Japan's stock market is no longer a hidden gem in global investing. It is setting records, attracting fresh foreign attention, and forcing traders to rethink the old assumption that Japan is "always cheap, always slow".

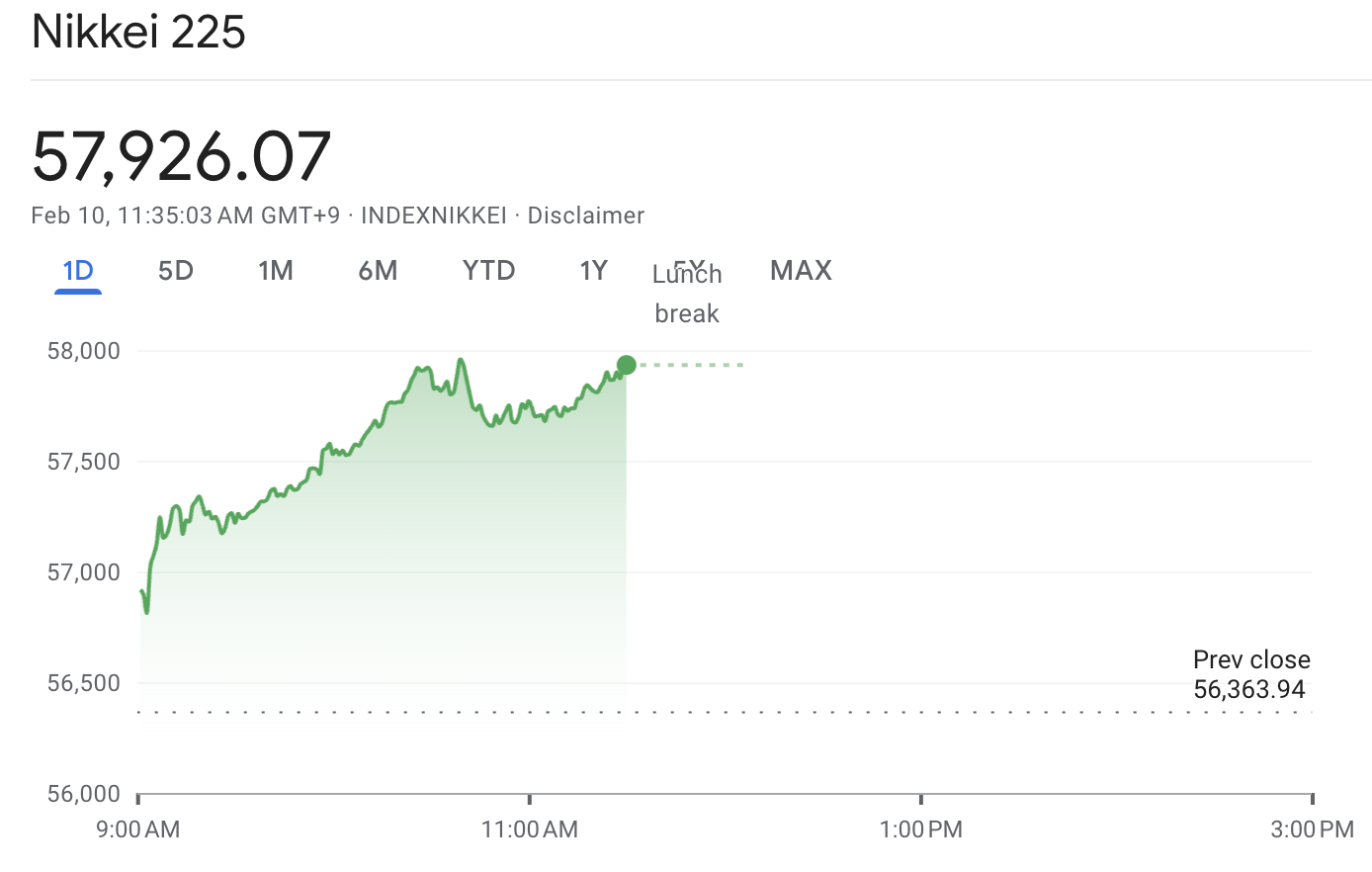

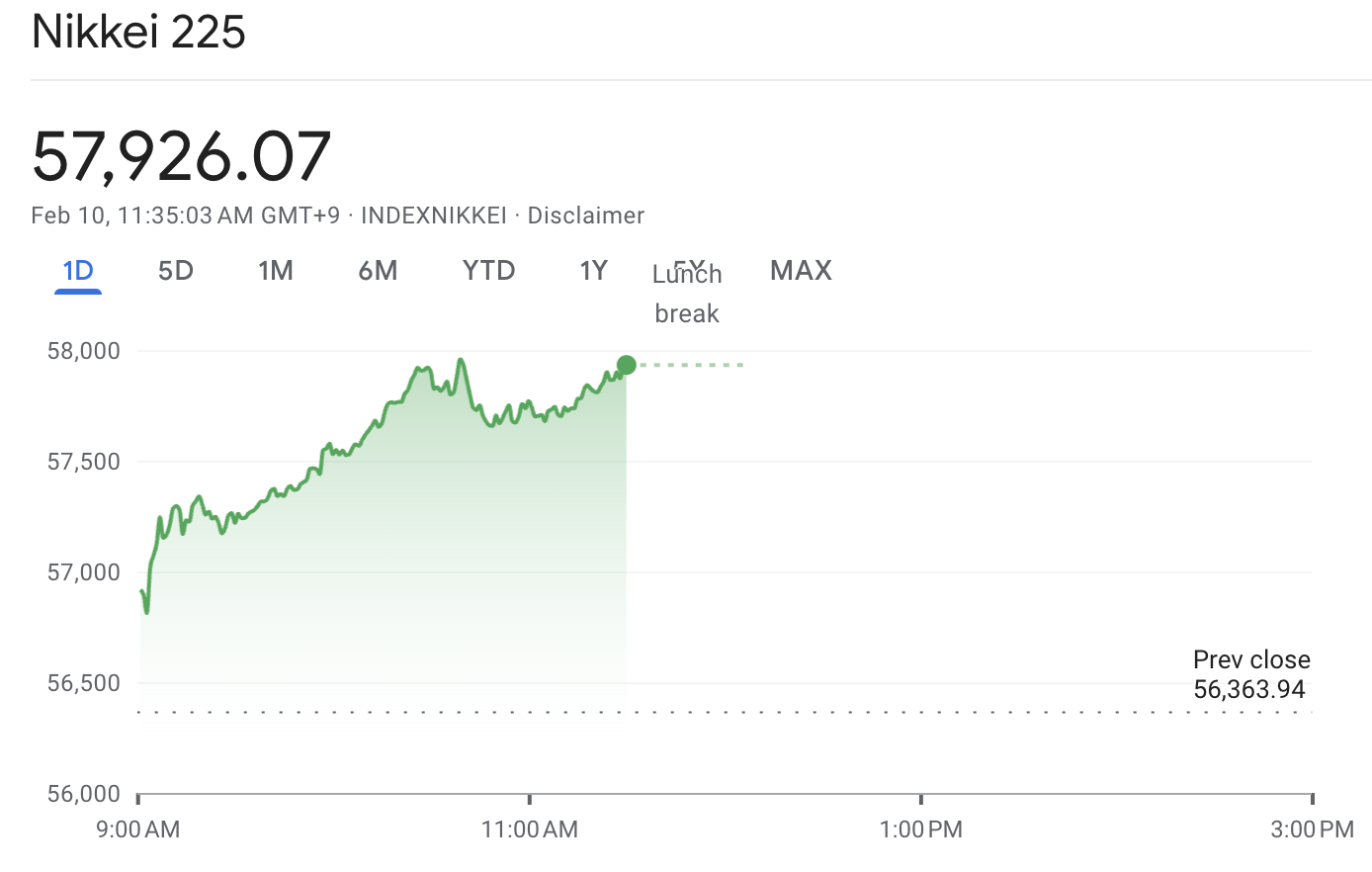

On 9 February 2026, the Nikkei 225 surged to fresh all-time highs, topping 57,000 intraday and closing at a record 56,363.89, while the broader Topix index also jumped.

This rally has produced a clear "real money" winner in Berkshire Hathaway's longstanding investments in Japan's five major trading companies.

For instance, the value of Berkshire's positions in Japan has exceeded $40 billion, nearly tripling from an initial cost figure around $13.8 billion, transforming what began as a value investment into one of the most prominent global successes of this cycle.

Warren Buffett's Japanese Investment Timeline

| Year |

Development |

Why it mattered for Japanese equities |

| 2019 |

Berkshire began building positions in five trading houses |

Japan gained a high profile long horizon foreign sponsor |

| 2023 |

TSE reform push gained visibility globally |

Capital efficiency became a measurable expectation |

| 2024 |

Buffett letter: ownership caps “moderately” relaxed |

Market began to price the possibility of larger Berkshire stakes |

| 2025 |

Regulatory filings showed stakes rising toward 10 percent |

Reinforced that Berkshire was still accumulating |

| Feb 2026 |

Nikkei reached fresh records after election mandate |

Political clarity intensified flows into Japan |

Why Warren Buffett's Japanese Stocks Profited?

Japan's record rally is being built on three pillars that can reinforce each other.

A political catalyst that markets read as pro-growth and market-friendly.

A shareholder return revolution that is making Japanese companies act more like global peers when it comes to buybacks, dividends, and capital discipline.

A currency and rates backdrop that still makes Japan attractive for global allocators, even as Japanese yields rise and policy normalises.

Warren Buffett's Japan trade works because it fits those pillars. He bought businesses that were cheap, disciplined, diversified, and improving their shareholder culture. He also financed part of the position in yen at low fixed rates, which matters far more than most headlines admit.

Warren Buffett's Japanese Stocks: Why the Trade Paid Off

What Berkshire Owns in Japan

Berkshire's Japan bet centres on five "sogo shosha" trading houses:

ITOCHU

Marubeni

Mitsubishi

Mitsui

Sumitomo

Buffett described these companies as operating like Berkshire, as each owns interests across a broad range of businesses in Japan and globally.

