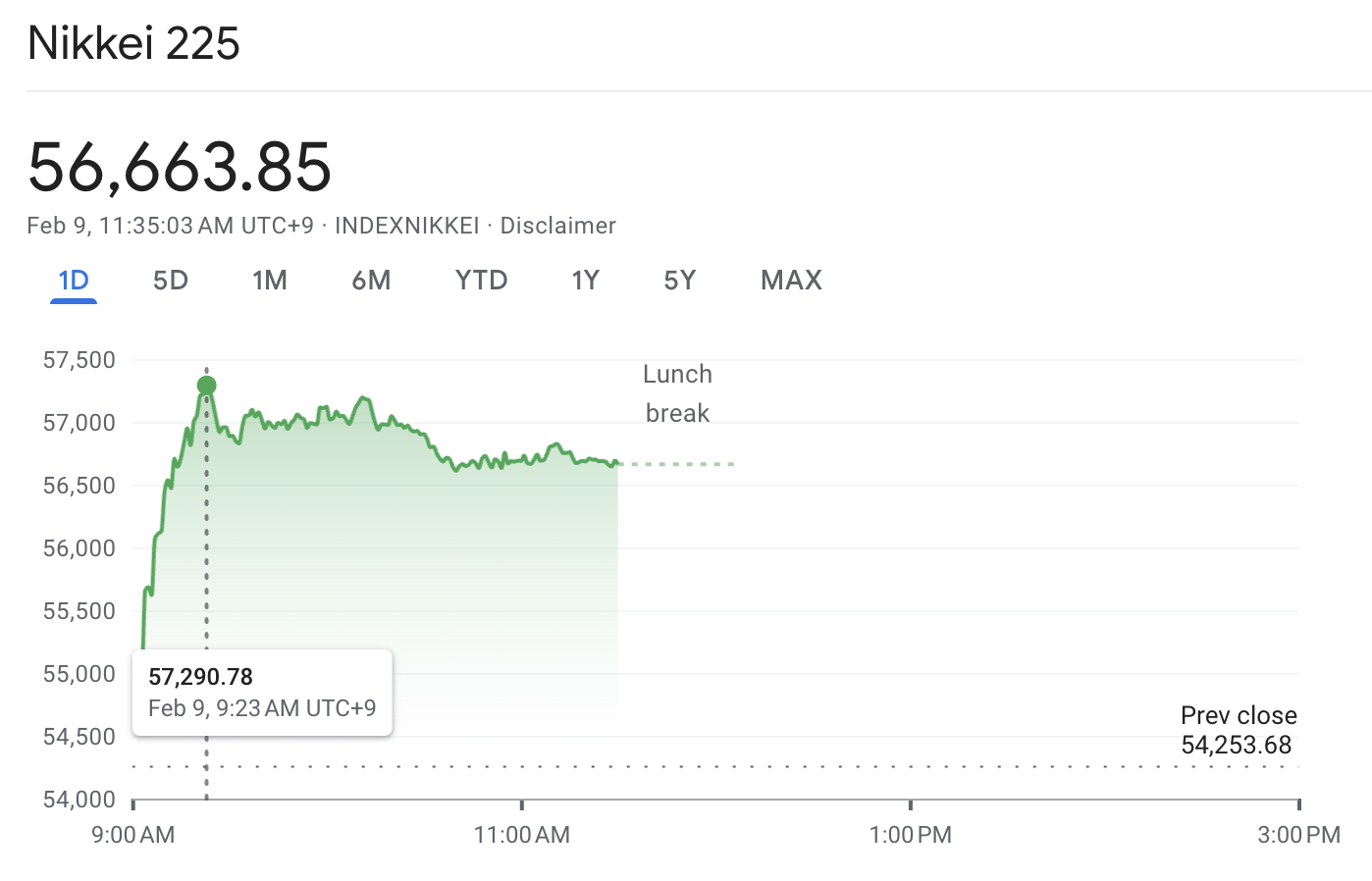

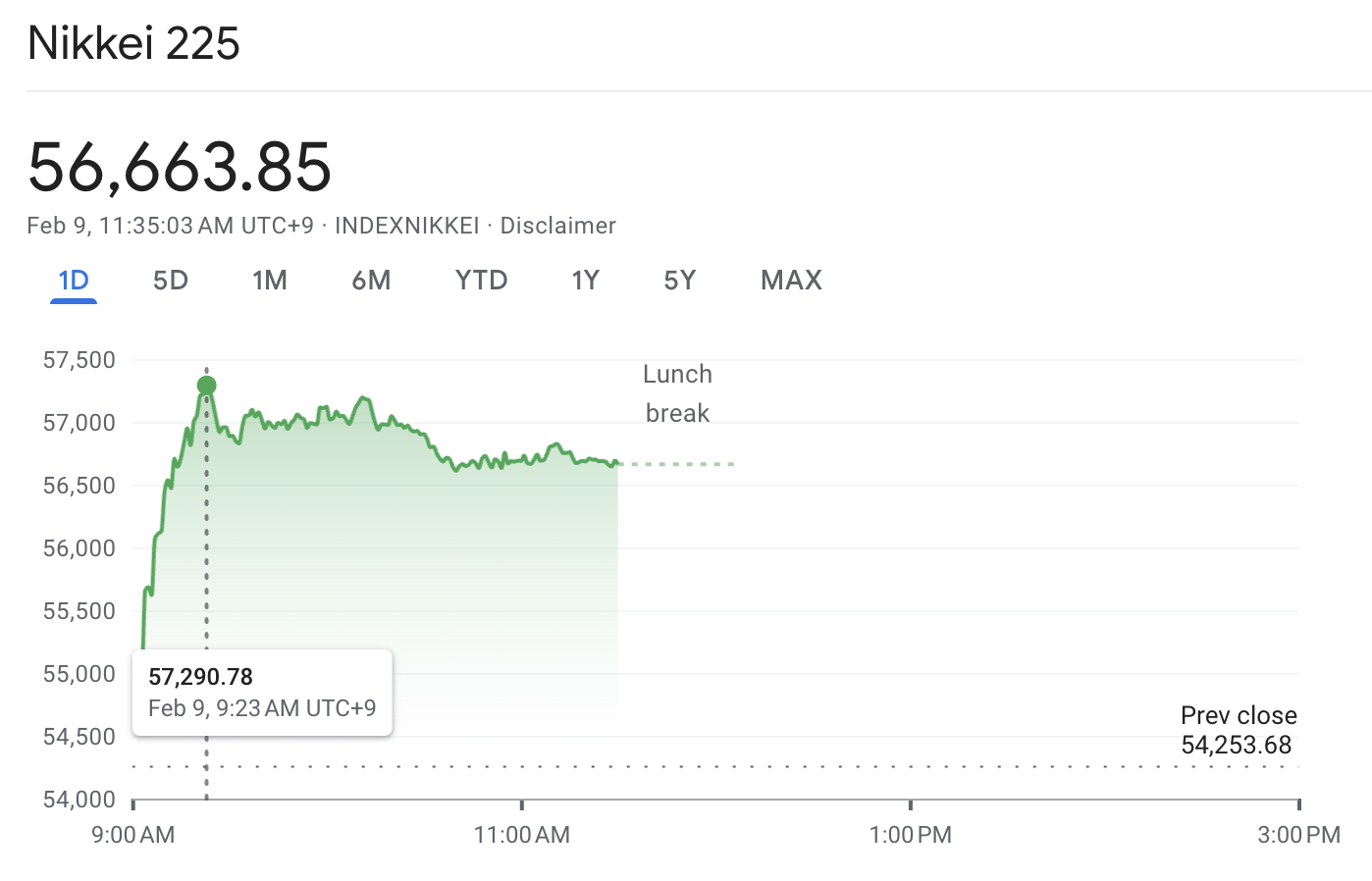

Japan's stock market just hit another milestone. The Nikkei 225 jumped more than 5% and broke 57,000 for the first time, while the broader Topix index also pushed to a fresh record and moved above 3,800.

The immediate catalyst was political clarity. Prime Minister Sanae Takaichi's snap-election landslide triggered a sharp repricing in Japanese assets, with investors leaning into a pro-growth fiscal agenda and the likelihood of continued policy support.

