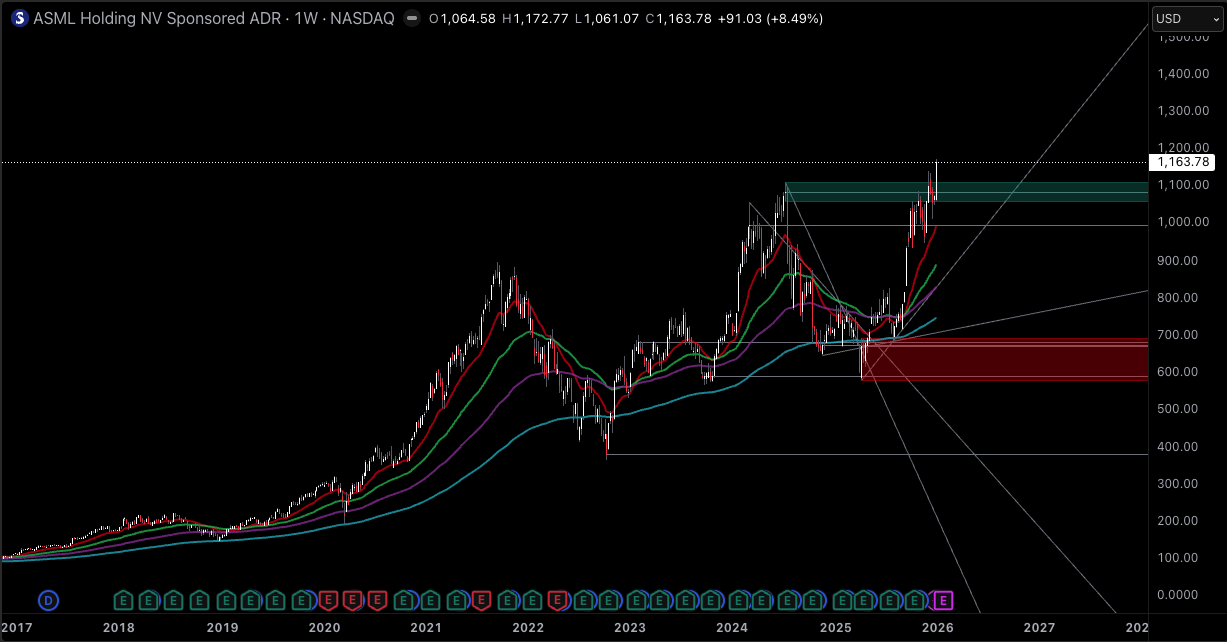

ASML Stock has re-rated sharply, and the move accelerated in the last Friday session with a +8.78% jump. The broader tape is equally important for context: +9.15% (5 days), +4.82% (1 month), +47.88% (6 months), +65.00% (1 year), +137.51% (5 years), and very large long-term compounding.

This is not a one-week story. It is a market repricing of ASML’s role in the semiconductor supply chain.

For 2026, the central question for any ASML stock forecast is simple. Can EUV demand and recurring service revenue offset a likely drop in China sales without damaging margins or order quality?

ASML has already provided a critical anchor: it does not expect 2026 total net sales to be below 2025, even as it expects China's total net sales in 2026 to decline significantly from 2024 and 2025.

Why ASML Stock Is Surging

1) The company put a floor under 2026 revenue expectations

Markets reward clarity. ASML explicitly stated it does not expect 2026 total net sales to be below 2025. That matters because it reduces the likelihood of a deep-down-cycle narrative taking hold, even if growth slows.

2) EUV demand is doing the heavy lifting in the order book

In Q3 2025, ASML reported €5.4 billion of net bookings, with €3.6 billion tied to EUV. That EUV share is a strong signal about demand quality because EUV is the most capacity-constrained, most critical segment of the product portfolio.

3) Recurring service revenue stabilizes the model when systems' timing swings

ASML’s installed base generates service and field-option sales that tend to be steadier than new-system shipments. In Q3 2025, Installed Base Management sales were €1.962 billion. For investors, this is the underappreciated stabilizer that supports cash generation across cycles.

4) Margins remain structurally high for a capital equipment company

ASML guided to a full-year 2025 gross margin of around 52%. High and stable gross margins make it easier for the stock to sustain a premium valuation during a slower-growth year, provided bookings quality remains intact.

