Ever wonder why the Alphabet stock trades under two tickers that move almost exactly the same? At first glance, GOOGL and GOOG look interchangeable, showing the same price action and reacting to the same news. But beneath that surface similarity is a meaningful difference in what investors actually own.

GOOGL represents Alphabet’s Class A shares, while GOOG represents its Class C shares. Both give investors the same financial exposure to Alphabet Inc., including earnings growth and long-term returns. The difference lies in ownership rights, not performance.

Class A shares come with one vote per share, offering limited participation in corporate decisions. Class C shares remove voting rights entirely, providing pure economic exposure. That simple distinction explains why two nearly identical Alphabet stocks exist and why choosing between them is more about preference than price.

The Differences: What Makes Class A and Class C Different

The main difference between Alphabet Class A and Class C shares lies in voting rights. Class A shares come with one vote per share, while Class C shares carry no voting rights.

Aside from governance, the two are actually economically identical, offering the same exposure to share price performance and any dividends Alphabet may choose to pay.

This setup allows Alphabet’s founders have control while still being a public company. For the investors, though, it simply means choosing between owning shares with voting rights or choosing the option that focuses purely on price and ease of trading.

Alphabet Share Classes at a Glance

| Feature |

Alphabet Class A (GOOGL) |

Alphabet Class C (GOOG) |

| Voting Rights |

1 vote per share |

No voting rights |

| Economic Interest |

Full |

Full |

| Dividend Rights |

Equal |

Equal |

| Index Inclusion |

Yes |

Yes |

| Typical Liquidity |

Very high |

Very high |

| Governance Influence |

Limited but present |

None |

Alphabet’s Dual-Class Structure Explained

Why Alphabet Uses Multiple Share Classes

Alphabet Inc. adopted a multi-class structure to balance public market access with strategic continuity. Founders and insiders retain control through Class B shares, which carry super-voting rights and are not publicly traded. Class A and Class C exist to meet investor demand without altering that control framework.

This ensures that management can pursue long-term initiatives such as artificial intelligence infrastructure, cloud expansion, and moonshot projects without short-term shareholder pressure influencing strategic decisions.

Class A Shares (GOOGL)

GOOGL Class A shares grant investors one vote per share. In theory, this allows participation in shareholder resolutions, board elections, and governance matters. In practice, voting influence remains limited because Class B insiders control the overwhelming majority of voting power.

