Apple Inc. (NASDAQ: AAPL) has seen its stock climb sharply, hitting the highest levels of 2025. largely due to strong consumer interest in the newly released iPhone 17.

This surge in share price has prompted analysts to revise their price targets upward, reflecting increased optimism among investors.

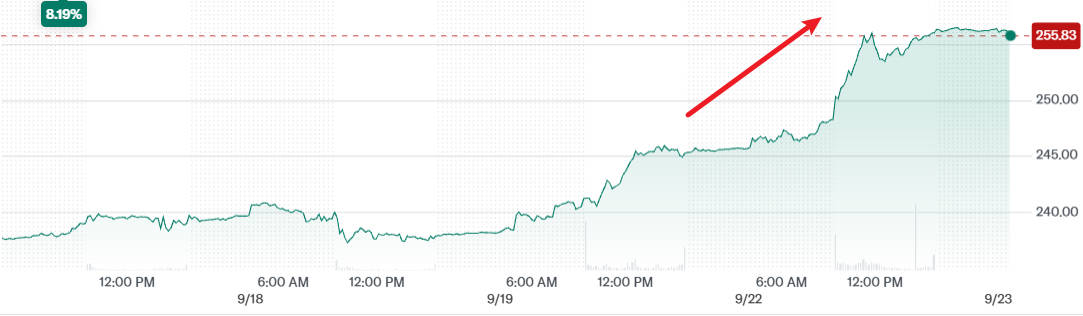

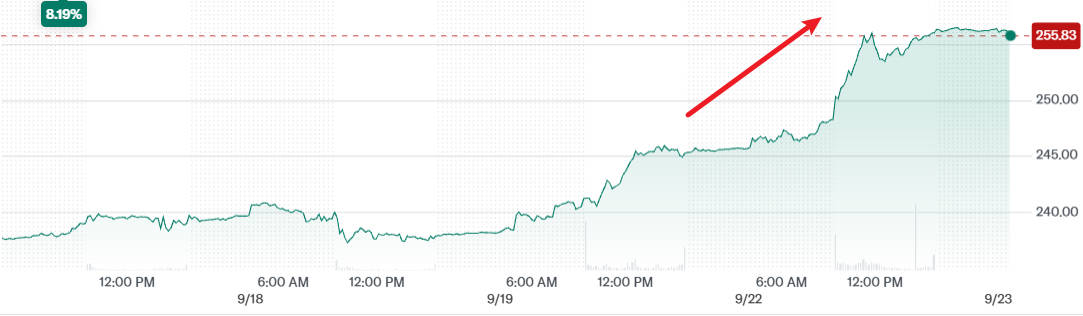

Overview of Stock Performance

As of 23 September 2025. Apple shares closed at $255.83. up around 4.3% from the previous trading session. This rally brings the stock near its 52-week high, demonstrating resilience in the market.

Apple's market capitalisation currently stands at approximately $3.01 trillion, with a price-to-earnings (P/E) ratio of 30.28 and earnings per share (EPS) of $6.59. Despite earlier concerns over tariffs and the company's approach to artificial intelligence, Apple has rebounded strongly, gaining nearly 12% over the past month.

iPhone 17 Launch Spurs Strong Demand

The iPhone 17 has been met with robust consumer demand, particularly in the Chinese market, where longer shipping times indicate strong uptake. Bank of America analysts note that current delivery times for the iPhone 17 are around 18 days, compared with 10 days for the iPhone 16 at the same stage last year.

Wedbush analyst Dan Ives reports that sales of the iPhone 17 are 10–15% ahead of the iPhone 16. prompting a price target adjustment from $270 to $310. Similarly, Deepwater analyst Gene Munster expects the iPhone 17 cycle to surpass forecasts for fiscal year 2026. signalling a significant upgrade wave among consumers.

Analyst Ratings and Price Target Updates

Artificial Intelligence: A Key Growth Driver

Analysts highlight that Apple's AI strategy is crucial for its long-term growth. The company's potential collaborations with technology giants, such as Alphabet, could enhance its AI capabilities, with an estimated $75–$100 potential contribution per share in future value.

Global Demand and Supply Chain Insights

Investor Sentiment and Outlook

Conclusion

The recent rally in Apple stock reflects strong consumer enthusiasm for the iPhone 17 and favourable analyst sentiment. While challenges remain, including AI integration and supply chain management, the company's solid market position and growth prospects continue to make it an attractive option for investors.

Frequently Asked Questions

Q1: Why is Apple's stock rising?

Strong demand for iPhone 17 and analyst upgrades are driving optimism in Apple's growth.

Q2: What role does AI play?

AI is a key growth driver; partnerships could add $75–$100 per share in future value.

Q3: Is Apple stock a good investment?

Apple's strong market position, product demand, and AI strategy make it attractive, rated "Moderate Buy."

Q4: How is Apple performing globally?

High demand, especially in China, and production increases for iPhone 17 indicate strong global performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.