The recent drop in Monday.com (NASDAQ: MNDY) stock resulted in new multi-year lows and did not reflect a judgment on the previous quarter’s performance. Instead, it represented a reset of future expectations. When a profitable SaaS company reports strong results but projects slower growth, reduced margins, and lower cash generation, the market interprets this as a structural shift rather than an isolated event. Upcoming earnings reports will clarify whether this downturn marks a temporary capitulation or the beginning of a prolonged de-rating cycle.

Monday.com reported fourth-quarter revenue of $333.9 million, representing a 25% year-over-year increase, and full-year 2025 revenue of $1.232 billion, up 27%. However, the 2026 outlook indicated 18 to 19 % growth and an 11 to 12 % non-GAAP operating margin, a decline from 2025’s 14 %. The sharp decline in the stock price reflected the market’s assessment that slowing growth combined with margin compression poses significant risks to a valuation predicated on sustained compounding.

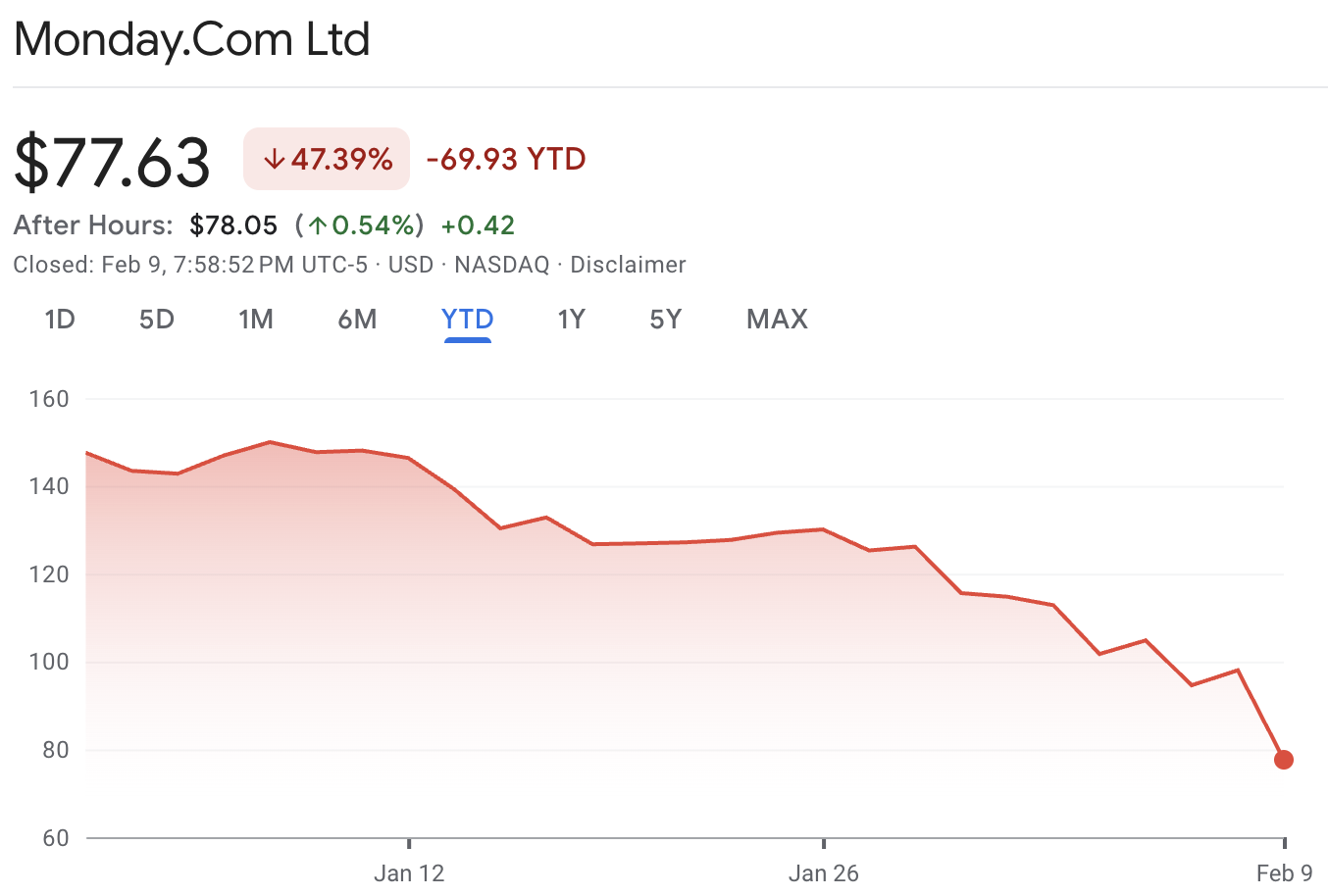

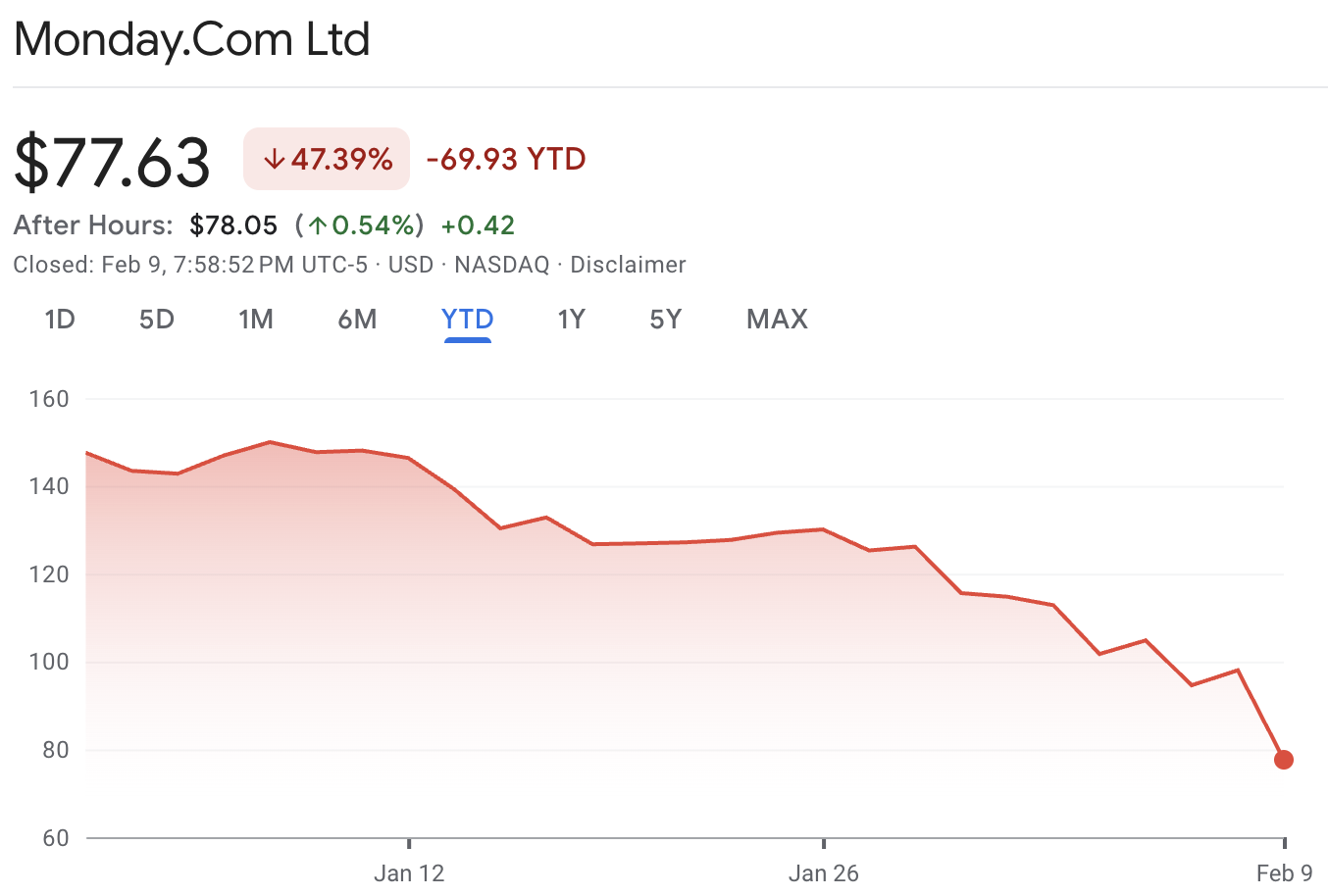

MNDY Stock Performance (1W, 1M, 6M)

