After a stretch of record highs, Wall Street's optimism ran into headwinds today. The same AI- and tech-heavy stocks that powered much of 2025's rally are now under pressure, as investors question whether the tech-led boom may have outpaced fundamentals.

Today's market pullback was primarily led by declines in the technology sector, driven by mounting concerns over lofty AI valuations and increasing uncertainty about the timing of interest rate cuts. Global equities also showed weakness as risk-off sentiment gained traction.

Below, we break down the four main drivers behind today's market move, what investors should keep an eye on going forward, and key events to watch this week.

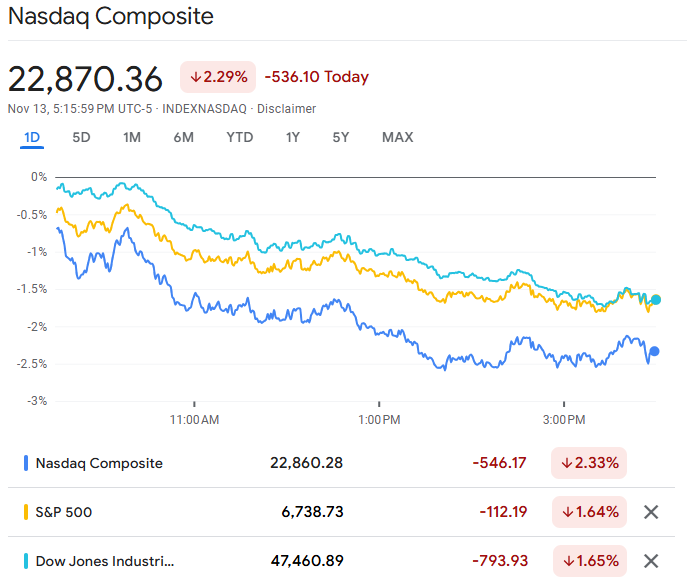

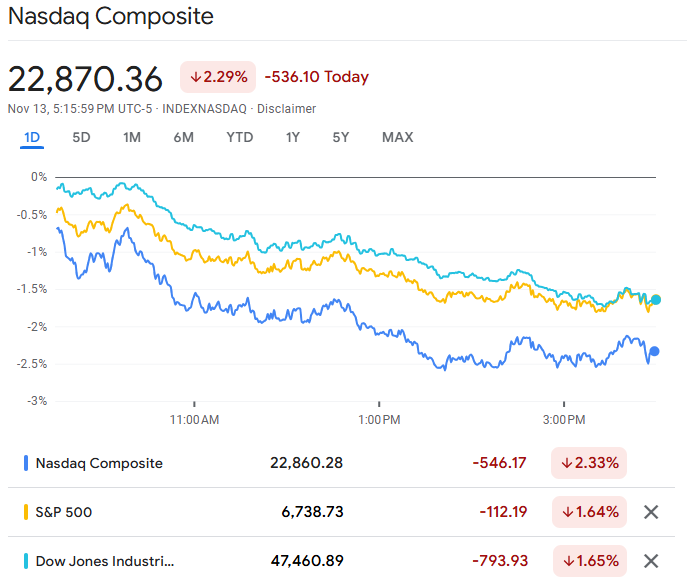

Stock Market Snapshot (November 13–14, 2025)

| Index / Stock |

% Change |

Notes / Context |

| Nasdaq Composite |

−2.3% |

Tech and AI stocks led the fall, with significant declines in chip/AI-infrastructure names. |

| S&P 500 |

−1.7% |

Broad-market drop as growth stocks underperformed. |

| Dow Jones Industrial Average |

−1.7% |

Declined after yesterday’s record close above 48,000; value stocks lagged. |

| NVIDIA Corporation (NVDA) |

−3–5%+ |

Heaviest weight on the market decline amid AI bubble concerns. |

| Palantir Technologies (PLTR) |

−6–8% |

Among top tech/AI-darlings under fresh investor scrutiny. |

The tech-heavy Nasdaq composite fell about 2.3% and the S&P 500 dropped 1.7% amid concerns over soaring valuations and uncertainty about policy direction.

Why Did the Stock Market Go Down Today? 4 Main Drivers

1. Tech Sector Turmoil: AI Hype Meets Reality

Valuations in the AI and semiconductor space are coming under fresh pressure. For example, NVIDIA dropped 3–5 %+ amid fears that its runaway valuation may no longer be justified.

