In 2026, Asia hosts some of the world's highest-valued currencies, driven by hydrocarbon wealth, hard pegs, and disciplined monetary frameworks.

For businesses, investors, and traders, the key is to distinguish between a currency's "high face value" and its true underlying strength, because a peg can hold the nominal exchange rate steady even as the country's competitiveness shifts.

The list below shows the purchasing power of $1 in each local currency, represented as an estimated dollar value for 1 unit of currency at mid-January 2026 rates.

Top 10 Asian Countries with High Currency

| Rank |

Country |

Currency |

Approx. Value ($) |

| 1 |

Kuwait |

Kuwaiti Dinar (KWD) |

≈ $3.25 |

| 2 |

Bahrain |

Bahraini Dinar (BHD) |

≈ $2.66 |

| 3 |

Oman |

Omani Rial (OMR) |

≈ $2.60 |

| 4 |

Jordan |

Jordanian Dinar (JOD) |

≈ $1.41 |

| 5 |

Brunei |

Brunei Dollar (BND) |

≈ $0.78 |

| 6 |

Singapore |

Singapore Dollar (SGD) |

≈ $0.78 |

| 7 |

Azerbaijan |

Azerbaijani Manat (AZN) |

≈ $0.59 |

| 8 |

Saudi Arabia |

Saudi Riyal (SAR) |

≈ $0.27 |

| 9 |

United Arab Emirates |

UAE Dirham (AED) |

≈ $0.27 |

| 10 |

Qatar |

Qatari Riyal (QAR) |

≈ $0.27 |

1. Kuwaiti Dinar (KWD)

The strongest currency in Asia and the world, the Kuwaiti dinar's value, around 3.26 USD per KWD, is underpinned by vast oil reserves, strict fiscal controls, and a managed peg to a basket of major currencies.

Its stability reflects Kuwait's disciplined monetary framework and sovereign wealth backing.

2. Bahraini Dinar (BHD)

Trading at approximately 2.66 USD, the Bahraini dinar maintains a tight peg to the U.S. dollar.

The country relies heavily on oil exports and offshore banking, which contribute to a consistent flow of foreign exchange. Robust governmental regulation and economic reforms support the dinar's long-term stability.

3. Omani Rial (OMR)

Valued at about 2.60 USD, the Omani rial is protected by a dollar peg and Oman's conservative fiscal policies.

Although dependent on hydrocarbons, Oman has diversified gradually and maintained confidence in its currency through strong external reserves and moderate inflation.

4. Jordanian Dinar (JOD)

Despite limited natural resources, the Jordanian dinar maintains a solid value of roughly 1.41 USD thanks to a prudent monetary strategy and its fixed link to the U.S. dollar.

Foreign aid, remittances, and tight central bank control provide critical support for the dinar's purchasing power.

5. Brunei Dollar (BND)

Close to being equal to the Singapore dollar, around 0.78 USD per BND, the Brunei dollar's robustness stems from oil and gas earnings and its currency pact with Singapore.

Brunei's small population and high GDP per capita contribute to a strong external balance and low inflation.

6. Singapore Dollar (SGD)

Trading around 0.78 USD, the Singapore dollar is one of Asia's most actively managed currencies.

It benefits from Singapore's robust financial system, low inflation, and diversified export economy. The Monetary Authority of Singapore regulates inflation and growth using a managed exchange-rate band instead of traditional interest-rate targeting.

7. Azerbaijani Manat (AZN)

Azerbaijan's manat, valued at approximately 0.59 USD, is bolstered by its oil and gas exports, as well as increasing investment in non-oil industries.

The central bank maintains stability by managing its reserves and intervening in currency markets when needed.

8. Saudi Riyal (SAR)

Pegged at about 0.27 USD, the Saudi riyal is backed by the Kingdom's oil wealth and the financial strength of Aramco.

Since 1986, the riyal has maintained its fixed rate, supported by large foreign exchange reserves that absorb fluctuations in oil prices.

9. United Arab Emirates Dirham (AED)

The UAE dirham holds steady at roughly 0.27 USD due to its fixed exchange rate and the country's diverse economy.

