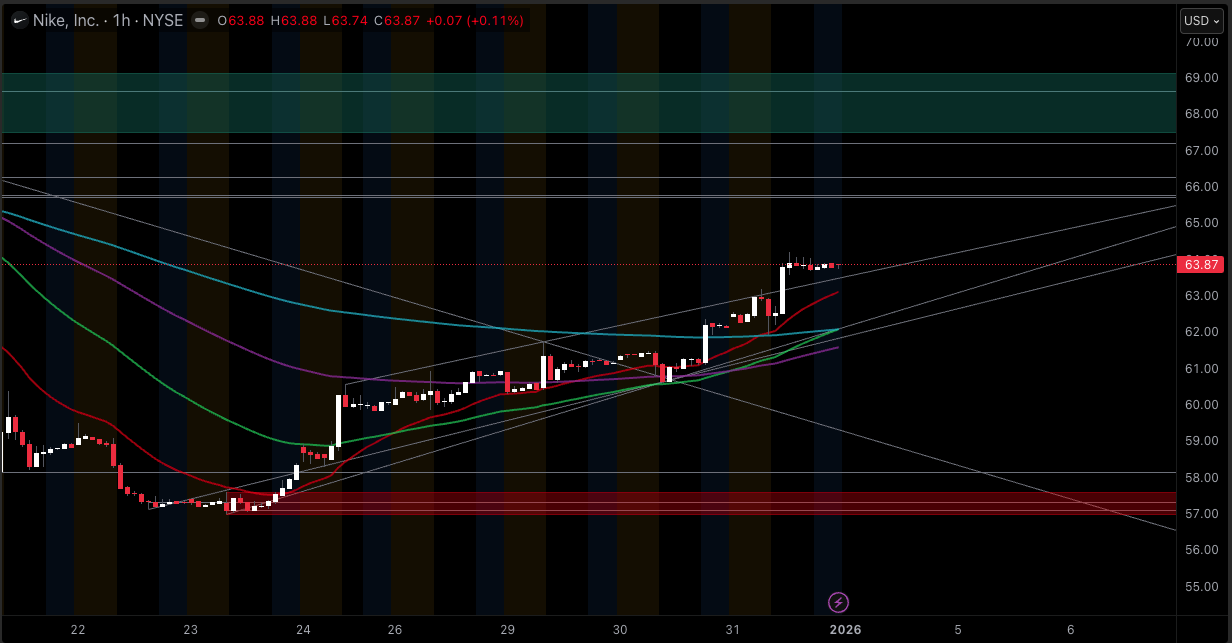

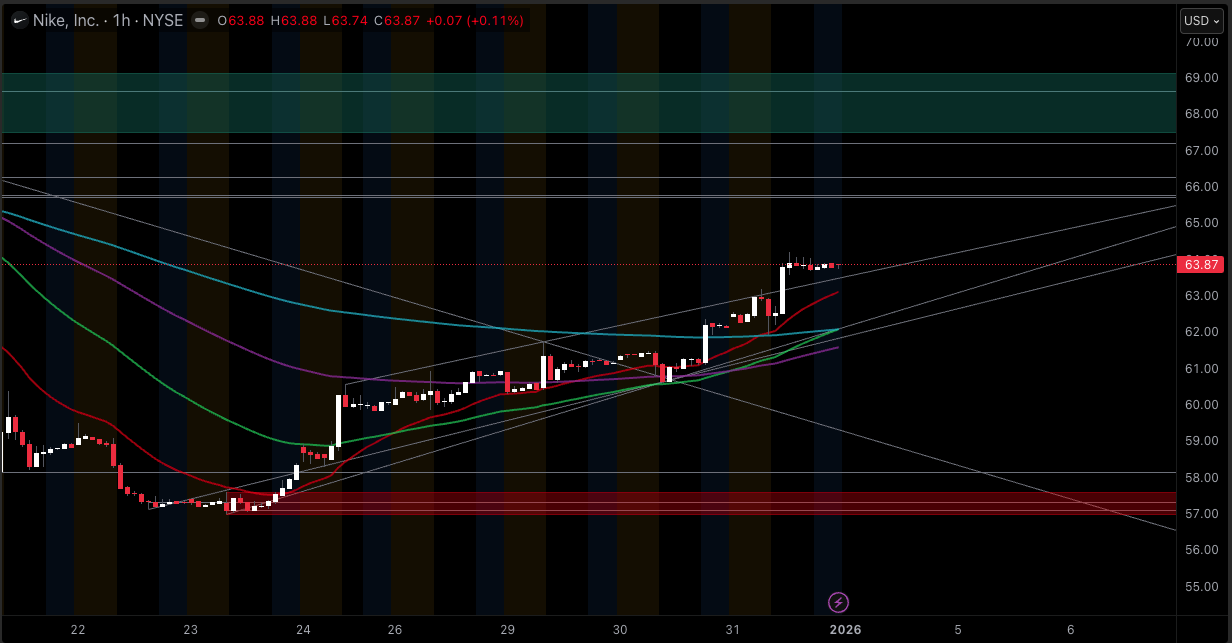

Nike stock turned higher into the final week of the year after a steep decline earlier in December. The move looks abrupt, but the drivers are clear. NKE stock rebounded from a late-December low near $57 and most recently closed at $63.71, supported by unusually strong buying interest on a high-volume session.

The bigger issue is whether this is the start of a durable recovery or a short-lived relief rally. The chart has improved, but the business is still navigating margin pressure, tariff impacts, and uneven regional demand. What comes next for Nike stock will depend on whether price holds key support while upcoming results show progress on profitability and inventory discipline.

This Week In The Nike Stock Chart

Nike stock price action this week (last five sessions)

| Date |

Open |

High |

Low |

Close |

Volume |

| Dec 24, 2025 |

58.88 |

60.58 |

58.88 |

60.00 |

35.60M |

| Dec 26, 2025 |

60.00 |

60.93 |

59.86 |

60.93 |

21.98M |

| Dec 29, 2025 |

60.54 |

61.75 |

60.51 |

61.21 |

17.19M |

| Dec 30, 2025 |

61.30 |

61.30 |

60.64 |

61.19 |

12.73M |

| Dec 31, 2025 |

62.25 |

64.20 |

61.92 |

63.71 |

35.30M |

Source: daily historical pricing and volume for NKE stock.

What Matters Technically

High-volume confirmation: Dec 31 volume was elevated versus the prior few sessions, which strengthens the signal that the rebound drew real participation.

A clear pivot low: The late-December low around $57.22 (Dec 22 close) became the reference point for buyers. Moves like this often begin when selling pressure finally exhausts after a sharp drop.

Why Nike Stock Is Rising

Nike stock is rising because the market received a credible confidence signal at the same time the chart was set up for a rebound. Four forces explain most of the movement.

1) Insider buying shifted sentiment

Two separate open-market purchases stood out. One was from the company’s chief executive, totaling about $1 million. Another was from a long-serving board member, totaling about $3 million. When insiders buy after a steep decline, investors often interpret it as a sign that leadership views the Nike share price as attractive relative to the company’s longer-term earnings power.

