A carry trade is a trading strategy built on interest rates rather than short-term price moves.

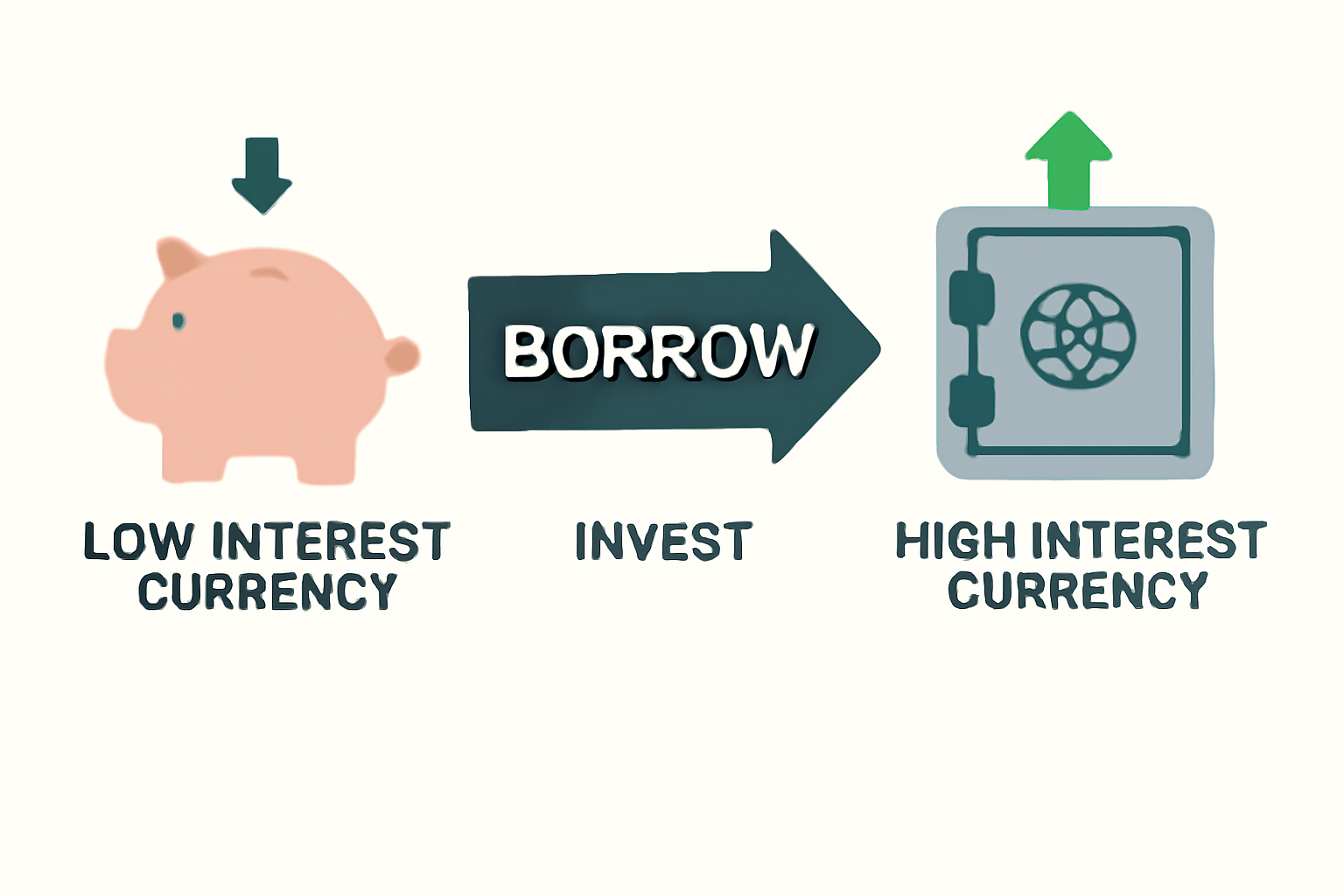

Traders borrow a low-interest currency and invest in a higher-interest one, aiming to earn the interest rate difference over time. This approach is common in the forex market during stable, risk-on conditions when central bank policies are predictable.

While carry trades can generate steady income through daily swap payments, they also expose traders to exchange rate risk. Understanding how carry trades work helps traders see why interest rates, market sentiment, and currency stability matter as much as price direction.

Definition

A carry trade is a forex trading strategy where a trader borrows money in a currency with a low interest rate and uses it to buy a currency offering a higher interest rate. The goal is to earn the interest rate difference, known as the carry, while also being exposed to movements in the exchange rate.

Carry trades are often used in calm, stable market conditions where interest rate policies are predictable.

What Carry Trade Means In Trading

In trading, a carry trade involves selling a low-yielding currency and buying a higher-yielding currency. The trader earns the interest rate difference, often called the carry, for as long as the position remains open.

Some trades aim to profit from price moves. A carry trade aims to profit from time itself, by earning interest while holding a position.

Carry trades are usually held for days, weeks, or even months. Traders monitor both interest rates and exchange rates closely. If the higher-yielding currency weakens sharply, price losses can outweigh the interest earned.

How To Use Carry Trade

Choose the Pair: Look for a high-yield currency (e.g. USD) to buy and a low-yield currency (e.g. JPY or CHF) to borrow.

Borrow the Low-Yielding Currency: Through your broker, you borrow or short the low-interest currency.

Buy the High-Yielding Currency: Use the borrowed funds to invest in the higher-interest currency.

Hold the Trade: As long as the interest rate difference remains favourable and the exchange rate is neutral or positive, you collect the carry.

Carry trades are mostly used in spot forex but also apply across futures and options markets.

