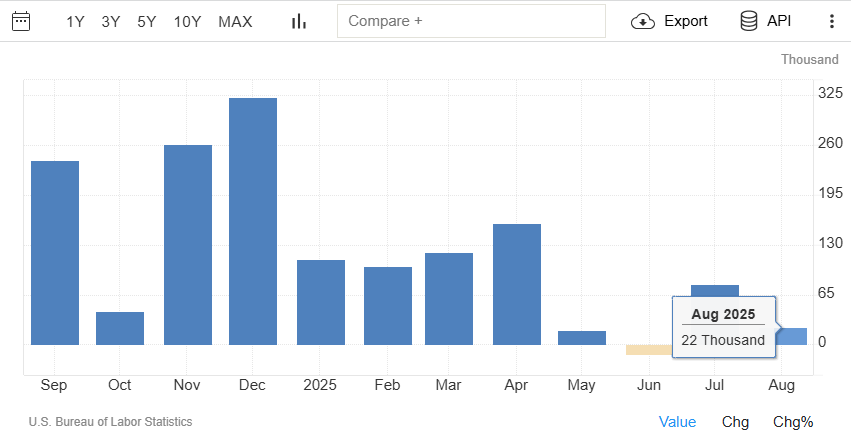

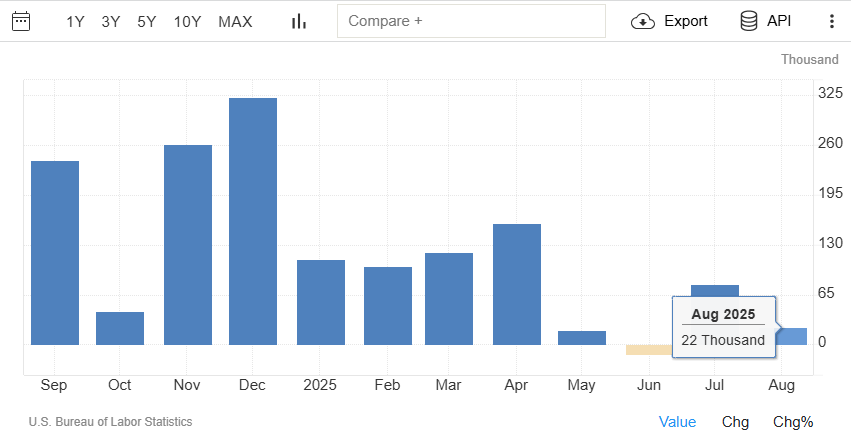

Over the next six months, the stock market is more likely to rally than to collapse into a deep recession. However, the path will be bumpy. As of August 2025, payrolls rose just 22,000, unemployment stands at 4.3%, and benchmark revisions cut nearly a million jobs from earlier counts.

