Weekly Round-Up: Key Global Market and Economic Developments (Week Ending August 4, 2025)

Equities and Sector Movers

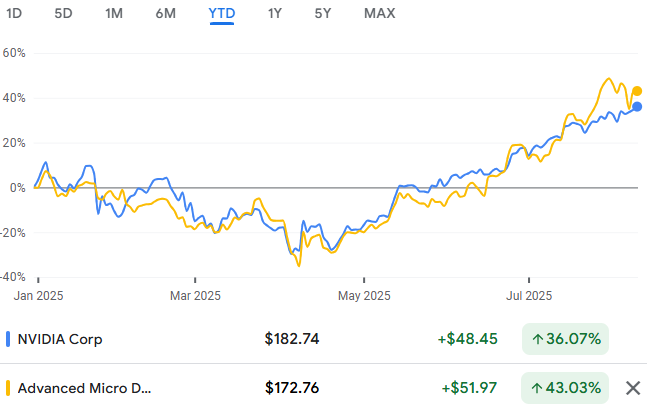

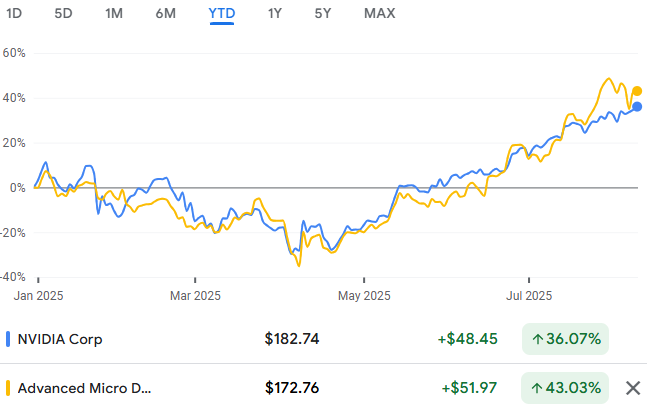

The week ending August 4, 2025, was marked by significant volatility in global equity markets, driven principally by semiconductor sector developments. Nvidia and AMD agreed to pay 15% of their revenues from advanced AI chip sales in China, such as Nvidia's H20 and AMD's MI308, to the US government in exchange for export licenses. This unprecedented revenue-sharing deal allowed them to re-enter the lucrative Chinese market but introduced a political tariff that pressures profit margins.

Initially, Nvidia and AMD stocks rallied strongly on news of resumed China access. However, some gains were pared as investors absorbed the cost implications of the deal. Meanwhile, Intel's shares fell by over 3% following a Fitch downgrade of its credit rating to BBB with a negative outlook, a reflection of operational and demand challenges. The broader semiconductor sector showed divergence, with AI-focused players such as Nvidia and AMD outperforming legacy competitors like Intel.

Currencies and Commodities

The US dollar strengthened amid solid economic data and rising expectations of a Federal Reserve pause or easing in monetary policy later this year. The Chinese yuan weakened due to trade tensions and regulatory uncertainties related to chip exports. Commodity markets experienced mixed movements: oil prices rebounded from a five-week low amid concerns over US tariff threats targeting Indian crude imports, while precious metals attracted safe-haven buying in volatile markets. Copper imports into China showed mixed signals, pointing to cautious optimism about near-term industrial demand.

Bond Markets and Credit

Global bond yields edged slightly lower, helped by easing inflation readings, but credit spreads widened notably in the technology and semiconductor sectors. Intel's downgrade to BBB by Fitch was a major contributor, raising market concerns about financing risks for capital-intensive tech firms. This widening credit risk pressured investor sentiment and complicated funding for chipmakers' costly manufacturing and R&D projects.

Macro Data Recap

Economic data released during the week painted a cautious outlook. US services sector activity slowed more than expected in July, increasing concerns about a potential growth slowdown. While headline inflation showed some easing, core inflation remains sticky, contributing to central banks' continued caution regarding policy decisions.

Preview: Key Economic Data and Corporate Earnings for the Week Starting August 11, 2025

Key upcoming data and events likely to influence the markets include:

-

US Nonfarm Payrolls (July): The labour market gauge showed an increase of 73,000 jobs, below the previous 147,000 gain and analyst expectations, confirming cooling momentum.

-

US Consumer Price Index (CPI, July): Inflation is projected to rise by about 0.3% monthly, with year-over-year core CPI expected around 3.0%, maintaining pressure on central banks.

-

Purchasing Managers' Indexes (PMIs): Reports from the US, Eurozone, and China will indicate manufacturing and service sector health.

-

Federal Reserve commentary: Speeches from Fed officials will provide clues on monetary policy, especially regarding rate changes.

Corporate earnings: Palantir's results are anticipated as a key tech earnings event, with the company recently surpassing $1 billion in quarterly revenue and raising full-year guidance. Other tech and semiconductor earnings will also be closely watched post the new tariff and export deal environment.

Market Sentiment, Sector Trends, and Risks

The Nvidia AMD China chip deal poses a dual impact. It restores essential market access to China's multibillion-dollar AI chip sector but imposes a 15% US government revenue share, effectively a new political tariff. This pressures profit margins and injects earnings uncertainty.

Sector rotation is accelerating toward companies with clear AI growth trajectories and innovation leadership, such as Nvidia and AMD. Meanwhile, more traditional peers like Intel face credit and operational headwinds. AI demand remains the main sector growth driver, leading to greater divergence between winners and laggards.

Elevated US-China trade tensions, alongside renewed US tariff threats on semiconductor imports and Indian crude oil, exacerbate supply chain risks and market volatility. These factors contribute to currency fluctuations, risk-off sentiment, and higher credit spreads.

Central banks face conflicting pressures: stubborn core inflation suggests caution, but slower growth and labour market softness hint at easing. This interplay keeps bond yields and currency markets choppy, influencing risk appetite in technology stocks.

Policy, Geopolitics, and Trade Impact

The new revenue-sharing deal between Nvidia, AMD, and the US government represents a strategic shift in export control policy. Instead of outright bans, Washington is leveraging direct financial terms to regulate advanced technology exports while keeping US firms competitive internationally.

This arrangement sets a precedent that could influence future export licensing terms and impact global semiconductor supply chains. The added cost creates a complex trade-off for chipmakers between accessing the Chinese market and yielding margin to the US government.

Further complicating matters, US tariff threats on Indian crude imports and semiconductor supplies amplify global supply disruptions and trade fragmentation risks. While exemptions and negotiations are underway for some parties, these dynamics contribute to ongoing uncertainty in global trade and capital flows.

Monetary policy decisions, particularly by the US Federal Reserve, remain central to market sentiment. Upcoming inflation and jobs data will guide the Fed's next steps, impacting asset prices, US dollar movements, and broader risk conditions.

Conclusion

The week ending August 4, 2025, underscored a complex nexus of geopolitical manoeuvres, semiconductor industry shifts, and cautious economic data shaping market trends. The Nvidia and AMD China chip deal epitomises this dynamic, reopening a vital market while imposing a costly new revenue-sharing model that reshapes US tech companies' profit outlooks.

Intel's ongoing challenges highlight the widening gap between AI-driven innovators and legacy chipmakers facing credit and demand pressures. The semiconductor sector's division will likely intensify as investors favour scalable AI leadership amid geopolitical and macroeconomic headwinds.

Looking forward, the markets will closely watch US economic data, corporate earnings, and evolving trade policies to gauge risk appetite and sector rotation. Volatility and active positioning around these developments will define the near-term landscape for global financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.