Dubai's trade, tourism, and finance sectors complement Abu Dhabi's oil wealth, making the dirham one of the most stable currencies in the Gulf.

10. Qatari Riyal (QAR)

Trading close to 0.27 USD, the Qatari riyal is supported by Qatar's vast natural gas reserves and high per-capita income.

Its fixed peg to the U.S. dollar, combined with sovereign wealth funding and consistent trade surpluses, ensures enduring currency stability.

Honourable Mentions: Noteworthy Currencies

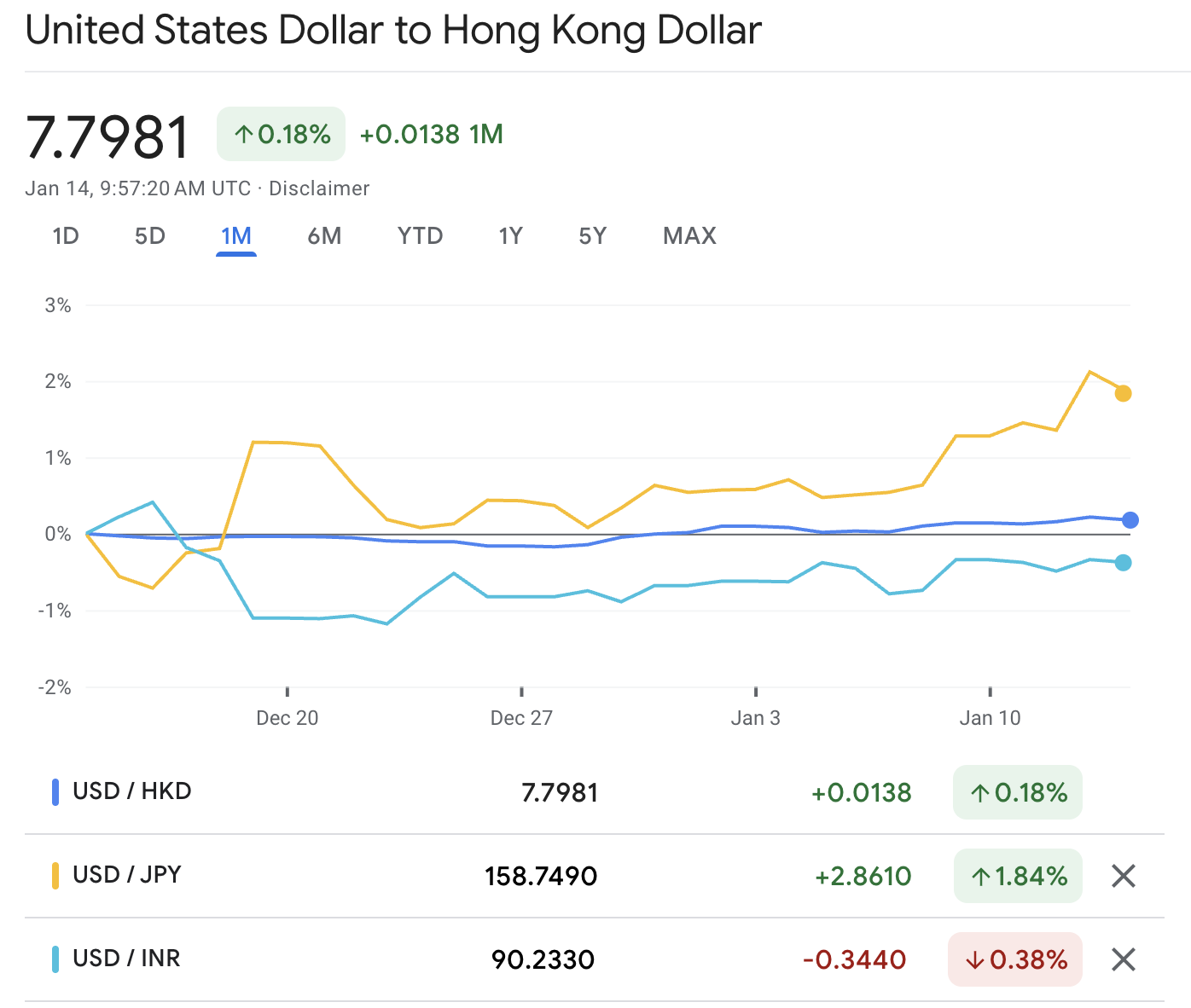

1) Hong Kong Dollar (HKD)