| Period |

Start (nearest trading day) |

Start Close |

End (Feb 9, 2026) |

End Close |

Return |

| 1W |

Feb 2, 2026 |

$112.82 |

Feb 9, 2026 |

$77.63 |

-31.19% |

| 1M |

~30-day window |

— |

Feb 9, 2026 |

$77.63 |

-46.96% (30D) |

| 6M |

Aug 8, 2025 |

$248.04 |

Feb 9, 2026 |

$77.63 |

-68.70% |

The Guidance Cut That Mattered: Margins and Cash Flow, Not Last Quarter’s Beat

The market’s reaction was not due to a lack of growth at Monday.com, but rather to a perceived decline in the quality of that growth. In 2025, Monday.com achieved 27% revenue growth and a 14% non-GAAP operating margin. This combination exceeds the 'Rule of 40' threshold and justifies a premium valuation multiple. clears the “Rule of 40” and supports a premium multiple.

The 2026 guide breaks that symmetry. Revenue growth falls to 18 to 19% and margins to 11 to 12%, dragging the Rule of 40 profile closer to the high-20s to low-30s. More importantly, the company guided adjusted free cash flow margin to 19-20%, a material step down from 2025’s 26%. In SaaS, the market can forgive slower top-line growth if cash conversion rises. It rarely forgives slower growth when cash conversion is also falling.

This dynamic explains why the decline in MNDY stock appeared abrupt and severe. The market rapidly reassessed the next 12 to 18 months as a period of lower-quality compounding. When revised guidance compels analysts to reduce operating profit forecasts, the stock frequently falls below previous support levels due to limited buying interest between valuation ranges. Such conditions often result in 'earnings air pockets.

2024 to 2026 Shows the Deceleration Shock

| Metric |

FY2024 |

FY2025 |

FY2026 guidance |

| Revenue |

$972.0M |

$1,232.0M |

$1,452–$1,462M |

| YoY revenue growth |

33% |

27% |

18–19% |

| Non-GAAP operating income |

$132.4M |

$175.3M |

$165–$175M |

| Non-GAAP operating margin |

14% |

14% |

11–12% |

| Free cash flow / adjusted FCF |

$295.8M |

$322.7M (adjusted) |

$275–$290M (adjusted) |

| FCF / adjusted FCF margin |

~30% |

26% |

19–20% |

| Net dollar retention rate |

112% |

110% |

Not guided |

Even in the absence of recession indicators, the market interpreted this as a strategic shift toward slower growth, increased spending, and reduced near-term cash flow. While this approach may be justified if it strengthens long-term demand and competitive positioning, it also tends to prompt valuation multiple compression, particularly when investors are already reducing risk exposure in the software sector.

Key Reasons Behind the MNDY Stock Fall

1) The market repriced the forward curve, not the quarter

The selloff in Monday.com stock was driven by a guidance reset that implied slower growth and softer profitability than investors had modeled. For a SaaS name valued on durable compounding, a weaker 12-month outlook hits harder than a single-quarter beat because it lowers the entire earnings and cash flow trajectory investors discount into the multiple.

2) Self-serve weakness is a valuation problem, not just a growth problem

Monday.com’s self-serve motion has historically scaled efficiently through digital acquisition. When that funnel becomes unstable, the economics change quickly. A weaker search-driven pipeline typically forces a trade-off: accept slower customer adds or spend more to defend growth. Either path compresses the near-term margin profile. In this setup, investors do not treat conservative guidance as prudence.

They treat it as confirmation that the funnel is not normalizing soon, which is why the MNDY stock fall looked disproportionate to headline results.

3) Upmarket momentum is intact, but mix shift changes timing and cost

The company’s enterprise push remains a structural positive, and large customers continue to expand as a share of ARR. However, moving upmarket can create short-term friction at exactly the wrong time for sentiment. Enterprise cycles are longer, procurement is stricter, and deal timing becomes less predictable.

Supporting multi-product deployments also pulls forward investment in sales capacity, partner coverage, and product enablement. The result is a period where revenue quality improves, but near-term margin and cash conversion can dip, reinforcing the market’s de-rating impulse.