That is the headline, but it is not the whole story. Japan stocks have been building momentum for months through corporate reform, higher buybacks, and a steady return of foreign capital. The election added a near-term accelerant and reduced uncertainty about the policy mix.

What Happened in the Nikkei 225 Today?

As highlighted above, the Nikkei's move through 57,000 came during a strong post-election rally. The index rose as much as 5% and cleared 57,000 for the first time after the snap election result, with Topix also breaking 3,800.

This followed a run of fresh highs even before the election. For example, Nikkei closed at a record 54,720.66 earlier in February, helped by strong earnings from tech and financial stocks.

Thus, the Japanese stock rally story is best read in two layers:

The structural layer: reforms, buybacks, better governance, and foreign inflows.

The catalyst layer: politics and policy expectations, plus a supportive yen backdrop

Why Japan Stocks Are Soaring: The Five Main Drivers

1. The Political "Risk-On" Shock

The market reaction was not only about who won. It was about what the win implied for fiscal policy, corporate investment, and the Bank of Japan's room to move.

Takaichi's victory delivered a two-thirds supermajority and put a stimulus-friendly agenda back at the center of the narrative. Therefore, investors responded to expectations of stronger stimulus and corporate investment in strategic technology sectors.

For context, the coalition won 316 of 465 seats and referenced a large stimulus plan and a proposal to suspend an 8% consumption tax on food, both of which reinforced a pro-growth interpretation in markets.

Why This Moves an Equity Index So Quickly

Policy duration became clearer

Rate-hike expectations can shift

Risk appetite improves when uncertainty falls

2. The Yen Effect: A Weaker Yen Is Still an Earnings Lever

Japan's equity market remains highly sensitive to the yen because a significant portion of Nikkei earnings is generated overseas. When the yen is weak, foreign revenues translate into robust reported profits, and export-heavy sectors tend to outperform.

The market has been actively trading this relationship for months. For instance, Japanese stocks rose while the yen slipped as investors priced looser fiscal and monetary conditions tied to the same political leadership shift.

There is also a second layer. Currency volatility has become significant, prompting U.S. and Japanese authorities to express their concerns about disorderly fluctuations.

A rare incident involving a "rate check" by the U.S. Treasury and the New York Fed underscored their close monitoring of currency conditions, ultimately boosting the yen.

3. Corporate Reform and a Real Shift in Shareholder Returns

Japan's market has been undergoing internal changes and developments. The Tokyo Stock Exchange's emphasis on "capital efficiency" and stock-price-focused management has compelled companies to utilize cash more effectively, reduce cross-holdings, and increase shareholder returns.

It sits alongside the Corporate Governance Code and broader market restructuring work.

One hard proof point is buybacks. In April 2025, Japanese companies announced a total of ¥3.8 trillion in buybacks, nearly triple the figure from the previous year. For fiscal 2024, buybacks totaled approximately ¥20 trillion.

Why This Matters for the Nikkei 225

Buybacks reduce share count and can support earnings per share.

They often serve as natural buyers during market weakness.

They signal that management is taking valuation and shareholders more seriously.

4. Foreign Money Has Been Leaning Back Into Japan

International investors have been rebuilding exposure to Japan for diversification and to reduce reliance on the United States.

According to Bloomberg, foreign investors bought Japanese equities in 2025 at the strongest pace since 2013, partly driven by demand for a non-US alternative during U.S. political and economic uncertainty.

When foreign inflows rise, Japan's biggest liquid index names often lead, and that lifts the Nikkei.

5) Japan's Sector Mix Now Captures Global AI and Automation Spending

Japan's stock rally has also been supported by earnings delivery in key sectors.

The Nikkei is heavily exposed to technology, automation, and semiconductor-linked supply chains relative to many European benchmarks.

This matters because:

Banks can benefit when rates rise from ultra-low levels, because net interest margins can improve.

Tech and AI-linked supply chains attract global flows when investors want growth exposure outside U.S. megacaps.

In short, when global investors seek "AI beta" alongside geographic diversification, Japan becomes a natural destination, especially if the currency is supportive.

