As 2025 unfolds, the debate between cryptocurrency and stocks as the better investment option has grown more relevant than ever. The stock market, led by the S&P 500 in the US and the Nifty 50 in India, has delivered strong returns over the past year, despite interest rate and geopolitical uncertainty.

Meanwhile, cryptocurrencies like Bitcoin and Ethereum have staged a powerful comeback, with Bitcoin crossing the $124,000 mark in mid-2025, attracting both retail and institutional investors.

For investors in India and the US, deciding between stocks and crypto requires analysing their unique risk-return profiles, regulatory landscapes, and macroeconomic drivers. This article explores both asset classes in depth, compares their performance in 2025, and suggests which one might suit different investor goals.

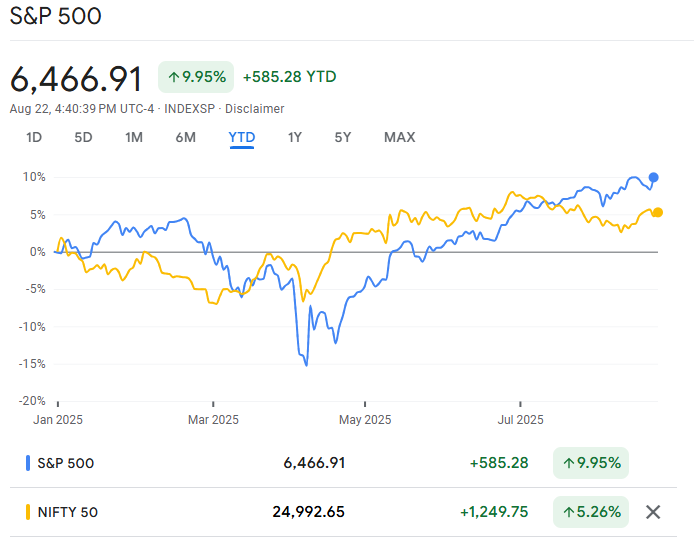

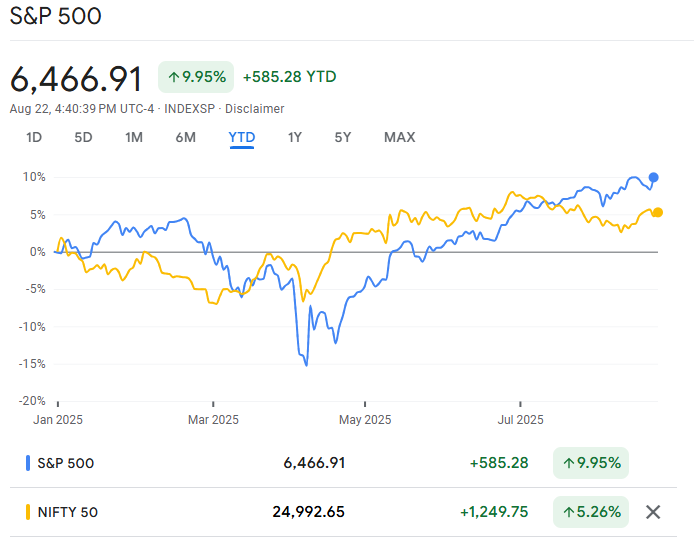

2025 Stock Market Performance

US Stock Market

In August 2025, the S&P 500 surged past 6,466 points, driven by robust performance in the technology, healthcare, and financial sectors. Nvidia, Apple, and Microsoft remain growth engines, while energy and defence stocks benefit from global demand.

Despite concerns about a slowdown, the resilience of corporate earnings has kept valuations supported.

Indian Stock Market

India's Nifty 50 touched record highs above 25,000, fueled by robust GDP growth (expected at 6.8% for 2025) and foreign portfolio inflows.

Sectors such as IT services, banking, and manufacturing continue to attract investor attention, while government reforms on taxation and digital infrastructure strengthen fundamentals.

