduce the risk of poor timing.

Frequently Asked Questions (FAQ)

Q1: Can I buy the S&P 500 index directly?

A: No, you cannot buy the index itself. You must invest in a fund (ETF or mutual fund) that tracks the S&P 500.

Q2: Which ETF is best for S&P 500: VOO, SPY or IVV?

A: It depends on your goals. VOO and IVV have very low costs (around 0.03 percent), while SPY offers extremely high liquidity but costs more (around 0.09 percent).

Q3: How much money do I need to start investing in the S&P 500?

A: It depends on your broker. If your broker offers fractional shares, you can start with a small amount. For full‑share purchases, you need at least enough to buy one share.

Q4: Should I invest all at once or use dollar‑cost averaging?

A: Dollar‑cost averaging helps reduce timing risk by spreading your investment over time. Lump‑sum investing may benefit you if markets rise, but comes with greater risk.

Q5: What are the tax implications of investing in the S&P 500?

A: It depends on your country. You may pay taxes on dividends, capital gains, or both. Non‑U.S. investors should consider withholding rates and local tax laws.

Q6: Is the S&P 500 really diversified?

A: While the S&P 500 covers 500 companies, its largest holdings (especially tech) represent a significant portion of the index, which can skew risk.

Conclusion

Investing in the S&P 500 is one of the most efficient ways to gain exposure to the U.S. equity market. By selecting a suitable ETF or index fund, setting up a contribution plan, and managing your investment over time, you can participate in long‑term growth while minimising costs and effort. Always consider your personal financial goals, risk tolerance, and tax situation before investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.