Asia–Pacific equities climbed on Monday as traders increasingly priced in a Federal Reserve rate cut in December, buoying risk appetite across the region. The rally was driven by dovish signals from influential Fed officials, softer US data expectations and a marked re-pricing in fed funds futures, though currency and geopolitical risks kept investors wary.

Markets at a glance

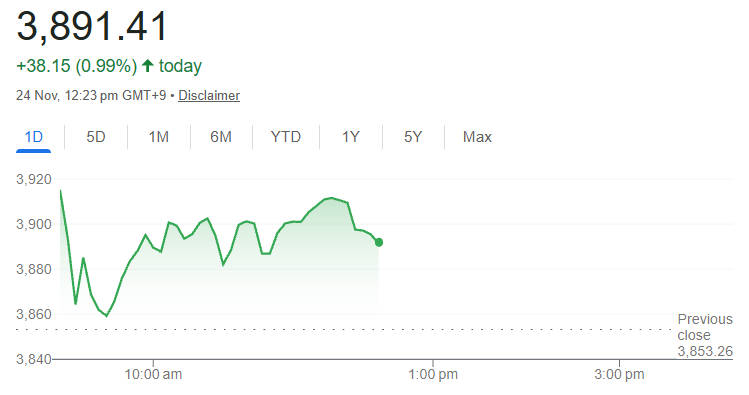

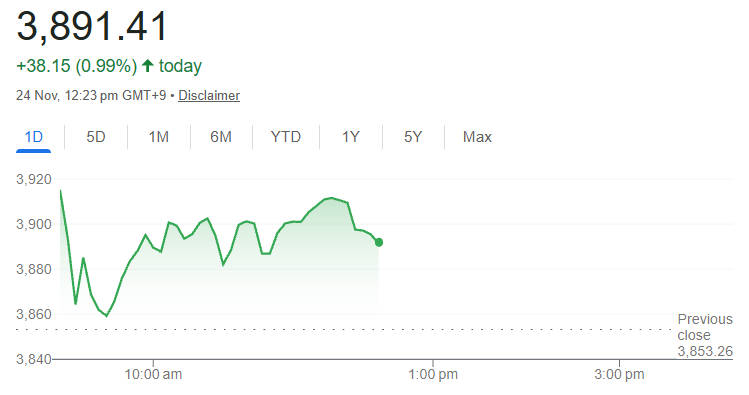

MSCI's broad Asia–Pacific index (ex-Japan) and several national bourses opened firmer, with technology and growth names among the chief beneficiaries.

US equity futures rose, signalling positive spillovers into European markets.

US Treasury yields eased slightly as traders pushed up the probability of a December cut; different market gauges put the odds in the mid-50s to mid-60s per cent range.

Fed Policy Signals and Their Role in the Asia–Pacific Equities Rebound

The primary catalyst was a series of comments from US Federal Reserve officials, most notably New York Fed President John Williams, that were taken by markets as indicating openness to a near-term easing of policy. Those remarks, together with cooler inflation readings and signs of a moderating labour market, prompted a material shift in futures pricing.

Key drivers:

Dovish Fed rhetoric that left traders more confident of a December cut.

Softer inflation expectations and the prospect that incoming US data (retail sales, PPI) could reinforce a dovish tilt.

Profit-taking and bargain buying in beaten-up technology and semiconductor stocks, which typically benefit when rates fall.

Regional Winners and Laggards in the Asia–Pacific Equities Rebound

Performance across Asia–Pacific was mixed but broadly positive, with notable cross-market nuances:

1.Winners and positive flows:

-

South Korea (KOSPI):

Strength in chip-related names lifted the index, as investors bet on stronger profit multiple expansion under a lower-rate outlook.

