On February 5, 2026, the iShares Expanded Tech-Software Sector (IGV) ETF reported a net asset value of $79.65, at the lower bound of its 52-week range ($79.65 to $117.79), reflecting a one-day decline of approximately 4.97%. This decline aligns with a broader market repricing of AI-related and enterprise software equities, as investors increasingly prioritise near-term monetisation and balance-sheet discipline over unrestricted spending.

Markets are experiencing heightened uncertainty regarding future developments. Political events, policy disruptions, renewed geopolitical tensions in several regions, and the substantial scale of investment in artificial intelligence have collectively contributed to fragile risk appetite and sustained market volatility.

Within this context, a central question arises: which specific factors triggered IGV’s recent decline, and will these forces dissipate rapidly or persist long enough to alter software valuations over an extended period?

IGV ETF Latest Snapshot

| Metric |

Latest read |

| NAV (as of Feb 5, 2026) |

$79.65 |

| 52-week range |

79.65 to 117.79 |

| Net assets (as of Feb 5, 2026) |

$5.75B |

| Expense ratio |

0.39% |

| Holdings |

114 |

| Beta (3y) |

1.29 |

| P/E |

35.21 |

| Top 10 concentration |

60.01% |

What the IGV ETF Owns, and Why That Matters

Although IGV is often described as a software ETF, its portfolio composition is more nuanced, a distinction that is particularly relevant in the 2026 market environment. The fund targets North American software and related interactive media sectors, exhibiting a classic growth profile with elevated beta. Key characteristics include 114 holdings, a three-year beta of 1.29, a price-to-earnings ratio near 35, and a price-to-book ratio exceeding 6.

