Investing in growth-focused exchange-traded funds (ETFs) has gained popularity as traders seek exposure to innovative companies poised to outperform the broader market over time. One standout option is the Vanguard Growth ETF (VUG).

This fund offers access to a diversified portfolio of large-cap U.S. growth stocks and is designed for investors looking for long-term capital appreciation.

In this guide, we'll explore what makes VUG a strong contender for long-term investment and how it fits within a modern, forward-looking portfolio.

What Is the VUG ETF?

The Vanguard Growth ETF (VUG) is an exchange-traded fund that tracks the CRSP US Large Cap Growth Index. It includes companies that exhibit strong earnings growth, high price-to-book ratios, and robust revenue expansion. The fund was launched in 2004 and is managed by Vanguard, a name known for low-cost, index-based investment solutions.

VUG currently holds over 200 companies, many of which are household names across the tech, consumer discretionary, and healthcare sectors. As of mid-2025, VUG has accumulated more than $130 billion in assets under management (AUM) and maintains a low expense ratio of just 0.04%, making it a cost-effective vehicle for long-term investors.

Moreover, VUG targets large-cap growth stocks—businesses with above-average growth potential. The fund's top holdings often include companies like Apple, Microsoft, NVIDIA, Amazon, and Alphabet (Google).

Performance Overview of VUG

Historically, growth stocks have outperformed value stocks during periods of low interest rates and strong economic expansion. Over the past 10 years, VUG has delivered an average annual return of around 13–15%, significantly outpacing the broader S&P 500 during cycles.

In 2023 and 2024, VUG bounced back sharply following a period of underperformance in 2022 when inflation and rising interest rates caused a broad sell-off in growth stocks. With the Federal Reserve pausing rate hikes and AI-driven companies surging, VUG has continued to perform well into 2025.

7 Reasons to Invest in VUG ETF

1) Exposure to Industry Leaders and Innovators

One of the main reasons to invest in VUG is its exposure to market leaders in innovation. These companies often set the pace for technological progress and digital transformation.

For example, NVIDIA's dominance in AI chips, Tesla's disruption in electric vehicles, and Amazon's hold on e-commerce give VUG's portfolio an edge in growth potential.

Investors indirectly gain access to these high-performing companies, many of which would be too expensive or risky to own individually. It provides both convenience and diversification.

2) Low Expense Ratio

Cost is a key factor in long-term investing. VUG's ultra-low expense ratio of 0.04% means that more of your money stays invested and compounds over time. Compared to actively managed funds or even many other ETFs, this cost efficiency is a significant advantage.

When compounding over 20–30 years, even small differences in expense ratios can lead to thousands of dollars in extra returns. It makes VUG a strong option for retirement and tax-advantaged accounts like IRAs.