-

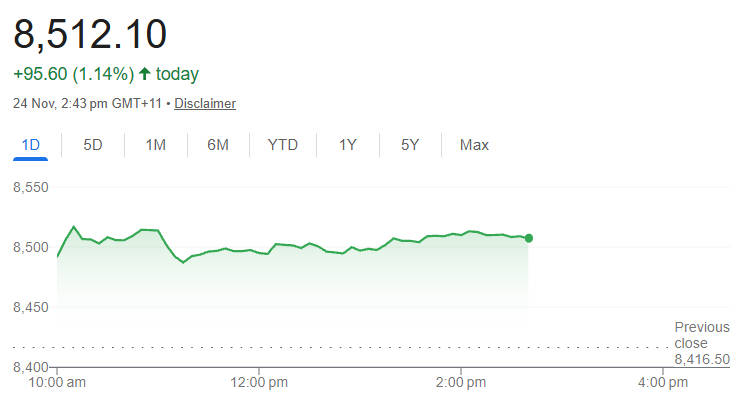

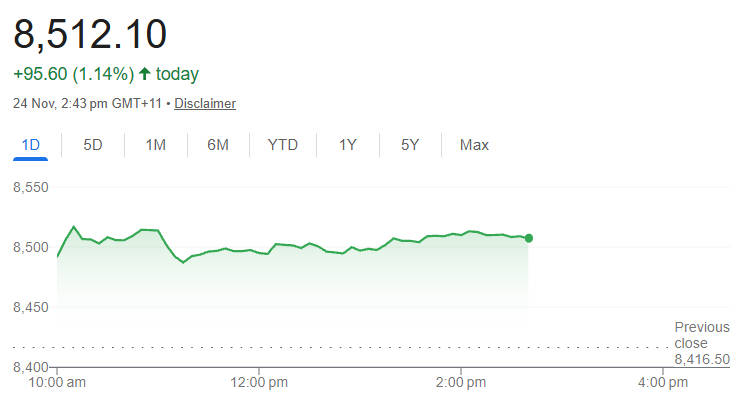

Australia (ASX 200):

Resource stocks and cyclicals advanced on the improved risk backdrop.

-

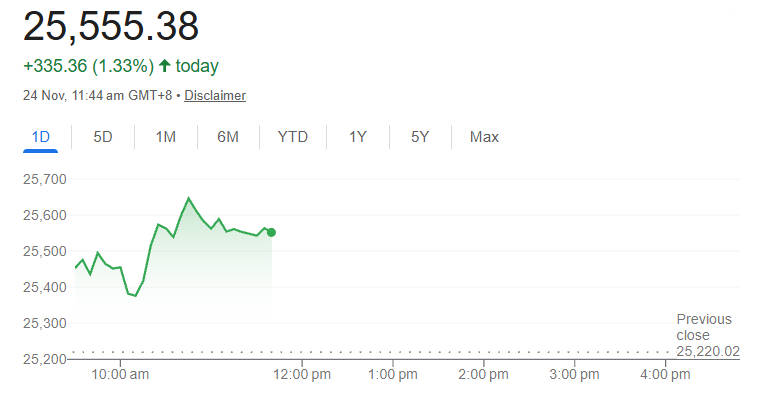

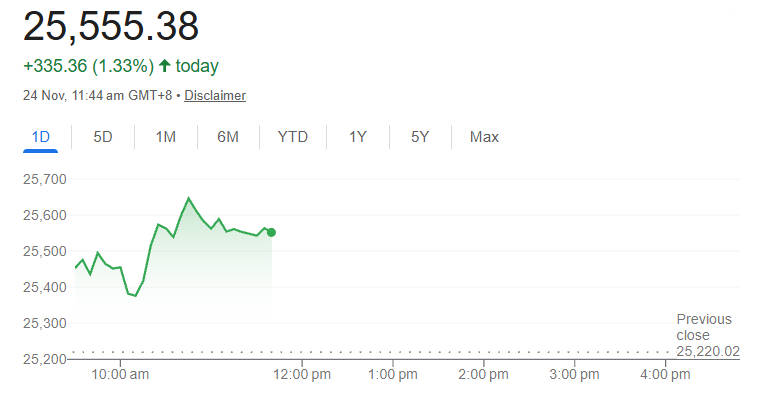

Hong Kong:

Tech-heavy segments saw renewed interest, lifting the Hang Seng in early trade.

2. Laggards / watch points:

Mainland China:

Some mainland chipmakers continued to struggle after sector-specific weakness, leaving mainland indices more subdued.

Japan:

Markets were quieter due to a public holiday, which reduced regional liquidity and masked larger directional moves.

3. Sectoral picture (quick bullets):

Technology and semiconductors: renewed buying interest after recent sell-offs.

Financials: mixed — beneficiaries of the growth rebound but sensitive to yield curve moves.

Resources and energy: steadier, though oil prices remained influenced by separate geopolitical developments.

