Key Takeaways

Confirmation of the Trump–Xi meeting was the principal catalyst for the spike in risk appetite.

Record levels or multi-year highs were recorded in some markets, reflecting a blend of domestic and geopolitical optimism.

Fund flow data indicated a significant weekly inflow to global equity funds at the time markets reacted.

Asian equity markets rose sharply after confirmation that US President Donald Trump will meet Chinese President Xi Jinping on 30 October during the APEC summit in Busan, South Korea.

Investors viewed the meeting as a chance to ease trade tensions and address issues such as tariffs and export controls. The news triggered strong buying across regional markets and lifted overall risk appetite.

This article reviews the latest market movements, key drivers of the rally, country and sector impacts, cross-asset reactions, policy risks and practical takeaways for investors.

Immediate Asian Market Reaction and Snapshot

On clearance of the meeting headline, key Asian indices rallied:

The shift was accompanied by noticeable fund flows into global equity products during the same period, signalling that the market move was not solely local and included international repositioning.

Primary Drivers Behind the Rally

Official confirmation of a Trump–Xi bilateral meeting on 30 October in Busan, during the APEC summit, removed near-term uncertainty about whether leaders would hold face-to-face talks.

Markets tend to reward confirmed diplomatic windows that create the possibility of tangible policy progress.

Market positioning ahead of high-profile events.

Traders frequently cover short positions and buy into risk assets when an event offers a plausible positive outcome, producing a self-reinforcing rally in the short term.

Convergence of other supportive headlines, including optimistic corporate earnings elsewhere and weaker near-term safe-haven demand due to falling volatility, which amplified the move.

Technical and liquidity factors, including algorithmic flows and regional index rebalancing, which can exaggerate directional moves once momentum is established.

How the Asian Markets Surge Played Out Across the Region

1. Japan: Asian Markets Surge and Japan Equity Repricing

Japanese equities outperformed regional peers on the day of the rally, in part because of domestic political developments that suggested a pro-stimulus tilt in policy, which combined with trade optimism to lift exporters and large-cap technology names.

Reported market highs in Japan were consequently a mix of domestic expectations and favourable global headlines.

2. South Korea: KOSPI Benefits from Trade Optimism

South Korea's market registered a pronounced gain and set fresh records as semiconductor and export-oriented stocks led the advance.

The country's heavy exposure to global supply chains and chip exports made it particularly sensitive to any signs of easing in US–China trade friction.

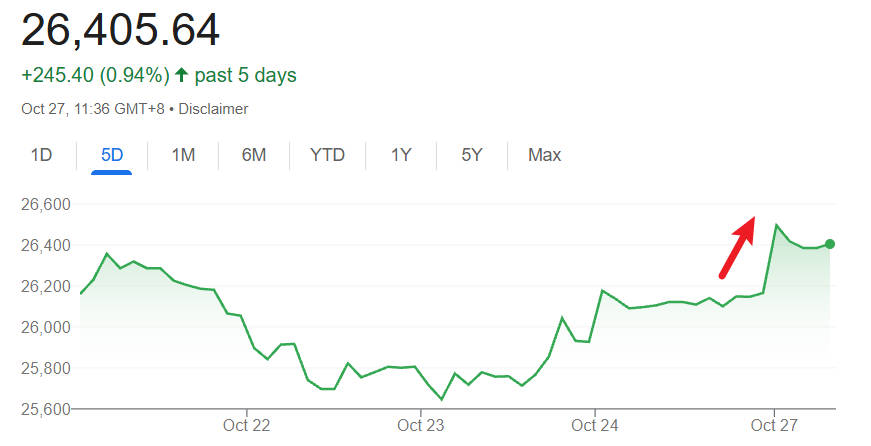

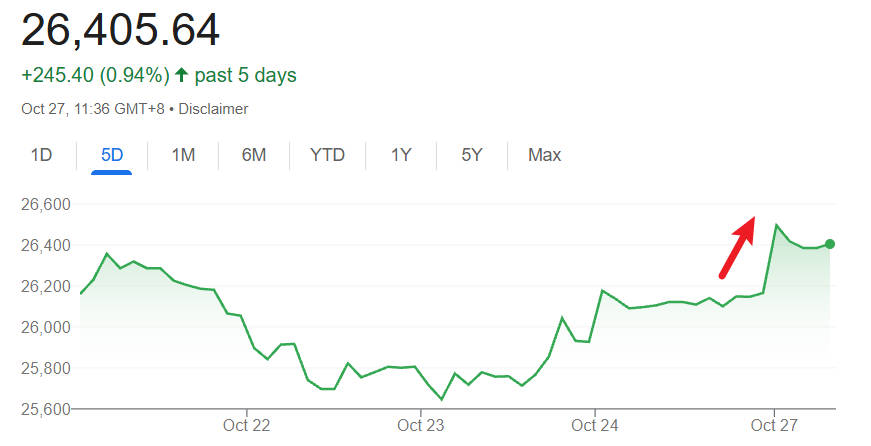

3. China and Hong Kong: Measured Gains on Trade Prospects

China's onshore benchmark and Hong Kong's H-share complex advanced as investors priced a lower probability of escalatory tariff actions becoming entrenched.