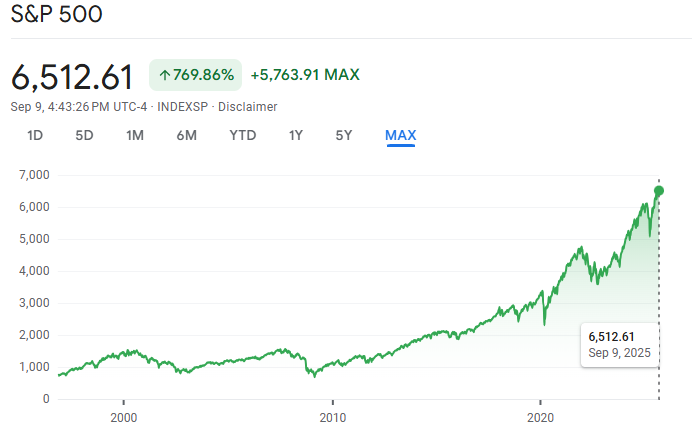

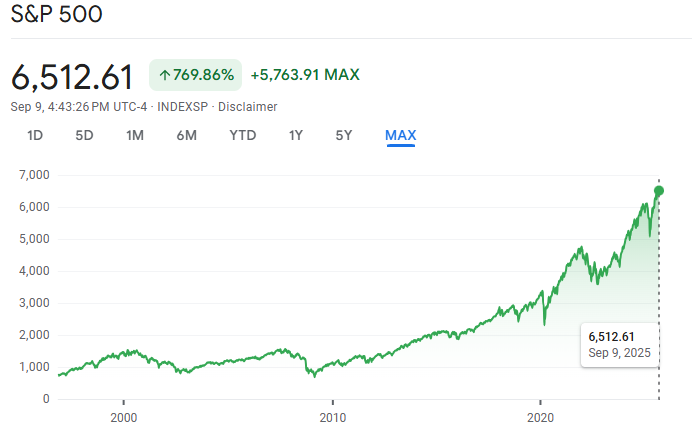

At the same time, equities, powered by big-cap tech and AI beneficiaries, have recently hit record highs, with analysts nudging up EPS expectations. This bullish tilt coexists with risks: a softening labour market, contracting manufacturing activity, political volatility, and global growth headwinds.

In short, probability favours continued gains with elevated volatility; a shallow slowdown (growth deceleration) is likelier than a sudden, deep recession. But watch employment data, Fed signals, and credit conditions closely.

Where Does The Market Stand In 2025? Key Data Points

1) S&P 500:

The index has reached new highs on expectations of Fed rate cuts and strong AI-driven earnings from large-cap leaders.

2) Labour Market:

As of August 2025, U.S. nonfarm payrolls rose just 22,000, with unemployment at 4.3%, signalling a meaningful softening in jobs growth.

At the same time, benchmark revisions show ~911,000 fewer jobs through March 2025 than previously reported, a material downgrade to the labour backdrop.

3) Analyst EPS Estimates:

Wall Street has modestly lifted third-quarter EPS estimates for the S&P 500 (a minor +0.5% revision), reflecting slightly healthier corporate profit expectations. [1]

4) Yield Curve & Credit:

The treasury curve has been volatile as markets debate whether the curve inversion signal holds after revisions and political shocks.

Some segments have steepened recently due to long-term yield moves. Policy and political risks are also raising term premia.

5) Manufacturing:

The ISM manufacturing PMI is at ~48.7, its sixth straight month in contraction.

Stock Market Forecast Next 6 Months: Will the Market Go Up or Down?

| Scenario |

Probability |

What Happens |

Market Impact |

Investor Playbook |

| Rate-Cut-Led Soft Landing |

40% |

Jobs cool but avoid collapse; inflation drifts lower; Fed cuts 1 to 2 times; earnings steady on AI strength. |

S&P 500 rallies 5–15%; yields ease; credit holds. |

Buy growth/quality cyclicals, add duration. |

| Growth Deceleration / Stagflation Risk |

35% |

Manufacturing weakens, consumer spending slows, sticky inflation delays cuts. |

Choppy markets; equities flat to down mid-single digits. |

Hold defensives, gold, liquidity. |

| Shallow Recession / Risk-Off |

25% |

Payrolls fall, unemployment >5%, EPS cuts deepen, credit spreads widen. |

S&P 500 drops 10–25%; safe-haven flows to Treasuries/gold. |

De-risk, add high-quality bonds, cash. |

Above are three scenario frameworks for the next six months. The probabilities are illustrative, based on current data and market pricing.

Stock Market Forecast Next 6 Months: Bull Case

1) Policy Easing Supports Valuations

Markets currently expect the Fed to start cutting rates; that reduces discount rates and supports higher equity valuations, especially for long-duration growth names tied to AI and cloud adoption.

Recent market moves reflect that expectation and the rotation into tech and megacap leaders. [2]

2) Earnings Momentum in AI/Tech

Analysts have nudged EPS estimates higher for the coming quarter; even small upward revisions help support indices dominated by a few large-cap names that benefit from AI spending. If big tech continues to report upside, the index can rally further.

3) Resilient Consumer & Services

Despite weak manufacturing, services remain strong. If consumer spending persists, equities can sustain gains.

4) Positioning and Flows

After a protracted rotation into equities in late 2024–2025, persistent inflows (into ETFs, pension vehicles, and AI-themed funds) can sustain markets even amid soft macro news, creating "momentum fuel."

Stock Market Forecast Next 6 Months: Bear Case

1) Labour Market Risks

If unemployment rises above 5%, consumption and housing could weaken sharply.