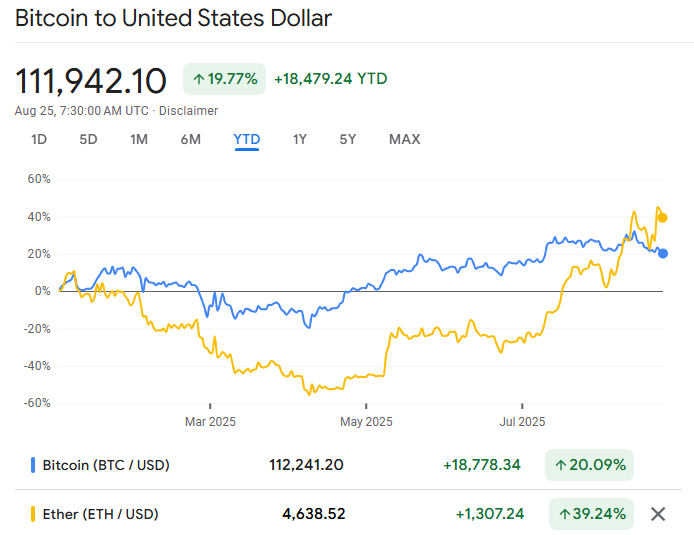

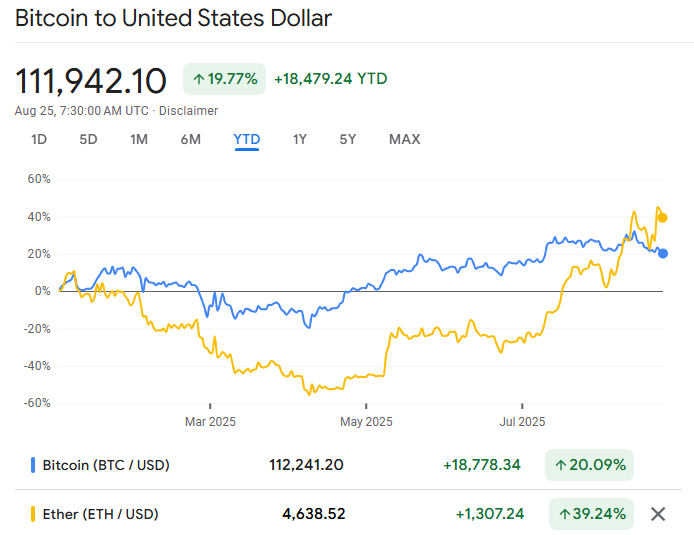

2025 Crypto Market Performance

After a difficult bear market in 2022–2023, cryptocurrencies have rebounded impressively.

Bitcoin

Trading above $111,935 in August 2025, Bitcoin remains the bellwether, bolstered by rising institutional adoption, including ETF inflows in the US and growing acceptance by Indian fintech platforms.

Ethereum

At around $4,647, just shy of its all-time high of ~$4,953, Ethereum benefits from ongoing upgrades that improve scalability and lower transaction costs, making it a backbone of decentralised finance (DeFi) and Web3 applications.

Altcoins

Select altcoins such as Solana and Polygon are gaining traction due to ecosystem growth, although risks remain high in smaller-cap tokens.

Crypto's rise in 2025 is linked to global liquidity cycles, regulatory clarity in major economies, and demand for diversification outside traditional assets. However, its high volatility and exposure to sentiment shifts make it unsuitable for conservative investors.

Crypto vs Stocks: 5 Things Investors Must Consider

1) Risk and Volatility

Stocks

More stable but not risk-free.

Analysts have cautioned that if the S&P 500 reaches 7,500, bubble-like conditions could arise, increasing the chances of a crash if earnings fail to catch up.

Crypto

Extreme volatility remains.

BTC can swing 10–15%, and ETH is similarly sensitive to DeFi demand and regulatory shifts. For risk-averse investors, this remains the biggest drawback.

Verdict: Stocks are safer for stability and wealth preservation, while crypto offers high-risk, high-reward potential.

2) Return Potential

Stocks

The S&P 500 has surged over 9% YTD, fueled by AI-related tech growth and Fed rate cut expectations.

However, experts' poll sees the index ending 2025 at 6,300, slightly lower than today, reflecting valuation concerns.