4) FX headwinds amplified the margin narrative

Management flagged foreign exchange as a meaningful near-term margin headwind. FX alone rarely breaks a high-quality software stock, but it can deepen the perception that profitability is moving the wrong way, especially when the company is already signaling incremental investment and a more cautious growth stance.

5) Credibility and expectation asymmetry worsened the reaction

A recurring pattern in software selloffs is “beat the quarter, guide cautiously.” When that repeats, the market stops paying for upside that isn't reflected in guidance. Investors begin to treat strong prints as backwards-looking and guidance as the only tradable truth.

That credibility discount can accelerate multiple compressions and make declines look like “rock bottom” moves as liquidity thins and positioning unwinds.

Valuation After The Drop: The Market is Pricing a Very Different Company

After the selloff, the valuation lens shifts. Monday.com ended 2025 with $1.503 billion in cash and cash equivalents plus $162 million in marketable securities, while maintaining an active buyback authorization. That balance sheet reduces existential risk and gives management flexibility to invest through a weak funnel period.

Simultaneously, investors are no longer attributing a premium multiple to the company’s previously consistent and predictable growth. The stock is now valued as a business that must demonstrate the resilience of its customer acquisition strategy and prove that margin pressures are temporary rather than structural.

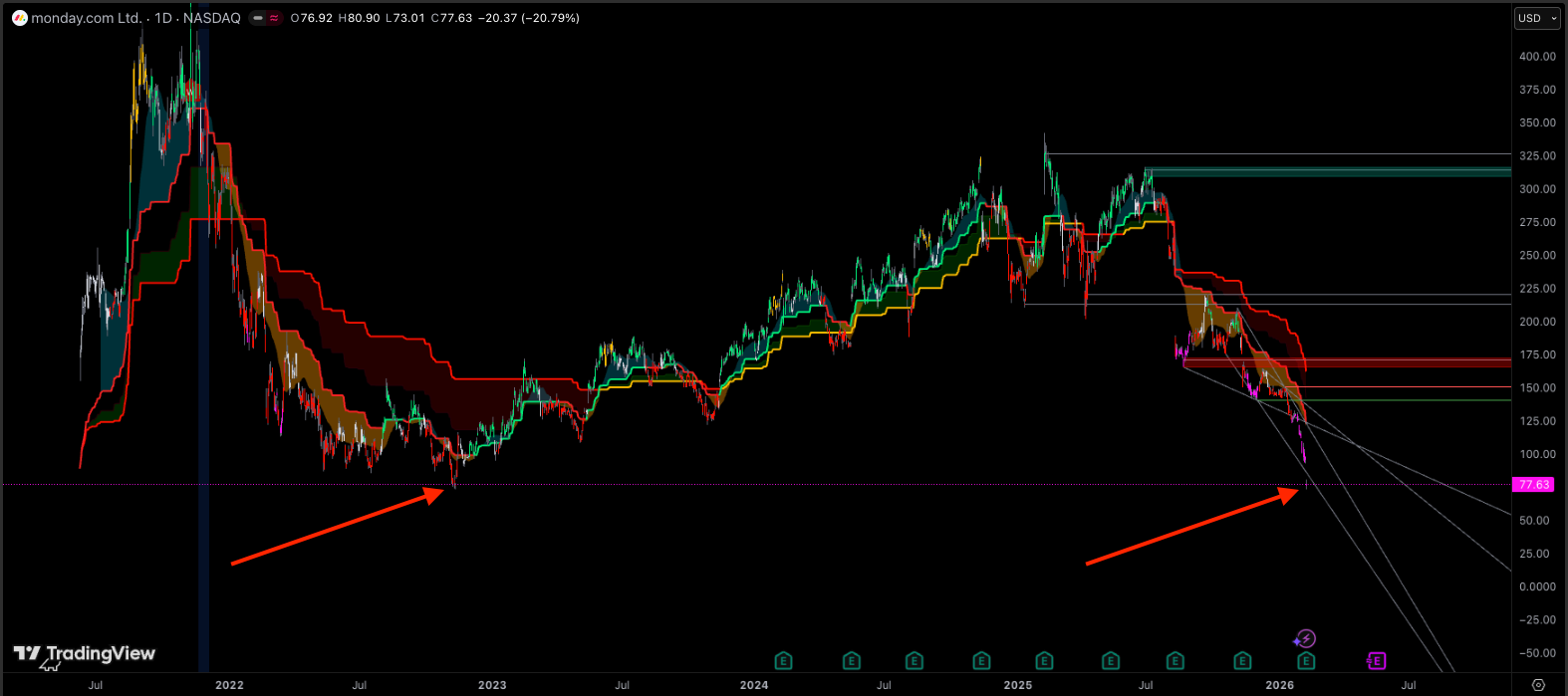

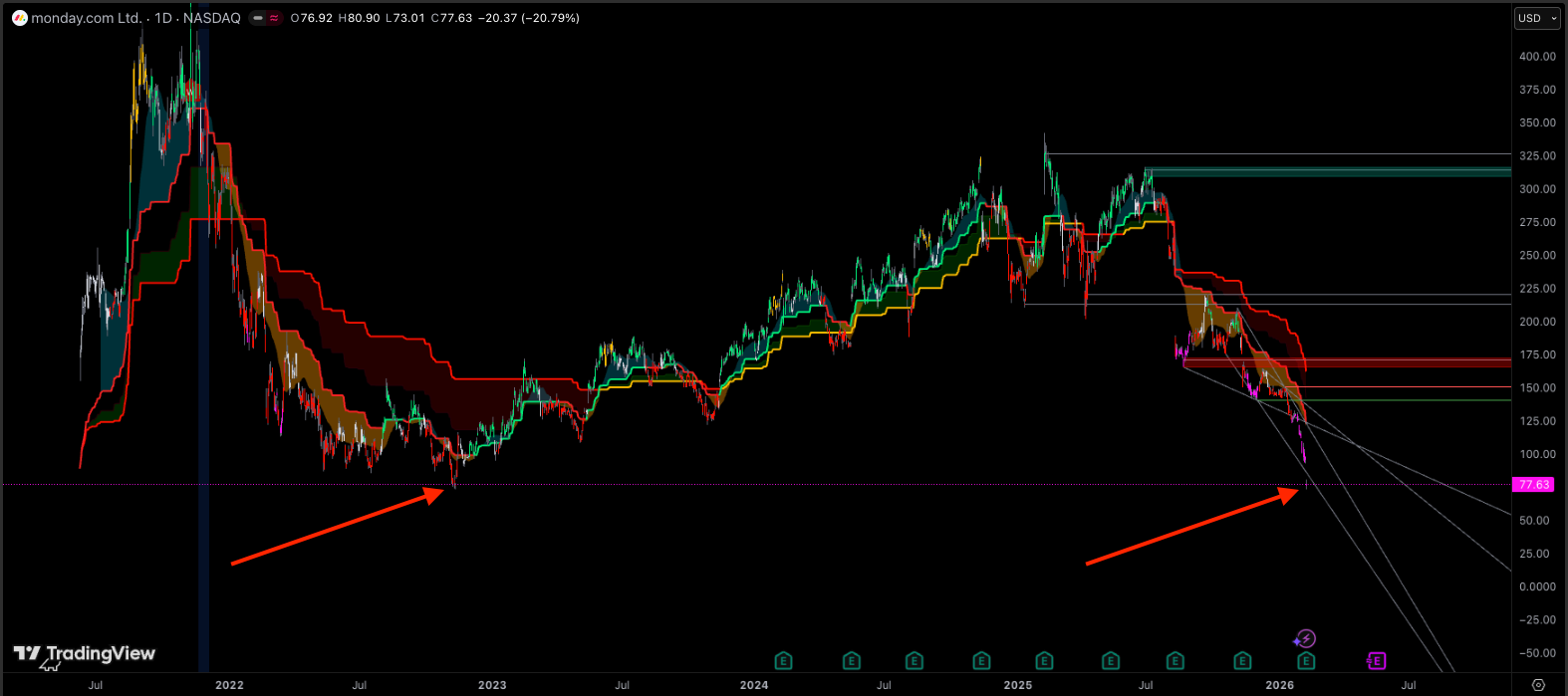

Technical Analysis: Oversold Conditions, Heavy Overhead Supply

The price movement following earnings was characteristic of a liquidity event, featuring a sharp decline, elevated volatility, and rapid testing of lower price levels as stop orders and risk reduction encountered limited liquidity. Such a move may indicate capitulation, but confirmation requires price stabilization and a recovery of key moving averages.