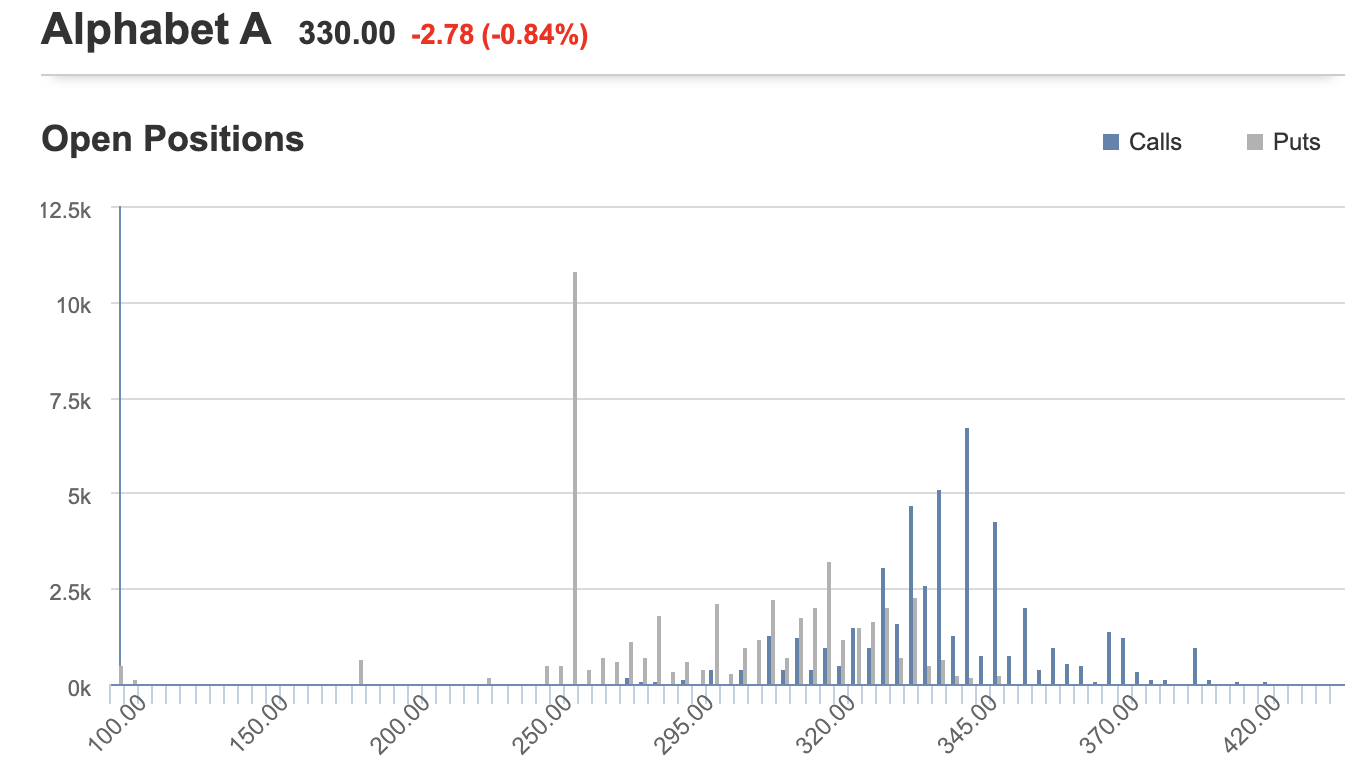

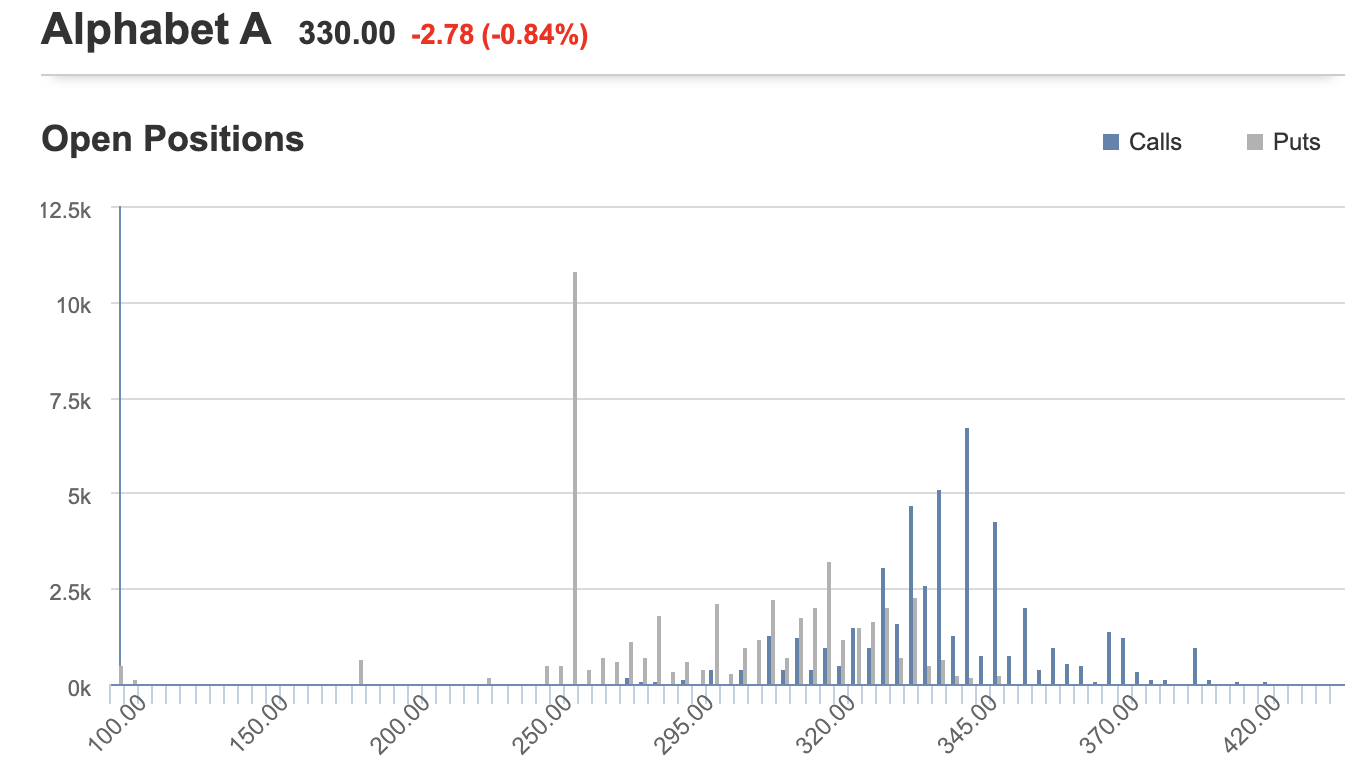

The chart below shows the open options interest for Alphabet Class A shares across different strike prices. The blue bars represent call options, and the grey bars represent put options. It highlights where traders are positioning for upside or downside, indicating key price levels where market expectations and hedging activity are concentrated.