Practical Example

Let's say you borrow the equivalent of $10,000 in Japanese yen at an interest rate of 0.5%. You convert that to US dollars and invest in a USD-denominated asset yielding 5% interest.

But here's the catch: if the US dollar weakens against the yen significantly, you'll lose when converting back even if you earned the interest.

Extended Example With Exchange Rate Risk

Assume you converted to USD when USD/JPY = 150

One year later, USD/JPY drops to 140

When converting back to yen, you receive fewer yen per dollar, which could severely reduce or even wipe out your gains

When Carry Trades Work Best and When They Don't

Carry trades influence how traders choose currencies, position size, and holding period. Because profits build over time, patience and discipline matter more than fast execution.

Carry trades also expose traders to sudden risk. A single sharp move can wipe out weeks of interest income. This makes risk management essential, especially during major news events.

Best Conditions:

Stable or rising interest rate spreads

Minimal exchange rate volatility

Predictable central bank policies

General “risk-on” market sentiment

Worst Conditions:

High volatility or “risk-off” sentiment

Unexpected currency depreciation

Central bank rate reversals or interventions

Global financial crises or liquidity shocks

Popular Carry Trade Pairs

Some currency pairs are favoured for carry trades due to their rate differentials and relative liquidity:

| Currency Pair |

Reason for Popularity in Carry Trades |

| AUD/JPY |

Historically wide interest rate gap and strong activity during the Asian trading session |

| NZD/JPY |

Attractive carry yield combined with a relatively liquid forex market |

| USD/ZAR |

Very high interest rate differential, but with elevated political and currency risk |

| TRY/JPY |

Extremely high yield potential, paired with severe volatility and rapid price swings |

Note: Emerging market currencies offer higher yields but come with political and liquidity risks that make them best suited to experienced traders.

Common Misconceptions or Mistakes

Ignoring exchange rate risk: Many focus only on interest rates but forget that changing exchange rates often matter more.

Assuming carry profits are guaranteed: Even if the interest rate spread is positive, a currency decline can wipe out gains.

Using too much leverage: Because returns can feel slow, traders may use heavy leverage and get wiped out by small exchange rate moves.

Missing the market environment: Carry trades don't suit all market conditions. They're high risk during uncertain or fast-changing times.

Risk Management Tips for Carry Trading

Use stop-loss orders to protect against adverse currency moves

Avoid excessive leverage, especially across volatile pairs

Monitor interest rate announcements from central banks

Keep track of correlation between currencies and other markets (e.g. equities)

Scale in or out of positions rather than going all-in upfront

Know when to exit: carry trades can unwind fast if the market turns

Pros and Cons of a Carry Trade

| Pros of Carry Trades |

Cons of Carry Trades |

| Can generate income in flat or slow-moving markets |

Vulnerable to exchange rate fluctuations |

| Works best in stable economic conditions |

Central bank decisions can quickly reverse the trade |

| Simple concept and widely used across forex markets |

Using leverage increases both gains and losses |

| Many trading platforms support carry trade strategies |

Sudden unwinds can be rapid and severe |

Carry Trades and Global Markets

Large institutions like hedge funds and investment banks actively use carry trading strategies. When carry trades are popular, they can:

Strengthen high-yielding currencies due to large inflows

Put pressure on low-yielding currencies, often used as funding sources

Cause fast reversals when there's a global risk-off event, as seen during the 2008 financial crisis and early COVID-19 periods

An unexpected risk event can cause mass exits from carry trades, known as a carry trade unwind, which often results in sharp currency moves, especially for emerging markets.

Related Terms

Central bank: The institution that sets interest rates and monetary policy, which directly influences whether a carry trade is attractive or risky.

Interest rate: The cost of borrowing or return on holding a currency, which determines the income earned in a carry trade.

Exchange: A marketplace where currencies and other assets are traded, allowing carry trades to be opened and closed.

Exchange Traded Fund (ETF): A traded fund that can offer exposure to currencies or interest rate differences, sometimes used to gain indirect carry trade exposure.

Yield: The income earned from holding an asset or currency, which carry trade strategies aim to capture over time.

Market To Market: The process of valuing an asset based on its current market price, rather than its past cost.

Frequently Asked Questions (FAQ)

1. What is the main purpose of a carry trade?

The main purpose of a carry trade is to earn steady income from the interest rate difference between two currencies while holding the position over time. Traders rely on stable exchange rates so that interest income is not offset by adverse price movements.

2. Is carry trade only used in forex markets?

Carry trades are most visible in forex because currencies have clear interest rates and daily swap payments. Similar strategies also exist in bond markets and other assets where investors borrow at low rates and invest at higher yields.

3. Do carry trades always make money?

No. Carry trades can perform well for long periods but are vulnerable to sudden reversals. A sharp currency move or an unexpected central bank decision can erase months of interest income in a short time.

4. Are carry trades suitable for beginners?

Carry trades require patience, risk awareness, and an understanding of interest rates and market sentiment. Beginners should approach them cautiously, use small position sizes, and avoid relying on carry income alone.

5. Why do carry trades fail during market crises?

During market stress, investors tend to move away from higher-yielding assets and toward safer currencies. This shift causes high-yield currencies to fall quickly, forcing carry trades to unwind and amplifying losses.

Final Thoughts

Carry trades can be a useful long-term strategy when market conditions are right. But they come with inherent risks, especially from currency fluctuations and central bank shifts. You need to watch two fronts: interest rates and exchange rates, and manage your exposure accordingly.

They're not set-it-and-forget-it strategies. Smart use of risk controls, position sizing, and market awareness turn a basic strategy into a professional one.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.