MNDY Stock Technical Snapshot

| Indicator |

Reading |

What it suggests |

| RSI (14) |

~24.2 |

Deeply oversold, bounce risk elevated |

| MACD (12,26) |

~-7.47 |

Downtrend momentum remains dominant |

| EMA 20 |

~87.95 |

Price well below, short-term trend bearish |

| EMA 50 |

~99.19 |

Medium-term trend bearish |

| EMA 200 |

~122.43 |

Long-term trend bearish, major overhead supply |

| Support |

~73.98 to 75.89 |

Downside levels where bids may cluster |

| Resistance |

~77.80 to 79.56 |

First rebound zone, supply likely heavy |

| Trend |

Bearish |

Structure remains lower highs, lower lows |

| Momentum |

Negative |

Needs basing to stabilize |

An oversold condition does not inherently indicate that a stock is undervalued. Rather, it reflects that the price declined more rapidly than available liquidity could accommodate. A sustainable reversal typically occurs when volatility subsides, the stock establishes a base, and it recovers the 20-day and 50-day moving averages as market participation increases. Until these conditions are met, upward movements may be short-lived as previous investors exit on strength.

MNDY Stock Key Support Levels

| Support level |

Why it matters |

What would confirm it |

| $73.0–$75.0 |

Capitulation zone: $73.01 printed as the 52-week low on Feb 9, 2026, with price stabilizing into the close. |

Multiple daily closes holding above ~$73, ideally with shrinking volatility after the earnings-gap shock. |

| $70.0 |

Round-number support that often acts as a “decision level” when a stock breaks to fresh multi-month lows. |

Intraday undercuts that quickly reclaim $70, or a clear base forming just above it. |

| Late-2022 base area |

With shares described as at their lowest levels since November 2022, any clean break below the 2026 low risks “air pocket” price action until longer-term buyers reappear. |

A failed breakdown (flush below the 2026 low, then rapid recovery) would be the first sign that longer-term demand is returning. |

What Would Change The Narrative For MNDY Stock

Three developments would matter most:

Self-serve stabilization: Evidence that top-of-funnel acquisition is improving, even modestly, would support a higher confidence growth path.

Cash flow credibility: Meeting or beating the 2026 adjusted free cash flow range would signal that margin pressure is contained and investment is disciplined.

AI monetization with measurable uplift: Rapid product adoption is positive, but the market will reward AI only when it shows up in retention, expansion, or pricing power at scale.

Until these developments materialise, the market is likely to keep Monday.com in a lower valuation category, despite continued strong quarterly performance.

Frequently Asked Questions (FAQ)

Why did MNDY stock fall if Monday.com beat earnings?

Because the market discounted the forward outlook, not the reported quarter. The 2026 guide implied slower growth, lower operating margin, and weaker cash flow conversion, which forces valuation multiples lower even when reported revenue and EPS beat near-term expectations.

What exactly was the Monday.com guidance cut?

For 2026, Monday.com guided revenue to $1.452 to $1.462 billion (18 to 19 % growth) and non-GAAP operating income to $165 to $175 million (11 to 12 % margin). Adjusted free cash flow is guided to $275 to $290 million, below 2025 levels.

Is monday.com stock at a record low?

Yes, the post-guidance selloff pushed the stock to fresh multi-year lows, with reporting describing it as a record low level for the shares during the reaction.

What is net dollar retention, and why does it matter here?

Net dollar retention measures expansion versus churn in the existing base. Monday.com reported 110 % net dollar retention, meaning the base expanded slightly on net. In a guide-down cycle, retention is watched closely because it can offset weaker new customer acquisition.

How much cash does Monday.com have to weather volatility?

At year-end 2025, Monday.com reported $1.503 billion in cash and cash equivalents and $162 million in marketable securities. That liquidity, plus an ongoing share repurchase authorization, provides flexibility if growth investments need to be sustained longer.

Conclusion

The decline in Monday.com’s stock was not merely the result of an earnings miss. Instead, it reflected a reset of valuation multiples prompted by guidance indicating slower growth, reduced margins, and lower cash flow conversion. In a higher-yield market environment, this combination is penalized severely, leading to a pronounced selloff as liquidity diminishes and investor positions are unwound. While the company’s progress in the enterprise segment and its robust balance sheet provide important mitigating factors, a sustained recovery in the stock will depend on stabilization in the self-serve channel and a clear trajectory toward improved cash flow conversion.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.