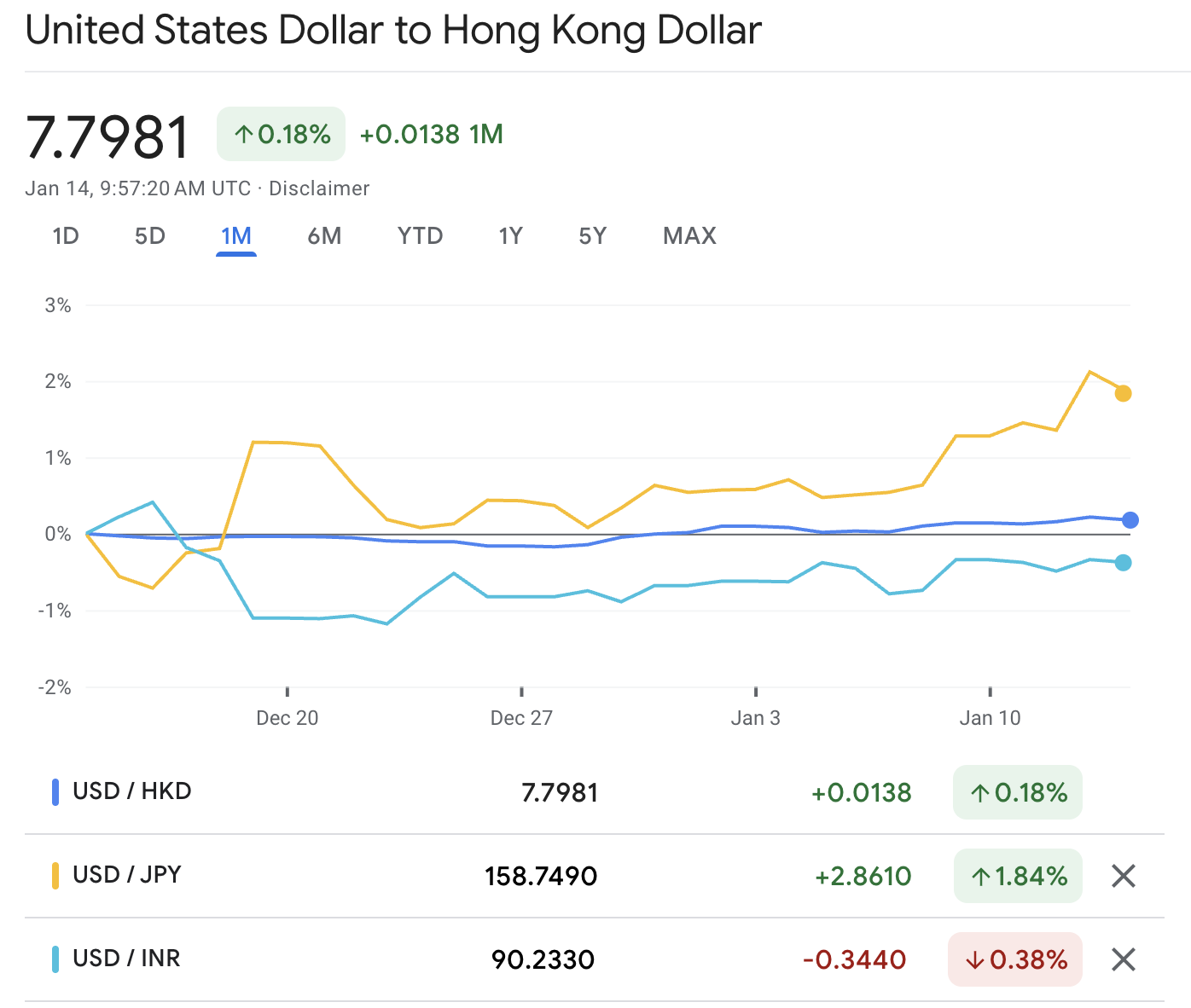

In mid-January 2026, USD/HKD is trading near 7.80, held inside the long-standing 7.75 to 7.85 convertibility zone under Hong Kong's linked exchange rate framework.