The Simple Reason It Worked: Price and Discipline

Berkshire began buying the five stocks in July 2019, and they were "amazed at the low prices."

He then laid out what mattered most to him:

They raise dividends when appropriate.

They repurchase shares when it is sensible.

Their top managers are less aggressive about pay than many of their US peers.

In other words, Buffett did not "discover Japan". He discovered a set of businesses that were already changing how they treated shareholders.

The Numbers Behind the Payoff

In Berkshire's shareholder letter, Buffett stated that at year-end the aggregate cost of Berkshire's holdings was $13.8 billion, and the market value was $23.5 billion.

That indicates a profit of approximately 70% on the cost based on these two figures alone.

Since then, the rally has continued, and market coverage says Berkshire's Japan investments are now worth more than $40 billion.

The Underrated Edge: Yen Funding With Fixed-Rate Debt

Buffett also explained the funding structure in plain language. Berkshire has increased yen-denominated borrowings as it keeps them at fixed rates, and it aims for a position that is close to currency-neutral rather than making a big FX call.

He also gave a rare, trader-friendly cashflow snapshot:

That amounts to approximately $677 million in net carry annually, before tax and other implications, even before considering price increases.

Buffett Is No Longer CEO, but the Japan Thesis Did Not Retire

Berkshire's board has voted to appoint Greg Abel as President and CEO, effective 1 January 2026, while Warren Buffett will remain as Chairman.

That matters because it frames the Japan stakes as an institutional position, not a personal trade. Buffett also wrote that he expects Berkshire to hold the Japanese position for "many decades".

Buffett's annual letter stated that the five companies agreed to "moderately relax" the original cap that kept Berkshire's stakes below 10 percent, and it explicitly signaled that ownership could increase.

In 2025, Berkshire raised its stake to between roughly 8.5 percent and 9.8 percent, reinforcing that the position has been actively built rather than passively held.

How "Buffett's Japanese Stocks Pay Off" Connects to the Nikkei's Record Highs

Japan Is Being Repriced From Cheap for a Reason to Cheap With Catalysts

For years, analysts attributed Japan's low valuation multiples to governance inertia, cash hoarding, and weak alignment with shareholders. The 2023 onward reform push changed the market's framing by making capital efficiency a public expectation rather than a private debate.

Buffett's selection of the trading houses functions as a credibility anchor in this transition. It tells global investors that Japan's value is not only statistical. It can be captured through firms that return capital, diversify cash flows, and benefit from the complexity of global trade.

Berkshire's Size Has Become Part of the Flow Story

As Berkshire's Japan holdings grow, they influence sentiment by signaling durability. A retail investor can buy an index at any time. Berkshire's public stance suggests a long-term commitment that encourages institutional investors to hold their positions during market downturns rather than sell at the first sign of economic distress.

This is why a new high for the Nikkei and an increase in Berkshire's valuation mutually support each other. Rising index levels confirm the validity of the reform thesis, while Buffett's gains affirm the belief that Japan can once again generate capital growth.

What Should Investors Monitor Next?

1) Bond Yields Will Keep Sending Signals

Rising yields near 2.28% indicate that Japan is no longer in the old "zero-rate world."

If yields rise because growth improves, equities can withstand the rise. If yields rise because fiscal credibility is questioned, equities can struggle.

2) Corporate Results and Guidance Will Decide Whether This Rally Is Real

A record index level can be justified by earnings or by hope. Traders should watch whether companies talk about:

3) Berkshire's Stance Is a Sentiment Anchor

When Berkshire expresses patience and advocates for long holding periods, it can bolster investor confidence in the "Japan rerating" theme, even amid volatility.

Frequently Asked Questions (FAQ)

Which Japanese Stocks Did Buffett Buy?

Berkshire bought stakes in five Japanese trading houses: ITOCHU, Marubeni, Mitsubishi, Mitsui, and Sumitomo. Buffett said Berkshire began buying in July 2019 and intends to hold the position for the very long term.

Why Are Japanese Trading Houses Attractive to Buffett?

Buffett praised their capital discipline, shareholder-friendly payouts, sensible buybacks, and relatively modest executive pay. He also likes their broad mix of businesses, which resembles Berkshire's diversified model.

How Much Is Buffett's Japan Portfolio Worth in 2026?

The value of Berkshire's holdings in Japanese trading houses exceeds $40 billion following the recent surge in the Nikkei, which reflects both price appreciation and increased position sizes over several years.

What Is the Biggest Risk to Japanese Equities From Here?

The most direct risks are a rapid yen appreciation, faster-than-expected policy tightening, and a loss of fiscal credibility that drives yields higher. Any of these can compress equity multiples even if corporate earnings remain stable.

Conclusion

In conclusion, the Nikkei's record rally is not only a momentum story. It is also a story about Japan changing how it treats capital and shareholders, while politics has reduced uncertainty in the short term.

Buffett's investment in Japan was successful due to low entry prices and improved corporate behavior. Additionally, Berkshire paired these equity stakes with fixed-rate yen borrowing, resulting in a strong carry profile.

For 2026, the key risks to watch are bond yield pressure, fiscal credibility, and whether earnings keep up with the market's new confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.