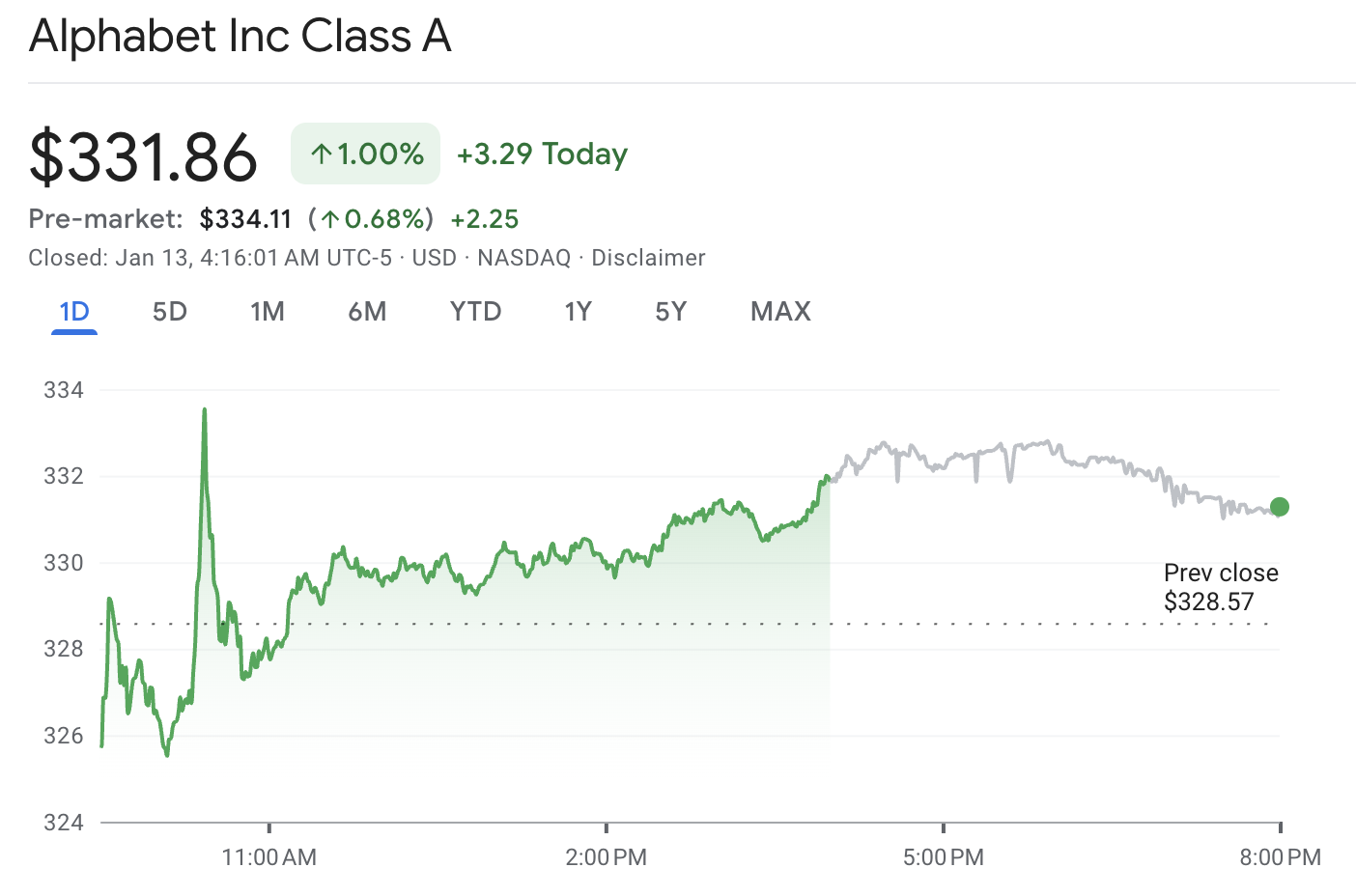

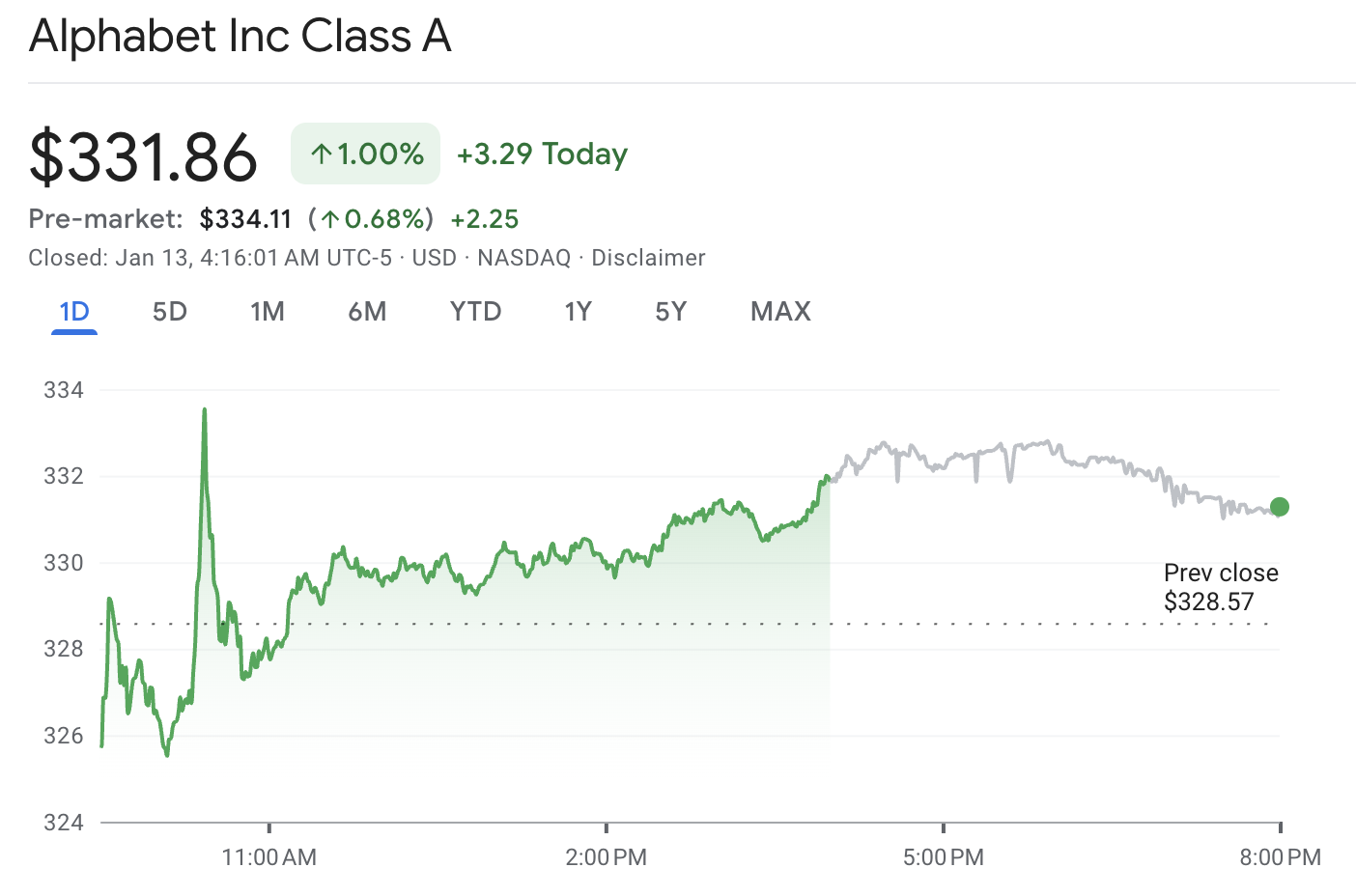

On Monday, January 12, 2026, Google stock closed at a new record high of $331.86, elevating the company's market capitalization to over $4 trillion in several prominent market assessments.

The agreement spanned several years, allowing Apple to develop its upcoming AI generation models on Google's Gemini, which is anticipated to bring significant upgrades for Siri and additional AI functionalities at Apple.

Simply put, the market is saying Alphabet is not losing the AI race. Alphabet is selling the picks and shovels, and it is also keeping the biggest shopfront in the world, which is Google Search.

What Happened to Google Stock and Alphabet?

| Item |

Value |

Why it matters |

| Record close |

$331.86 |

Confirms buyers held the gain into the close. |

| Intraday high |

$334.04 |

Shows where sellers first showed up. |

| Intraday low |

$325.00 |

Maps the day’s "line in the sand" for dip buyers. |

| Daily volume |

~33.8M shares |

High volume makes the move harder to dismiss as noise. |

| Market value milestone |

$4T+ |

Puts Alphabet in a rare club with Nvidia, Microsoft, and Apple. |

For context, Alphabet's stock rose about 65% in 2025, which means the market was already in an uptrend before this week's catalyst arrived.

Why Did Google Stock Hit a Record Close? 5 Key Drivers

1) The Apple–Gemini Deal Changed the AI Distribution Map

Apple's choice of Gemini is a distribution win on a scale that few AI companies can match.

For context, Alphabet confirmed a multi-year deal where Apple's next-generation AI models will be based on Google's Gemini. The partnership helped cement Alphabet's position in the AI arms race.

Furthermore, the deal is tied to a major Siri overhaul, and the financial terms were not disclosed.

Why traders cared immediately: The market loves distribution because it reduces customer acquisition risk. A strong model is useful. A strong model that ships on hundreds of millions of devices is a different story.

2) Gemini Is No Longer Catching Up, It Is Setting the Pace

The Gemini 3 model drew strong reviews, intensifying pressure on rivals, especially after a competing flagship release received a more lukewarm reception.

That strong early feedback helped lift Alphabet's shares as investors grew more confident in Google's AI positioning.

