As 2026 begins, global stock markets are finding a new balance after the surge of artificial intelligence enthusiasm. Following two years in which AI-driven optimism lifted valuations across the board, investors are now slowing down, looking past the hype, and focusing more carefully on fundamentals, execution, and sustainable returns.

For long-term investors, the Dogs of the Dow strategy has become a systematic way to target large, dividend-paying companies likely to rebound as valuations adjust in a higher interest-rate environment.

With the Federal Funds Rate currently anchored, the opportunity cost of capital is no longer negligible. In this climate, “the dogs of the Dow, the ten highest-dividend-yielding constituents of the Dow Jones Industrial Average (DJIA), offer a compelling intersection of valuation discipline and cash-flow reliability.

The 2026 Macro Thesis

The 2026 equity market is no longer a monolith. While mega-cap technology continues to command headlines, capital flows tell a subtler story beneath the surface.

Market leadership is broadening as investors rotate away from stretched growth multiples and toward high-quality franchises trading at discounted valuations.

The dogs of the Dow strategy exploits this cyclicality, assuming that the blue-chip status of these entities guarantees an eventual return to parity, even if current sentiment is momentarily bearish.

The 10 Best Dogs of the Dow To Look Out For In 2026

Calculated based on Jan 1, 2026, market close data.

| Ticker |

Company |

Sector |

Dividend Yield |

Forward P/E |

| VZ |

Verizon Communications |

Communications |

6.4% |

9.2x |

| DOW |

Dow Inc. |

Materials |

5.1% |

12.4x |

| MMM |

3M Company |

Industrials |

4.9% |

13.1x |

| CVX |

Chevron |

Energy |

4.4% |

11.8x |

| IBM |

IBM |

Technology |

3.9% |

15.5x |

| CSCO |

Cisco Systems |

Technology |

3.6% |

14.2x |

| MRK |

Merck & Co. |

Healthcare |

3.2% |

21.5x |

| JNJ |

Johnson & Johnson |

Healthcare |

3.1% |

14.8x |

| AMGN |

Amgen |

Healthcare |

3.1% |

13.9x |

| KO |

Coca-Cola |

Consumer Staples |

2.9% |

11.5x |

1. Verizon (VZ) - The "Yield King"

Why it’s popular: With a yield near 6.85%, Verizon remains the anchor of the Dogs. In 2026, it is favored for its massive free cash flow and "5G densification" efforts. It is viewed as a "bond alternative" now that the Federal Reserve has stabilized rates.

Key Catalyst: 19 consecutive years of dividend growth and a low P/E ratio (approx. 8.5x).

2. Chevron (CVX) - The "Fortress Balance Sheet"

Why it’s popular: Chevron is the energy play for 2026. Investors love its low production breakeven (around $30/bbl) and aggressive share buyback program.

Key Catalyst: Record-high dividend payouts and a resilient performance despite volatile oil prices.

3. Nike (NKE) -The "Turnaround Story"

Why it’s popular: A new entry for 2026, Nike is the ultimate contrarian bet. After a multi-year slump, the return of CEO Elliott Hill has sparked optimism for a "product resurgence."

Key Catalyst: Innovation cycles timed for the 2026 FIFA World Cup and the Winter Olympics, which are expected to reclaim market share from niche competitors.

4. UnitedHealth Group (UNH) - The "Margin Recovery"

Why it’s popular: After a difficult 2025 ("annus horribilis") marked by regulatory headwinds, UNH is popular as a "value recovery" play.

Key Catalyst: Management’s successful 2026 repricing strategy, which is restoring profit margins in its Medicare Advantage business.

5. Merck & Co. (MRK) - The "Oncology Powerhouse"

Why it’s popular: Merck is favored for its clinical pipeline. While many fear the "patent cliff" for Keytruda, the success of new launches like Winrevair has convinced the market of its long-term growth.

Key Catalyst: Healthcare sector rotation as investors seek defensive earnings.

