The Indian stock market crash of 2025 wiped out several lakh crore in market value within weeks, driven by foreign portfolio investor (FPI) exits, a rupee crash past ₹88/$, and tariff fears shaking confidence.

FPIs have pulled ~USD 13–15 billion (₹1.1–1.2 lakh crore) YTD from India, while the rupee slid past ₹88/$, and ultra-low headline inflation removed the case for faster monetary easing. That combination created a rapid unwinding of crowded positions and increased volatility.

This article explains the causes, the mechanics of the sell-off, the likely paths ahead (three scenarios), which sectors and investor types win or lose, and practical action steps for traders and long-term investors in India.

What Happened to the Indian Stock Market in 2025?

From mid-August to mid-September 2025, Indian markets experienced repeated bouts of selling pressure. Index moves were meaningful: the Nifty 50 slipped below key technical supports (near the 24,700–25,100 area), and the Sensex crash wiped out multi-hundred points on headline days.

In one notable session, the BSE market capitalisation decreased by several lakh crore rupees as risk aversion escalated. Domestic headlines and intraday trade commentary repeatedly flagged FPI outflows, the rupee crash, and U.S. tariff shocks as the triggers.

What Caused the Indian Stock Market Crash of 2025? 5 Key Factors

1. Large Foreign Outflows

Foreign portfolio investors have been net sellers through 2025. Trackers indicated FPIs have withdrawn approximately USD 13–15 billion (₹1.1–1.2 lakh crore) so far in 2025, with fresh selling continuing into September. [1]

August saw a notable spike in selling across financials and IT names. When non-resident sellers accelerate, domestic liquidity and valuations come under pressure.

2. Rupee Weakness and Dollar/FX Shocks

In early to mid-September 2025, the Indian rupee fell below ₹88 per USD due to concerns about increasing U.S. tariffs on Indian goods and volatility in global policies. A weaker rupee heightens the risk of imported inflation and discourages foreign investment.

Reuters reported that the rupee reached record low levels, highlighting how Foreign Portfolio Investors (FPIs) are sensitive to currency fluctuations, often reducing their exposure to India when the risk associated with the rupee increases.

3. Macro Surprises: Low-But-Rising Inflation and Growth Fears

India's inflation in July 2025 was remarkably low (headline CPI ~1.55% YoY), prompting commentary about disinflation and its policy implications; the August print edged up but remained subdued.

Low CPI can be a double-edged sword: while it gives the RBI room to ease later, very low inflation can signal demand weakness, a growth scare that hurts equities.

4. Global Monetary & Political Shocks

Global markets have responded to a combination of Fed messaging, U.S. politics, and fluctuations in yields. Even when the Fed cuts, uncertainty about the size/timing, and how that affects real yields, can swing global flows.

In 2025, the market narrative included Fed moves that were interpreted as "risk management" rather than plain dovish, which kept yields volatile and pressured EM flows.

In addition, U.S. tariff decisions on Indian exports (announced in 2025) materially raised risk premiums for India.

5. Corporate or Sectoral Triggers and Crowded Trades Unwinding

Some large caps (especially pockets of IT, financials, and exporters) disappointed on guidance or saw downgrades, triggering stop-loss cascades and momentum selling.

Hedge funds and quant strategies with crowded long positions, often concentrated in the same handful of stocks, were vulnerable to rapid reversals, amplifying the crash dynamics.

Who Lost and Who Benefited During the Crash?

Clear Losers

1) Small and Mid-Cap

Newgen Software in the Nifty Smallcap 250 index fell around 43% in a month.

In the same index, 22 multibagger small-caps dropped between 20% and 43% in a sharp correction.

The Nifty SmallCap 100 index was also down ~21.6% from its peak, and the Nifty MidCap 100 ~18.4%, showing that mid and small-caps are bearing the brunt.

2) IT and Pharma Stocks Exposed to Tariffs

The IT sector experienced a decline of approximately 0.9% during certain sessions when U.S. tariff news affected India.

Some pharmaceutical stocks also dropped around 0.7% following a decline in the pharma index due to weak earnings and concerns over trade friction.

Bajaj Finance dropped ~5.1% in July 2025 due to MSME asset-quality concerns, which spilt over to other finance-linked midcaps.

