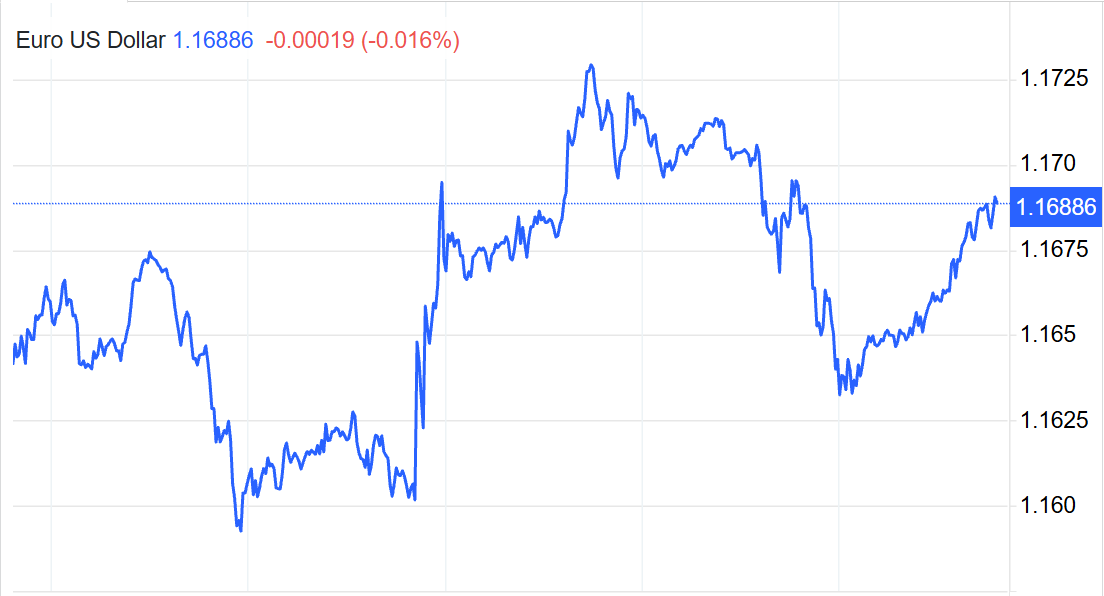

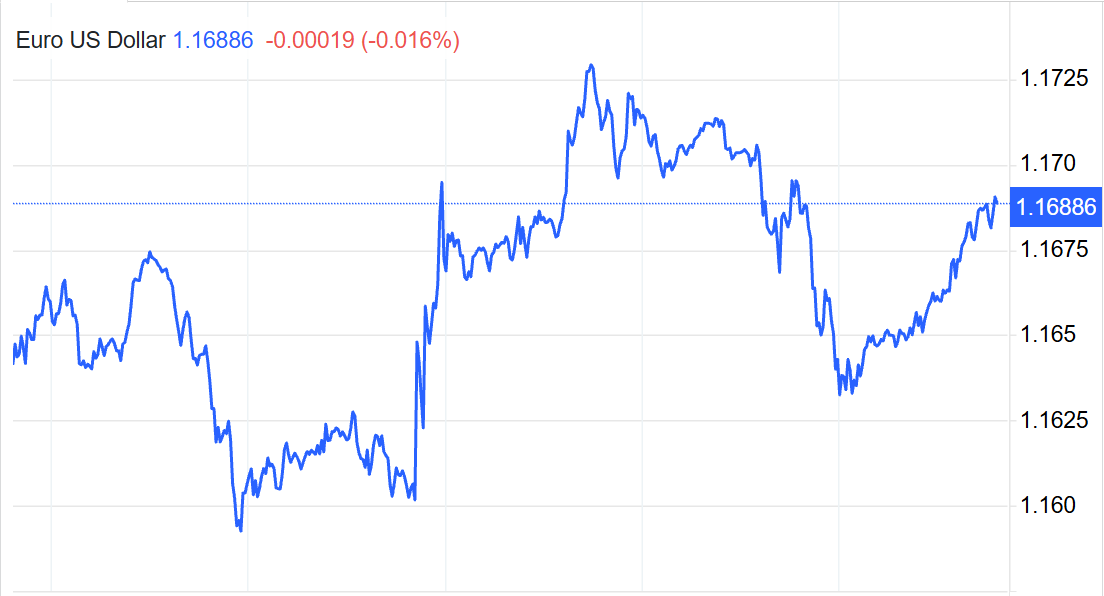

The EUR to USD pair continues to draw intense market attention, as traders balance between robust US inflation data, a cautious Federal Reserve, and signs of economic fragility in the Eurozone. On Friday's European session, the euro recovered modestly but remained capped below the 1.1700 threshold, still some distance from the week's high at 1.1730. This level has emerged as a formidable resistance point, with price action repeatedly stalling beneath it.

