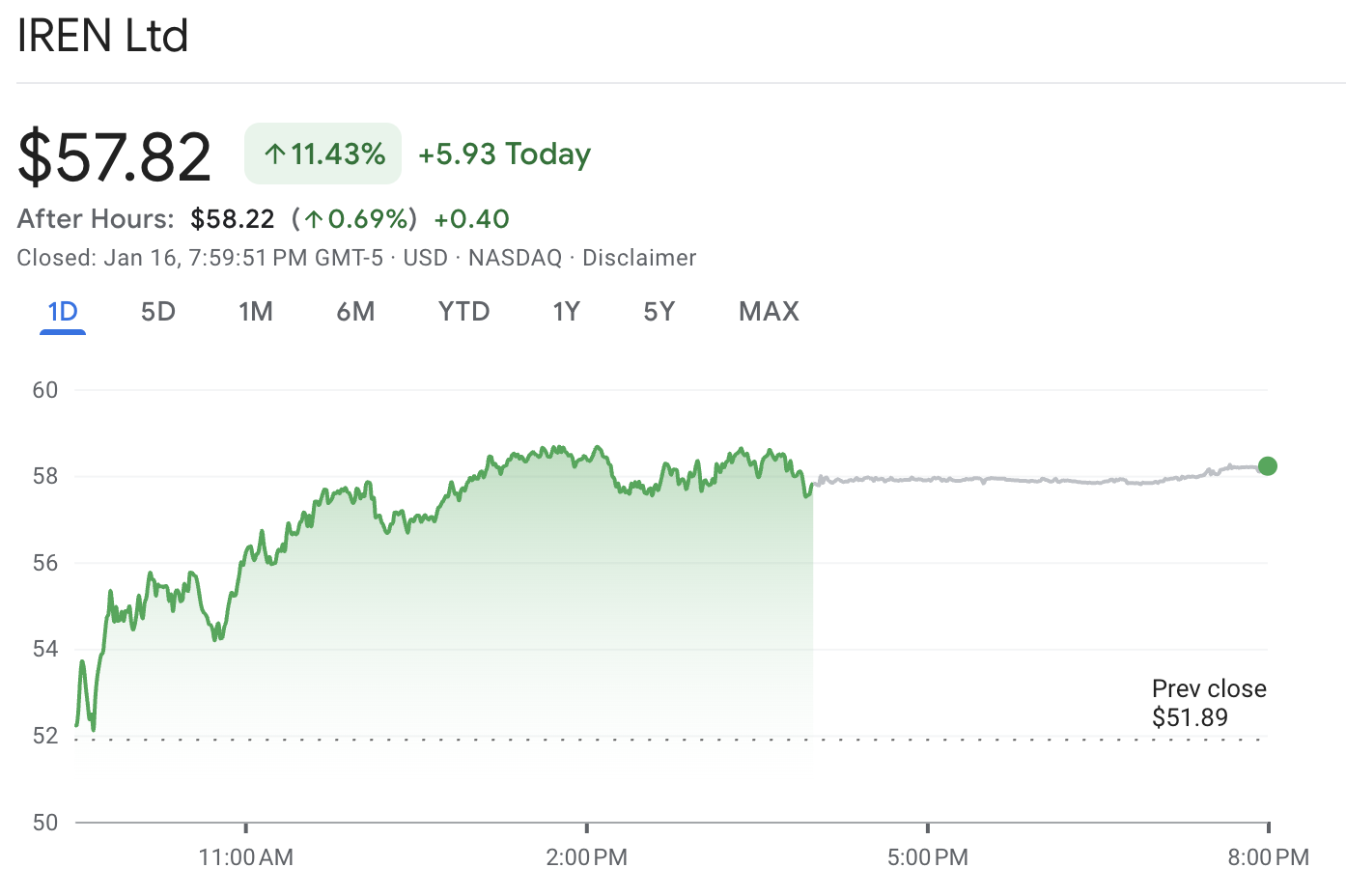

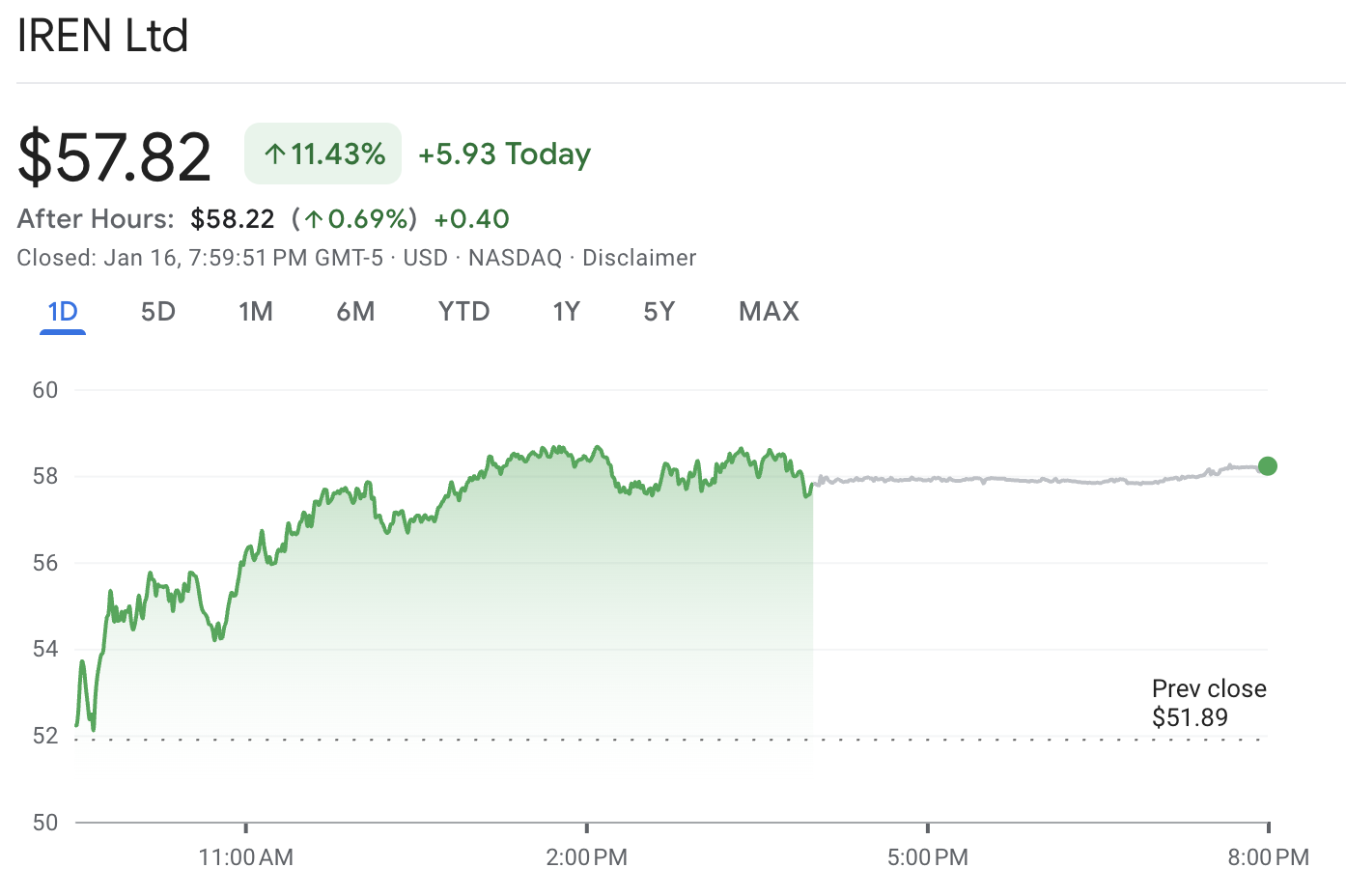

IREN stock delivered one of the most eye-catching moves on the Nasdaq last week. The stock closed at $57.82 on Friday, January 16, 2026, up from $46.03 on Friday, January 9, 2026, a gain of about 25.6% in five trading sessions.

This was not a quiet grind higher. The move came with very heavy trading volume, including more than 53 million shares traded on both January 12 and January 16, which is the kind of activity that tends to pull in momentum traders and short-term funds.

The catalysts include analyst upgrades that occurred at an opportune time, and investors shifted back towards the "AI infrastructure" theme. IREN is increasingly viewed as not just a Bitcoin miner, but also a data center and AI compute story.

What Happened to IREN Stock Last Week?

| Date (2026) |

Close ($) |

Daily change |

Volume |

| Jan 09 |

46.03 |

— |

30.33M |

| Jan 12 |

50.33 |

+9.34% |

53.23M |

| Jan 13 |

52.99 |

+5.29% |

42.18M |

| Jan 14 |

52.88 |

-0.21% |

38.74M |

| Jan 15 |

51.89 |

-1.87% |

38.23M |

| Jan 16 |

57.82 |

+11.43% |

53.97M |

The week was defined by two strong up-days, with a mid-week pause, and then a sharp push into Friday's close.

The key detail is participation. When volume expands while price rises, it often signals that the move is not just a small group of traders, but a broader bid across the market.

Why Did IREN Stock Surge Last Week? 4 Key Factors

1) Analyst Upgrades Flipped the Near-Term Narrative

The recent movement was sparked by more supportive Wall Street commentary within a short timeframe.

Bernstein commentary published on January 6, 2026, referenced IREN as the firm's top AI pick in its 2026 outlook coverage.

H.C. Wainwright upgraded IREN to a Buy rating and set an $80 target, highlighting 2026 as a pivotal year for the company's AI infrastructure development.

In the market, upgrades matter most when a stock is already "in play," because they provide a clean headline that traders can act on quickly.

2) The Microsoft Contract Is Still the Foundation of the Bull Case

IREN's agreement with Microsoft is the main structural factor that allows the stock to react so strongly to positive news.