This does not solve operational challenges on its own. What it does is change the psychology of the trade. It makes it easier for buyers to argue that the downside is priced in and that the next surprise could be less negative than the last one.

2) The stock was primed for a technical rebound after the post-results drop

Nike shares fell sharply after its most recent quarterly update, with investors focused on profitability pressure and region-level weakness. That kind of sell-off often creates a two-step setup: forced selling into a low, then a fast rebound as sellers dry up and buyers step in.

The rebound from the high $50s into the low $60s fits that pattern. It is not a guarantee of a new uptrend, but it is a common first phase of stabilization.

3) Inventory progress improved the quality of the rebound

One of the most important operational metrics for an apparel company is inventory. High inventory tends to lead to discounting, which compresses gross margin. Nike reported inventories down 3% to $7.7 billion. That matters because it supports the idea that excess product is being worked down rather than building further.

Inventory discipline is not a headline feature. It is a margin feature. The market often rewards early evidence that inventory is moving in the right direction, even if earnings are still under pressure.

4) Investors are selectively focusing on what can improve first

Nike’s recent results showed mixed direction across channels and regions. Revenue was $12.4 billion for the quarter, while gross margin declined to 40.6%, down 300 basis points. Nike pointed to tariff-related pressure in North America as one factor weighing on margins.

The key is sequencing. The market does not need everything to improve at once for Nike stock to rise. It needs a believable path: first, improvements show up in inventories, then in discounting, then in margins. That is why the inventory signal and insider buying worked together.

NKE Stock Technical Analysis That Matters Now

Good technical analysis is a decision map. It defines the levels that confirm improvement and the levels that invalidate the bullish case.

Trend and Momentum Context

As of late December, the intermediate trend was still under pressure. Depending on the data provider and calculation method, Nike’s 50-day moving average sat near the mid $60s and the 200-day near the upper $60s, with the stock closing at $63.71.