2) Manufacturing Contraction

Prolonged PMI weakness signals risk to business investment and wages.

3) Policy & Political Volatility

Election-year uncertainty, central bank independence risks, or tariff shocks could destabilise markets.

4) Credit Stress

If credit spreads widen and lending tightens, a slowdown could turn into a recession.

Global Market Context

While the U.S. dominates headlines, global factors shape the 6-month outlook:

Europe: Growth is stagnant, with the ECB under pressure to cut rates. Weak German manufacturing drags the eurozone.

Asia: India continues to deliver strong earnings growth, a bright spot for global investors. China's slowdown remains a wildcard, as policy stimulus is being watched closely for signs of renewed momentum.

Emerging Markets: A weaker U.S. dollar would provide relief, but volatility in commodity prices may hit commodity-linked economies.

Which Data Will Decide the Outcome and What Should Investors Monitor?

1) Monthly Nonfarm Payrolls & Unemployment Rate (1st Friday Each Month)

A continued monthly payroll print below +50k and unemployment rising past 4.5% would push markets toward recession pricing.

2) CPI / Core CPI (Mid-Month)

If inflation re-accelerates, the Fed may delay cuts (bad for equities); if inflation cools further, cuts are likelier (good for equities).

3) ISM Manufacturing & Services PMIs

Sustained contraction (below 50) in services would signal concern; the robustness of services underlies growth. [3]

4) Yield Curve Dynamics & Credit Spreads (Monthly)

Inversion, persistence, and expanding credit spreads typically signal upcoming recessions. Watch 2s10s, 3m–10y, and HY spreads.

5) Corporate Guidance & Buybacks

Growing conservatism in guidance or slowing buybacks can indicate management's expectation of slower growth. Conversely, aggressive buybacks and upward guidance support the bull case.

What Investors Can Do Now?

1) Conservative Allocation (Capital Preservation):

Shift toward high-quality bonds (intermediate Treasuries), cash, and defensive sectors.

Increase short-dated duration to lock rates if you expect cuts (then ladder).

Hold gold as a hedge against political risk and currency volatility.

2) Balanced Allocation (Core Long-Term Investors):

Maintain core equities (broad index ETFs) but trim speculative small-cap holdings.

Add selective overweight to AI/Tech large caps with strong balance sheets and recurring revenue.

Keep 5–10% in cash to buy volatility dips.

3) Aggressive Allocation (Opportunistic Growth):

Lean into AI/semiconductor leaders and secular-growth names if you accept higher volatility.

Use options strategies (protective puts, collars) to cap downside on concentrated positions.

Consider tactical exposure to emerging markets if USD weakness persists.

Frequently Asked Questions

1. Will the U.S. Stock Market Go Up or Down in the Next 6 Months?

Analysts expect a modestly bullish trend, with the S&P 500 supported by strong AI-driven earnings and expected Fed rate cuts.

2. Is the U.S. Heading for a Recession Soon?

A deep recession seems unlikely for the next six months, but a deceleration in growth is quite likely.

3. How Will Federal Reserve Decisions Impact the Stock Market Forecast?

Rate cuts would support equities, but sticky inflation could delay cuts and hurt sentiment.

4. Which Sectors Are Expected to Perform Best in the Next 6 Months?

Tech/AI, healthcare, and consumer staples are expected to outperform.

Conclusion

Whether the next six months bring a soft landing or a mild recession, investors who stay diversified, hedge risks, and remain disciplined are best positioned. The next phase of the market will likely be shaped by Fed policy, labour resilience, and the durability of AI-driven earnings.

The prudent approach is balanced exposure: participate in the market's upside while maintaining hedges and high-quality ballast to survive a possible downturn.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://insight.factset.com/analysts-increasing-eps-estimates-slightly-for-sp-500-companies-for-q3-1

[2] https://www.reuters.com/business/sp-500-registers-record-high-close-data-keeps-rate-cut-views-intact-2025-09-04/

[3] https://www.ismworld.org/supply-management-news-and-reports/news-publications/inside-supply-management-magazine/blog/2025/2025-09/ism-pmi-reports-roundup-august-2025-manufacturing/