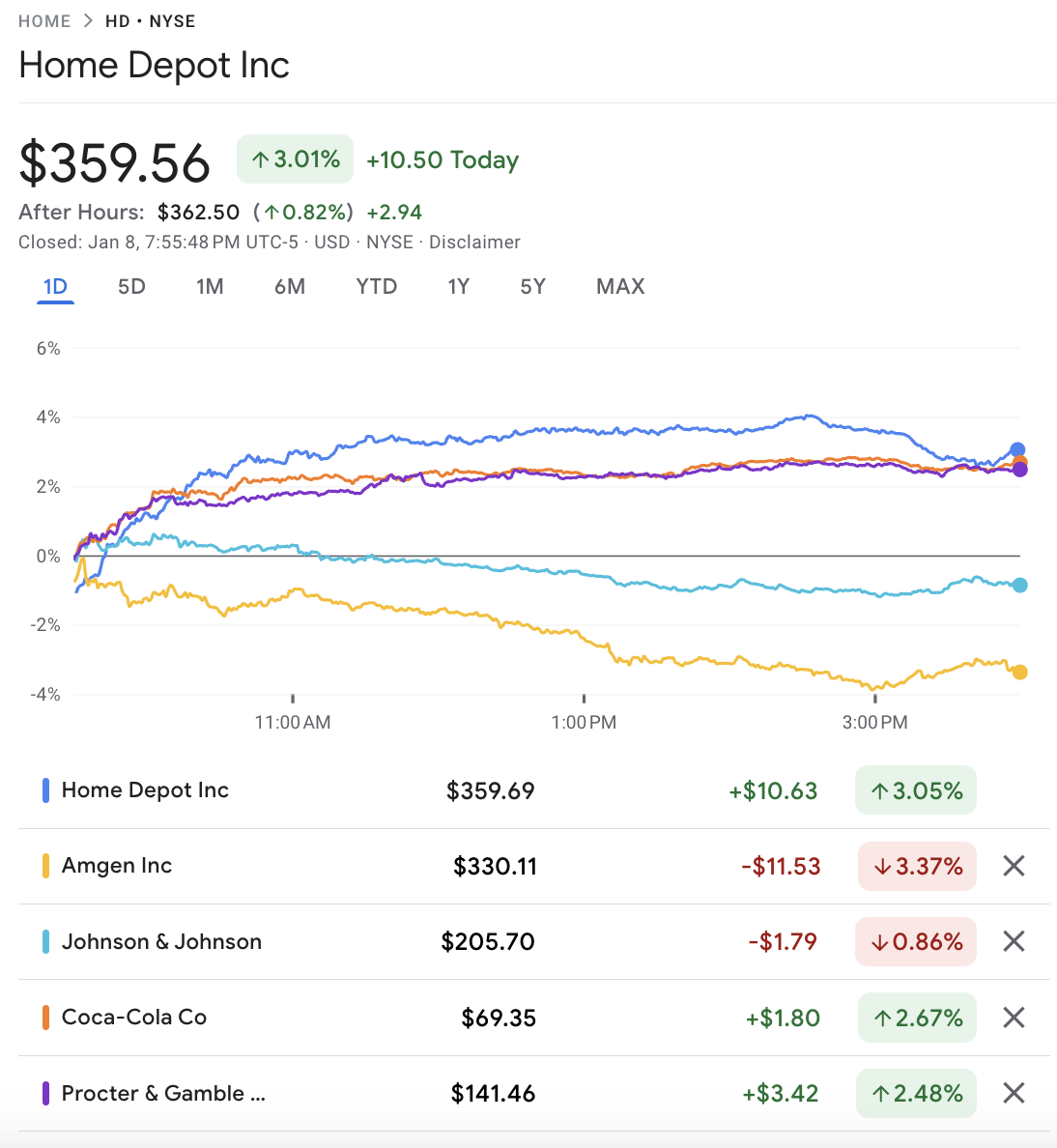

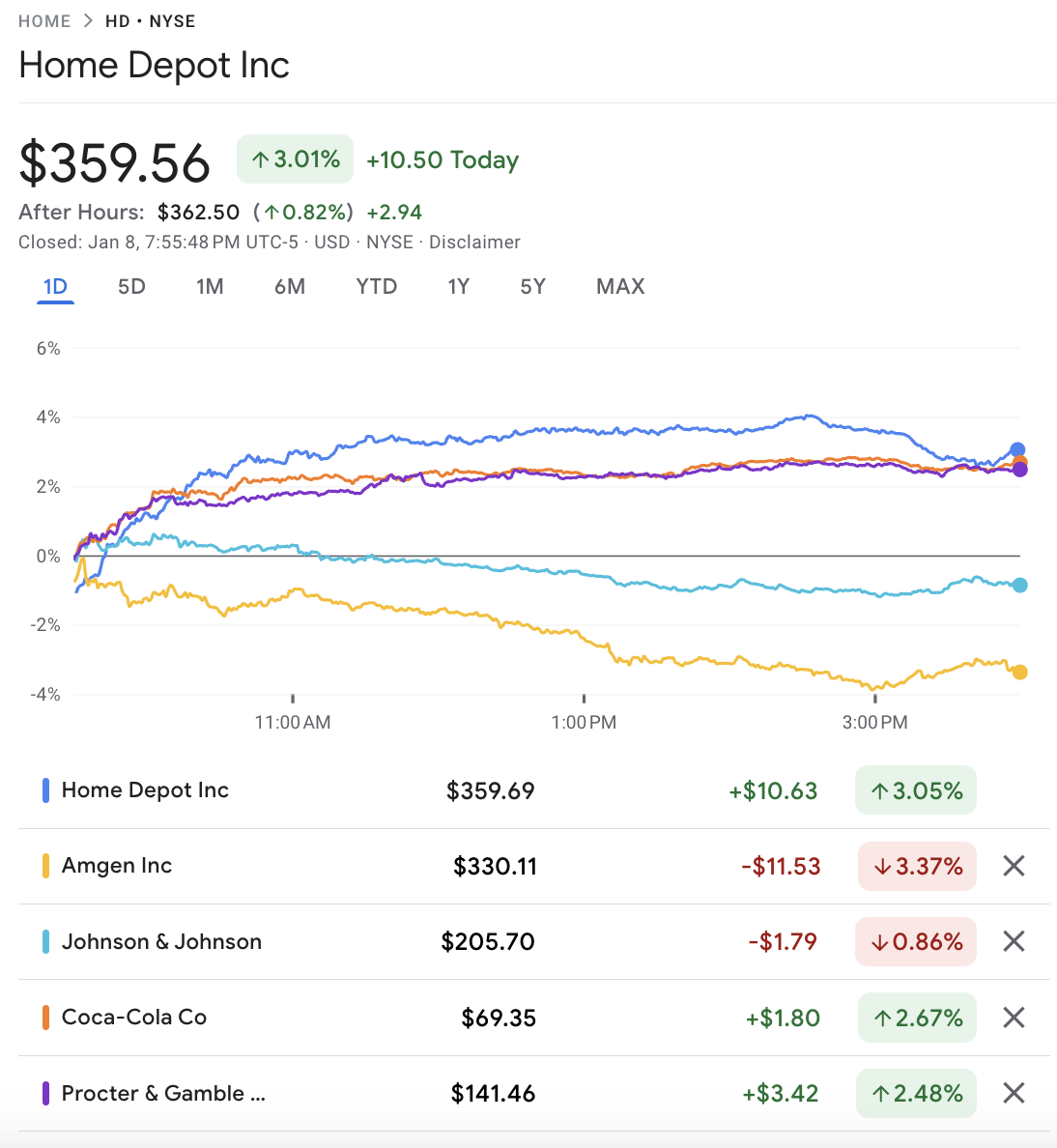

6. Home Depot (HD) - The "Soft Landing" Bet

Why it’s popular: As mortgage rates have stabilized in early 2026, Home Depot is the go-to stock for a recovering housing market.

Key Catalyst: Growth in the "Pro" (contractor) segment following its strategic acquisitions of SRS and GMS.