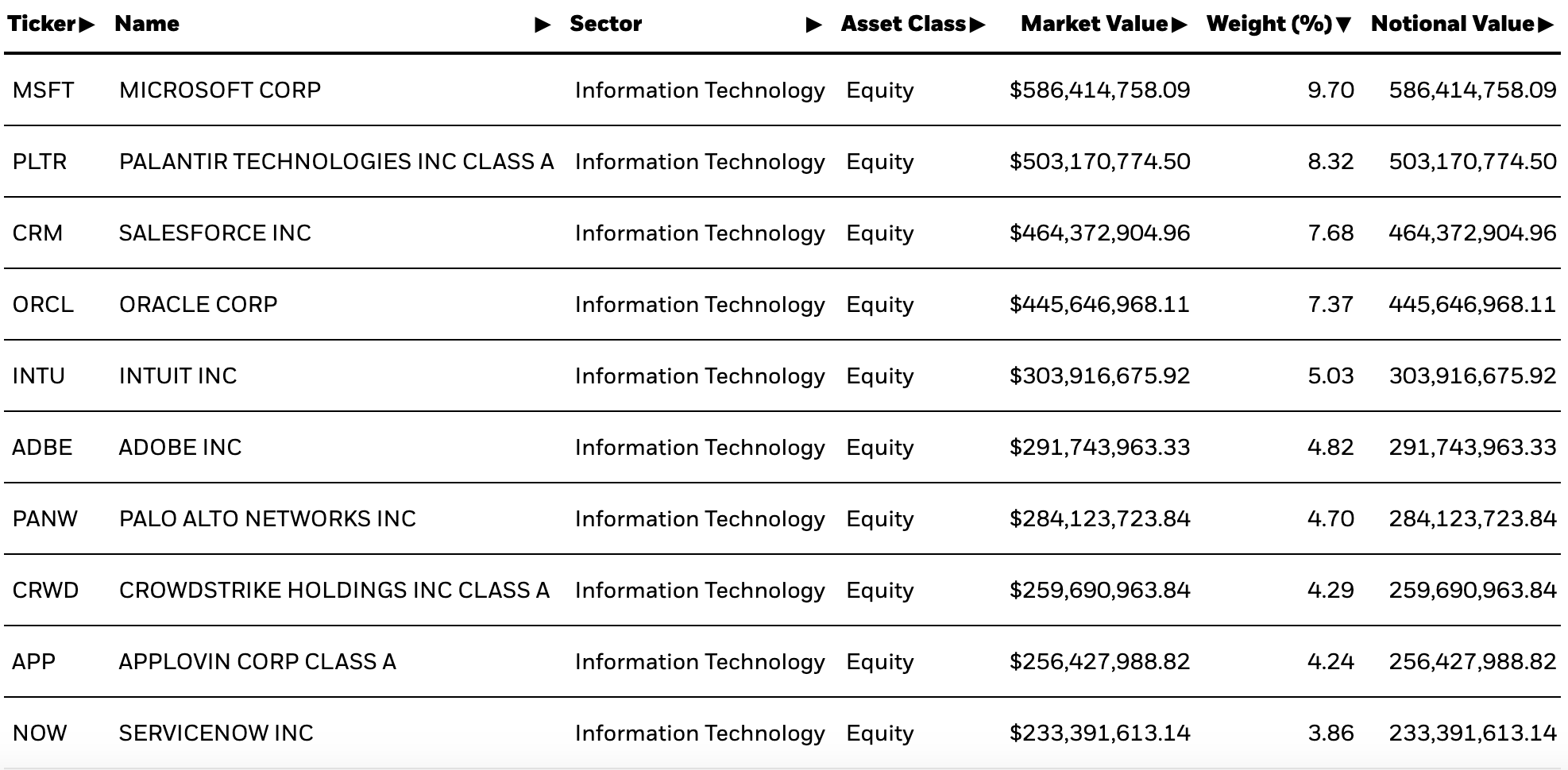

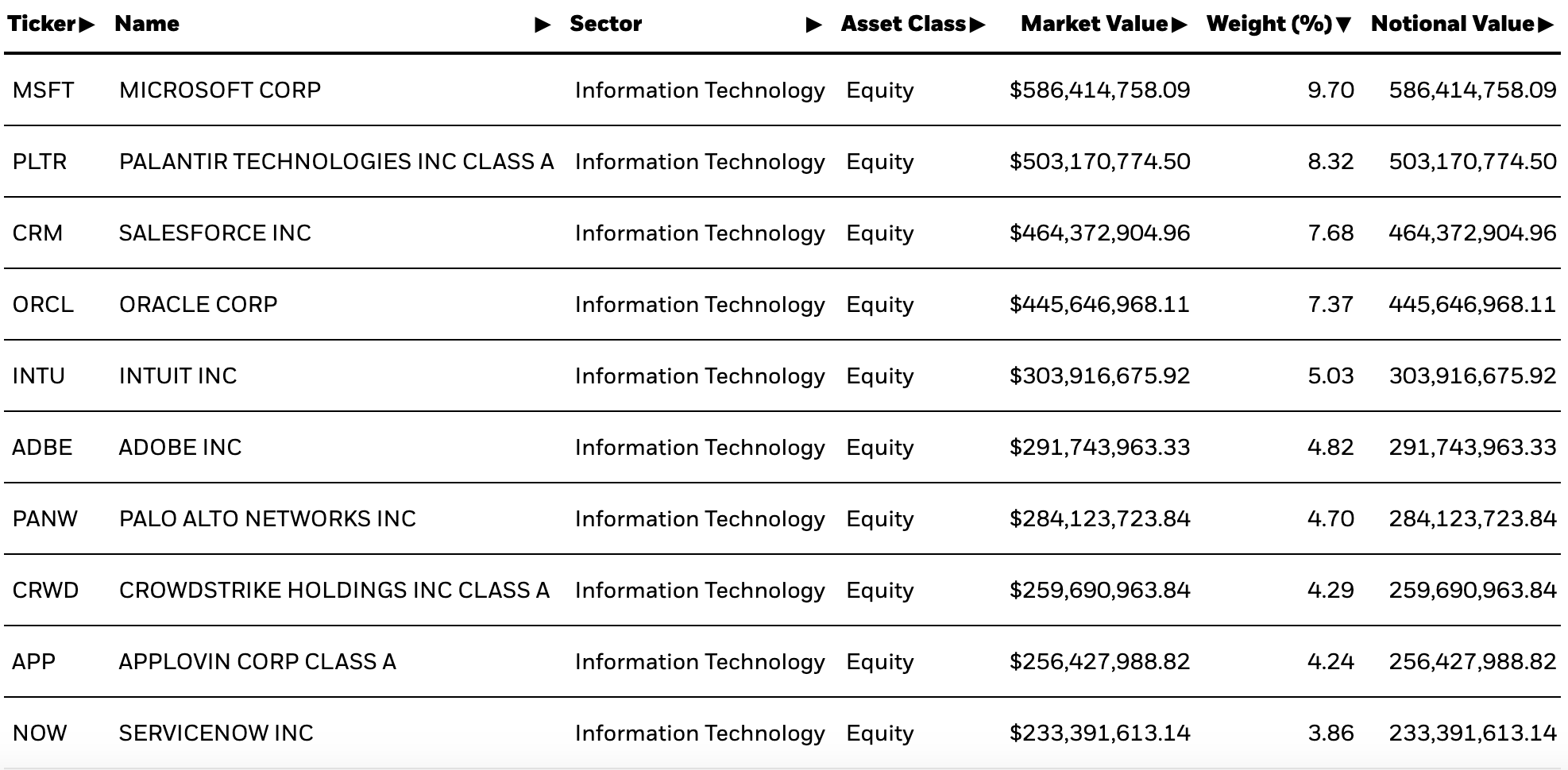

Top 10 IGV holdings

The composition of leading software companies within IGV has shifted. Early-stage SaaS firms no longer dominate the fund; instead, it is led by mega-cap platforms, data analytics, cybersecurity, and established enterprise incumbents with substantial installed user bases. This dynamic increases expectations, as the largest holdings are now required to demonstrate both credible narratives and measurable margin or bookings durability, particularly as investors intensify scrutiny of AI return on investment.

