A 2025 "crash" is not the base case among major institutions right now. However, the odds of a sharp correction (10–20%) are elevated because valuations remain rich, AI-led tech leadership is wobbling, and the unpredictability of the Federal Reserve's upcoming actions ahead of the Jackson Hole meeting.

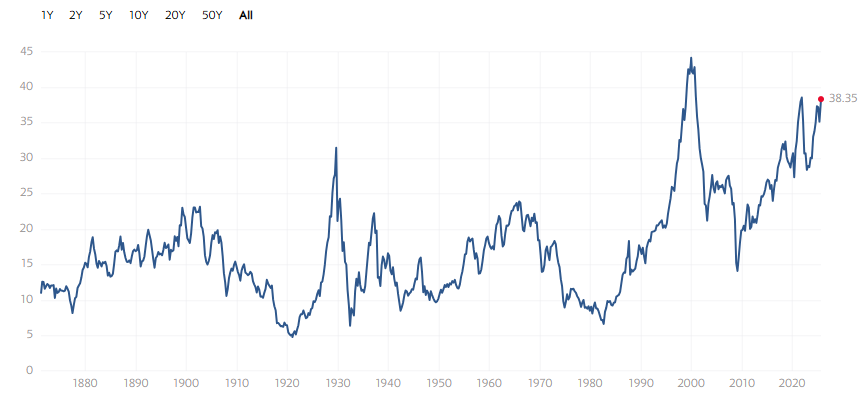

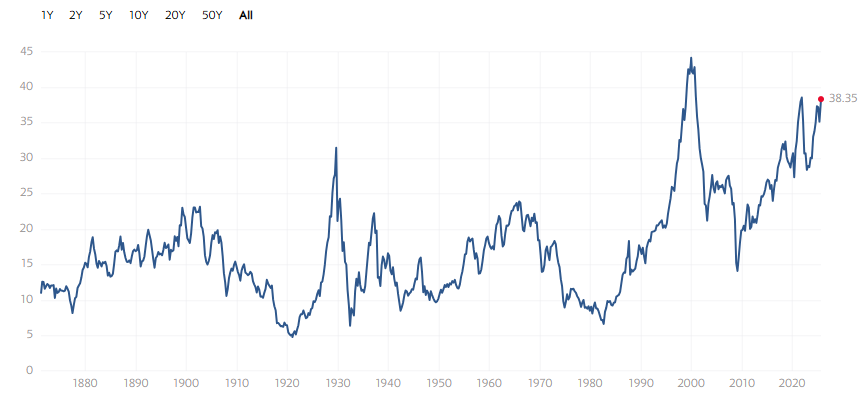

As of September 2025, the forward P/E for the S&P 500 is around 23.7×, down from the near 27–29× highs of 2024. CAPE (Shiller P/E10) is elevated at 37.9, among the highest since late 2021.

Together, these signals suggest that if growth disappoints or policy missteps occur, downside risks could materialise quickly.

Why Is the Stock Market Crash Talk Back in 2025?

Markets tend to fret about three things at once: price, policy, and positioning. In August 2025, all three are flashing "pay attention":

1) Price:

U.S. equities trade on expensive multiples by historical standards. Forward P/E estimates hover around ~23, while the Shiller CAPE is in the high-30s, a zone historically associated with lower forward returns and fatter left tails.

2) Policy:

The Federal Reserve is at the centre of a debate on how quickly to cut without reigniting inflation. In Jackson Hole, officials have sounded cool on a near-term cut, keeping markets uneasy.

3) Positioning:

Leadership has been tech-heavy. As investors reassess the ROI of AI spending, we've seen a budding rotation out of richly valued names, an early warning that crowded trades may be thinning out.

Taken together, this isn't a doomsday outlook. However, it does raise the probability that even a small shock, whether from earnings, inflation, or geopolitics, could spark a bigger pullback than markets currently price in.

As Goldman Sachs has noted in broader risk research, markets often underestimate the duration and impact of geopolitical events, a habit that can turn orderly pullbacks into air pockets.

What Experts Are Saying About the Stock Market Crash 2025

1) The Fed: One Speech Can Move a Year of Expectations

All eyes are on Chair Jerome Powell's Jackson Hole remarks. With inflation sticky and growth mixed, officials have sounded lukewarm about a September cut, suggesting the central bank wants more proof before easing.

The message matters: if Powell leans hawkish (or simply non-committal), expensive equities can sell off as discount rates stay higher for longer. If he opens the door to cuts, cyclicals may catch a bid while long-duration tech stabilises.

2) Wall Street Strategy Desks: "Not a Crash Call, But Mind the Risks"

Recent notes from major houses highlight a familiar trio of slowing labour, mixed earnings, sticky prices, and under-appreciated risks as U.S. indices press higher.

The gist: The risk-reward has narrowed; any disappointment gets magnified when multiples are already generous.

3) Global Macro Bodies: Growth Isn't Falling Off a Cliff

The IMF's July update projected ~3.0% global growth for 2025, a slowdown but far from crisis territory. This provides a floor under "crash" fears but doesn't eliminate volatility if shocks emerge.

In simpler terms, the macro floor exists, but markets can still overreact due to fear.

Factors Fueling Stock Market Crash 2025 Predictions

1) Valuation Reality Check: Why Expensive Markets Don't Need a Big Catalyst to Drop

Valuation is not a timing tool, but it sets the spring tension. Three gauges frame 2025:

Forward P/E (S&P 500): hovering in the ~22–23 zone, well above long-term norms.

Shiller CAPE: ~38, historically linked to weaker 10-year returns.