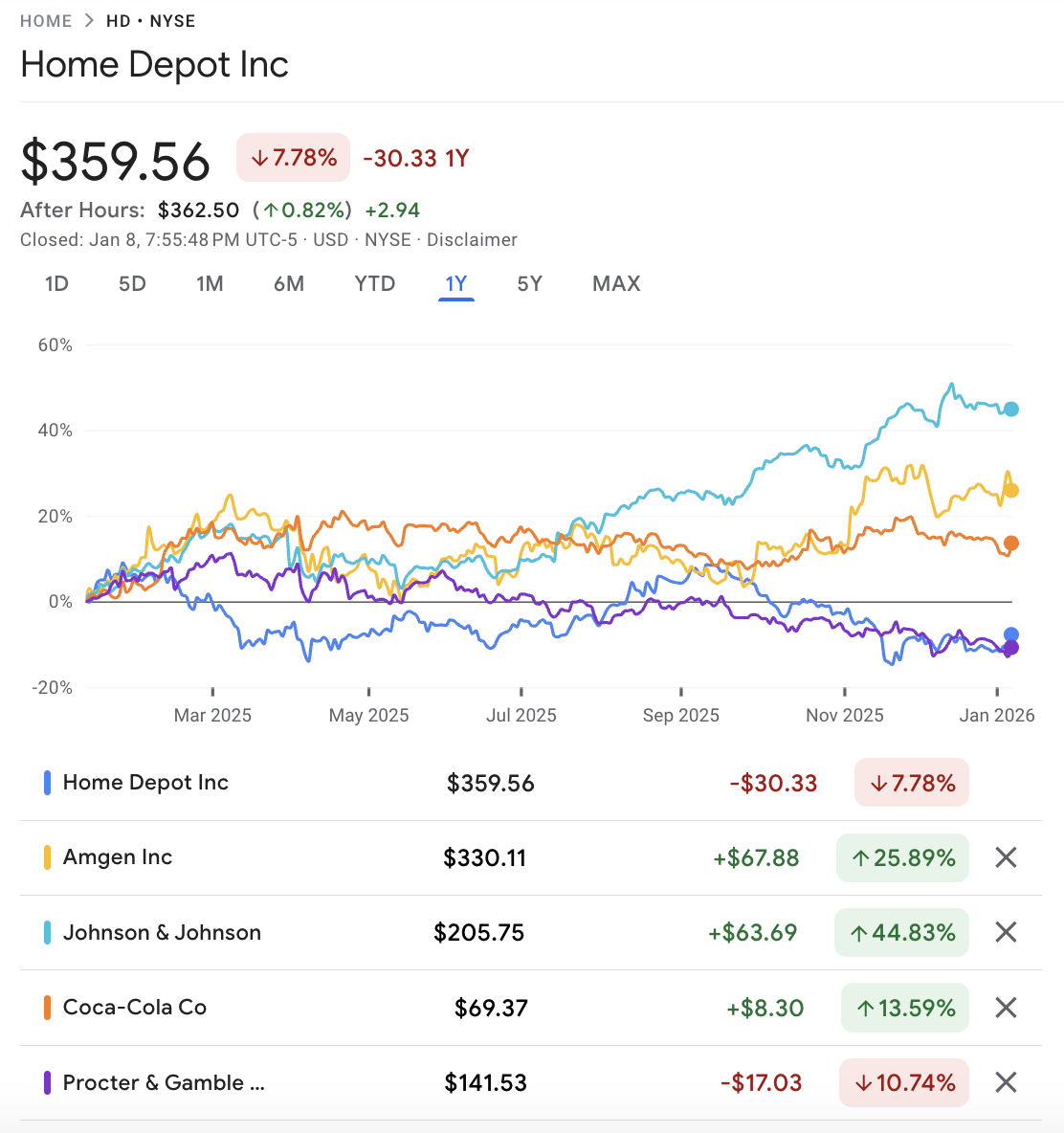

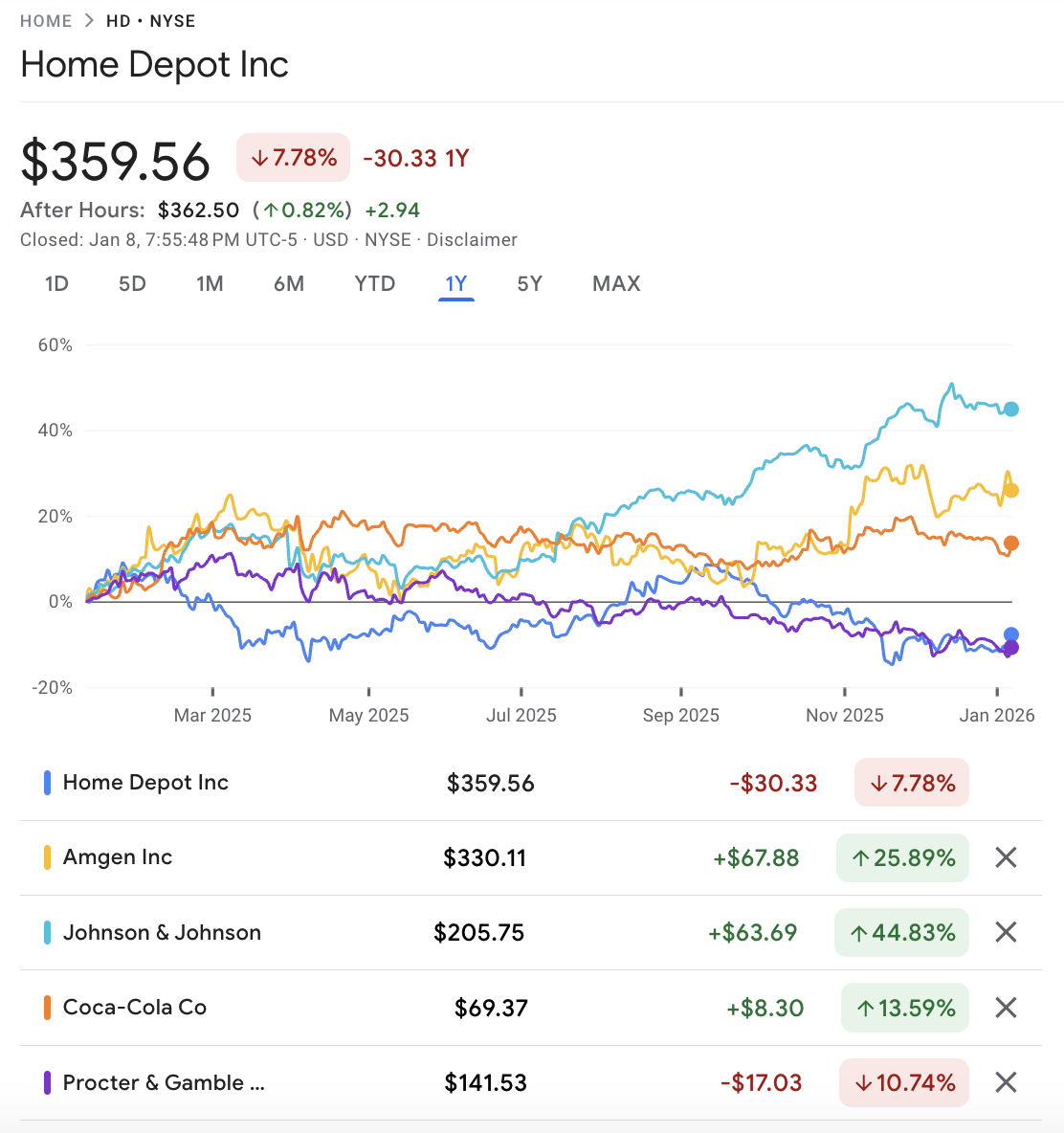

7. Amgen (AMGN) - The "Biotech Income"

Why it’s popular: Amgen bridges the gap between high-growth biotech and steady income.

Key Catalyst: Strength in its oncology and immunology portfolios, providing a 3.08% yield that is highly attractive in a slowing growth environment.

8. Johnson & Johnson (JNJ) - The "Pure Play" Medical Giant

Why it’s popular: Since spinning off its consumer health business (Kenvue), J&J is now a high-growth Innovative Medicine and MedTech company.

Key Catalyst: Legal clarity regarding historical liabilities, allowing the market to finally value its massive R&D pipeline.

9. Coca-Cola (KO) - The "Affordable Luxury"

Why it’s popular: In an era of "cost-of-living" awareness, Coca-Cola remains a habitual purchase with immense pricing power.

Key Catalyst: Success in the "Zero Sugar" and "Ready-to-Drink" alcohol categories, keeping volumes high despite global economic cooling.

10. Procter & Gamble (PG) - The "Efficiency Machine"

Why it’s popular: P&G is the defensive play. It is currently undergoing a $1.5 billion restructuring to streamline its supply chain.

Key Catalyst: Commitment to returning $15 billion to shareholders in 2026 via dividends and buybacks.

12-Month Forward Performance Outlook (2026–2027)

Over the next twelve months, the dogs of the Dow are positioned to deliver a return profile defined less by momentum and more by compounding fundamentals.

