Paul Tudor Jones is widely regarded as one of the greatest macro traders of all time. With a career spanning decades, he built his reputation by blending deep macroeconomic insight with precise technical execution and rigorous risk management.

His success is not just measured in profits, but in his consistent preservation of capital, especially in volatile markets. By studying his strategies, traders can gain valuable lessons in patience, discipline and adaptability.

The Global Macro Approach of Paul Tudor Jones

Paul Tudor Jones's strategy begins with a macro‑first philosophy. He does not trade in isolation; rather, he analyses macroeconomic trends such as interest rates, inflation, fiscal policy and geopolitical developments to form an overarching view of where markets may move.

He also considers intermarket relationships. For example, how bond markets, commodity prices and currency flows interconnect. This intermarket analysis allows him to derive leading signals that inform his positioning across asset classes.

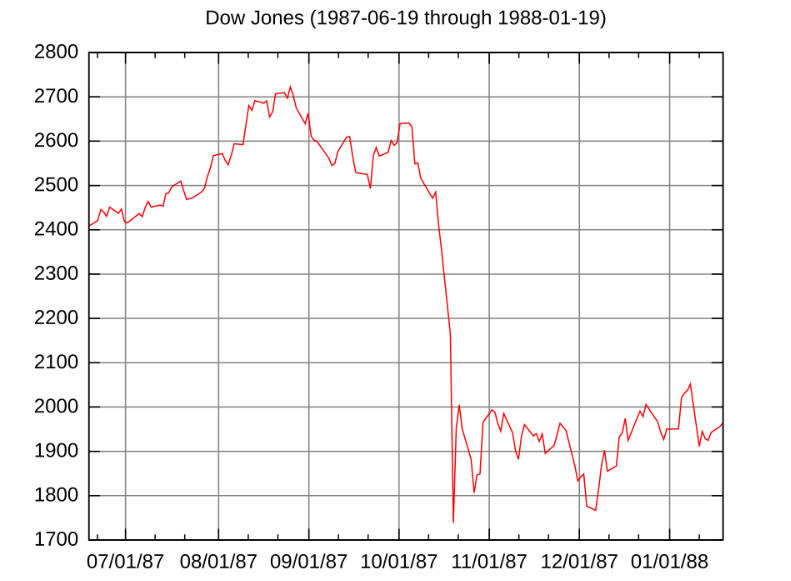

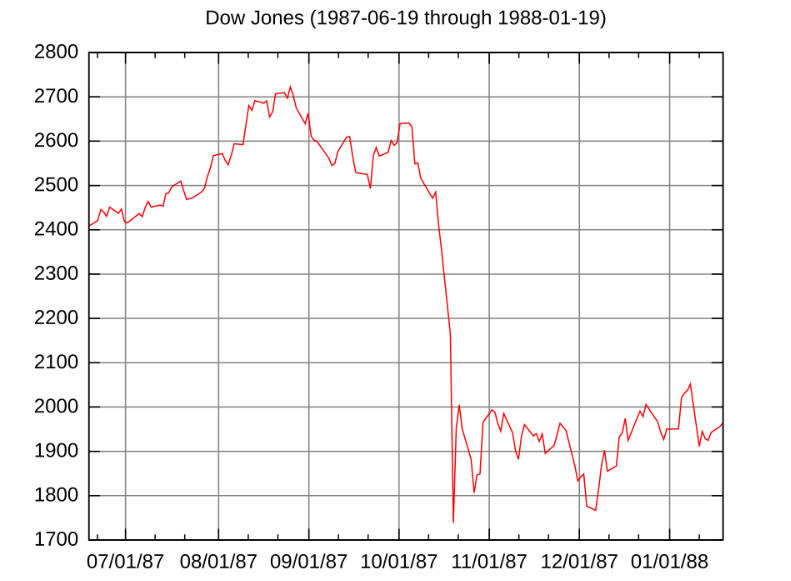

Jones's historic trades, such as his prediction of the 1987 Black Monday crash, exemplify how he combined macro thematic views with awareness of structural patterns in markets.

How Paul Tudor Jones Uses Charts to Enter and Exit

While his foundation is fundamentally macro, Paul Tudor Jones uses technical analysis to optimise timing for entry and exit points. He has emphasised the use of the 200‑day moving average as a key long‑term trend indicator.