The recent rebound in EUR to USD was largely driven by a softer pullback in the US dollar, as investors digested the implications of red-hot US Producer Price Index (PPI) data released on Thursday. That surge in wholesale prices underscored the inflationary impact of trade tariffs, raising difficult questions for Federal Reserve policymakers caught between slowing growth and persistently high price pressures.

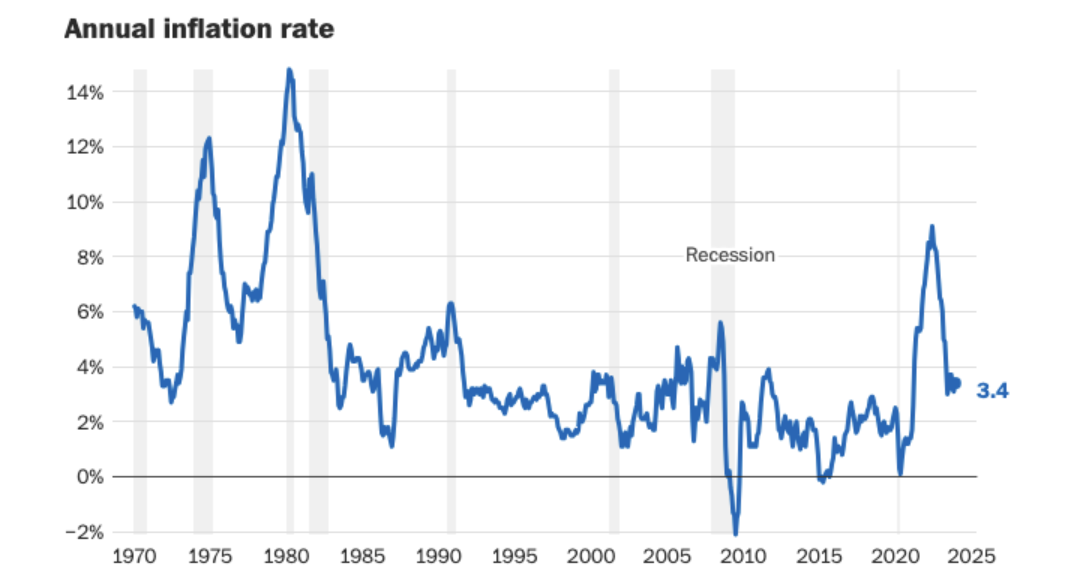

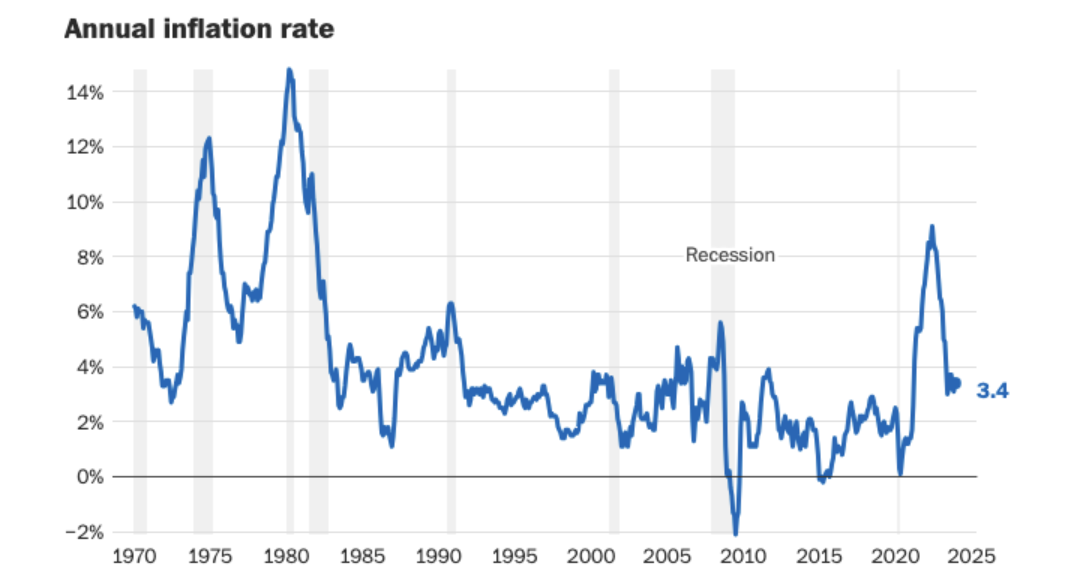

US Inflation Data and the Fed's Policy Dilemma

The latest figures revealed that US wholesale prices in July rose at their fastest pace in three years. Headline PPI climbed 0.9% month-on-month and 3.3% year-on-year, far exceeding consensus forecasts of 0.2% and 2.5% respectively. Core PPI, which strips out food and energy, also accelerated sharply to 0.9% monthly and 3.7% annually, again well above estimates.

This surge in input costs initially drove expectations that the Federal Reserve may resist more aggressive rate cuts. According to the CME FedWatch tool, the probability of a 50-basis-point cut in September fell sharply after the data release, though a 25-basis-point reduction remains firmly priced in. Weekly jobless claims also offered a counterbalance, falling by 3.000 to 224.000. easing concerns about a weakening labour market.

For EUR to USD, this created a complicated backdrop: while robust inflation bolsters the dollar by curbing expectations of rapid policy easing, the market's risk-on sentiment—still betting on some level of Fed accommodation—has limited the greenback's upside momentum.

Eurozone Growth Concerns Deepen

Across the Atlantic, Eurozone data painted a far less encouraging picture. The final reading of second-quarter GDP confirmed that the bloc grew by only 0.1% quarter-on-quarter and 1.4% year-on-year, well below prior estimates of 0.6% and 1.5%. Industrial production also disappointed, plunging 1.3% month-on-month in June, against expectations for a 1% drop. On an annual basis, output contracted 0.2%, compared with forecasts for a 1.7% increase.

Employment data provided little relief, with job growth stagnating at 0.1% quarter-on-quarter and 0.7% year-on-year. Taken together, these figures highlight the Eurozone's lack of economic momentum, adding persistent downward pressure on the euro.