The composition of leading software companies within IGV has shifted. Early-stage SaaS firms no longer dominate the fund; instead, it is led by mega-cap platforms, data analytics, cybersecurity, and established enterprise incumbents with substantial installed user bases. This dynamic increases expectations, as the largest holdings are now required to demonstrate both credible narratives and measurable margin or bookings durability, particularly as investors intensify scrutiny of AI return on investment.

Why IGV ETF Sold Off: The Market’s “AI Payback” Pivot

The recent decline can be attributed to a threefold repricing: adjustments in discount rates, shifts in narrative credibility, and company-specific balance-sheet concerns.

1) Duration math reasserted itself

Software companies typically generate cash flows that are weighted toward future periods, making their valuations particularly sensitive to changes in market discount rates. When investor focus shifts toward immediate earnings and free cash flow, the valuation multiple for recurring revenue contracts rapidly declines. Consequently, even firms with stable customer retention may experience significant declines during periods of macroeconomic repricing. IGV’s profile, with a beta near 1.29 and a sector price-to-earnings ratio in the mid-30s, underscores this sensitivity and indicates limited tolerance for underperformance.

2) AI enthusiasm turned into AI scepticism

A more significant shift has occurred in market narratives. During early-stage cycles, markets tend to reward increased spending; however, in later stages, they penalize expenditures that lack clear monetization pathways. Recent developments highlight this transition, as major technology firms’ planned AI infrastructure investments have renewed concerns about speculative excess and led to substantial declines in market value, prompting investors to question whether capital expenditures are outpacing near-term revenue growth.

3) Single-stock pressure spilled into the ETF

ETF investors sometimes miss how quickly large constituents can drag down the entire basket. Oracle’s slide is a case study: reports tied the broader software sell-off to concerns about AI strategy, debt funding, and reliance on key partnerships, and explicitly noted the iShares Expanded Tech-Software ETF suffering its worst eight-day loss since March 2020.

Simultaneously, corporate actions, such as layoffs, have signalled greater cost discipline. For example, Workday’s workforce reductions occurred alongside declining software stock prices and heightened concerns that AI would alter the value proposition of legacy enterprise tools. During periods of reduced market risk, investors often sell highly liquid proxies first, and IGV is among the most efficient in this regard.

Is This a Cyclical Reset or a Structural Break

The prospect of a recovery depends on whether the software sector’s overall profit pool remains robust.

The structural case for software has not disappeared. Enterprise IT still trends toward subscription delivery, cloud migration is ongoing, and security remains non-discretionary. Even in a slower spending environment, vendors with mission-critical integration points tend to protect revenue better than hardware-heavy cycles.

The primary change lies in how markets value the transition to AI-native workflows:

Winners tend to sit where AI raises switching costs: security platforms, data and observability, developer tooling, and systems of record that can embed AI into decision loops.

Losers are perceived to sit where AI compresses differentiation: narrow workflow tools without unique data, weak platform distribution, or unclear pricing power.

This distinction is significant for IGV, as its largest holdings encompass both platform distribution companies (such as Microsoft, Oracle, Salesforce, and ServiceNow) and firms positioned as AI-driven defensive plays (including Palo Alto Networks and CrowdStrike). Should AI-driven IT spending persist but remain selective, IGV may recover; however, future performance is likely to be more concentrated and driven by earnings rather than broad liquidity trends observed in previous years.

What Would Make IGV Rise Again

A sustained recovery will likely require at least two of the following three conditions: more accommodative financial conditions, enhanced earnings visibility, and a shift in the narrative from viewing AI as a threat to recognising its monetisation potential.

Condition 1: Lower rates or lower term premium

When markets anticipate policy easing, long-duration growth assets often experience valuation re-ratings. Consequently, projections for 2026 frequently associate interest rate reductions with support for technology sector valuations, although investors remain discerning regarding business models. For IGV, the most favorable macroeconomic catalyst is a rate cut without accompanying concerns about economic growth. Conversely, a recession-driven rate-cut cycle may still constrain enterprise budgets and delay software-related transactions.