In a market environment characterized by elevated real rates, uneven growth, and heightened valuation sensitivity, return dispersion is expected to widen, an outcome that historically favors disciplined, income-oriented strategies.

Base-Case Scenario: Normalized Repricing

Under a base-case macro scenario- moderate economic growth, stable credit conditions, and no sharp acceleration in inflation, the Dogs of the Dow are likely to benefit from incremental multiple expansion alongside steady dividend income. Current forward valuation discounts relative to the broader Dow suggest room for price appreciation as sentiment normalizes.

Expected total return range: high single digits to low double digits

Primary drivers: dividend yield contribution, modest multiple expansion, earnings stability

Volatility profile: lower than growth-heavy index components

In this scenario, dividends account for a meaningful portion of total return, reinforcing the strategy’s defensive characteristics without sacrificing upside participation.

Bull-Case Scenario: Accelerated Value Rotation

Should capital rotation toward value and income intensify, driven by persistent rate pressure or growth fatigue among mega-cap leaders, the Dogs cohort could outperform more aggressively. The Small Dogs subset, in particular, tends to exhibit higher beta during valuation-driven recoveries.

Upside potential: low-to-mid teens total return

Key catalyst: rapid compression of valuation spreads between growth and income equities

Most responsive segments: telecommunications, industrials, and energy

This outcome would reflect not speculative enthusiasm, but a re-rating of neglected balance-sheet strength and cash-flow durability.

Bear-Case Scenario: Growth Reacceleration or Risk-Off Shock

The principal risk to the dogs of the Dow over the next year lies in either a sharp reacceleration of growth-led momentum or an exogenous risk-off shock that compresses equity multiples broadly.

Downside profile: cushioned by dividend yield but vulnerable to capital drawdowns

Relative performance: likely to outperform high-multiple growth, but lag pure defensives.

Mitigating factor: income provides return ballast even in flat markets

Even in adverse conditions, the strategy’s income component historically reduces drawdown severity relative to the broader equity market.

Risks and Structural Limits

No strategy is immune to failure. The Dogs of the Dow can underperform during momentum-driven bull markets or periods of rapid multiple expansion. Additionally, certain high yields may reflect secular challenges rather than temporary dislocation.

Effective implementation in 2026 requires monitoring:

Frequently Asked Questions (FAQ)

1. What fundamentally defines “The Dogs of the Dows” strategy?

It is a contrarian investment framework that mandates purchasing the ten highest-yielding stocks in the Dow Jones Industrial Average at the start of the year and rebalancing annually. The core logic is that high yield indicates an undervalued price in a fundamentally strong company.

2. Why is the 2026 macro-environment particularly favorable for this approach?

After the 2025 “Magnificent 7” fatigue, investors have shifted focus toward FCF (Free Cash Flow) yield and valuation safety. With the DJIA trading near 49,000, the “Dogs” represent the only segment of the index still trading at historically attractive multiples.

3. Does the strategy require active management?

Technically, no. It is a rules-based, passive strategy. However, sophisticated analysts recommend monitoring for “dividend traps,” which are companies whose yields are high due to terminal structural decline rather than temporary market cycles.

4. How does the 2026 Top Dogs Of The Dows list handle recent index changes?

The index committee’s 2024 decision to swap legacy tech (Intel) for AI leaders (Nvidia) has increased the overall quality of the DJIA. As a result, even the “Dogs” of 2026 are of higher fundamental quality than the Dogs of a decade ago.

5. Are there specific tax implications for this strategy?

Since the strategy requires annual rebalancing (selling losers or stocks that no longer yield enough), it can trigger short-term capital gains. In 2026, many institutional investors utilize “Total Return” swaps or tax-advantaged accounts to execute “The Dogs of the Dow” to mitigate this drag.

Conclusion

The Dogs of the Dow in 2026 is not a strategy rooted in nostalgia, but one grounded in valuation discipline and probability. As capital costs remain elevated, market leadership naturally shifts away from speculative growth toward established companies with durable cash flows and reliable dividends.

This rotation back to dividend-paying blue chips reflects a market that is re-anchoring itself to fundamentals, signaling a healthier and more disciplined financial environment where returns are earned through earnings, balance sheet strength, and capital allocation rather than multiple expansion alone.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.