3) Diversified Growth Exposure

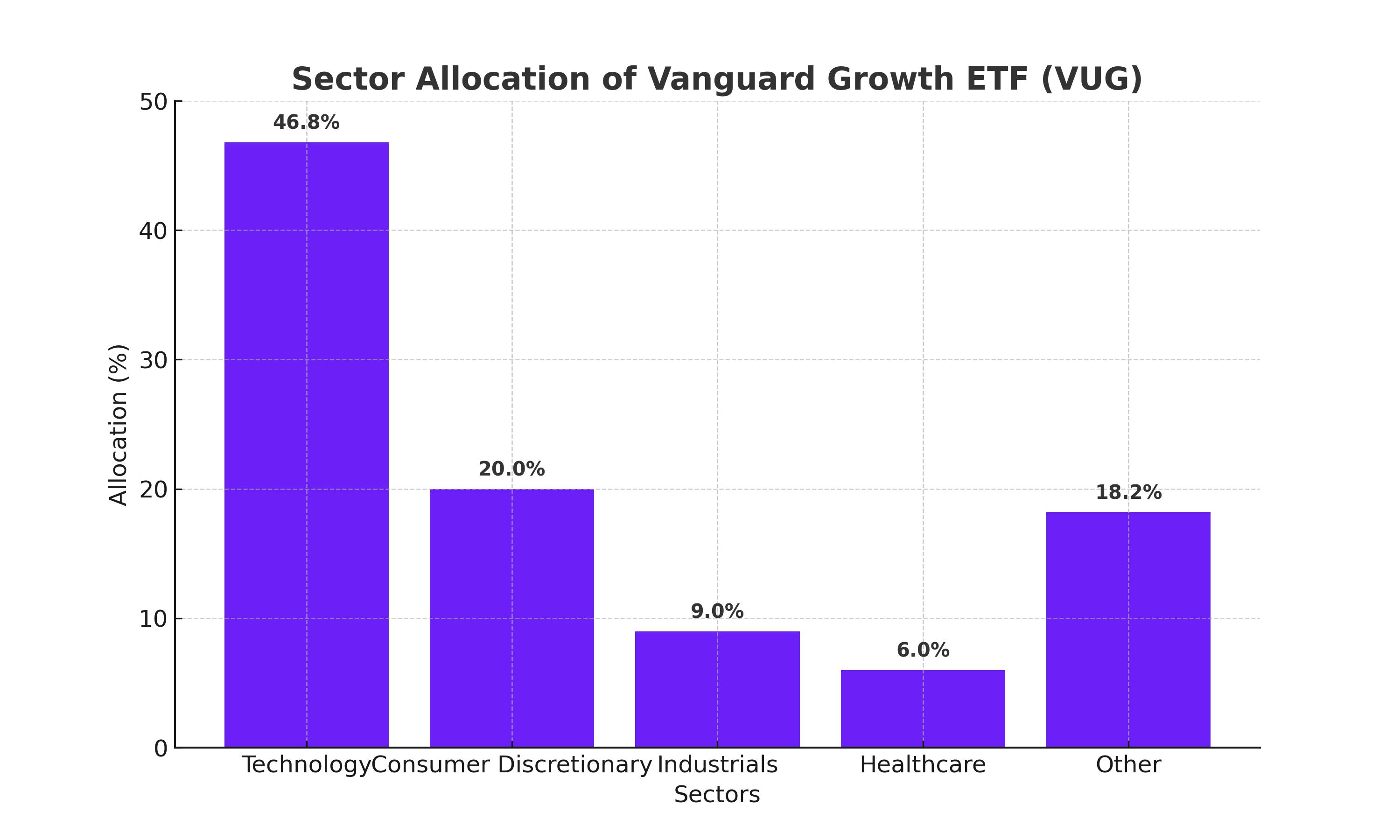

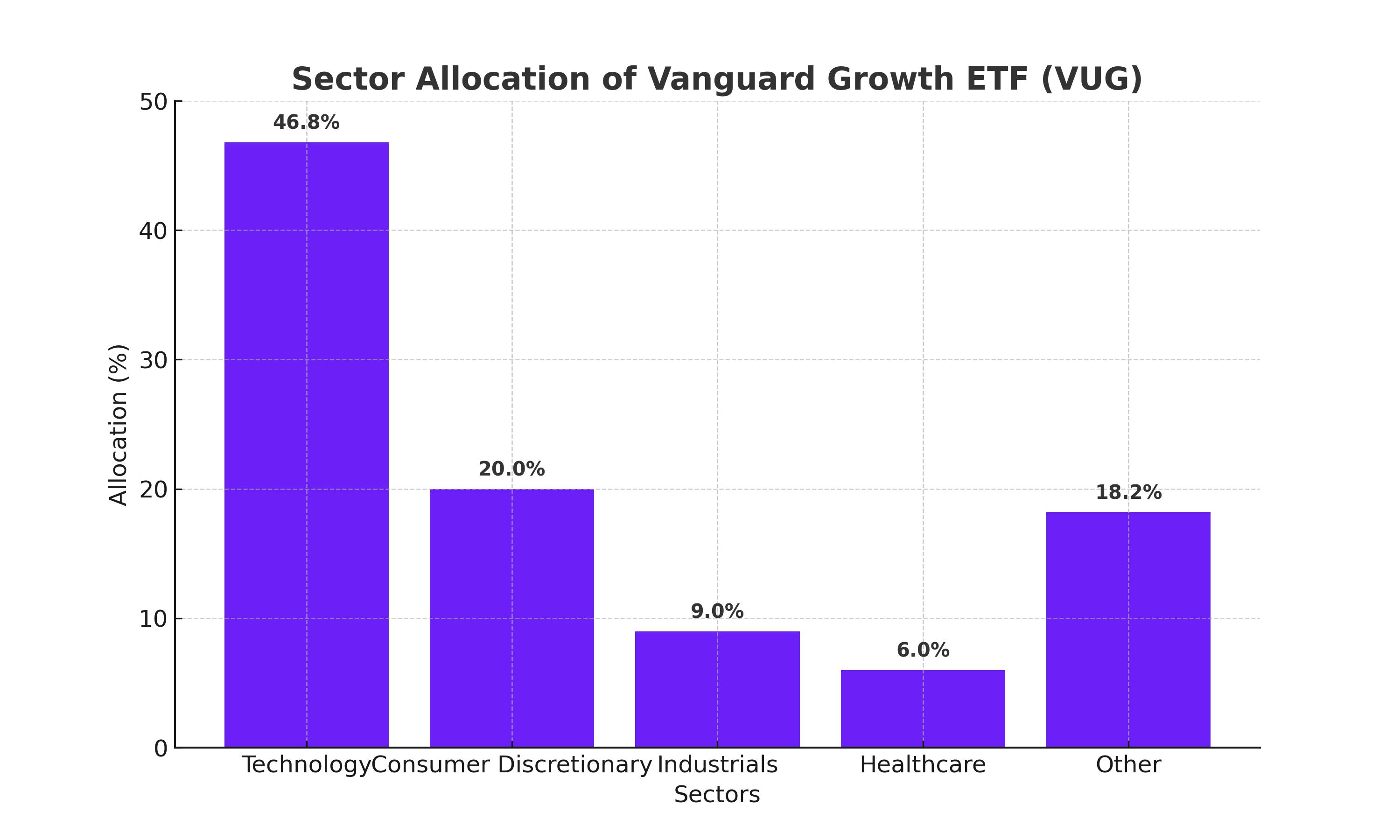

Although VUG is growth-focused, it still offers broad diversification across multiple sectors and industries. Technology makes up a massive portion, but healthcare, consumer discretionary, communication services, and industrials are also represented.

This diversification helps manage risk by avoiding over-concentration in a single company or sector. If tech stocks correct, gains in healthcare or consumer services may provide a buffer.

4) Strong Historical Resilience

Even during market downturns, VUG has shown impressive resilience. While it's true that growth stocks can suffer during rate hikes or recessions, VUG has typically rebounded stronger than the market during recoveries.

For example, in the post-COVID bull run and the AI boom of 2023–2025, VUG surged alongside companies involved in automation, cloud computing, and digital transformation.

5) Backed by Vanguard's Reputation

Vanguard is one of the most trusted names in investing, known for its investor-first philosophy, low-cost approach, and transparent fund management. With VUG, investors benefit from the same rigorous indexing strategy and strong governance that underpin all Vanguard ETFs.

The brand alone is a vote of confidence for many long-term investors, particularly those focused on retirement planning or wealth preservation.

6) Ideal for Passive, Buy-and-Hold Investors

VUG is a perfect example of a "set it and forget it" investment. Its low fees, high-quality holdings, and long-term growth potential make it an attractive option for passive investors who want to stay the course through market volatility.

Rather than trying to time the market or pick individual stocks, holding VUG provides consistent exposure to high-growth opportunities with minimal intervention.

In addition, its large-cap orientation makes it more stable than small-cap growth funds, while its focus on innovation drives higher returns over time.

VUG also works well in core-satellite strategies—it can serve as the "core" holding while smaller, more speculative assets form the "satellite" component.

7) Easy to Access and Trade

VUG is listed on the NYSE Arca, making it available through nearly all brokerage platforms. One reputable provider is EBC Financial Group, which offers VUG as part of its CFD ETF trading product lineup.

