Understanding the 2025 INR/USD Decline

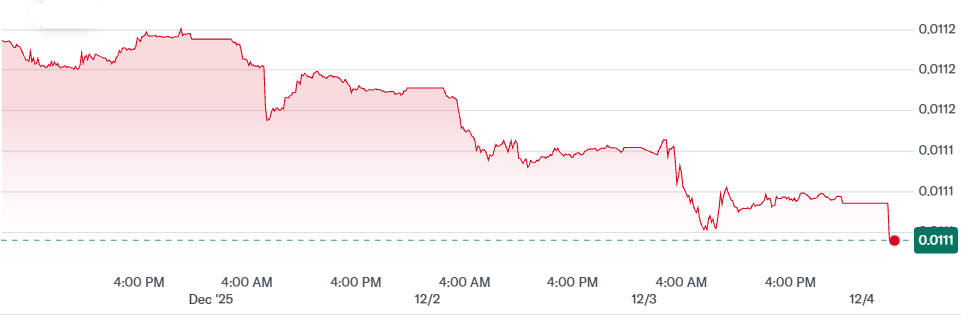

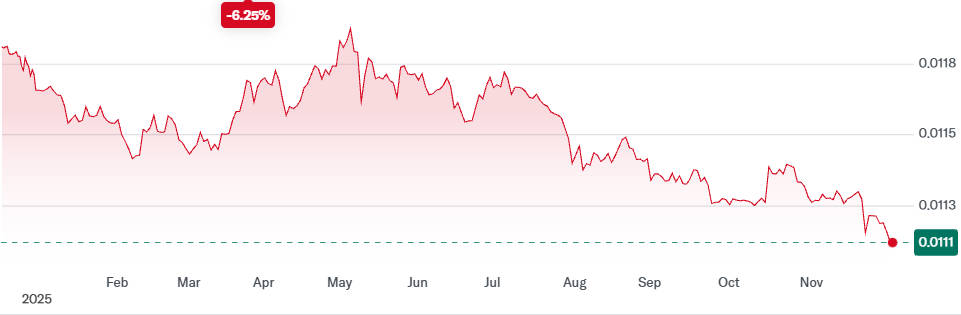

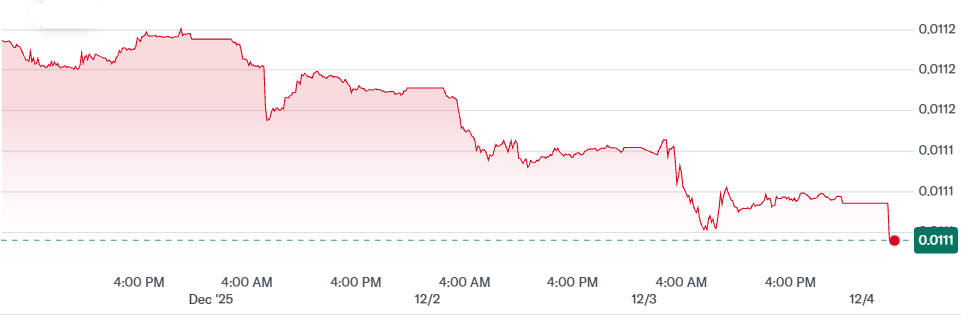

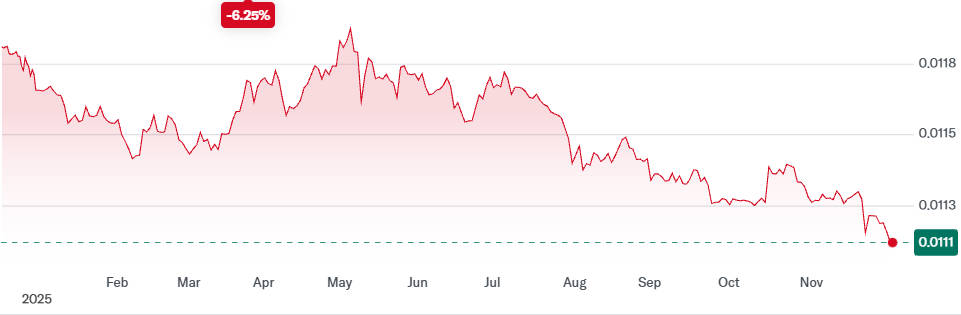

The Indian Rupee's slide against the US Dollar in 2025 has become one of the most scrutinised currency developments in Asia. As of 4 December 2025. the conversion rate stands at approximately 1 INR = 0.0111 USD.

Yet this seemingly modest number belies a deeper story: despite India's impressive growth trajectory, with GDP expansion projected between 6.6% and 7% for FY2025/26. the Indian Rupee continues to lose ground against the US Dollar.

The disconnect between robust domestic fundamentals and a weakening currency underscores a core reality: global macro‑economic dynamics and structural vulnerabilities in India are exerting far greater influence on the INR/USD exchange rate than domestic growth alone.

This article explores the main global headwinds, internal economic pressures, central‑bank policy responses, and stabilising factors shaping the Rupee's trajectory — and what this means for the near future.

The Dominance of the US Dollar: The Global Forces Behind INR Weakness

1. The US Federal Reserve and the Interest-Rate Differential

The single most influential factor behind the 2025 INR/USD trend is the Fed's higher-for-longer interest-rate stance. With US yields remaining elevated, global investors have directed capital toward safer, higher-returning US Treasuries.

For emerging markets like India, this creates:

Capital outflows, especially from foreign portfolio investors (FPIs)

Reduced USD liquidity domestically

Downward pressure on the Indian Rupee

As long as the rate differential heavily favours the US, the Rupee remains structurally disadvantaged.