Analysts note that despite strong growth in parts of the AI ecosystem, adoption and monetisation are not keeping pace with exuberant expectations. The market mood is shifting from unrestrained enthusiasm for tech stocks to a more discerning and cautious stance.

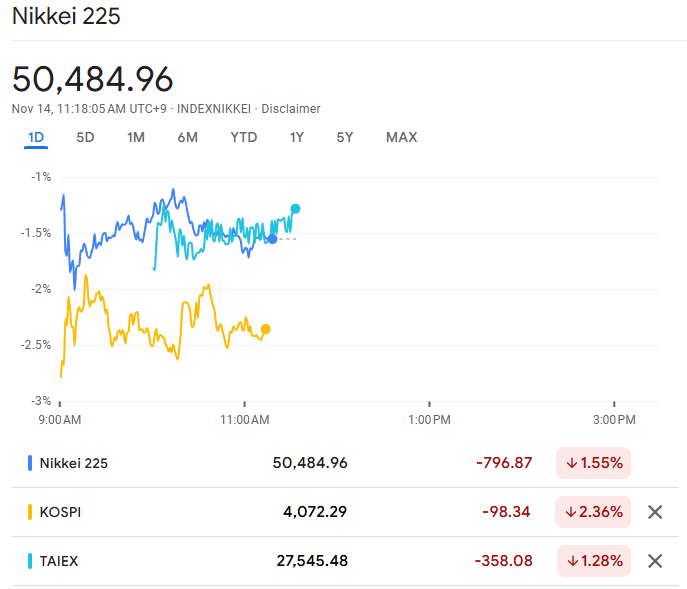

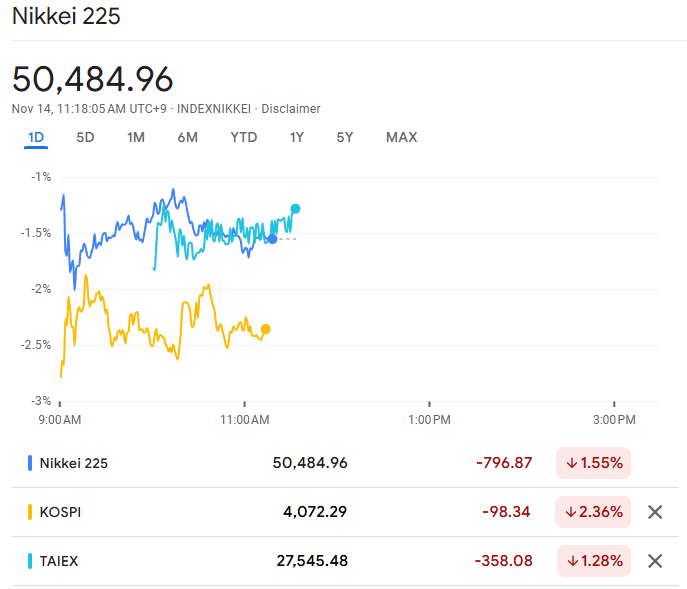

2. Global Markets Follow Suit: Risk Off

The U.S. tech sell-off is rippling globally, as recent movements imply that markets in Asia and Europe are increasingly sensitive to U.S. tech weakness and valuation risks.

For example, the Nikkei 225 index dropped nearly 2% in early trading, with the Kospi index also slipping 2.4% and the TAEIX index lagging with a 1.28% dip.

In short, the weakness is not isolated as it's broadening beyond the U.S., reflecting a more global risk-off posture.

3. Elevated Valuations & Big Bank Warnings

Major banks have flagged potential drawdowns in equities due to stretched valuations, particularly in the tech/AI sectors.

Warnings of a 10–20% market correction are resurfacing as investors appear to be responding by reducing risk exposures and shifting toward less speculative stocks. [1]

4. Unclear Policy & Liquidity Environment

While the U.S. government shutdown has officially ended, the broader macro picture remains murky. Investors remain uncertain about the timing of rate cuts from the Federal Reserve and how inflation, labour-market data, and liquidity conditions will evolve.

That ambiguity is denting risk appetite and increasing volatility across asset classes.

Beyond Today: Why the Stock Market Typically Goes Down

While today's drop is punctuated by tech/AI worries and valuation hang-ups, here are broader structural reasons markets fall:

Interest rate hikes: When borrowing costs rise, growth stocks are hit harder.