That structure keeps HKD stable, but it also means local rates and liquidity conditions can tighten quickly when the currency drifts toward the weak-side boundary.

2) Japanese Yen (JPY)

The yen is not a "high face value" currency, but it remains one of Asia's most systemically important.

In mid-January 2026, USD/JPY is hovering around ¥158 per $1, leaving the yen sensitive to shifts in rate differentials and risk appetite, and keeping official intervention risk in the market's peripheral vision.

3) Indian Rupee (INR)

The rupee may not appear strong in nominal terms, but it remains central to regional trade and capital flows.

In mid-January 2026, USD/INR is trading around ₹90 per $1, with day-to-day direction often influenced by energy prices, portfolio flows, and the global dollar cycle.

What's Changed in 2026?

Nominal rankings at the top remain broadly stable because most of the list is either pegged to the U.S. Dollar or tightly managed.

The more meaningful 2026 change is in the macro backdrop:

The yen is trading in a weaker range near ¥158 per $1

HKD remains pinned near 7.80 inside its convertibility zone

INR is trading around ₹90 per $1.

Those moves matter for hedging costs, import inflation, and cross-border cash-flow planning far more than the "face value" ranking itself.

Asian Currency Outlook into 2026

1. Pegged Currencies Should Remain Steady, but Liquidity Conditions Can Still Swing

For the Gulf bloc and Jordan, the exchange rate is designed to be stable. The real variable in 2026 is not the quoted level, but the domestic financial conditions required to defend it.

When global rates rise or risk sentiment deteriorates, pegged systems typically transmit tighter liquidity and higher funding costs rather than visible FX depreciation.

2. Oil Remains the Hidden Driver Behind "Strong Currency" Narratives in West Asia

Because hydrocarbon revenue underpins fiscal strength and external balances, oil-market conditions still play a major role in shaping confidence in the region's currency pegs and overall policy credibility.

The pegs may not move, but forward pricing of fiscal comfort and reserve adequacy often does.

3. Asia Ex-Gulf Is Where the Action Is Likely to Stay

Singapore and Brunei should remain relatively resilient because both currencies are supported by credible policy frameworks and strong external positions, with Brunei's dollar effectively anchored to Singapore's via the long-running Currency Interchangeability Agreement.

Japan's yen, by contrast, remains highly sensitive to shifting policy expectations and volatility, since USD/JPY has been trading in the mid-to-high 150s, where rate differentials and intervention risk can quickly drive large moves.

India's rupee is likely to trade as a managed, flow-driven currency around prevailing levels, with its risk skew tied to energy prices and global dollar strength.

Frequently Asked Questions (FAQ)

1. Which Is the Strongest Currency in Asia in 2026?

The Kuwaiti dinar remains the most valued currency in Asia, exchanging at approximately $3.25 for 1 KWD in mid-January 2026.

2. Does a "Strong Currency" Mean a Country Is Economically Stronger?

Not necessarily. A high face value often reflects policy design, such as pegs, redenominations, or limited float, rather than competitiveness. True strength is better assessed through inflation, productivity, current-account dynamics, and real effective exchange rates.

3. Why Do Several Top Asian Currencies Barely Move Year to Year?

Many are fixed or tightly managed against the U.S. Dollar, so stability is the goal.

Conclusion

In 2026, the headline ranking still favours currencies with managed regimes and strong external backing. However, the more useful takeaway is what sits behind the face value: policy credibility, reserve depth, and the ability to absorb shocks without importing inflation.

In West Asia, oil-linked fiscal capacity continues to reinforce confidence in long-standing pegs, while Singapore and Brunei remain supported by disciplined frameworks and stable external balances.

The real edge for investors, businesses, and traders in 2026 is reading the regime: knowing which exchange rates are engineered to stay stable (via pegs or managed floats), where volatility is most likely to break out, and how changes in the global dollar cycle can ripple through trade, liquidity, and cross-border flows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.