Gains were more measured compared with Japan and Korea, reflecting simultaneous domestic policy considerations and targeted capital controls.

4. Southeast Asia and Other Markets

ASEAN markets experienced spillover gains in trade-linked sectors, although performance varied with domestic data and commodity exposures.

Commodity-importing economies showed some benefit from clearer global demand expectations.

Sector and Thematic Impact of the Asian Markets Surge

| Sector |

Typical Reaction on Trade-Optimism |

Example Rationale |

| Semiconductors and Technology |

Strong outperformer |

Beneficiaries of resumed supply-chain normalisation and reduced risk of export controls. [1] |

| Industrials and Transport |

Positive |

Trade normalisation supports shipping and capital goods demand. |

| Materials and Commodities |

Positive to mixed |

Metals and oil gain on higher growth expectations, but supply-side stories may differ. [2] |

| Financials |

Positive |

Higher equity prices and improved business sentiment can lift bank and broker revenue prospects. |

| Safe Havens (Gold, Government Bonds) |

Underperform/decline |

Risk-on moves typically reduce safe-haven flows, pushing yields higher. |

How the Asian Markets Surge Affected Global Asset Classes

Currency:

The yen weakened in the episode described, which supported Japan's exporters and accentuated the equity rally there. The Chinese renminbi showed modest stabilisation as trade tensions appeared less likely to escalate immediately.

Fixed Income:

Sovereign yields edged higher in some markets as risk premia compressed and investors rotated out of bonds into equities.

Commodities:

Base metals and energy prices rose modestly on improved demand expectations, though supply-side constraints kept moves differentiated by commodity.

Policy and Geopolitical Considerations Behind the Asian Markets Surge

The scheduling of a high-level meeting does not itself resolve policy disputes. Key policy items likely to be in market focus include tariffs, export control regimes, rare-earth and strategic material export regulations, and enforcement mechanisms for any agreed commitments.

Markets should therefore treat progress at the meeting as the beginning of a negotiation cycle rather than as definitive resolution. Officials' post-meeting communiqués and follow-up technical talks will be decisive for sustained repricing.

Risks That Could Reverse the Asian Markets Surge

Headline risk: leaks, ambiguous readouts or sharp unilateral announcements could reverse sentiment rapidly.

Implementation risk: even a positive leaders' statement will require negotiators to translate vague commitments into operational agreements; failure to do so risks disappointment.

Macro shocks: abrupt movements in US yields, unexpected central bank comments or geopolitical incidents could overwhelm the optimistic narrative.