Crypto

Bitcoin and Ethereum have massively outperformed stocks. BTC has gained over 100% in 2025 so far, while ETH broke past its 2021 highs.

Analysts even project BTC could rise toward $200K in this cycle, though sceptics warn rallies may not last into 2027.

Verdict: Crypto may outperform in the short term, but stocks remain more reliable for consistent, compounding growth.

3) Regulation

Stocks

Stocks are heavily regulated by agencies in the US and in India, offering investor protection through disclosure, reporting, and compliance requirements.

Market transparency ensures greater trust and accountability.

Crypto

In 2024, the US authorised spot Bitcoin ETFs, marking a significant step toward widespread acceptance. Regulatory clarity for altcoins and DeFi is still developing.

In India, crypto is taxed at 30% on gains, with 1% TDS on transactions, which discourages frequent trading. The Reserve Bank of India continues to caution against risks while creating its Digital Rupee (CBDC) as a safe alternative.

Verdict: Stocks benefit from established regulation, while crypto remains in a grey zone, especially in India.

4) Liquidity and Accessibility

Stocks

Accessible to retail investors via platforms such as EBC. High liquidity ensures smooth entry and exit.

Crypto

Easily tradable on global exchanges, available 24/7. However, liquidity can dry up in smaller tokens during downturns, amplifying losses.

5) Portfolio Role

In modern portfolios, both stocks and crypto can play complementary roles.

Stocks provide stable long-term growth and dividends.

Crypto provides uncorrelated exposure, serving as a safeguard against threats of currency devaluation.

Advisors are progressively recommending minor allocations (1–5%) to cryptocurrency while maintaining the majority of investments in stocks, bonds, or mutual funds.

India vs US: Investor Perspectives on Crypto vs Stocks

India

Stocks remain the primary vehicle for long-term wealth, supported by strong GDP growth and domestic savings.

Crypto faces high taxation and strict regulations, making it less attractive for frequent trading but still appealing to younger investors seeking rapid growth.

US

Stocks benefit from a well-regulated environment, dividend culture, and global corporate dominance.

The rise in crypto adoption can be attributed to ETF offerings, more defined regulations, and significant involvement from institutions.

Practical Tips for Investors in 2025

Assess Risk Appetite: Conservative investors should stick primarily to stocks. Aggressive investors can explore crypto with limited allocations.

Stay Informed on Policy: Follow updates from the Fed and other authorities to anticipate regulatory shifts.

Diversify Globally: Use ETFs, mutual funds, and limited crypto exposure to balance risk.

Avoid Overexposure to Hype: Crypto bull runs often tempt investors to over-allocate; maintaining discipline is key.

Frequently Asked Questions

1. Which Is Safer: Stocks or Crypto?

Stocks are generally safer because they are regulated and backed by real businesses. Cryptocurrency carries greater risk from volatility and changing regulations, yet it can yield higher returns.

2. How Much of My Portfolio Should I Allocate to Crypto vs Stocks?

Financial advisors often suggest keeping 80–95% in stocks for stability and 1–5% in crypto for growth potential, depending on your risk appetite.

3. Do Stocks and Crypto React the Same Way to Market News?

Not always. Stocks usually react to earnings, interest rates, and economic data, while crypto is more influenced by sentiment, regulation, and global liquidity cycles.

4. Can I Invest in Both Crypto and Stocks at the Same Time?

Yes, many investors diversify by holding both, as stocks provide steady growth, while crypto adds high-risk, high-reward exposure to digital assets.

5. Which Is Better for Beginners: Crypto or Stocks?

Stocks are generally better for beginners because they're less volatile and easier to understand. Beginners can start with stocks and later add small amounts of cryptocurrency once they are comfortable.

Conclusion

In conclusion, Stocks remain the cornerstone for long-term wealth building, offering stability, dividends, and regulatory protection in 2025.

Conversely, crypto presents higher upside in the short term, especially with Bitcoin and Ethereum gaining mainstream adoption, but faces risks related to price fluctuations and changing regulations.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.