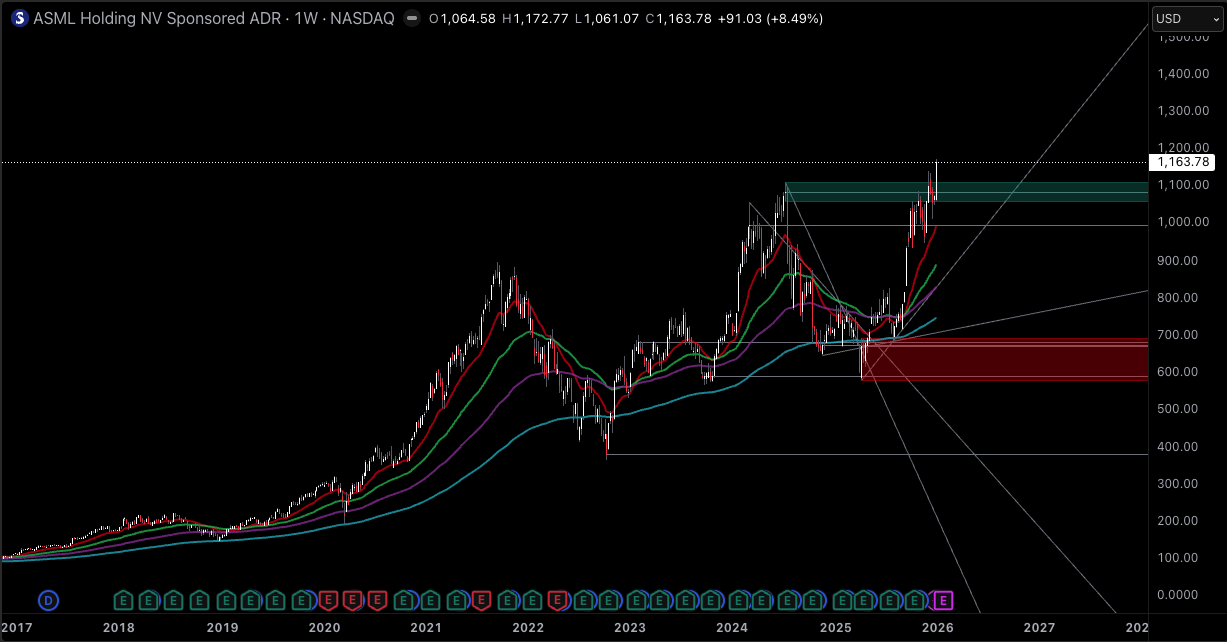

5) The chart confirmed the fundamental repricing

The latest session data shows a powerful trend day, with a last price of $ 1,163.78, an intraday high of $1,172.81, and heavy volume. When a stock pushes into new highs, it often attracts incremental demand from momentum-driven strategies and benchmark rebalancing.

ASML Stock Forecast 2026

A disciplined ASML stock forecast should focus on what actually drives earnings and cash flow in 2026: bookings mix, EUV output, service growth, and China revenue normalization.

Base case for 2026

Total net sales are flat to modestly higher, consistent with management’s statement that 2026 should not be below 2025.

EUV stays a majority share of bookings, supporting resilient margins.

Services continue to provide earnings stability as the installed base grows.

Bull case for 2026

China declines, but less sharply than investors fear, so headline revenue holds up better.

EUV shipments and upgrades remain strong enough to keep gross margin near guidance levels.

Investor confidence improves as quarterly order volatility compresses.

Bear case for 2026

China's revenue falls faster than expected, creating a visible growth air pocket.

EUV bookings have softened for multiple quarters, which would put more pressure on valuation than a single weak quarter would.

Policy and licensing friction add uncertainty to customer planning, slowing commitments.

China Sales In 2026: Why The Mix Shift Matters More Than The Headline

ASML’s own message is the key starting point: China's total net sales in 2026 are expected to decline significantly compared with the very strong 2024 and 2025 levels.

Here is the practical implication for readers.

A decline in China can reduce reported growth even if demand elsewhere is solid. This is a mix effect, not necessarily a demand collapse.

Investors should watch whether the decline is concentrated in less advanced systems or affects demand visibility more broadly.

In 2026, the market will likely react more to changes in order quality and margin guidance than to single-quarter revenue noise.