2. A Persistent Global Risk-Off Environment

Geopolitical fragmentation—including trade disputes, regional conflicts, and prolonged US tariff actions affecting Indian exports—has amplified risk aversion.

In such an environment, global capital naturally gravitates toward safe-haven assets, especially the US Dollar, intensifying INR/USD depreciation pressure.

3. Market Volatility and Sudden Shocks

Sharp one-day declines in the Rupee during 2025 highlight how sensitive the currency has become to global surprises—be it US data releases, oil price spikes, or risk-off shifts.

This volatility strengthens the Dollar's dominance while weakening the INR further.

Structural Economic Weaknesses in India

1. The Persistent Current Account Deficit

India runs a consistent current account deficit (CAD) due to:

Every additional dollar spent on imported oil exerts downward pressure on the INR/USD pair.

2. Foreign Investment Flows: FPI Outflows vs. FDI Inflows

2025 has seen intermittent but notable FPI outflowsfrom Indian equity and debt markets. These flows tend to follow global risk sentiment and US rate expectations.

FDI inflows remain stable, but not strong enough to fully offset:

As a result, net foreign currency inflows remain insufficient to support the Rupee.

3. Valuation Concerns and the REER Debate

India's Real Effective Exchange Rate (REER) has often appeared stretched, prompting intermittent market corrections.

If the Rupee is perceived as overvalued relative to peers, traders anticipate depreciation—reinforcing the downward INR/USD trend.

The Role of the RBI: Stability Over Strength

1. RBI's Intervention Strategy

The RBI aims to prevent "sharp and disorderly" movements, not defend a specific level. It intervenes through:

However, even with sizeable reserves, the RBI cannot fight a global Dollar bull cycle indefinitely.

2. IMF Reclassification: A Shift Toward Flexibility

The IMF recently reclassified India's de facto exchange-rate regime from "stabilised" to "crawl-like".

This implies the RBI is allowing more gradual INR depreciation so the Rupee can function as a shock absorber, especially during periods of external stress.

3. Monetary Policy Balancing Act

A weaker Rupee raises imported inflation, especially for:

Energy

Electronics

Industrial inputs

Yet tightening policy aggressively could suppress domestic growth. The RBI therefore walks a tightrope:

Positive Domestic Factors: Why the Rupee Isn't Falling Faster

1. Solid Economic Growth

India's robust GDP trajectory, strong domestic consumption, and public investment cycle provide macroeconomic stability—even as the currency weakens.

2. Contained Inflation

Headline inflation remains relatively well-managed compared with global peers. This gives the RBI precious room to manoeuvre and prevents panic selling of the INR.

3. A Resilient Financial System

India's regulated banking and financial sector, with improved asset quality and strong capital adequacy, contributes to confidence in long-term economic prospects—softening the INR's downside.

What's Next for INR/USD in 2025?

The Rupee's struggle in 2025 is fundamentally a contest between strong domestic fundamentals and powerful global forces. India's growth story remains compelling, but the external environment—characterised by a dominant US Dollar, high US yields, geopolitical tension and persistent import dependency—continues to overshadow these positives.

Near-Term Outlook

Most institutional forecasts suggest that the INR will remain under pressure through FY2026, with the potential for further modest depreciation if:

US rates stay elevated

Oil prices rise

FPI outflows intensify

What Could Support a Stronger Rupee?

Medium- to long-term INR stability will depend on:

Accelerating structural reforms

Strengthening supply-chain competitiveness

Finalising key trade agreements

Reducing oil import dependency

A potential future pivot by the US Federal Reserve

Frequently Asked Questions

1. Why is the Indian Rupee weakening against the US Dollar in 2025?

The Rupee is weakening because strong domestic growth is outweighed by global factors such as high US interest rates, risk-off sentiment, oil dependency and persistent capital outflows, all of which increase demand for US Dollars.

2. How does the US Federal Reserve influence the INR/USD exchange rate?

Higher-for-longer US interest rates attract global capital toward US assets, strengthening the Dollar. This widens the rate differential, drives FPI outflows from India and puts sustained downward pressure on the Rupee throughout 2025.

3. Is India's economic growth helping to stabilise the Rupee?

India's strong GDP growth provides some support, but it cannot fully offset external pressures. Robust domestic demand and investment help limit volatility, yet global monetary tightening and energy import costs still dominate currency movement.

4. What role does the RBI play in managing the Rupee's performance?

The RBI aims to prevent sharp volatility rather than defend a fixed level. It intervenes strategically, sells USD to smooth fluctuations and balances inflation control with growth, though it cannot counter strong global Dollar momentum indefinitely.

5. Will the Rupee continue to weaken in the coming months?

Most forecasts suggest gradual Rupee weakness will persist. Continued US monetary tightness, geopolitical risks and India's import dependency remain challenges, though any Federal Reserve pivot or stronger FDI inflows could stabilise the INR/USD trajectory.

6. What could help strengthen the Rupee in the long run?

Reducing oil dependency, deepening supply-chain competitiveness, increasing exports, securing trade agreements and attracting more long-term FDI would support the Rupee. A future shift in US monetary policy could also offer meaningful relief.

Conclusion

The Rupee's weakness in 2025 reflects strong global headwinds overpowering India's solid domestic fundamentals. A dominant US Dollar, high US rates and India's import dependence continue to pressure the INR/USD pair. While further gradual depreciation is likely, structural reforms, stronger exports and a future shift in US monetary policy could help stabilise the Rupee over time.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.