Selected Market Numbers During the Asian Markets Surge

| Market / Indicator |

Reported Move or Level |

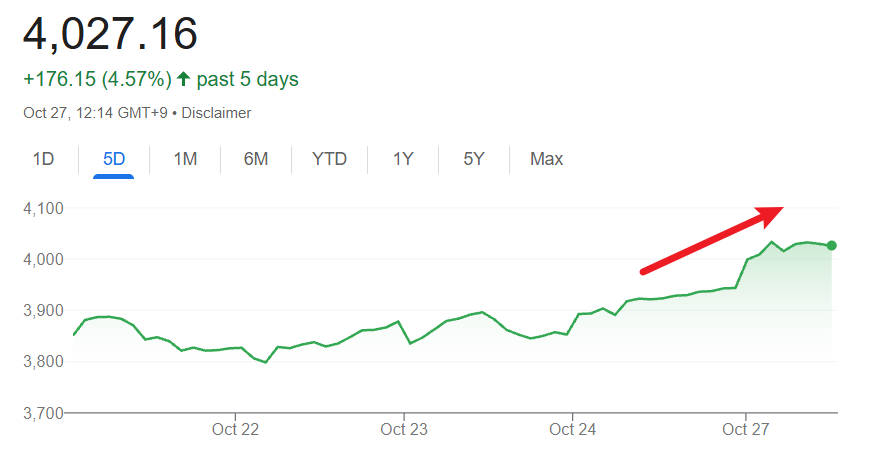

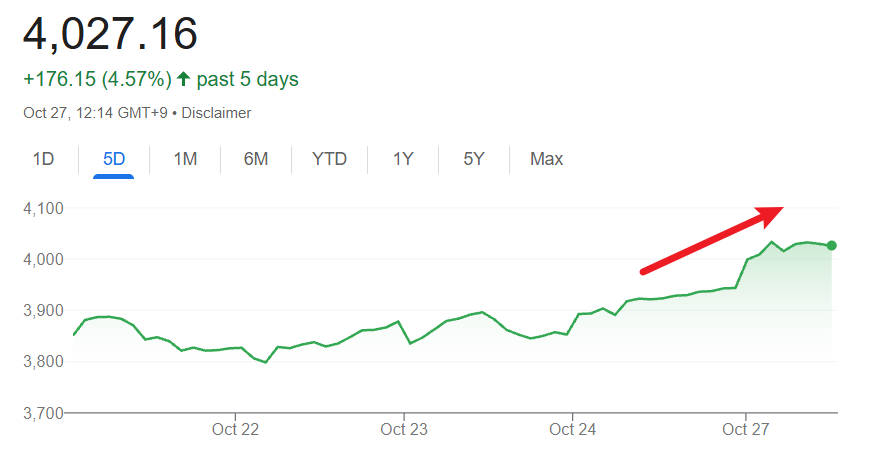

| South Korea KOSPI |

+2.19% to 4027.16 |

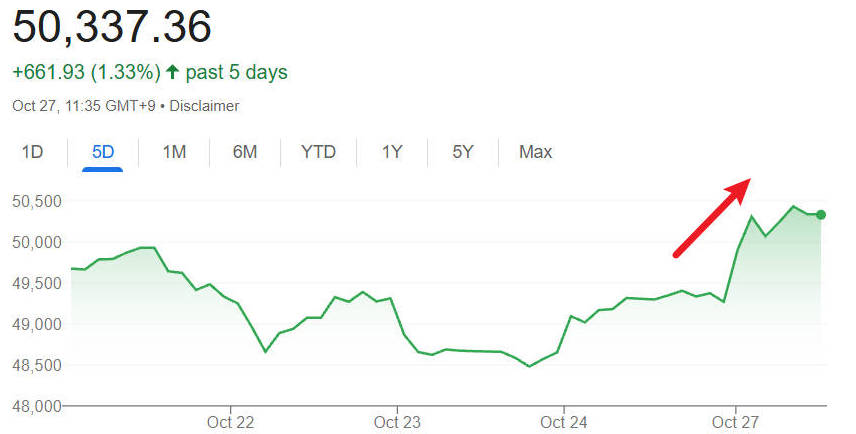

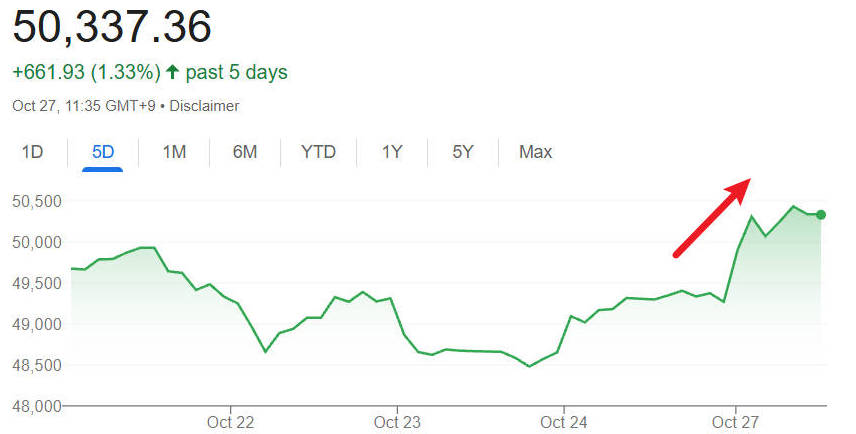

| Japan Nikkei 225 |

+1.93% to 50337.36 |

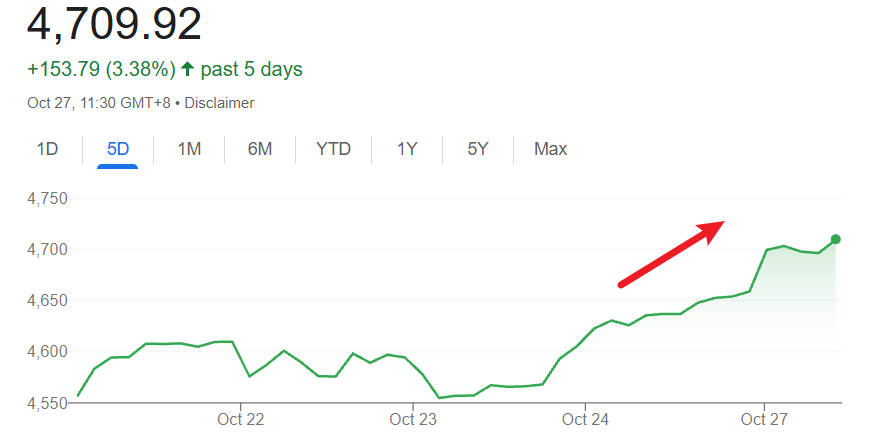

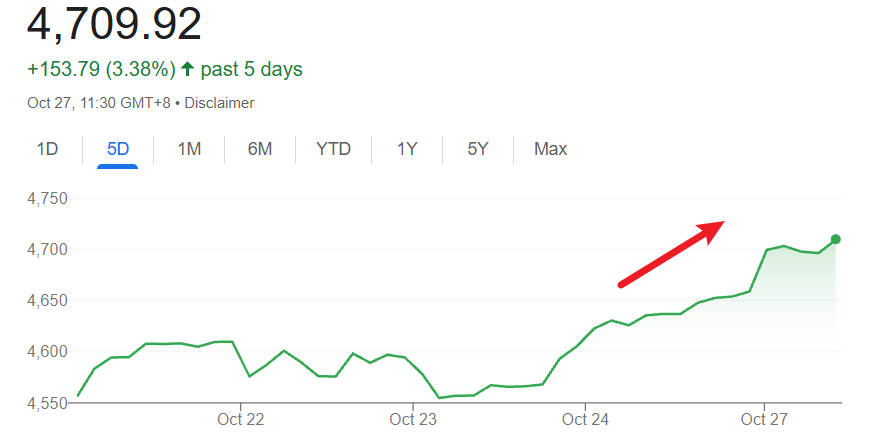

| CSI 300 (China onshore) |

+1.06% to 4709.92 |

| Weekly Global Equity Fund Flows |

Net inflow of US$11.03 billion (week of reporting) [3] |

Conclusion and Recommended Next Steps for Analysts and Writers

The confirmation of a Trump–Xi meeting in Busan on 30 October produced a marked re-rating across several Asian equity markets. The immediate move appears to be a combination of genuine sentiment shift and technical positioning. For a substantive reassessment of risk and opportunity, readers should:

Obtain closing index values on 30 October and compare them with pre-event levels to measure persistence.

Track the post-meeting communiqués and subsequent technical negotiations for evidence of implementation.

Re-run sector and factor exposures for portfolios based on actual earnings sensitivity to US and Chinese demand.

For publication purposes, update the data appendix with end-of-day quotes on 30 October and, where possible, include a short expert quote from a regional strategist to add colour and market perspective.

Frequently Asked Questions

Q1: Why did Asian markets rally when a single meeting was announced?

Markets price probabilities. A confirmed meeting between two major leaders creates a window for negotiation and potential de-escalation of trade measures.

Traders often front-run anticipated policy easing because even tentative progress can reduce immediate downside risk for trade-sensitive earnings.

Official confirmation removes an element of headline uncertainty and often triggers short-term risk-on positioning.

Q2: Does a meeting guarantee a trade deal or tariff rollbacks?