Why this matters for Alphabet's core business: If AI answers become the main way people search, Alphabet needs to be the company that controls the interface, the model, and the ad format. Strong model perception reduces the fear that search is about to be "disintermediated."

3) Google Cloud Is Turning Into a Second Profit Engine

Alphabet's cloud business has moved from "nice to have" to "must watch."

For example, Google Cloud revenue rose 34% in Q3 2025, and it highlighted $155 billion in backlogged contracts (non-recognised sales contracts).

This is significant because cloud agreements often have a lasting impact, and AI tasks can rapidly increase customer expenditure once systems are operational.

A key angle traders sometimes miss: Cloud growth also protects the ad business. When demand for ads decreases, cloud services can maintain more stable revenue growth, typically bolstering valuation multiples.

4) Alphabet Is Monetising AI Infrastructure, Not Just Chat

One of the most underappreciated parts of the story is hardware. For instance, Google has been renting out its self-developed AI chips to outside customers, which has supported cloud growth.

Additionally, Meta was in talks to spend billions on Alphabet's chips for data centres starting in 2027.

Why infrastructure matters: It creates a "tool supplier" business model. Tool suppliers can earn money even when the app layer is fiercely competitive.

5) The Legal Cloud Eased, Even if It Has Not Disappeared

Regulation and antitrust have been a persistent discount factor for Alphabet.

Google stock rose following a September decision by a US judge, who ruled against dismantling the company, enabling it to keep control of Chrome and Android.

It was a "moderate" result from a significant case that investors viewed as less harmful than anticipated, which contributed to a strong surge in the stock prices.

Despite that, Alphabet still faces another major antitrust fight tied to the online ad market, where remedies could include forcing divestments.

The market's message: A lower risk of break-up can raise the valuation ceiling, despite ongoing cases still posing headline risks.

What Alphabet $4 Trillion Market Cap Signals About Expectations?

Crossing $4 trillion is impressive, but it also sets higher expectations for future results.

When a company reaches this size, the market is usually pricing three things at once:

Durable cash generation from ads (Search and YouTube).

A second growth engine in the cloud that can scale.

A credible AI roadmap that protects the moat and creates new revenue streams.

The biggest risk is that investor enthusiasm could reverse if the market decides the AI spending surge is turning into a bubble.

3 Key Risks That Could Derail Google Stock Rally

Risk 1: The "AI Bubble" Fear Returns

Even Alphabet's CEO has acknowledged the possibility of market "irrationality" in AI pricing.

If rate expectations rise or risk appetite drops, mega-cap AI leaders can still sell off sharply.

Risk 2: Rising Costs Eat the AI Upside

AI products can rapidly increase usage, but they can also quickly escalate computing expenses.

Investors will monitor whether Alphabet can enhance its AI capabilities while sustaining robust margins.

Risk 3: Ads Stay Resilient Until They Do Not

Alphabet's advertising business has largely held steady despite economic uncertainty and competition.

Ad cycles can turn quickly, and search ads remain the biggest profit pool that funds everything else.

What Should Traders and Investors Monitor Next?

1) Alphabet's Next Earnings Date

Alphabet's investor relations website indicates that it will announce its Q4 and full-year 2025 results on February 4, 2026, with the earnings call scheduled for 1:30 p.m.

What Will Matter Most in That Report:

Google Cloud growth and AI backlog conversion.

Any early monetisation signals from Gemini are featured inside Search and Workspace.

Capital spending guidance.

2) Clarity on How Apple Will Ship Gemini Features

The market will want details on what runs on-device, what runs in the cloud, and how the economics work.

Even without published dollar figures, investors will look for hints on usage, integration depth, and whether this expands Alphabet's reach beyond Android.

3) Antitrust Headlines Swinging the Stock

The break-up threat may have faded, but the ad market case and remedy discussions remain a real risk.

Headline shocks in this sector can quickly influence the stock, even when the fundamentals appear strong.

Frequently Asked Questions (FAQ)

1) Why Did Google Stock Hit a Record Close?

Alphabet shares hit a record close after Apple confirmed a multi-year plan to base its next AI models on Google's Gemini, which investors read as a major AI distribution win.

2) Did Alphabet Top $4 Trillion in Market Value?

Alphabet crossed $4 trillion on 12 January 2026, placing it in a rare group alongside Nvidia, Microsoft, and Apple.

3) When Is Alphabet's Upcoming Earnings Report?

Alphabet said it will report its fourth-quarter and full-year 2025 results on 4 February 2026, followed by an earnings call at 1:30 p.m. PT.

Conclusion

In conclusion, Google's record close of $331.86 on January 12 reflected a straightforward shift in investor sentiment. The market now sees Alphabet as a leader in AI distribution and infrastructure, not just a defender of legacy search.

The Apple–Gemini partnership offered investors a clear, headline-driven catalyst, while improving cloud momentum and fading break-up concerns provided additional support for the rally.

The upcoming key event is Alphabet's earnings report on February 4, 2026, where the company's perspective on cloud expansion, AI investments, and revenue generation will probably influence whether the momentum continues or slows down.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.