According to IREN's SEC filing, this agreement is valued at approximately $9.7 billion through 2031. It covers an average term of five years and consists of a 20% prepayment for every tranche, which will be applied later during the service period. The deployments are planned across four "Horizon" facilities at Childress, Texas, totaling about 200MW of IT load.

The same broad structure tied the company to the wider "capacity crunch" in advanced AI compute, which is vital because it explains why hyperscalers are willing to sign large, long-dated contracts.

IREN also stated that the Microsoft agreement is expected to contribute roughly $1.94 billion in annualized run-rate revenue once fully commissioned.

3) Investors Are Re-Pricing IREN as AI Infrastructure, Not Just a Crypto Name

IREN still has meaningful exposure to bitcoin mining, but its own investor messaging has increasingly emphasized its AI cloud platform and its power portfolio.

In its Q1 FY26 results release, IREN described itself as a leading AI Cloud Service Provider, supported by grid-connected land and data centers in renewable-rich regions in the U.S. and Canada.

That same release also emphasizes the power capacity IREN has and its ongoing expansion. For example, it cited a target for Sweetwater 1 substation energization in April 2026 and discussed continued build-out plans.

When investors adopt that viewpoint, they frequently start to assess the stock not as a miner would but as if it were a form of infrastructure capacity. That valuation shift is one reason the stock can gap and run.

4) Momentum and Positioning Did the Rest

Once the stock started moving, the tape began to matter as much as the headlines.

The week included a significant rise above the low-$50s area, culminating in a powerful breakout on Friday.

Technical dashboards indicate high volatility through the ATR and present a Strong Buy technical summary, supporting the idea that trend-following flows contributed to the move.

This is also why the rally looked "fast." Momentum trading compresses time.

IREN Fundamental Snapshot: What the Latest Reported Numbers Show

IREN's most recent published quarter (Q1 FY26) showed a business still dominated by bitcoin mining revenue, with AI cloud revenue present but smaller at that point:

| Q1 FY26 (quarter ended Sep 30, 2025) |

Amount (US$ m) |

| Bitcoin mining revenue |

232.9 |

| AI cloud services revenue |

7.3 |

| Total revenue |

240.3 |

| Adjusted EBITDA |

91.7 |

IREN also reported net income of $384.6 million for that quarter. However, the release shows that results included large non-operating items such as unrealized gains on financial instruments, so traders should read beyond the headline profit figure.

IREN Stock Technical Analysis

| Indicator |

Value |

Signal |

| RSI (14) |

67.796 |

Buy |

| MACD (12,26) |

2.146 |

Buy |

| ADX (14) |

39.316 |

Buy |

| Stoch (9,6) |

85.736 |

Overbought |

| Stoch RSI (14) |

83.165 |

Overbought |

| Williams %R |

-11.311 |

Overbought |

| CCI (14) |

109.8226 |

Buy |

| ATR (14) |

1.7526 |

High volatility |

Daily technical summary shows "Strong Buy", with momentum indicators leaning bullish and several readings flashing "overbought."

| Level |

Price |

| Support 1 (S1) |

57.451 |

| Pivot |

58.070 |

| Resistance 1 (R1) |

58.739 |

| Resistance 2 (R2) |

59.358 |

| Resistance 3 (R3) |

60.027 |

In short, the trend is strong, but the week's run has pushed several oscillators into overbought territory. That can lead to sharp pullbacks even if the broader uptrend stays intact.

What Traders Should Monitor Next?

Execution risk on AI deployments

Build-out milestones

Funding and capex

Volatility signals

Bitcoin price and mining economics

Frequently Asked Questions

1. Why Did IREN Stock Jump More Than 24% Last Week?

The stock increased by approximately 25.6% from January 9 to January 16, 2026, supported by positive analyst coverage and renewed focus on IREN's AI Cloud growth strategy and its partnership with Microsoft.

2. Is IREN Stock Still a Bitcoin Mining Stock?

IREN still reports meaningful bitcoin mining revenue, but it is increasingly positioning itself as an AI cloud provider supported by a large power and data center footprint.

3. Is IREN Stock Overbought Right Now?

Some oscillators are in overbought territory, and RSI is near 68. That does not guarantee a drop, but it does suggest the stock is extended and can correct quickly.

4. What Levels Matter Most Now?

Pivot levels around 58.07 and nearby support near 57.45 are key short-term reference points, while the 20-day and 50-day moving averages sit lower near 54.25 and 50.94.

Conclusion

In conclusion, IREN's stock experienced a weekly increase of over 24%, which was not just a random spike. This significant rise was a clear shift in sentiment, driven by stronger support from analysts and a market that is increasingly focused on AI compute capacity, contract visibility, and scaling operations.

The next phase is easier to describe than to navigate in trading: the stock must now demonstrate that it can maintain these gains, while the company delivers on its timelines, funding plans, and ambitious GPU roadmap.

Traders should anticipate continued volatility, as momentum-driven weeks like this often lead to sharp pullbacks along the way.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.