Through EBC's platform, traders can go long or short VUG with leverage and access charting tools, analytics, and risk management features tailored for ETF traders.

It also has strong liquidity, meaning tight bid-ask spreads and minimal slippage. This accessibility and transparency make it a practical solution for beginners and experienced investors alike.

Comparison with Competitor Growth ETFs

| ETF |

Index Tracked |

AUM (2025) |

Expense Ratio |

Top Sectors |

| VUG |

CRSP US Large Cap Growth |

$130B+ |

0.04% |

Tech, Consumer, Healthcare |

| QQQ |

Nasdaq-100 |

$230B+ |

0.20% |

Tech-heavy (Apple, Nvidia) |

| SCHG |

Dow Jones U.S. Large Cap Growth |

$20B+ |

0.04% |

Tech, Financials |

| IWF |

Russell 1000 Growth |

$90B+ |

0.19% |

Tech, Health, Comms |

VUG vs QQQ (Invesco Nasdaq-100): QQQ includes non-U.S. and non-tech names like Tesla or Moderna; VUG remains purely U.S. large-cap growth.

VUG vs IWF (iShares Russell 1000 Growth): IWF tracks a broader index but charges about 5x VUG's fee.

Thematic ETFs: Focused themes (robotics, fintech) have momentum but lack VUG's scale and diversity.

Experts call VUG "best-in-class" for cost, accessibility, and strategic positioning.

Best Ways to Use VUG in Your Portfolio

VUG can be used in a variety of portfolio strategies:

As a core holding for growth-oriented investors looking for long-term capital appreciation.

In tax-advantaged accounts (IRA, Roth IRA), to maximise tax efficiency.

For young investors who are building wealth over decades with a higher risk tolerance.

Paired with value ETFs to balance styles and cycles (e.g., pairing with VTV for diversification).

Dollar-cost averaging into VUG over time can also help reduce the impact of short-term volatility and improve entry prices.

Conclusion

In conclusion, if your investment goal is long-term growth, exposure to market-leading innovators, and low-cost portfolio construction, then VUG is a compelling choice. It brings together quality, performance, and cost efficiency in one well-diversified fund.

While it may experience short-term volatility, history has shown that patient investors are often rewarded with strong compounding returns.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.