He also applies momentum indicators, volume analysis and chart patterns to confirm his macro views. For instance, he watches for unusual volume spikes to validate trend strength or to indicate exhaustion.

A historical pattern recognition skill plays a critical role: Jones studies past market crashes, turning points and structural anomalies, believing that markets often follow recurring motifs.

Paul Tudor Jones's Risk Management Principles: Defence as the Primary Strategy

At the heart of Paul Tudor Jones's trading strategy is his risk management discipline. He famously said: "Don't focus on making money; focus on protecting what you have."

Some of his core risk management practices include:

Strict Position Sizing:

He limits risk per trade to a small fraction of his overall capital. Some sources report he keeps single‑trade risk to around 1 per cent.

Relentless Use of Stop Losses:

He uses mental, technical and time‑based stops. He avoids the temptation to average down losers.

Asymmetric Risk‑Reward Profiles:

He often seeks trades where potential gain is at least five times the potential loss.

Defensive Orientation:

He treats capital protection as a form of offence.

Here is a simplified table summarising some of his risk‑management rules:

| Risk Principle |

Paul Tudor Jones's Practice |

| Position sizing |

Risks only a small portion of capital per trade (around 1 per cent) |

| Use of stops |

Applies stop losses (mental, time‑based, price‑based) |

| Reward to risk |

Targets trades with at least a 5:1 reward to risk ratio |

| Capital preservation |

Prioritises protecting capital over making profits |

The Mental Discipline and Trading Mindset of Paul Tudor Jones

Paul Tudor Jones's mindset is a central pillar of his strategy. He believes that emotional control, humility and adaptability are as important as any technical tool.

One of his mental rules is: "Every day I assume every position I have is wrong." This level of self‑awareness forces him to consider worst‑case scenarios before entering a trade.

He also stresses patience and discipline. He does not trade for the sake of trading; he waits for high‑conviction setups.

Moreover, he strongly advises traders not to let their egos dominate their decisions. Through decades of experience, he has maintained that humility in markets is vital.

How Trades Are Built and Managed Using Paul Tudor Jones Trading Strategy

Paul Tudor Jones's execution is deliberate and methodical. He does not rush into trades without conviction, nor does he commit all his capital in one go.

Some key features of his execution strategy include:

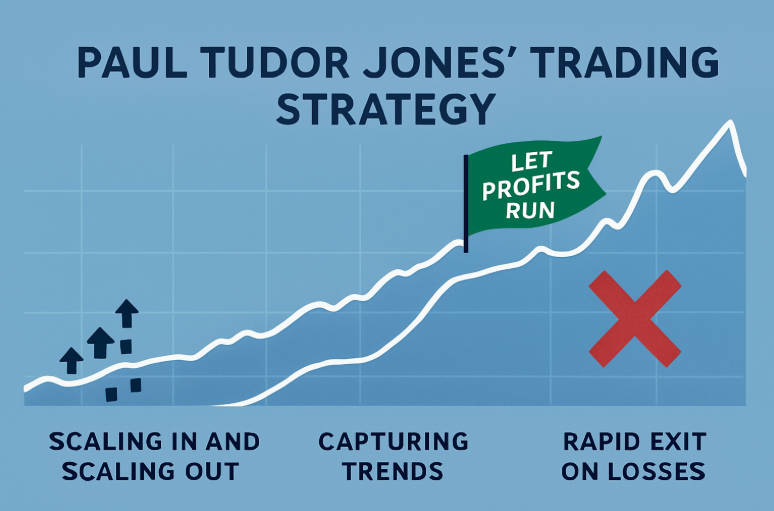

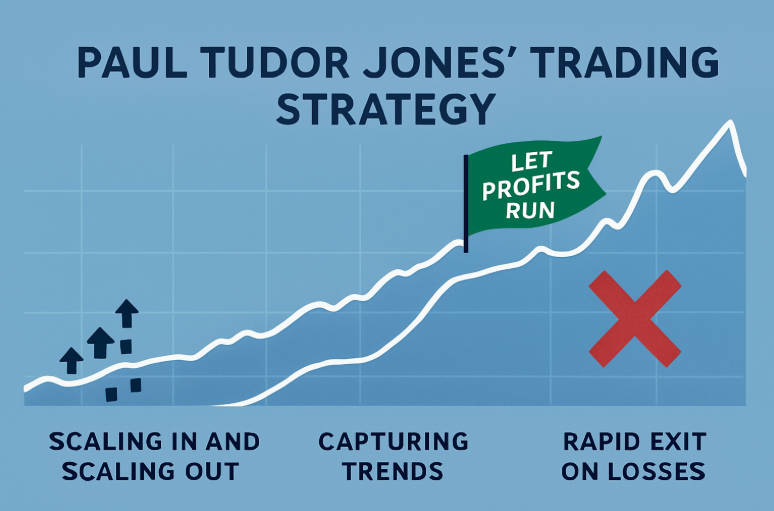

Scaling In and Scaling Out:

When conviction is high, he may build positions gradually. Conversely, he reduces position size in losing scenarios.

Capturing Trends:

Once a trade works, he lets it run, riding it for as long as the trend sustains.

Rapid Exit on Losses:

On trades that fail or reverse, he exits quickly without hesitation.

Paul Tudor Jones Trading Strategy: Being Flexible Amid Change

One of the most powerful aspects of Paul Tudor Jones's strategy is his flexibility. He recognises that markets are not static, and he adapts his playbook to different regimes.

He often trades event‑driven macro themes, responding to monetary policy shifts, geopolitical risks or economic cycles.

He also prefers markets with ample liquidity, which allows him to execute large bets and exit when needed.

Throughout his career, he has navigated high-volatility environments by combining macro insight, technical timing and a defensive mindset.

Paul Tudor Jones Trading Strategy for Long‑Term Success

Beyond specific tactics, Paul Tudor Jones's strategy is underlaid by a set of philosophical principles:

Humility:

He assumes he can be wrong, sets stops and does not trade with overconfidence.

Patience:

He waits for high‑probability trades rather than forcing activity.

Continuous Learning:

He studies market history and remains curious about intermarket dynamics.

Legacy and Purpose:

Beyond trading, he is known for his philanthropy through the Robin Hood Foundation.

What One Can Learn from Paul Tudor Jones

Traders seeking to emulate Paul Tudor Jones can draw several key lessons:

Capital protection must come first.

Without defence, even the greatest trades can destroy you.

Seek asymmetric trades.

Find opportunities where the potential upside greatly exceeds the risk.

Blend macro with technicals.

Use fundamentals to decide what to trade, and charts to decide when.

Maintain psychological discipline.

Keep emotions in check and be ready to admit you are wrong.

Be flexible.

Adapt your strategy to different market regimes rather than rigidly sticking to a single playbook.

Potential Challenges and Criticisms of Paul Tudor Jones's Style

While Paul Tudor Jones's strategy is highly effective, there are limitations and challenges:

Resource intensity:

Macro trading requires substantial research, access to data and a deep understanding of global markets. Such resources may be difficult for retail traders to replicate.

High conviction trades are rare:

His biggest wins often come from infrequent but significant macro calls; replicating this reliably is difficult.

Market evolution:

The markets he dominated in earlier decades were structurally different. Some of his historical patterns may not apply directly to today's markets.

Psychological burden:

The discipline he demands is psychologically taxing. Not all traders can maintain his level of humility and mental control consistently.

Frequently Asked Questions

Q1: What is Paul Tudor Jones's risk‑management rule?

He limits risk per trade to a small fraction of his capital—often about 1 per cent—uses strict stop‑losses, and seeks trades with at least a five‑to‑one reward to risk ratio.

Q2: How does Paul Tudor Jones time his entries?

He integrates macro views with technical analysis, often relying on the 200‑day moving average, momentum indicators and volume spikes to confirm entries.

Q3: Why is his trading style considered "macro"?

Because his trades are driven by global economic themes such as interest rates, inflation, fiscal policy, geopolitics and cross‑asset correlations.

Q4: What role does psychology play in his strategy?

Psychological discipline is central. He emphasises humility, emotional control, and the mindset that every position could be wrong.

Q5: Can retail traders replicate his strategy?

While aspects like risk management and trend‑following can be applied by retail traders, replicating his deep macro research and conviction trades may be challenging without similar resources.

Conclusion

Paul Tudor Jones's trading strategy remains legendary because it elegantly combines macro insight, technical timing and uncompromising risk discipline.

His motto of protecting capital above all else, paired with a readiness to make bold macro bets, offers a timeless blueprint for traders. For anyone seeking to trade intelligently and sustainably, studying his approach provides invaluable lessons.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.