Earnings disappointments: Even strong reports can disappoint if expectations were higher.

Geopolitical or policy shocks: Any trade conflicts, abrupt policy shifts, and market closures will weigh heavily on investor sentiment, often triggering broader risk aversion.

Bubble dynamics/speculative excesses: Overheated sectors eventually correct.

Liquidity & safe-haven shifts: When fear rises, money flows from equities into bonds, gold, and cash.

What Investors Should Know Moving Forward

1. Tech Sector Sensitivities Remain High

Volatility in the tech and AI space is unlikely to fade soon. Investors should watch:

Earnings revisions and forward guidance from major AI and semiconductor companies

Rising short interest across software and chip stocks signals that leverage in the tech sector is unwinding and scepticism toward stretched valuations is growing.

Upcoming large-cap tech earnings, which will heavily influence sentiment; any guidance cuts could accelerate rotation out of high-multiple names

AI hardware demand trends, which continue to shape expectations for the broader sector

As sector positioning becomes more cautious, the leading performers of 2025 could also face the most pronounced volatility ahead.

2. Valuation Risk is Elevated

Major banks continue to warn about stretched valuations, and market breadth remains narrow. Several indicators confirm a shifting landscape:

ETF flows are rotating: U.S.-listed equity ETFs saw nearly $100 billion in inflows in October 2025, but flows are no longer concentrated purely in tech. Investors are increasingly adding exposure to value stocks, industrials, healthcare, materials, and defensive sectors as part of a more cautious positioning strategy.

Rotation signals strengthening: While growth and AI still attract capital, the pace is slowing.

P/E compression risk remains high if bond yields rise again or if earnings guidance disappoints.

Valuation sensitivity will remain one of the biggest drivers of market direction into year-end.

3. Global Synchronisation of Risk Events

This week's sell-off shows that markets are still moving in lockstep:

Investors should be mindful that volatility abroad can spill over quickly into U.S. trading sessions, amplifying swings.

4. Policy & Liquidity Watch

Uncertainty around policy remains a major overhang:

Investors are closely monitoring upcoming Federal Reserve meetings. Even minor changes in tone could drive sharp sector rotations.

Liquidity conditions remain uneven despite the end of the U.S. shutdown, making markets more reactive to data releases.

While rate cuts are expected in 2026, the timing remains unclear, and sticky inflation could limit the Fed's ability to be flexible..

Until the policy path becomes clearer, risk appetite is likely to remain muted.

5. Rotation Opportunities Emerging

With high-valuation tech names facing pressure, several areas have begun to show relative strength, including:

While not a recommendation, this shift underscores that investors are increasingly preparing for a market environment that may reward stability and earnings visibility over momentum and narrative-driven growth.

Frequently Asked Questions

Q1) How Do Fed and Policy Speeches Impact Stock Markets?

Policy statements shape expectations around interest rates, liquidity, and economic growth, all of which directly influence market valuations.

Q2) Could Defensive Stocks Outperform After This Drop?

Yes. In environments where economic growth slows and risk appetite diminishes, defensive sectors such as consumer staples, utilities, and healthcare typically demonstrate relative strength and stability.

Q3) Should Beginners Worry About Short-Term Drops Like This?

Not necessarily. Daily volatility is part of investing. Focus on long-term diversification, but recognise that risk management is crucial during uncertain macro periods.

Q4) Is This Tech-Led Pullback the Start of a Broader Bear Market?

Not necessarily. Current data suggest rotation, not capitulation. While tech valuations are under pressure and short interest is rising, sectors such as healthcare and industrials are outperforming.

Conclusion

In conclusion, today's market weakness is primarily driven by a re-pricing of the tech/AI growth narrative, valuation stress, and a general shift toward risk-aversion.

The tech-heavy Nasdaq's sharp drop today (−2.3%), combined with pressure in key AI stocks, suggests traders are bracing for a choppier outlook ahead.

For investors, the key takeaway is that volatility is likely to remain high until clearer signals emerge on earnings, valuations and policy direction. Staying alert to sector leadership shifts, policy commentary, and global market cues will be critical in the near term.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://nypost.com/2025/11/04/business/dow-falls-450-points-as-goldman-sachs-morgan-stanley-warn-of-market-correction/