Nikkei 225 Technical Analysis: Is the Rally Overheating?

| Indicator |

Latest value |

Signal |

| RSI (14) |

69.367 |

Buy, but close to overbought conditions. |

| Stoch (9,6) |

96.546 |

Overbought, which can invite short-term mean reversion. |

| MACD (12,26) |

716.9 |

Buy, consistent with trend acceleration. |

| ATR (14) |

626.3 |

High volatility, which fits a breakout day. |

When an index breaks a significant round number, such as 57,000, price action can become emotional. This is when technical indicators often matter more, because they show whether buying is broad and steady or short-term and stretched.

Nikkei technical page indicates a "Strong Buy" summary across moving averages, with RSI rising into the upper 60s. At the same time, several oscillators are flashing overbought, typical after a vertical breakout.

Moving Averages and Trend "Repair" Levels

| Moving average |

Level |

What it implies |

| MA20 |

54,566 |

Short-term trend support, often tested after a sharp spike. |

| MA50 |

54,129 |

Medium-term support zone that trend followers watch closely. |

| MA200 |

53,244 |

Long-run trend anchor, which signals where deeper pullbacks can stabilize. |

These levels matter because a breakout that holds above rising moving averages tends to attract dip-buying rather than panic-selling.

Pivot Point Map (Classic)

| Level |

Value |

| S1 / Pivot / R1 |

56,450 / 56,849 / 57,094 |

| S2 / R2 |

56,205 / 57,493 |

| S3 / R3 |

55,806 / 57,738 |

These levels often become the "battle lines" after an impulsive move.

Key Takeaway:

The market has demonstrated its ability to trade above 57,000. The next question is whether it can hold above the pivot area near 56,849 on pullbacks.

A sustained hold keeps momentum intact. A fast drop back below that zone usually signals profit-taking rather than fresh institutional buying.

What Could Derail the Japan Stock Rally?

Japan's surge looks powerful, but the risk set is also clear. Traders should watch these four points.

1) The Yen Suddenly Strengthens

If the yen rises rapidly, exporters may lose a key advantage in their earnings. The market can reprice fast, especially when positioning is crowded.

2) Bond Yields Move Higher in a Disorderly Way

If fiscal concerns push long yields up too quickly, equity valuations can come under pressure, even if earnings are fine.

3) Policy Disappointment After the Election Bounce

Election rallies can fade if the first policy package looks smaller than hoped, or if timelines slip. The FT described the "Takaichi trade" as driven by stimulus and investment expectations, which means the market will want proof.

4)A Global Risk-off Shock

Japan remains a primary global market. If global tech stocks experience a sharp sell-off or fears of slowing growth intensify, the Nikkei 225 may decline, even amid strong domestic reforms.

Frequently Asked Questions (FAQ)

1. Why Did the Nikkei 225 Jump Above 57,000?

The immediate trigger was a landslide election result that reduced policy uncertainty and strengthened expectations for stimulus and strategic investment.

2. Is Japan's Stock Rally Only About Politics?

No. Although politics played a significant role, structural factors also contributed, particularly the pressure from the Tokyo Stock Exchange to enhance capital efficiency and increase shareholder returns.

3. Does a Weaker Yen Help the Nikkei 225?

Yes. A weaker yen typically benefits Japan's exporters by enhancing their international earnings when converted back to yen.

4. What Could Cause Japan Stocks to Pull Back in 2026?

The main risks are a jump in bond yields tied to fiscal concerns, a yen reversal driven by intervention risk, and geopolitical headlines that raise Japan's risk premium. Any of these can trigger profit-taking after a fast breakout.

Conclusion

In conclusion, the Nikkei 225 breaking 57,000 is not only a headline. It is the market pricing a mix of short-term political optimism and long-running structural change in corporate Japan.

The election result added fuel, but the longer trend has been built on governance reform, a sharp rise in buybacks, and renewed foreign demand for Japanese equities.

If the index can stabilize above the breakout levels without a sudden yen reversal or a shock to the bond market, the trend may continue. However, if yields increase sharply or the risk of intervention rises, the rally could lose momentum, even if the long-term reform narrative remains strong.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.