3) Micro-Caps and Deeply Illiquid Names

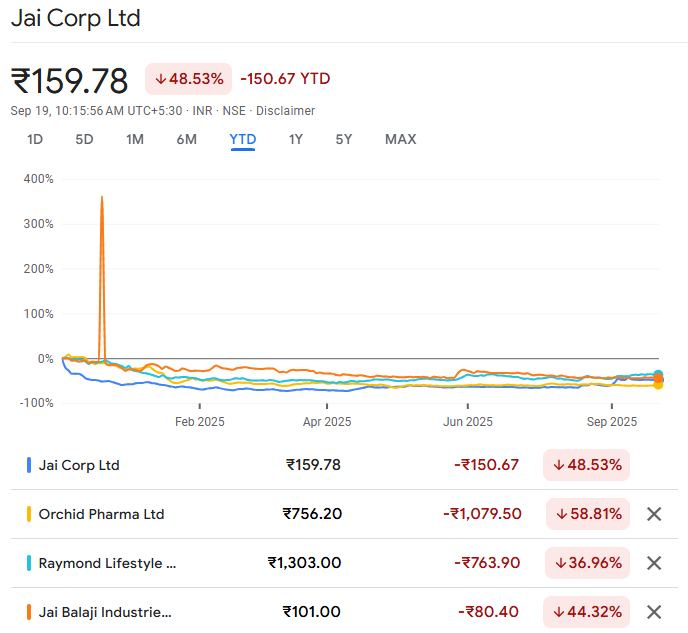

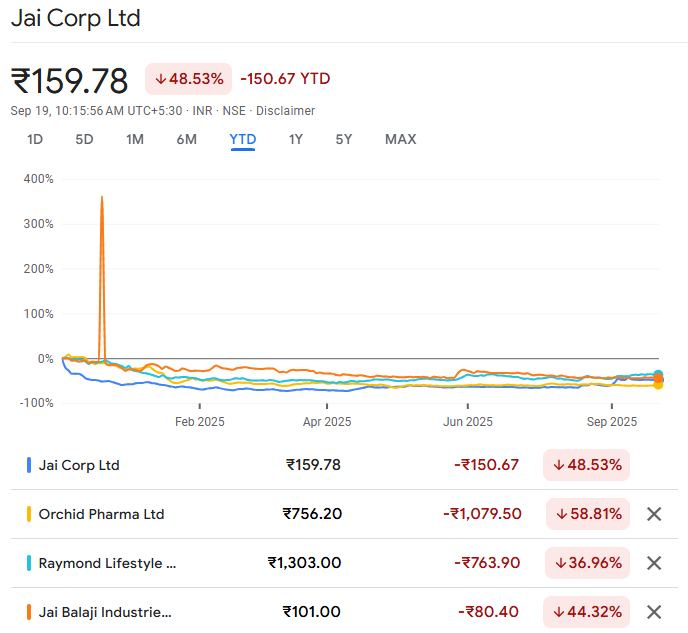

Jai Corp plunged ~67%, from ~₹327 to ~₹109.

Orchid Pharma dropped ~62%, Raymond Lifestyle ~51%, Jai Balaji Industries ~44%. [2]

Relative Winners

1) Large Blue-Chip and Defensive Sectors

HUL, ITC, Reliance, TCS, and Maruti Suzuki fell less than the broader market.

For instance, when mid and small-caps fell 7–9%, Nifty 50 losses were just 2–4%.

2) Some "Multibagger" Small-Caps Defying Gravity

Interestingly, some small-cap names bucked the trend: JSW Holdings, Tata Investment Corporation, Maharashtra Scooters, Bombay Burmah Trading, and Sundaram Finance Holdings delivered returns (up to ~118%) despite broader small-cap indices dropping.

Indian Stock Market Outlook: Expert Scenarios

Listed below are forward scenarios that reflect current data and market sentiment. Probabilities are illustrative, not predictive.

Base Case (50%): Shallow Correction & Recovery

What Happens: Foreign Portfolio Investors are reducing their selling as tariffs are clarified or softened. The Reserve Bank of India signals targeted liquidity measures, while the rupee stabilises near ₹86–88 per dollar. Additionally, growth indicators show resilience. Domestic flows and retail buying partially offset foreign selling.