However, Class A shares still appeal to institutional investors who prioritize governance alignment, voting symbolism, or fiduciary mandates requiring voting rights.

Class C Shares (GOOG)

Class C shares eliminate voting rights entirely. Investors receive identical economic exposure to Alphabet’s revenue growth, margins, and free cash flow, but without governance participation. This simplicity often results in slightly higher liquidity, particularly among passive funds and derivatives markets.

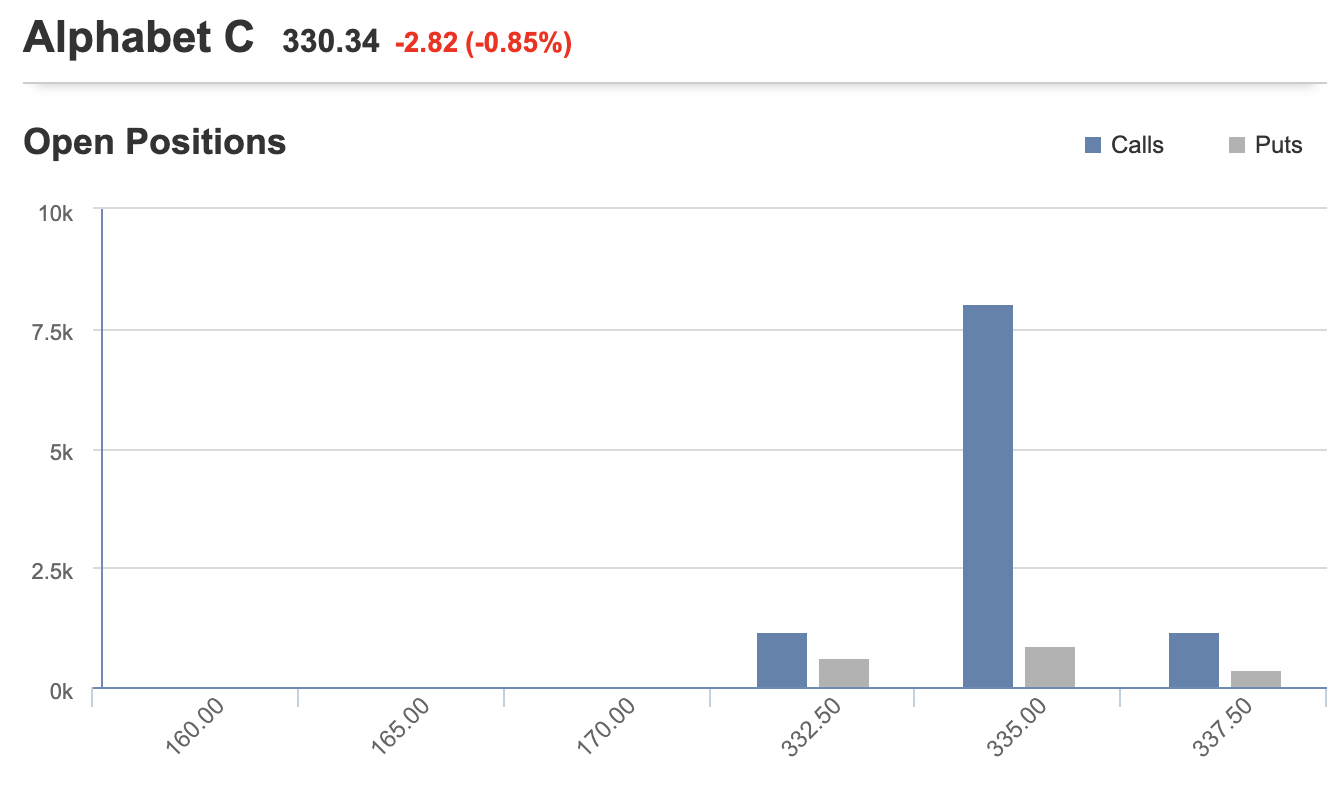

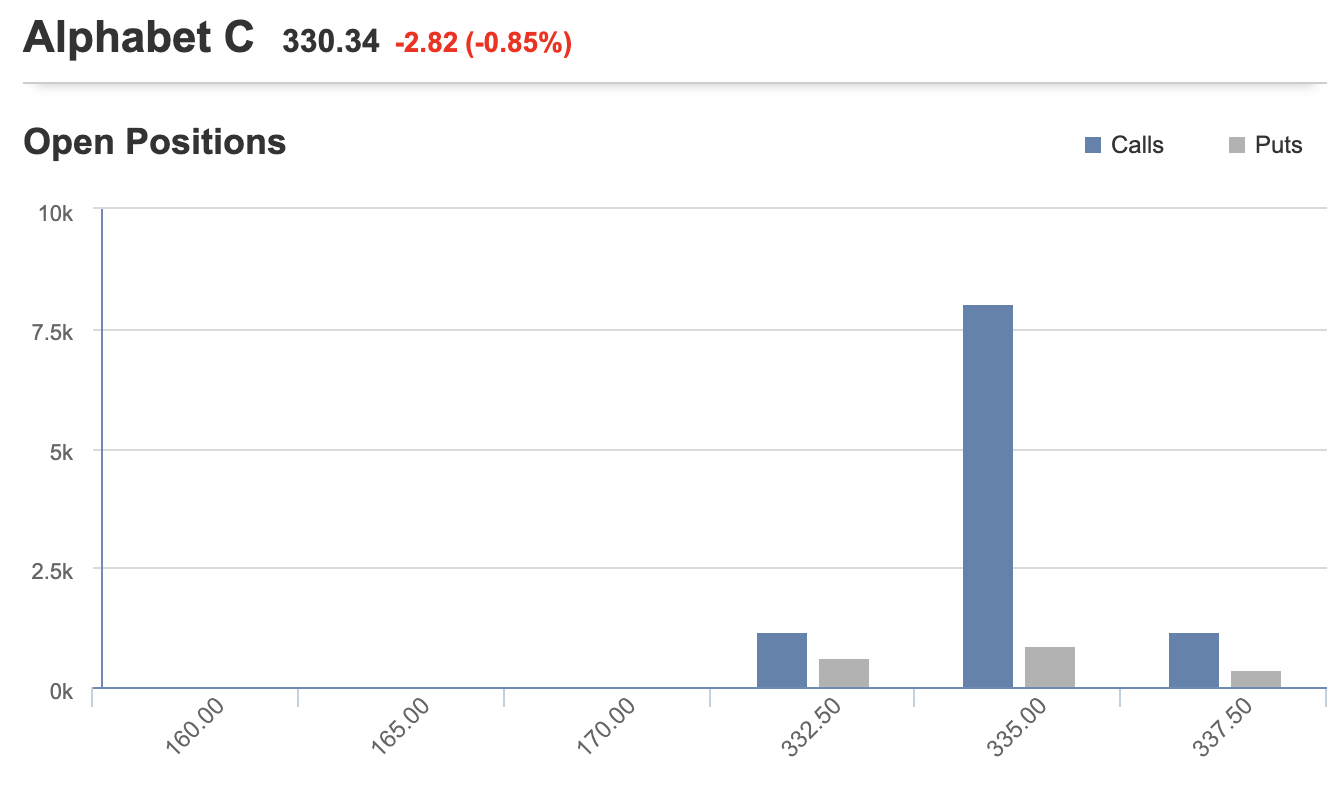

The chart above shows options open interest for Alphabet Class C shares concentrated around a narrow range of strike prices near the current market level. Call open interest dominates, especially around the $335 strike, suggesting traders are positioning for upside or defending nearby resistance, with comparatively lighter downside hedging.

The chart above shows options open interest for Alphabet Class C shares concentrated around a narrow range of strike prices near the current market level. Call open interest dominates, especially around the $335 strike, suggesting traders are positioning for upside or defending nearby resistance, with comparatively lighter downside hedging.

Alphabet Class A Shares: Who They Suit Best

Alphabet Class A shares appeal to investors who value at least nominal participation in corporate governance. Although one vote per share offers limited influence in a company dominated by Class B holders, it still preserves formal shareholder rights.

These shares are often preferred by:

Institutional investors with governance mandates

Funds that prioritize voting rights as part of fiduciary responsibility

Long-term holders who value shareholder engagement, even if symbolic

Class A shares may become slightly more relevant during periods of increased governance attention, such as regulatory scrutiny or shareholder activism, when voting rights carry greater practical or symbolic importance.

Alphabet Class C Shares: Why They Exist and Who Buys Them

Class C shares exist to maximize capital efficiency. They provide the same economic exposure to Alphabet’s cash flows, growth trajectory, and balance sheet strength without any governance privileges.

They are typically favored by:

In practice, Class C shares may trade at a modest premium or discount to Class A shares. These price differentials are typically narrow and short-lived, driven by liquidity conditions, institutional positioning, and periodic index rebalancing rather than any underlying difference in business fundamentals.