No. A leaders' meeting is an opportunity to set political direction and agree on broad frameworks. Concrete rollbacks or legally binding commitments usually require technical follow-up and legislative or administrative steps.

Markets should therefore treat any leaders' statement as preliminary until technical details are announced.

Q3: Which sectors should investors watch most closely ahead of and after 30 October?

Semiconductors and broader technology sectors are most sensitive because of supply-chain and export-control linkages. Industrials, transport and commodities are also cyclical beneficiaries of trade normalisation.

Conversely, defensive assets and exporters that benefited from a weaker domestic currency may react differently depending on currency moves.

Q4: What market signals would indicate that the rally is sustainable?

Concrete follow-up actions such as scheduled technical talks, mutual agreement on tariff rollbacks or clarifying adjustments to export controls would materially raise the probability that a rally is durable.

Sustained net inflows into regional equity funds and rising corporate guidance on improved trade outlook would also support the case for persistence.

Q5: How should short-term traders and longer-term investors differ in their responses?

Short-term traders may capitalise on event-driven volatility, using tight stop-losses and short-dated options to hedge downside risk.

Longer-term investors should evaluate whether the perceived improvement alters fundamental earnings trajectories and whether valuations remain within their risk tolerances.

Gradual adjustments and monitoring of implementation risk are prudent for longer horizons.

Sources:

[1] https://koreajoongangdaily.joins.com/news/2025-10-24/business/finance/Asian-shares-rise-after-White-House-confirms-plans-for-TrumpXi-meeting/2428293

[2]https://www.reuters.com/business/autos-transportation/global-markets-wrapup-1-2025-10-20/

[3]https://www.reuters.com/world/china/global-markets-flows-graphic-2025-10-24/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.