Condition 2: Proof of AI monetization inside software profit and loss statements (P&Ls)

The debate surrounding capital expenditures is evolving. Recent research increasingly emphasizes the scale of AI investment projected for 2026 and the market’s expectation for demonstrable revenue and productivity improvements. For IGV’s constituents, the implications are clear:

Reaccelerating remaining performance obligations (RPO), bookings, and net retention for core SaaS leaders.

Expansion of AI attach rates that show up as higher ARPU (average revenue per user), not just improved engagement.

Margin resilience as AI compute costs become a managed COGS (cost of goods sold) item rather than a blank check.

Condition 3: A positioning reset that creates asymmetric upside

Deep sell-offs can create technical conditions in which even marginal news sharply improves prices. This can occur before fundamentals shift, as short positions are covered and underweight managers re-enter positions near year-end or quarter-end. However, these rallies may fade if the macro narrative does not stabilize.

Technical Setup: What The Tape is Saying Now

Although technical indicators do not predict earnings outcomes, they offer insight into positioning stress and the risk of market reversals. Current readings indicate a transition from a downtrend to a state of panic.

IGV technical dashboard (daily)

The most actionable signal is the combination of a deeply depressed RSI and price positioned well below the 20-, 50-, and 200-day EMAs. This configuration often produces sharp countertrend rallies, but a trend reversal typically requires consolidation above the 20-day EMA, followed by a higher-low structure that holds above previous pivot supports.

| Indicator |

Value |

Signal |

| RSI (14) |

17.77 |

Oversold bias |

| MACD (12,26) |

-4.70 |

Bearish momentum, improving only if it starts rising |

| EMA 20 |

95.61 |

Price below, bearish |

| EMA 50 |

101.23 |

Price below, bearish |

| EMA 200 |

103.72 |

Price below, bearish regime |

| Trend |

Below key MAs |

Downtrend intact |

| Support / Resistance (classic pivots) |

S3 78.27, S2 81.28, S1 83.34 / Pivot 86.35 / R1 88.41 |

Key levels for mean-reversion tests |

IGV ETF Performance (1 Week, 1 Month, 6 Months)

At the close of trading on February 5, 2026, IGV ended at $79.67, continuing a pronounced decline across several timeframes.

| Period |

Start date (approx.) |

Start price |

End price |

Price change |

Return |

| 1 Week (5 trading days) |

Jan 29, 2026 |

$92.27 |

$79.67 |

-$12.60 |

-13.66% |

| 1 Month |

Jan 5, 2026 |

$103.63 |

$79.67 |

-$23.96 |

-23.12% |

| 6 Months |

Aug 5, 2025 |

$110.55 |

$79.67 |

-$30.88 |

-27.93% |

Frequently Asked Questions (FAQ)

1) What is the IGV ETF?

IGV is an equity exchange-traded fund that tracks a North American software-focused index, providing concentrated exposure to the software and related industries. The portfolio is dominated by large platform and enterprise software companies, comprising over 100 holdings with significant concentration in the top ten positions.

2) Why did IGV fall so sharply?

The drawdown reflects a valuation reset in long-duration growth, as well as a narrative shift from rewarding AI spending to questioning monetization and balance-sheet impacts. Single-stock weakness in major constituents can also transmit rapidly due to IGV’s high concentration in its top ten holdings.

3) Will IGV rise again if the Fed cuts rates?

Lower interest rates may support software sector valuations; however, a sustained recovery generally requires improved earnings visibility and clear evidence that AI features contribute to billable revenue or margin expansion. Rate reductions accompanied by concerns about economic growth may still negatively affect enterprise software demand.

4) Does IGV pay a dividend?

IGV’s yield metrics have been negligible in recent periods, with both its published SEC yield and trailing yield reported as 0.00% in the fund's characteristics. As a result, investors typically utilize IGV for growth exposure rather than income generation.

5) What are IGV’s biggest holdings right now?

The largest holdings in IGV include Microsoft, Palantir, Salesforce, Oracle, Intuit, Adobe, Palo Alto Networks, CrowdStrike, AppLovin, and ServiceNow. Collectively, these positions account for approximately 60% of the fund, significantly influencing both risk and return.

Conclusion

The recent sell-off in IGV ETF does not reflect a judgment on the long-term relevance of software, but rather a repricing of growth assets under more stringent performance expectations. The market now demands clearer evidence of AI-driven returns, greater capital discipline, and sustainable pricing power. Given the ETF’s concentration in a limited number of major platforms and mission-critical vendors, future performance will likely depend more on earnings and forward guidance than on broad liquidity conditions.

Until a recovery materializes, IGV is expected to serve as a high-beta proxy for software sector sentiment, with oversold technical conditions potentially leading to sharp rallies. However, bearish momentum is likely to persist unless the price reclaims key moving averages and establishes higher lows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.