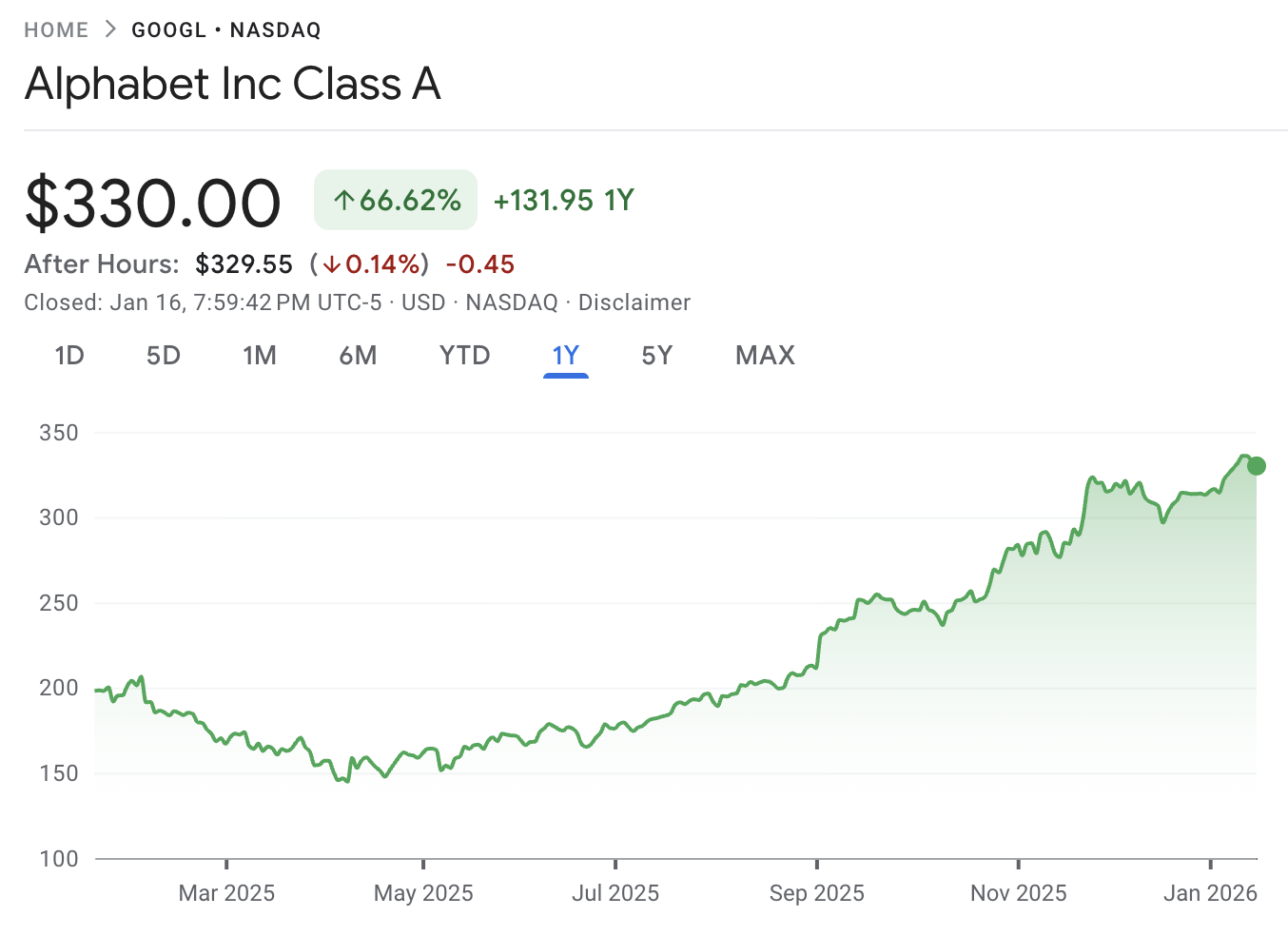

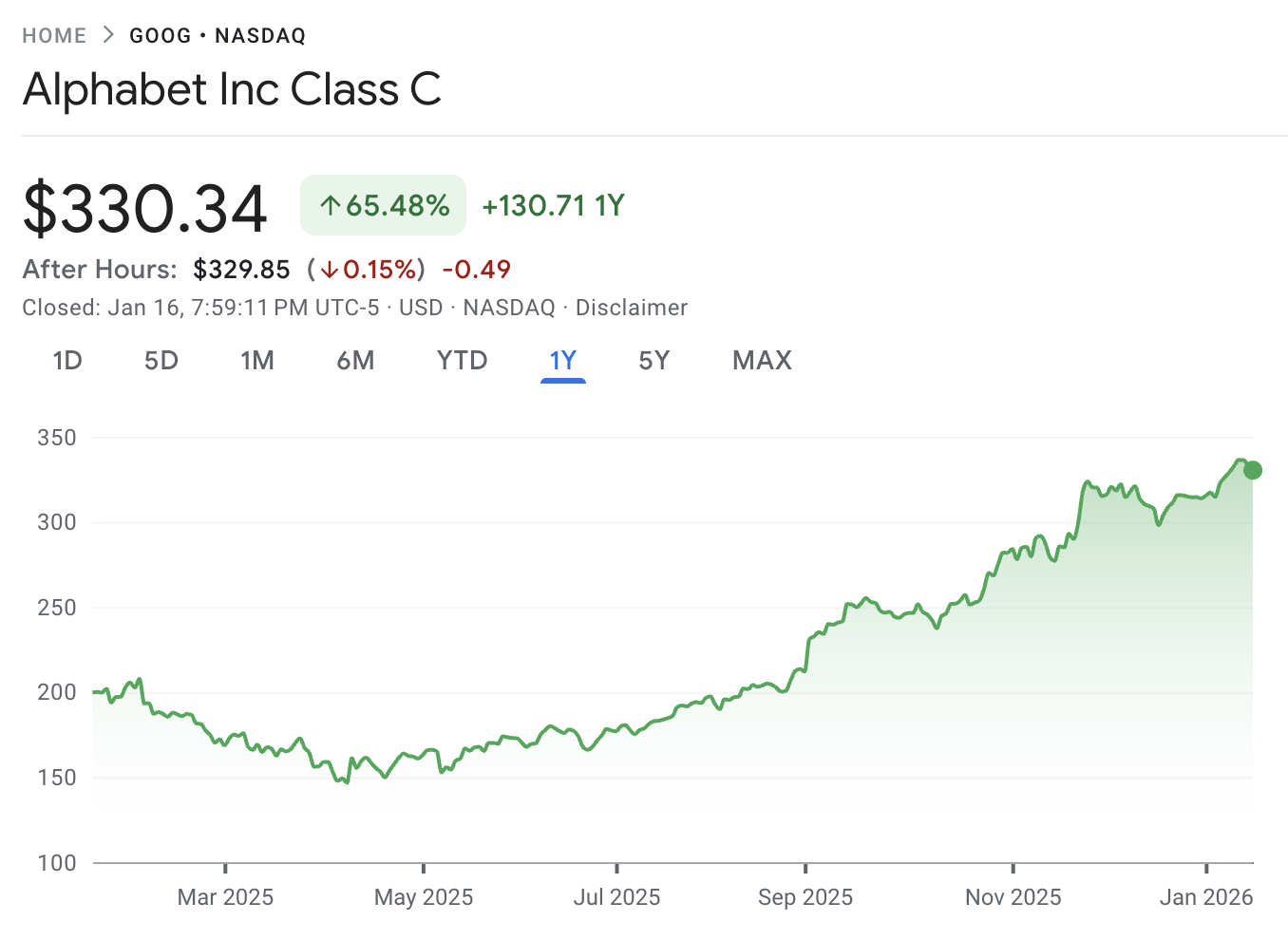

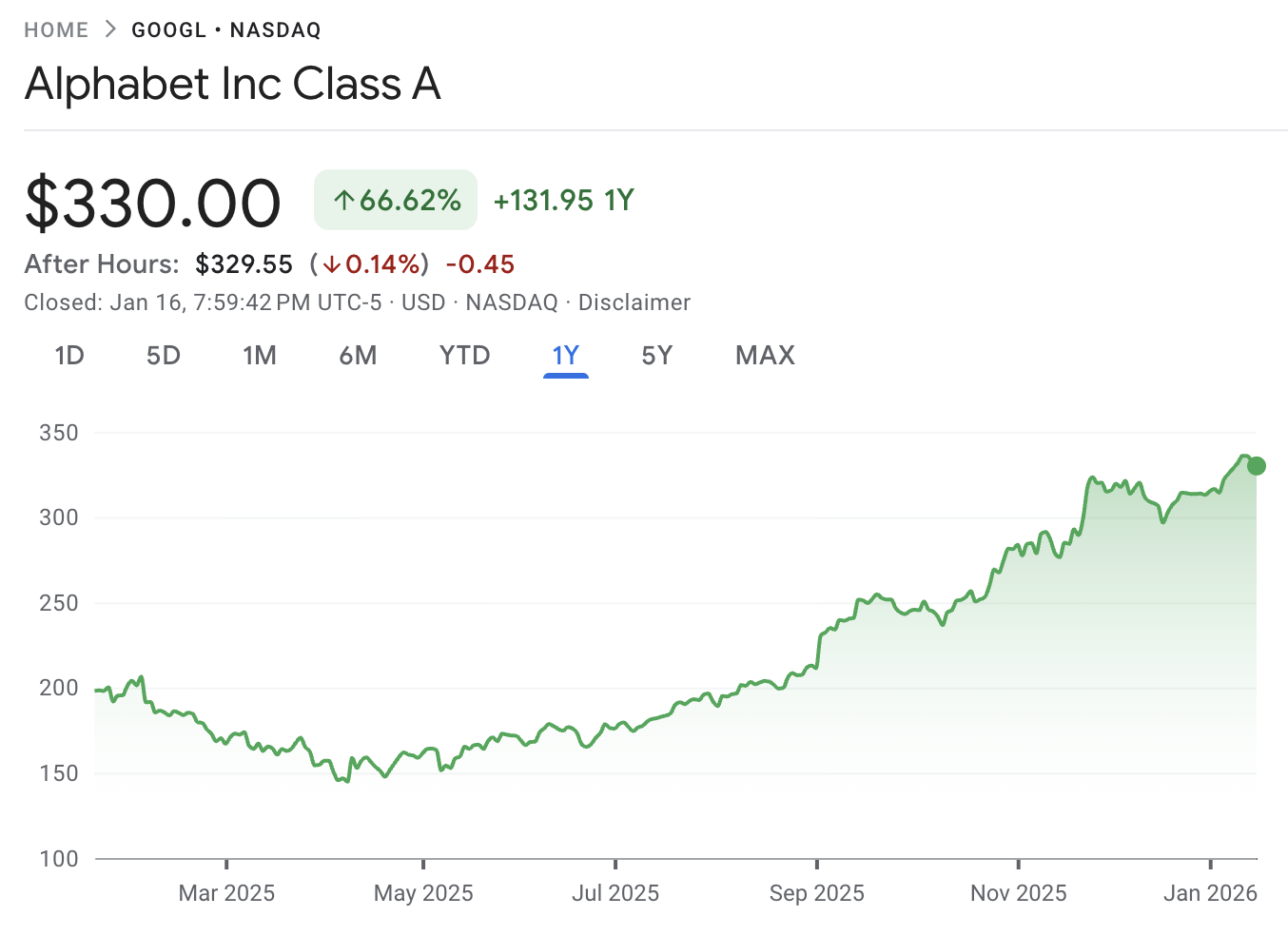

Price Differences Between Alphabet Class A and Class C

Historically, the price gap between Class A and Class C shares has been small and inconsistent. At times, Class C shares trade at a slightly lower price, reflecting the absence of voting rights.

At other moments, they trade higher due to stronger demand from index funds and ETFs that prioritize liquidity over governance.

For most retail investors, this price differential has minimal long-term impact. Total returns over extended holding periods have been nearly identical, reinforcing the idea that Alphabet Class A vs Class C is a structural choice rather than a performance-driven one.