Excess CAPE Yield (ECY): recent prints show thin equity risk premia versus real rates, meaning the "equity over bonds" edge is slim, so rate surprises bite harder.

None of these guarantees a crash; they do imply that 2025's market needs continued good news (disinflation, healthy earnings breadth, a steady Fed) to justify staying this pricey.

2) Tech & the AI Question: From Market Engine to Market Risk

For two years, index increases have been driven by megacaps associated with AI.

In August, the sentiment changed as reports of hiring freezes and restructuring at a major platform firm, along with doubts about ROI in enterprise AI, led to significant selling in growth leaders and a shift toward more affordable sectors. When leadership falters, beta increases across the entire market.

Why That Matters in Crash Debates:

Indexes are cap-weighted; when a handful of giants wobble, benchmarks move a lot.

AI capital expenditure cycles tend to be lengthy and uneven; if CFOs postpone implementations or restrict expenditures, revenue growth could become delayed, jeopardising optimistic valuations.

Momentum chases strength on the way up and on the way down, which can magnify swings during regime changes.

3) The Fed, Rates, and the "Accidental Hard Landing" Risk

A market crash in 2025 would most likely come from policy error or policy inertia:

If the Fed waits too long to cut, growth may slow, earnings drop, and multiples compress simultaneously.

If it cuts too soon, inflation may reignite, forcing more aggressive tightening later.

Both paths risk volatility, and Jackson Hole sets the tone for which way markets lean.

4) Geopolitics: The Wildcard That Models Underweight

From persistent conflicts to tariff regimes, macro friction can linger longer than pricing suggests.

Analysts have highlighted that markets misjudged the length of significant conflicts earlier in 2025. "Event risk" is often characterised by a left-tail bias: low probabilities, large impacts, and concentrated volatility.

Keep an eye on energy prices, shipping lanes, and sanctions headlines, the channels through which geopolitics translates into earnings and inflation.

Signals That Would Raise Crash Odds and Prove Crash-Callers Wrong

| Signals That Would Raise Crash Odds |

Signals That Could Prove Crash-Callers Wrong |

| Persistent high inflation forcing central banks (Fed, ECB, RBI, etc.) to keep interest rates elevated. |

Inflation continues to ease, allowing central banks to pivot toward rate cuts without triggering recession. |

| Sharp slowdown in global growth, especially in the US, Eurozone, or China. |

Strong GDP growth in the US, India, and emerging markets supports earnings and risk appetite. |

| Escalation of geopolitical risks (Ukraine, Middle East, Taiwan). |

De-escalation of geopolitical tensions improves global trade and investor confidence. |

| Surging government or corporate debt defaults creating systemic financial stress. |

Healthy corporate balance sheets, with tech and consumer sectors leading earnings growth. |

| Energy price spikes (e.g., Brent crude above $100/barrel) pressuring consumers and import-heavy economies like India. |

Stable or lower oil and commodity prices relieve inflationary and fiscal pressures. |

| Significant drop in consumer confidence and retail spending in developed markets. |

Resilient consumer spending and strong labor markets sustain economic momentum. |

Portfolio Playbook Ahead of A Potential Market Crash

1) Re-Balance by Rate Sensitivity, Not Just Sector Labels

Focus on free cash flow-rich tech versus capital-hungry peers. In cyclicals, prioritise firms with strong balance sheets and pricing power.

2) Respect the Valuation Math

At a forward P/E near the low-20s and a CAPE near ~38, the equity risk premium is thin. Size positions so that a one-turn multiple compression on consensus EPS won't force you to sell lows.

3) Use Options Intelligently

Collars or put spreads can manage risk while retaining long-term investments.

If you support sector rotation, utilising call spreads on value/cyclicals financed by covered calls on costly growth can assist in managing risks effectively.

4) Diversify Your "Defence"

Defence isn't only cash. Consider quality factor tilts, shorter-duration fixed income, and select commodities exposures that hedge inflation surprises.

Don't rely on a single safe haven; in 2025, JPY can behave differently now that the BOJ's policy rate is ~0.5%, altering classic funding dynamics.

5) Monitor the Calendar of Catalysts

Jackson Hole, then CPI/Payrolls, then the next FOMC.

Earnings seasons: revisions and margin commentary matter as much as top-line growth.

Tariff/energy headlines: geopolitics can reroute supply chains overnight.

Frequently Asked Questions

Q1. Is a Stock Market Crash Likely in 2025?

While no forecast is absolute, many analysts point to risks such as high global interest rates, corporate debt, and slowing economic growth. Others argue that strong earnings and technological innovation could prevent a crash.

Q2. What Are the Main Factors That Could Trigger a Stock Market Crash in 2025?

Potential triggers include shifts in U.S. Federal Reserve policy, global recession fears, rising oil prices, geopolitical conflicts, and sudden drops in investor confidence.

Q3. Should I Sell My Stocks Before a Potential 2025 Crash?

Experts generally advise against panic selling. Instead, diversifying your portfolio, holding some safe-haven assets (like gold or bonds), and focusing on long-term investments are better strategies than trying to time the market.

Conclusion

In conclusion, the possibility of a stock market crash in 2025 is more about elevated correction risk than a guaranteed collapse.

While we cannot ignore risks like high interest rates, global uncertainty, and debt pressures, the resilience of corporate earnings, technological innovation, and strong emerging market growth offer reasons for cautious optimism.

Ultimately, if you manage risk before the headlines shift, you won't need to predict the exact day a selloff starts to come through 2025 in one piece.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.