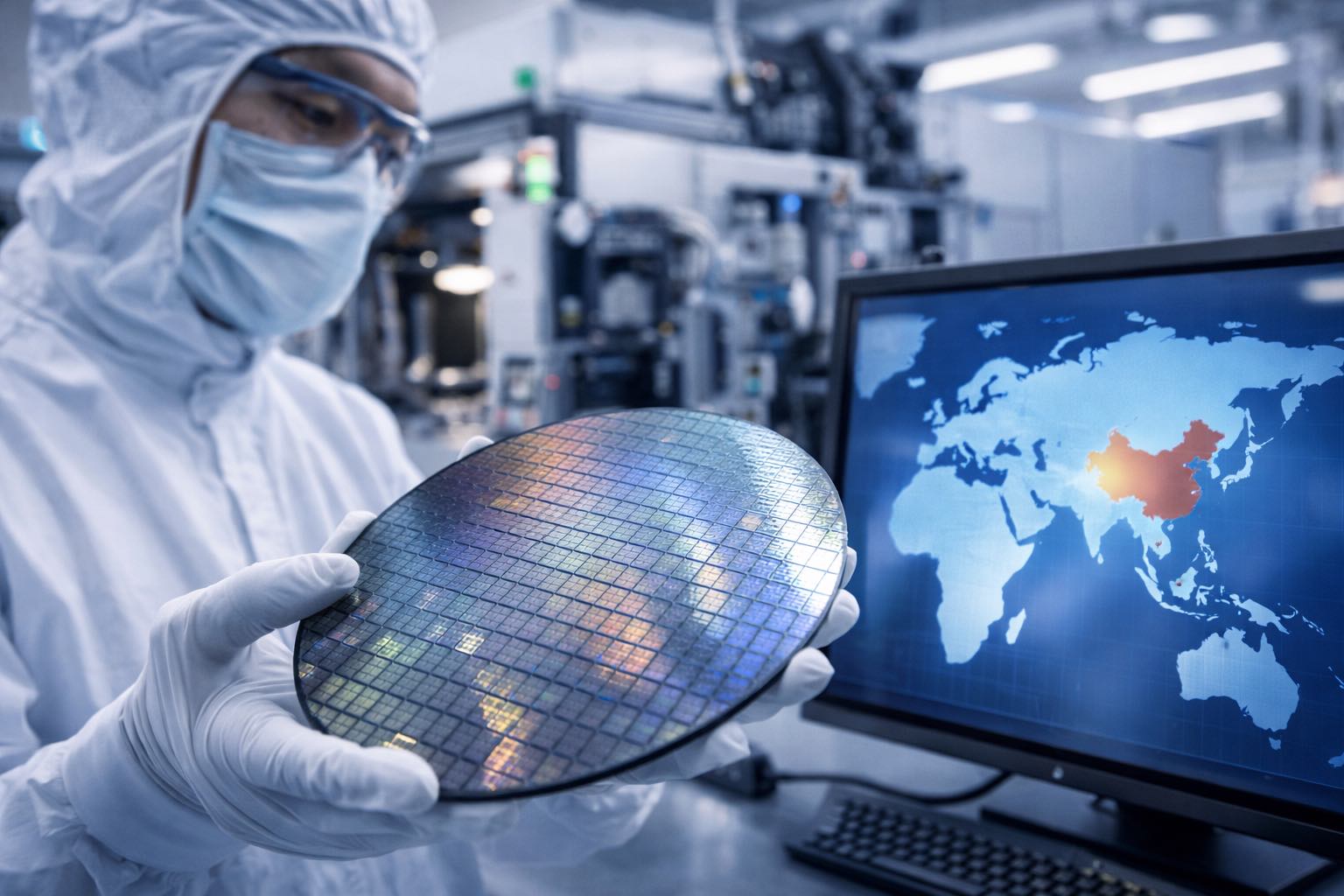

EUV and semiconductors: the real engine behind ASML Stock

ASML is not a broad semiconductor story. It is a lithography and installed-base economics story.

Two numbers from ASML’s disclosures frame why EUV remains central to any ASML stock forecast:

If EUV remains a large share of bookings and shipments, the company can sustain premium profitability even in a slower-growth year, because the product is scarce and the service attach rate grows with the installed base.

Technical Analysis For ASML Stock: Key Levels To Watch

Using the latest session range:

Resistance zone: near $1,173, the intraday high

First support zone: near $1,133, the open area where buyers stepped in

Deeper support zone: near $1,108, the intraday low

A constructive technical setup for 2026 is one where pullbacks hold above the first support zone and recover quickly. A break below deeper support would signal the market is questioning the new valuation regime.

What To Track In 2026 (The Investor Checklist)

Total net bookings and the EUV portion of bookings

China sales commentary and updated expectations for 2026

Installed Base Management sales trend

Gross margin guidance and the main drivers behind changes

Management language on 2026 versus 2025 revenue floor

Frequently Asked Questions (FAQ)

1. Why is ASML Stock surging?

ASML Stock is rising because investors are repricing durable EUV demand, strong recurring service revenue, and clearer 2026 revenue expectations. The company stated it does not expect 2026 total net sales to be below 2025, which supports confidence despite expected China normalization.

2. What is the ASML stock forecast for 2026?

A reasonable base case is flat to modestly higher sales versus 2025, supported by EUV demand and services, while China sales decline significantly from unusually strong 2024 and 2025 levels.

3. Will China sales hurt ASML in 2026?

China is expected to be a headwind in 2026, as ASML anticipates its total net sales in China to decline significantly. The key for investors is whether EUV demand and services offset that decline without pressuring margins.

4. Why does EUV matter so much for ASML Stock?

EUV is the most strategic part of ASML’s portfolio. In Q3 2025, EUV accounted for €3.6 billion of the €5.4 billion in net bookings, a mix that signals high-quality demand and supports premium profitability.

5. What numbers should I watch each quarter for ASML Stock?

Watch total net bookings, EUV bookings, Installed Base Management sales, and gross margin guidance. Also track any updates to the 2026 revenue floor and the expected trajectory of China sales.

6. Is ASML Stock a semiconductor stock or an equipment stock?

It is best understood as a semiconductor equipment and services company whose results are driven by lithography demand, order mix, and installed-base revenue, rather than by chip pricing.

Conclusion

ASML Stock is surging because the market is paying up for a business with scarce EUV capacity, a growing service base, and improved visibility for 2026 revenue. The cleanest ASML stock forecast for 2026 is a framework: total sales are guided to a floor versus 2025, China sales are likely to normalize lower, and EUV plus services are the stabilizers that can keep earnings quality intact.

If EUV remains a large share of bookings and margins hold near guidance, the stock’s new valuation can be defended even if headline growth looks slower.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.