For most retail investors, this price differential has minimal long-term impact. Total returns over extended holding periods have been nearly identical, reinforcing the idea that Alphabet Class A vs Class C is a structural choice rather than a performance-driven one.

Alphabet Class B Shares: The Control Layer

Alphabet Class B shares sit at the core of the company’s governance structure but are not available to public investors. These shares are primarily held by founders and early insiders and carry 10 votes per share, granting decisive control over corporate decisions at Alphabet Inc.

Class B shares ensure long-term strategic stability by insulating management from short-term market pressures and activist influence. For public investors, their relevance is indirect but important. The existence of Class B explains why Class A voting rights remain limited in practice and why Class C shares can exist without altering Alphabet’s control dynamics.

Governance Impact in Practical Terms

Does Voting Power Really Matter

For most retail and institutional investors, Alphabet’s governance outcomes are effectively predetermined. Insider ownership ensures strategic continuity regardless of Class A shareholder votes. As a result, voting rights rarely translate into tangible influence over executive compensation, board composition, or capital allocation.

This reality explains why Class C shares often trade at a negligible discount or premium relative to Class A, depending on market conditions. Investors are pricing cash flow dominance, not control.

Institutional Portfolio Considerations

Some long-only funds, pension managers, and ESG-focused portfolios will favor Class A shares due to governance alignment and proxy voting policies. Others explicitly avoid voting shares where influence is symbolic rather than substantive.

