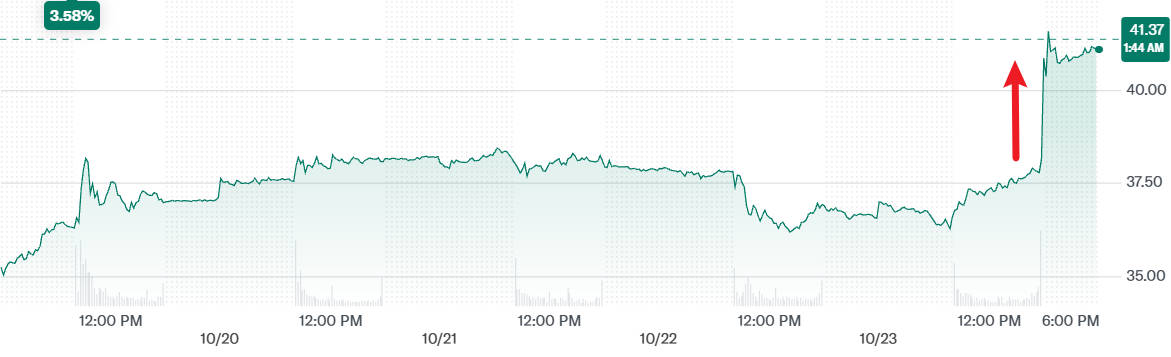

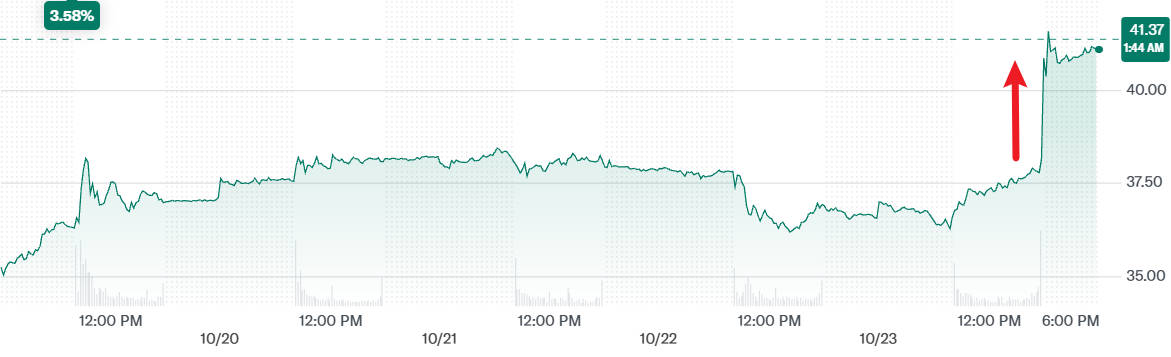

The Intel stock price climbed to around $41.30 after the company's Q3 2025 results revealed a clear revenue rebound and a return to profitability, signalling tangible progress in its long-term turnaround.

The stronger performance boosted investor confidence that Intel's restructuring efforts and heavy AI-focused investments are finally yielding measurable financial results.

This article explores how the Q3 earnings influenced the Intel stock price, detailing segment performance, market reaction, management guidance, analyst sentiment, and the critical risks shaping Intel's outlook for the next quarter.