Geopolitical Focus: US–Russia Talks and Energy Risks

Beyond macroeconomic indicators, markets are keeping a close eye on geopolitics. A much-anticipated summit between US President Joe Biden and Russian President Vladimir Putin could shape sentiment, particularly regarding the ongoing conflict in Ukraine. While few expect an immediate breakthrough, any signals pointing towards de-escalation could ease concerns about Europe's energy crisis and offer the euro some reprieve.

Additionally, US retail sales figures are due later today, with forecasts suggesting a 0.5% month-on-month rise for July (0.3% excluding autos). These numbers will provide further insight into the resilience of US consumer spending amid tariff-related pressures.

Technical Analysis: 1.1730 Remains a Key Barrier

From a technical standpoint, EUR to USD remains constrained below a descending trendline resistance at 1.1730. a level that has repeatedly capped upside attempts since early July. The Relative Strength Index (RSI) on the four-hour chart hovers near the neutral 50 mark, but the emergence of bearish divergence warns of fading bullish momentum.

On the downside, initial support lies at 1.1590. coinciding with recent swing lows. A deeper decline could bring 1.1530 and 1.1460 into view. Conversely, a sustained break above 1.1735 would mark the end of the corrective phase, opening the door towards 1.1789 and 1.1830.

At present, the pair trades around 1.1680/81. caught between a fragile Eurozone economy and the uncertain path of US monetary policy.

Conclusion

The EUR to USD outlook is finely balanced between competing forces: stronger-than-expected US inflation data, cautious but still accommodative Fed policy, and an increasingly fragile Eurozone economy. Technical barriers at 1.1730 remain pivotal, with traders watching for either a decisive breakout or renewed downside pressure. Meanwhile, geopolitical developments and upcoming US retail sales data may provide the next catalyst. For now, the pair looks set to remain volatile, with both bulls and bears awaiting clearer signals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.