That means the rebound is real, but the trend reversal is not fully confirmed until price reclaims those zones and holds them.

Momentum indicators also reflected a stabilization attempt rather than a full recovery. RSI readings were in the lower range typical of a stock emerging from a sell-off.

Key support levels

$61 to $60: This zone acted as a staging area during the rebound. Holding above it keeps the near-term structure constructive.

$57.22: The late-December pivot close. A fast break back below it would weaken the case that the bottom is in.

Key resistance levels

$64.20: The Dec 31 intraday high. Clearing it and holding above it is a near-term confirmation signal.

$66 to $67: A more meaningful test where longer moving averages cluster. This zone often decides whether a rebound becomes a trend change.

Is the move driven by short covering?

Short interest in Nike tends to be relatively modest as a percentage of float. That makes a classic short-squeeze explanation less likely. The move fits better as a sentiment reset and incremental buying after a heavy sell-off.

What Comes Next for Nike stock

The bullish roadmap

Nike stock can extend the rebound if two conditions hold:

Price holds above $60 and builds a higher low.

The next updates show tangible progress in the areas that directly drive earnings quality:

Gross margin pressure begins to ease as promotions normalize and tariff impacts are better absorbed.

Inventories remain controlled, reducing the need for discounting.

China's demand trends stop deteriorating, even if growth does not return quickly.

If those pieces improve, the market can justify a higher valuation multiple because the earnings outlook becomes less uncertain.

The bearish roadmap

The rebound can fail if margin pressure persists while demand softness continues in key regions. Nike itself highlighted pressure on gross margin and discussed the tariff impact. If those pressures remain elevated, the stock can struggle to move through the mid to upper $60s resistance zone.

A realistic base case

After a fast rebound, many stocks pause and trade sideways while the market waits for the next set of results to confirm whether the operational trend is actually improving. That consolidation period is often where the next durable move is built.

The Unique Angle That Matters Most: Why The Timing Was Decisive

The insider buying was powerful because it arrived after the sell-off had already produced a visible low. That sequence is important. When insiders buy before a decline ends, it can fail to change investor behavior. When insiders buy after a low, and the price begins to stabilize, it can serve as a validation mechanism that attracts additional buyers.

Nike’s sequence combined:

A sharp decline that likely exhausted near-term sellers.

A defined pivot low near $57.

Insider buying strengthened the case that valuation had become more compelling.

A high-volume up day that confirmed participation.

That is the clearest explanation for why Nike stock is rising now, even though the business is still in a reset.

Frequently Asked Questions (FAQ)

1. Why is Nike stock going up this week?

Nike stock is going up because insider buying improved sentiment right after a steep sell-off, and the chart rebounded from a clear late-December pivot low with strong participation.

2. What changed for NKE stock compared with earlier in December?

Earlier in December, the market was focused on margin pressure and regional weakness. After the decline, selling pressure eased, a pivot low formed, and insider buying provided a confidence signal that encouraged buyers to step in.

3. What are the most important support and resistance levels on Nike stock?

Support is near $60 to $61, then $57.22. Resistance is near $64.20, then $66 to $67. These levels help define whether the rebound is holding or failing.

4. Is Nike stock now in an uptrend?

Not fully confirmed. Nike stock has rebounded, but the intermediate trend is not clearly positive until the price can reclaim and hold above key moving-average zones in the mid to upper $60s.

5. What fundamentals matter most for Nike stock in 2026?

Watch gross margin, inventory levels, and China demand trends. Nike reported a gross margin of 40.6% and inventories of $7.7 billion, while noting the impact of tariffs. Those factors will heavily influence earnings quality and valuation.

6. Is Nike stock a buy after the bounce?

It depends on your time horizon and risk tolerance. Technical investors often wait for confirmation above resistance zones. Long-term investors typically look for evidence that margin pressure is peaking and that demand trends are stabilizing. This is not investment advice.

Conclusion

Nike stock is rising because a technical rebound coincided with a credible confidence signal from insider buying at a time when selling pressure had likely faded. The move was reinforced by improving inventory trends and a high-volume up session that validated demand for shares.

What comes next for NKE stock is straightforward. Bulls want the stock to hold above $60 and push through mid- to upper-$60 resistance. Fundamentally, investors need to see margin pressure begin to ease, inventories remain controlled, and China trends stabilize.

If those conditions improve, Nike stock can transition from rebound to recovery. If they do not, the rally is likely to remain a sharp but temporary reset move.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.