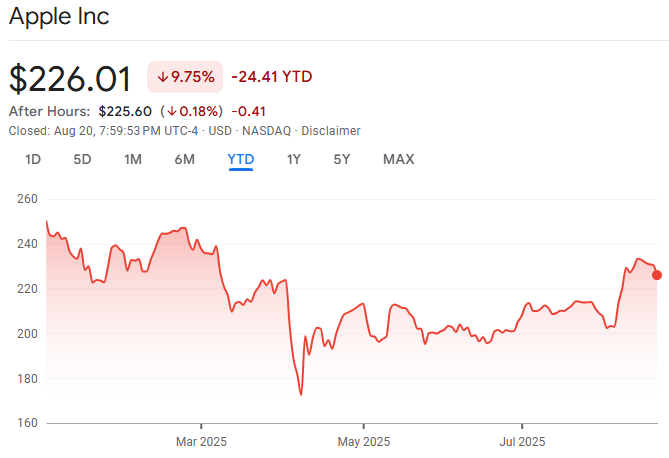

Apple Inc. remains one of the most watched stocks, with traders closely monitoring how global trade dynamics affect its valuation. Recently, Apple's growing shift of production to India has emerged as a strategic move to mitigate rising tariffs, especially those on goods manufactured in China. By diversifying its supply chain, Apple aims to protect its profit margins and maintain competitive pricing.

This transition has generated optimism among investors and traders, indicating potential support for the Apple share price amid ongoing global trade tensions. However, while increasing India's production reduces tariff exposure, challenges related to scale, infrastructure, and geopolitics still remain.

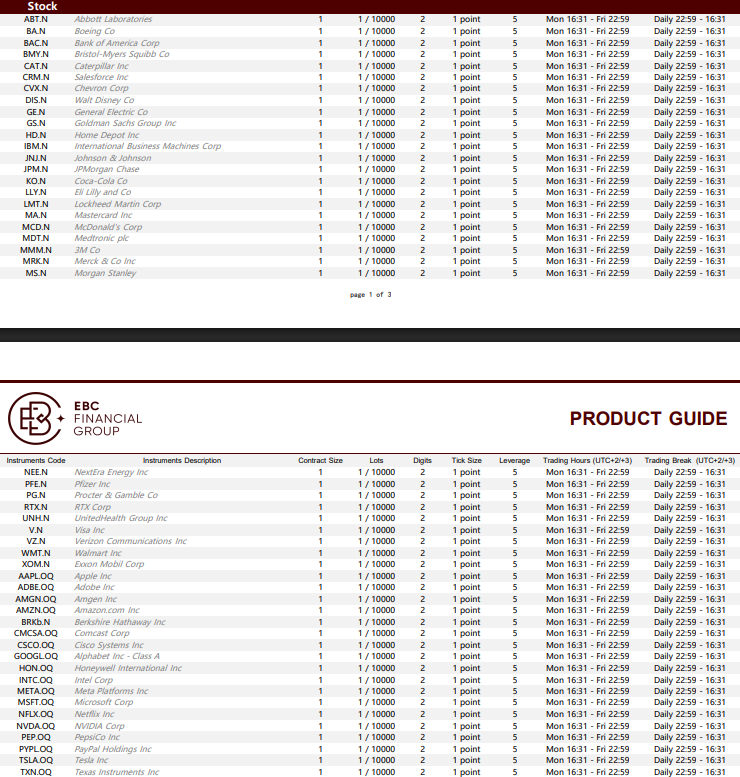

For traders on platforms such as EBC Financial Group (EBC), where Apple stock CFDs are actively traded, understanding this production strategy is vital to navigating price movements with greater insight.

The Tariff Landscape and Its Impact on Apple

The US-China trade war has introduced tariffs that significantly impact companies heavily reliant on Chinese manufacturing, Apple included. These tariffs increase production costs and cause fluctuations in Apple's share price as markets respond to trade policy developments. This adds uncertainty around profit margins and pricing strategies, making Apple's supply chain diversification all the more crucial.

India's Expanding Role in Apple's Production

India has become an essential component of Apple's strategy to counter tariff risks. Major contract manufacturers such as Foxconn and Wistron have established significant production lines in India, assembling various iPhone models. The Indian government's incentivisation policies, like “Make in India,” have further encouraged Apple to ramp up production locally. This move not only shields Apple from some tariff risks but also positions it well in the rapidly growing Indian consumer market.

Production Comparison Table:

| Factor |

China Production |

India Production |

Tariff and Cost Impact |

| Manufacturing Scale |

Large, mature ecosystem |

Growing but smaller scale |

Higher tariffs on China-made goods |

| Labour and Costs |

Established, efficient |

Developing capabilities |

Potential cost savings offshore |

| Tariff Exposure |

Subject to US-China tariffs |

Reduced by Indian production |

Mitigates some tariff risk |

| Infrastructure |

Advanced and extensive |

Developing and expanding |

Transition period challenges |

| Market Advantage |

Export-focused |

Local market access |

Supports Indian domestic growth |

Challenges and Limitations

Despite the clear benefits, some challenges remain with shifting production to India:

-

India's production scale is still smaller than China's, limiting its capacity to fully replace it.

-

Infrastructure, such as logistics and supply networks in India, is less developed.

-

Regional geopolitical tensions and regulatory complexities create uncertainty.