How Yen Movements Shaped the Asia–Pacific Equities Rebound

Although equities rallied, fixed income and FX markets underlined persistent cross-market tensions:

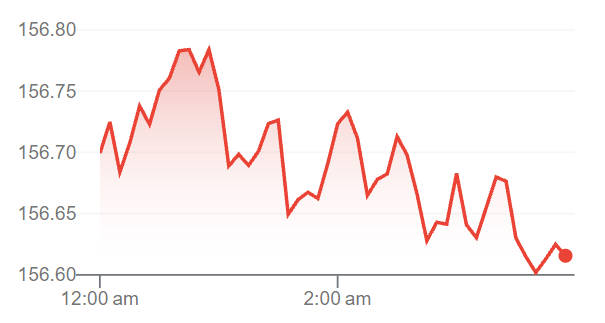

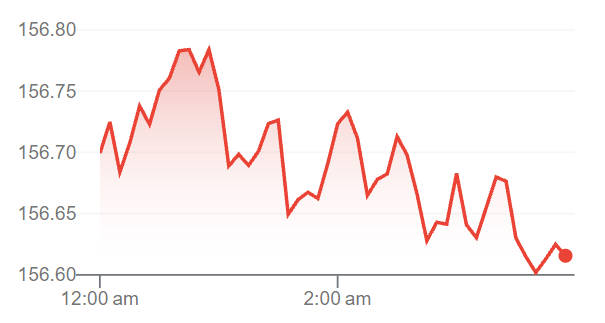

Yen:

The Japanese yen stayed close to multi-month lows against the dollar, increasing speculation that Japanese authorities might step in to halt the currency's decline. Such action could significantly alter regional capital flows if it happens.

US Treasuries:

Yields retreated modestly as fed funds futures priced a higher probability of a 25-basis-point cut in December; however, the exact odds varied across data providers (mid-50s to mid-60s per cent).

Other EM FX:

Currencies such as the Indian rupee drew attention for downside risk amid mixed domestic liquidity and growth cues.

Macro Risks That Still Hover Over the Asia–Pacific Markets

While the immediate market reaction was positive, several conditional risks could quickly reverse the rally:

Stronger-than-expected US data:

A surprise pickup in inflation or labour metrics would reduce the likelihood of a December cut and could prompt a rapid repricing.

Currency intervention:

Official action to support the yen or curtail depreciation would shift cross-border capital flows and could weigh on equity markets in the short term.

Geopolitical shocks:

Renewed tensions or abrupt developments in energy-sensitive regions could push commodity prices higher and squeeze corporate margins.

Investor Strategies During an Asia–Pacific Equities Rebound

US retail sales and producer-price index (PPI) data due this week, which is critical for the Fed's December calculus.

Any further comments from Fed officials that refine the likely timing and magnitude of cuts.

Currency moves and any signals of intervention from Japan or other authorities.

Look at company earnings, especially from leading technology and semiconductor firms, to gauge underlying demand trends.

Navigating Opportunities with Caution in the Rebound

The shift in market pricing makes a compelling case for selective exposure to growth-sensitive assets, but the position should be measured:

Long-term investors:

A lower policy rate backdrop can support equity valuations, particularly growth and technology sectors; however, maintain adequate diversification and currency hedges where relevant.

Short-term traders:

Be alert to rapid reversals if data contradicts current expectations. Tight risk controls and stop-loss discipline are advisable.

Fixed income investors:

Falling yields could provide near-term capital gains, but consider duration exposure carefully if the cut timetable is uncertain.

FX watchers:

Monitor yen moves closely — intervention risk could create sudden market dislocations.

Conclusion

The Asia–Pacific equity rebound reflects an important market re-pricing around the Fed's policy path in December. While optimism has returned to risk assets, the rally remains contingent on a stream of economic data and central-bank rhetoric. Investors should therefore treat gains as conditional, maintain clear risk parameters and watch currency markets, particularly the yen, for signs of a more structural shift in cross-border capital flows.

Frequently Asked Questions

1. Why did Asia–Pacific equities rebound today?

Asia–Pacific equities rebounded because traders increased expectations of a December Federal Reserve rate cut. Softer US data signals, dovish Fed commentary and easing Treasury yields improved global risk appetite, lifting technology, semiconductor and cyclical sectors across regional markets.

2. What has driven expectations of a December Fed rate cut?

Expectations rose after comments from key Fed officials suggested openness to a near-term policy shift. Combined with cooling US inflation and signs of a slower labour market, futures markets priced in a higher probability of easing before year-end.

3. Which Asia–Pacific markets gained the most?

South Korea's KOSPI and Australia's ASX outperformed, supported by strength in technology and resource shares. Hong Kong also saw selective gains in tech. Mainland Chinese markets were more mixed, with some chipmakers still under pressure after recent sector-specific weakness.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.