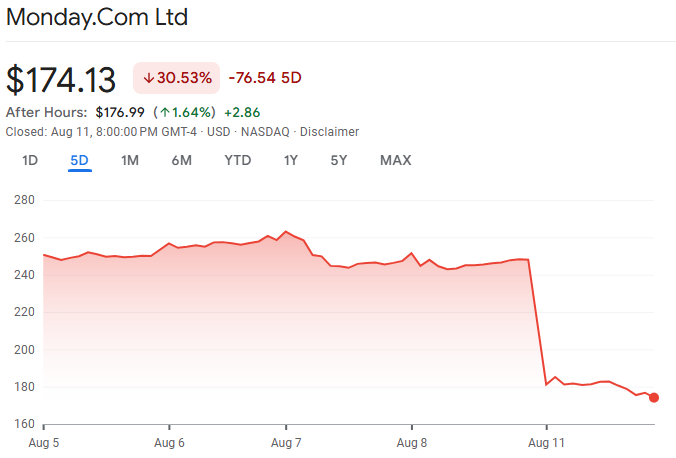

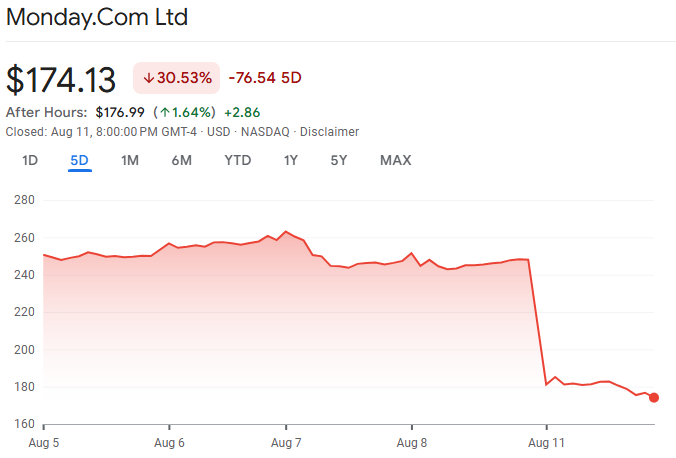

Monday.com (NASDAQ: MNDY) delivered impressive Q2 2025 results. Revenue rose 27% year-on-year to $299 million and adjusted EPS hit $1.09, both beating analyst forecasts. Yet, the share price dropped over 20% after the announcement, reaching a low near $174 as investors reacted swiftly to signs of a slowdown ahead. Why did the market punish Monday.com despite these strong figures? The answer lies in the company's conservative outlook for growth and operating margins in the coming quarters.

Q2 2025 Highlights: Revenue and Profit Beat Expectations

Monday.com reported a strong quarter, with revenue growing from $235 million in Q2 2024 to $299 million in Q2 2025, a 27% jump. Adjusted earnings per share came in at $1.09, well ahead of analyst expectations for $0.86. Non-GAAP operating income was $45.1 million, also a healthy increase, while free cash flow reached $66.8 million. Customer momentum continued with the number of clients spending over $100,000 annually surging 46% year-on-year to 1,472, reflecting broad adoption among enterprise users.

Market Reaction: Why Did the Stock Drop So Hard?

Despite beating quarterly forecasts, Monday.com's stock dropped from above $220 to as low as $174, wiping out over a fifth of its market value in a single day. Most of the damage came after the Q2 earnings call on August 11. The trigger? Investors focused on management's cautious guidance and signs of a slowdown in growth and margin expansion.

Key points behind the sell-off:

-

Q3 Guidance Missed Excitement: Projected Q3 2025 revenue of $311–$313 million was only marginally above consensus ($312.94 million) and showed no acceleration. Non-GAAP operating margin guidance dropped to 11–12%, down from 15% in Q2.

-

Slowing Growth Rates: Full-year revenue target of $1.224–$1.229 billion, while still reflecting about 26% growth, marked a notable slowdown from previous years (2024: +33%, 2023: +41%).

-

Margin Compression: Investors worried that the lower margin guidance signalled mounting expenses and a tougher path to profitability.

No Major Catalysts: The rollout of AI features and CRM platform growth (now at $100 million ARR) did not deliver enough upside surprise.

What Management Said: Conservative Outlook

Monday.com's leaders described the guidance as “prudent,” citing macroeconomic uncertainty and the need to balance investments in product innovation with operating discipline. They emphasised robust customer retention—net dollar retention held steady at 111%, enterprise retention rose to 117%—but acknowledged slower enterprise budget cycles and increased spending to support large customers.

Chief Marketing Officer D.R. Newland and Chief Customer Officer Gali Keren pointed to ongoing growth in accounts spending $100k or more and new AI capabilities for workflow automation. Still, their tone remained measured: driving sustainable profit, even at the cost of growth rate moderation, was the focus for the rest of 2025.

Peer Comparison: How Does Monday.com Stack Up?

Within the broader project management and cloud software sector, Monday.com's results were solid, but margin concerns and decelerating growth echoed trends seen at competitors like Asana and Smartsheet. Atlassian and Salesforce, though larger, have faced similar scrutiny over operating margins and the cost of scaling enterprise cloud services. This sector-wide pattern suggests investors are now valuing profitability and guidance clarity as much as headline growth.

Customer Base and Product Highlights

-

Customers spending more than $100,000 annually grew rapidly, showing Monday.com's ability to penetrate larger accounts.

-

ARR from the CRM platform reached $100 million, up sharply from the prior period.

-

AI-powered features in workflow and process automation are rolled out across the platform, supporting upsell and retention efforts.

Average net dollar retention was 111%, and top enterprise accounts posted retention of 117%.

Analyst Insights and Ratings

Analysts largely maintained “Buy” or “Overweight” ratings but cut price targets following the results. The focus shifted to operating discipline, margin potential, and the pace of enterprise adoption. Some suggested Monday.com's valuation could recover if guidance stabilises and margin expansion resumes by the end of 2025.

What Risks Remain?

The sharp stock decline highlights several investor risks:

-

Slower revenue growth signals harder year-on-year comparisons and potentially less “beat and raise” upside in future quarters.

-

Margin pressure could persist as Monday.com spends more to acquire and retain large clients, especially in a competitive environment where tech budgets remain under scrutiny.

Sector risk remains, as software shares have swung in response to guidance miss, macro data, and cautious spending signals.

Outlook

To understand whether Monday.com's share price will rebound, focus on:

-

Updated guidance with any signs of growth acceleration or margin recovery.

-

Customer expansion metrics, especially in enterprise and AI/CRM products.

-

Management's commentary in upcoming earnings calls about balancing growth and profitability.

How competitors are faring: whether market share gains hold or peer momentum shifts sector leadership.

Conclusion

Monday.com's stock plunge after strong Q2 2025 results serves as a lesson in market psychology: even record revenues and profits may not satisfy investors if forward-looking signals appear soft. Guidance on lower growth rates and squeezed margins spooked traders, while slower enterprise sales cycles put additional pressure on sentiment. Going forward, performance in enterprise adoption, margin control, and effective AI product rollout will be key drivers for whether Monday.com shares recover or remain under pressure.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.