Transitioning production involves complex supply chain adjustments and may cause short-term disruptions.

These factors mean that while India's production reduces tariff exposure, Apple's manufacturing remains a hybrid operation, retaining some dependency on China.

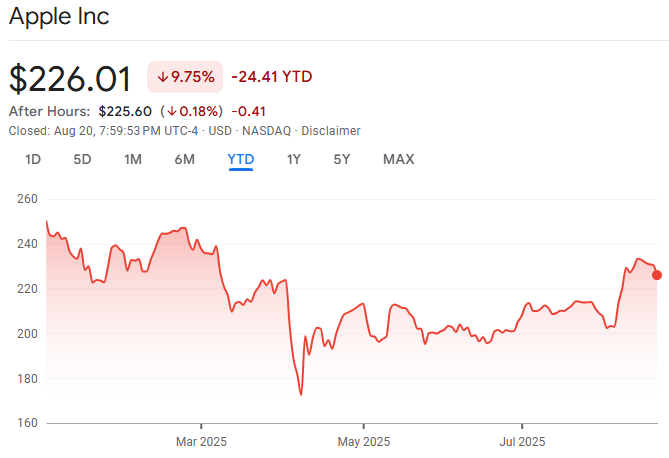

What This Means for Apple's Share Price

Apple's supply chain diversification into India is viewed as a positive move to offset tariff risks and reduce cost volatility. Combined with its strong brand, growing market demand, and product innovation, this diversification may underpin support for the share price. Traders on EBC, where Apple stock CFDs are available, should monitor these operational shifts as they can influence price volatility and trading opportunities.

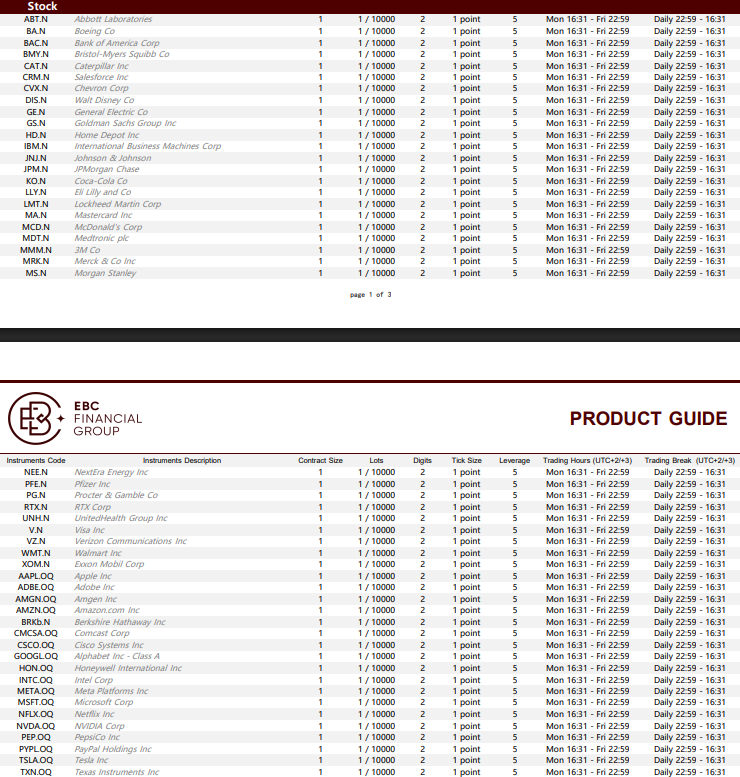

Trading Apple Stock CFD on EBC

Trading Apple CFDs on EBC's platform offers several advantages:

-

Flexibility to take long or short positions depending on market outlook.

-

Ability to leverage trades for greater exposure with controlled risk.

-

Access to real-time price data, charting tools, and news updates.

Opportunity to respond fast to supply chain or tariff-related market shifts.

This makes EBC a suitable platform for traders seeking exposure to Apple stock movements linked to evolving trade and production narratives.

Broader Market Implications

Apple's India production shift is part of a growing global trend where multinational companies diversify manufacturing to mitigate geopolitical risks. This restructuring may drive increased investment in emerging markets like India and alter trade flows and supply chains across sectors. Traders should watch these supply chain evolutions to better anticipate market and currency impacts.

Frequently Asked Questions

Q1: Can Increasing Production in India Fully Eliminate Apple's Tariff Risks?

No, while shifting production to India helps offset tariff exposure, India's current manufacturing scale and infrastructure limit full replacement of China. Apple still retains some dependency on Chinese production.

Q2: How Does Apple's Supply Chain Shift Affect Its Share Price Volatility?

Diversification into India is viewed positively as it reduces cost uncertainties from tariffs, possibly supporting the share price. However, broader market factors and product demand cycles continue to influence volatility.

Q3: Why Trade Apple Stock CFDs on EBC's Platform?

EBC offers real-time data, leverage options, and flexibility for traders to go long or short on Apple CFDs, enabling an effective response to news like supply chain shifts and tariff changes.

Conclusion

Apple's increasing production capacity in India represents a strategic hedge against tariff risks and a push towards geographic diversification. While India production mitigates some cost pressures, ongoing challenges and the scale of China-based production mean Apple's supply chain remains complex. Traders on EBC's platform can benefit from understanding these nuances, enabling more informed decisions when trading Apple stock CFDs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.