Class C shares dominate in index-tracking strategies, options markets, and tactical allocations where liquidity and simplicity outweigh governance considerations.

Tax, Dividends, and Capital Returns

From a taxation and income perspective, Alphabet Class A and Class C shares are identical. Alphabet does not currently pay a dividend; it prioritizes share buybacks and reinvestment. Any future dividends would be distributed equally across both classes.

Share repurchases affect both classes proportionally, preserving economic parity while gradually reducing public float.

Which To Choose: GOOGL or GOOG?

| Investment Consideration |

Alphabet Class A (GOOGL) |

Alphabet Class C (GOOG) |

| Voting rights |

Provides one vote per share |

No voting rights |

| Governance participation |

Suitable for investors who value formal governance involvement |

Not designed for governance participation |

| Portfolio philosophy |

Aligns with mandates that prioritize shareholder voting |

Aligns with return-focused, governance-neutral strategies |

| Liquidity and trading |

Highly liquid |

Typically slightly more liquid |

| Institutional preference |

Favored by funds with proxy-voting requirements |

Favored by passive, index, and tactical investors |

| Earnings exposure |

Full exposure to Alphabet’s earnings growth |

Identical exposure to Alphabet’s earnings growth |

| Best suited for |

Long-term holders who assign value to voting rights |

Investors seeking efficient, pure price exposure |

| Overall practicality |

Governance-oriented choice |

More efficient and practical choice for most investors |

Frequently Asked Questions (FAQ)

1. What is the main difference between Alphabet Class A and Class C shares?

The defining difference is in voting power. Class A shares carry one vote per share, while Class C shares carry no votes. Both represent identical economic ownership, with equal exposure to earnings, capital appreciation, and long-term shareholder returns.

2. Is Alphabet Class A or Class C better for long-term investing?

Neither share class has a structural return advantage over long horizons. Performance has historically tracked closely. The decision depends on whether an investor assigns value to voting rights or prefers a simpler, governance-neutral exposure to Alphabet’s growth.

3. Why did Alphabet introduce non-voting Class C shares?

Class C shares allow Alphabet to issue equity for acquisitions, employee compensation, and index inclusion without diluting insider voting control. This structure supports long-term strategic decision-making while maintaining broad access to public capital markets.

4. How many share classes does Google have?

Alphabet Inc. has three share classes. Class A (GOOGL) is publicly traded with voting rights, Class B is non-public with 10× voting power held by insiders, and Class C (GOOG) is publicly traded without voting rights.

5. Can Alphabet Class C shares ever gain voting rights?

No. Class C shares are permanently structured as non-voting under Alphabet’s corporate framework. They cannot be converted into voting shares through normal corporate actions or shareholder decisions.

6. When did Alphabet split its stock, and did it affect Class A and Class C shares?

Alphabet completed a 20-for-1 stock split in July 2022. The split applied equally to Class A and Class C shares, preserving their economic value and relative pricing while making the stock more accessible to a broader range of investors.

7. Where can I trade GOOGL Class A?

GOOGL Class A shares can be traded through global brokerage platforms offering access to U.S. equities. EBC Financial Group provides market access, professional execution, and research support for investors seeking exposure to Alphabet shares efficiently and securely.

Summary

The difference between Alphabet Class A and Class C shares has nothing to do with the company’s growth rate or the strength of its business. It comes down to whether an investor wants voting rights or simply wants exposure to the stock’s price performance. Both share classes represent the same ownership in Alphabet’s core businesses, including search, advertising, cloud services, and artificial intelligence.

Investors who place value on holding voting shares, even with very limited practical influence, may prefer Class A. Those focused solely on share price performance and trading flexibility often choose Class C. In both cases, returns are driven by Alphabet’s business execution and long-term growth, not by the share class itself.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The chart above shows options open interest for Alphabet Class C shares concentrated around a narrow range of strike prices near the current market level. Call open interest dominates, especially around the $335 strike, suggesting traders are positioning for upside or defending nearby resistance, with comparatively lighter downside hedging.

The chart above shows options open interest for Alphabet Class C shares concentrated around a narrow range of strike prices near the current market level. Call open interest dominates, especially around the $335 strike, suggesting traders are positioning for upside or defending nearby resistance, with comparatively lighter downside hedging.

For most retail investors, this price differential has minimal long-term impact. Total returns over extended holding periods have been nearly identical, reinforcing the idea that Alphabet Class A vs Class C is a structural choice rather than a performance-driven one.

For most retail investors, this price differential has minimal long-term impact. Total returns over extended holding periods have been nearly identical, reinforcing the idea that Alphabet Class A vs Class C is a structural choice rather than a performance-driven one.