Key Q3 Metrics Driving Intel Stock Price

| Metric |

Result (Q3 2025)[1] |

| Revenue |

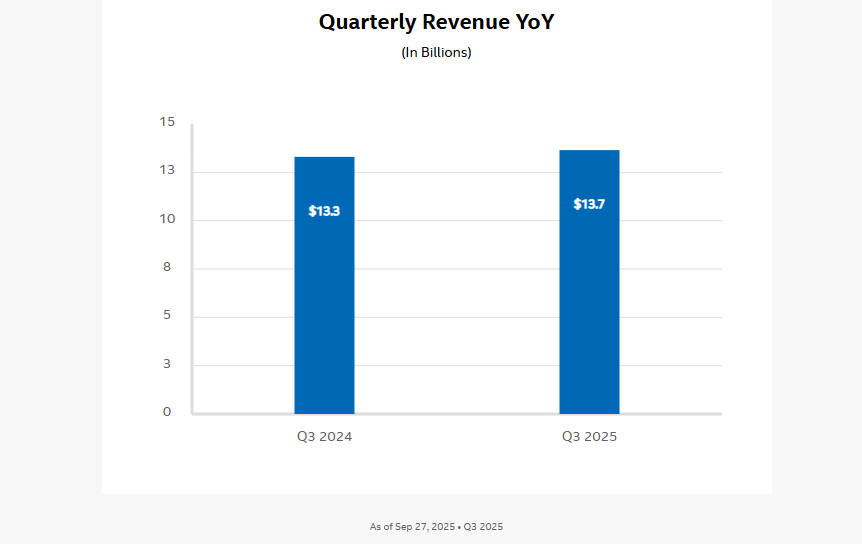

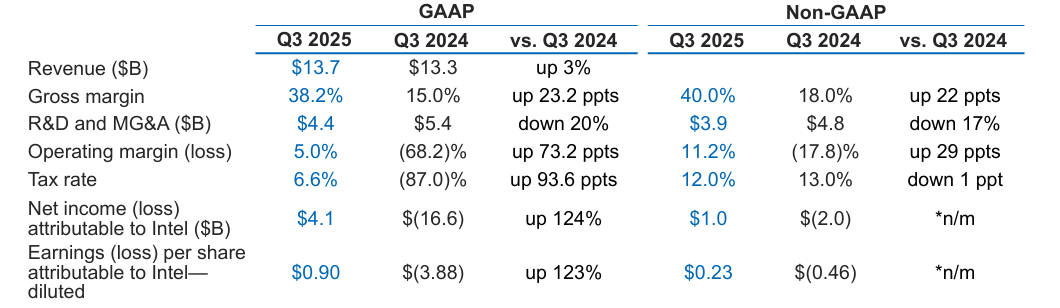

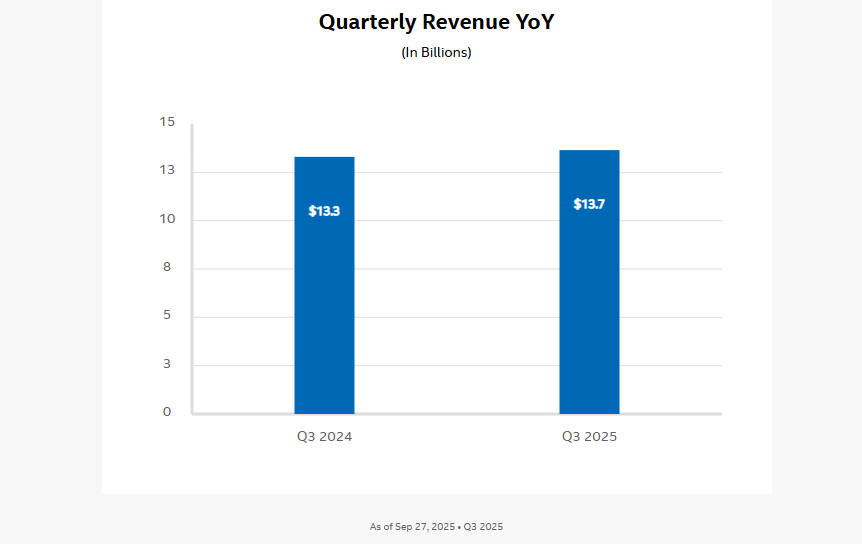

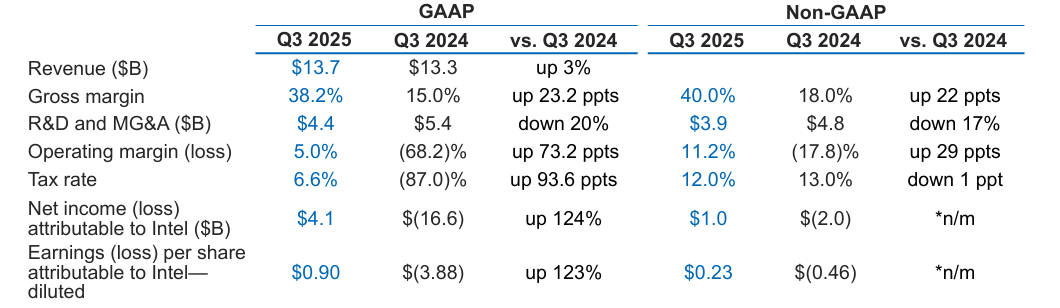

$13.7 billion (up ~3% YoY). |

| GAAP net income |

$4.1 billion (net income). |

| GAAP EPS (attributable to Intel) |

$0.90 per share. |

| Non-GAAP EPS |

$0.23 per share. |

| After-hours price move |

Shares rose roughly 7–8% after the release. |

| Q4 guidance (revenue) |

$12.8bn to $13.8bn; Q4 non-GAAP EPS guidance $0.08. |

Why the Intel Stock Price Reacted

1. Return to GAAP profit matters.

Investors reward the reversal from prior heavy losses to a positive GAAP net income because it signals that restructuring, cost discipline and strategic moves are having an effect. [2]

2. Revenue and EPS beats underpin confidence.

Revenue of $13.7bn and an adjusted EPS of $0.23 exceeded Street expectations, reducing short-term downside risk and prompting re-appraisal of forward earnings.

3. Guidance and foundry details temper euphoria.

Management's Q4 revenue range and mixed comments on foundry margins created a balance: good progress, but not a problem-free rebound. [3]

Intel Q3 Key Figures Versus Analyst Expectations

The most important immediate comparison is between reported results and consensus estimates:

Revenue of $13.7bn represented year-on-year growth of roughly 3 per cent and beat the guidance range from July.

Non-GAAP EPS of $0.23 comfortably surpassed the prior consensus estimate near $0.02–$0.05 per share, representing a material upside surprise for investors.