Result: The market recovers gradually; Nifty regains mid-20k levels over 3–6 months.

Why Plausible: India's underlying GDP and corporate earnings still show strength; low CPI gives RBI room to act if needed.

Risk On and Off Case (30%): Prolonged Pressure

What Happens: Tariffs and global political issues remain unresolved; FPIs continue to sell modestly. The rupee slides further into the high 88s, around 89. Economic growth is slowing, and earnings forecasts are revised downward.

Result: The market is currently range-bound, showing lower highs and higher volatility, while cyclical stocks are underperforming.

Why Plausible: Net FPI outflows YTD (~$15bn) are large; further policy uncertainty can deter re-entry by foreigners for months.

Sharp Crash: Tail Event (20%)

What happens: A major geopolitical shock, an unexpected credit event, or materially worse trade policy triggers panic and large further outflows. Liquidity freezes in midcaps, and indices fall 15–30% from prior highs before policy or global calm returns.

Result: Deep drawdown; many risk assets need time to recover.

Why plausible: Markets can snowball if margin calls and liquidity stress align with policy missteps; history shows tail events are rare but severe. The Federal Reserve's communication and international interest rate changes have heightened concerns about potential risks. [3]

Recommend Strategies for Traders and Long-Term Investors

For Day and Swing Traders

Tighten risk controls: Reduce position sizes, implement stop losses, and refrain from increasing leverage when spreads widen.

Trade volatility, not direction: Sell premium (carefully) or use small option plays to capture elevated IV; trade rebounds with tight stops.

Watch liquidity corridors: Prefer large-cap, liquid names during crisis windows; avoid low-volume plays unless you have a clear exit plan.

For Weekly and Monthly Traders

Buy the dip selectively: Concentrate on financially strong companies that possess cash reserves, generate consistent revenue, and have fair valuations.

Use staggered entries: Dollar-cost average into positions rather than timing a single 'bottom' entry.

Hedging: Protective puts or collars can be a reasonable cost if you're long and worried about short-term drawdowns.

For Long-Term Investors

Reassess core allocation: If your investment period is extended, downturns present an opportunity to realign with strong ROCE, minimal net debt, and a lasting competitive edge.

Avoid chasing the bottom: Waiting for two or three quarters of improving macro and earnings data before heavy buying reduces risk.

Preserve dry powder: keep some cash for disciplined buying after bad news is priced in.

Key Data and Events to Monitor for Indian Traders and Investors

FPI Flows (Daily/Weekly)

Rupee Levels & FX Swaps

CPI Prints (Monthly)

Corporate Earnings & Guidance

Government and Trade Policy Actions

RBI Communications and Open Market Operations (Omos)

Global Cues: Fed Statements & 10-Yr UST Moves

Frequently Asked Questions

1. How Much Have Foreign Investors Pulled Out of Indian Equities in 2025 So Far?

As of August-September 2025, FPIs have withdrawn about USD 13–15 billion (₹1.1–1.2 lakh crore) from Indian equities.

2. Which Sectors Have Seen the Worst Losses During the Crash?

Mid- and small-caps, IT (dragged by foreign selling), and select pharma.

3. What Are the Key Triggers That Led to the Stock Market Crash?

U.S. tariffs on Indian exports, FPI outflows, High valuations relative to other emerging markets, and rupee depreciation and currency risk.

4. How Severe Has the Loss Been in Major Indices?

The Nifty 50 has lost double-digit percentage points from its highs earlier in 2025.

Conclusion

In conclusion, the 2025 Indian stock market crash was sharp but not unprecedented. For long-term investors, it offers opportunities; for traders, it demands discipline.

While history shows markets recover, separating emotional reaction from rational allocation is the real edge.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/india/foreign-outflows-indian-financials-hit-7-month-high-august-2025-09-04/

[2] https://economictimes.indiatimes.com/markets/stocks/news/these-11-microcap-stocks-fell-upto-65-in-cy25-do-you-own-any/microcap-crash/slideshow/122021229.cms

[3] https://www.reuters.com/world/india/rupee-dips-below-88usd-investors-get-mixed-signals-fed-cut-2025-09-18/