The market's response (an after-hours move in the high single digits) is consistent with the size of the beat and the narrative that Intel's turnaround is beginning to show in the numbers.

What Drove Revenue and Margins

| Segment |

Q3 signal |

Why it matters for the Intel stock price |

| Client (PC) |

Stable but not booming; ASP dynamics mixed. |

PC recovery supports base revenue but is not the high-growth engine investors prize. |

| Data Centre & AI |

Growing demand, improving margins noted. |

AI/data-centre traction is critical for multiple expansion and long-term revenue quality. |

| Foundry |

Revenue contribution notable but margins remain a concern. |

Foundry revenue helps top line but capex intensity and margin drag constrain free cash flow and P/E expansion. |

Key takeaways:

Data-centre and AI demand is the strategic heart of the bull case.

If Intel successfully converts AI demand into sustainable market share and higher-margin products, the stock price can re-rate.

Foundry progress is a double-edged sword.

While foundry sales enlarge the revenue base, the business is capital intensive and so a drag on consolidated margins until utilisation and process economics improve.

Investors are therefore vigilant on margin commentary.

Next Quarter Expectations for Intel

1. Management provided a conservative but achievable set of expectations for Q4:

2. Why guidance matters for the Intel stock price:

It frames the near-term re-rating. Conservative guidance can temper a rally even after a beat.

It sets the bar for the next quarterly test. Investors will watch Q4 delivery against the current range and any incremental commentary from the next earnings call.

Analysts' Reactions and Valuation Context

1. Analyst responses were mixed but generally constructive:

Upgrades and price target increases were visible among some houses that emphasised cost cuts and an improving revenue mix.

Caveats from more cautious analysts focused on structural competition in AI chips and the execution risk embedded in foundry scaling.

2. Valuation snapshot:

Principal Risks and What Investors Should Watch

Moderate bullet points and a numbered watchlist to keep the picture practical:

Foundry margin and scale risk: low utilisation or slower yield improvements would keep pressure on consolidated margins.

Capital expenditure: large capex requirements can weigh on free cash flow and limit buybacks or dividend growth.

Competitive dynamics in AI: competitors continue to gain share in specialised AI accelerators; Intel must show product-level wins.

Short watchlist:

Next quarterly revenue and EPS relative to the current guidance range.

Foundry gross margin commentary and utilisation updates.

Any new strategic partnerships or customer design wins in AI and data centre segments.

Conclusion

Intel's Q3 2025 report gave investors the right kind of progress: a return to GAAP profitability, a revenue beat and an EPS surprise that together justified the after-hours rise in the Intel stock price.

However, sustaining the rally requires visible margin improvement from the foundry business and tangible, repeatable wins in AI and data-centre compute.

For investors, the coming quarters are likely to be decisive: incremental execution wins could unlock further upside, while execution shortfalls would reintroduce downside risk.

Frequently Asked Questions

Q1: Why did the Intel stock price rise after the Q3 2025 results?

The Intel stock price jumped around 7–8% in after-hours trading after the company reported stronger-than-expected revenue and a return to profitability. Investors welcomed the earnings beat as evidence that Intel's restructuring and AI-focused strategy are beginning to deliver results.

Q2: What were the key financial figures influencing the Intel stock price?

Intel posted $13.7 billion in revenue, up roughly 3% year on year, with net income of $4.1 billion. GAAP EPS was $0.90. and non-GAAP EPS $0.23. both comfortably exceeding analyst expectations — the primary catalyst for the Intel stock price surge.

Q3: How did the foundry segment impact the Intel stock price?

The foundry business contributed about $4.2 billion in revenue. While this segment demonstrated capacity growth, its lower margins limited overall profitability. Market analysts noted that sustainable margin improvement here will be key to supporting a higher Intel stock price.

Q4: What guidance could affect the Intel stock price in Q4 2025?

Management forecast Q4 revenue between $12.8 billion and $13.8 billion and non-GAAP EPS of $0.08. The cautious tone and focus on cost discipline may influence short-term movements in the Intel stock price, depending on execution and market sentiment.

Q5: What risks could pressure the Intel stock price going forward?

Risks include slower improvement in foundry margins, continued high capital expenditure, and competitive pressure from rival AI chipmakers. Any setbacks in these areas could restrain future gains in the Intel stock price.

Q6: What should investors watch next regarding the Intel stock price?

Investors should track foundry utilisation, AI product adoption, and free cash flow trends in the next quarter. Consistent execution in these areas will be decisive for the long-term direction of the Intel stock price.

Sources:

[1]https://d1io3yog0oux5.cloudfront.net/_a9c76828df1af0b055f7cffea57824a7/intel/db/887/9148/earnings_release/Q3%2725+EarningsRelease+FINAL.pdf

[2] https://apnews.com/article/intel-chips-trump-investment-d904acd88a50fda36876353258f42a40

[3] https://www.intc.com/news-events/press-releases/detail/1753/intel-reports-third-quarter-2025-financial-results

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.