On October 20. 2025. Japan's Nikkei 225 index achieved a historic milestone by surpassing the 49.000-point mark for the first time in its history.

This unprecedented surge marks a significant achievement for Japanese equities, reflecting a confluence of political developments, investor optimism, and macroeconomic factors.

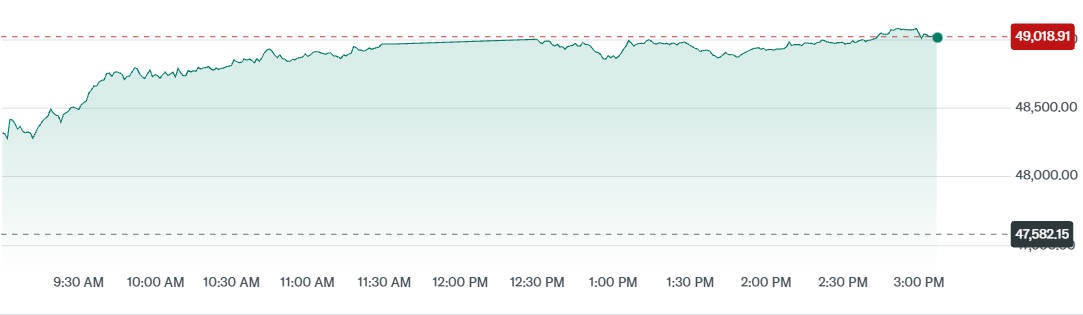

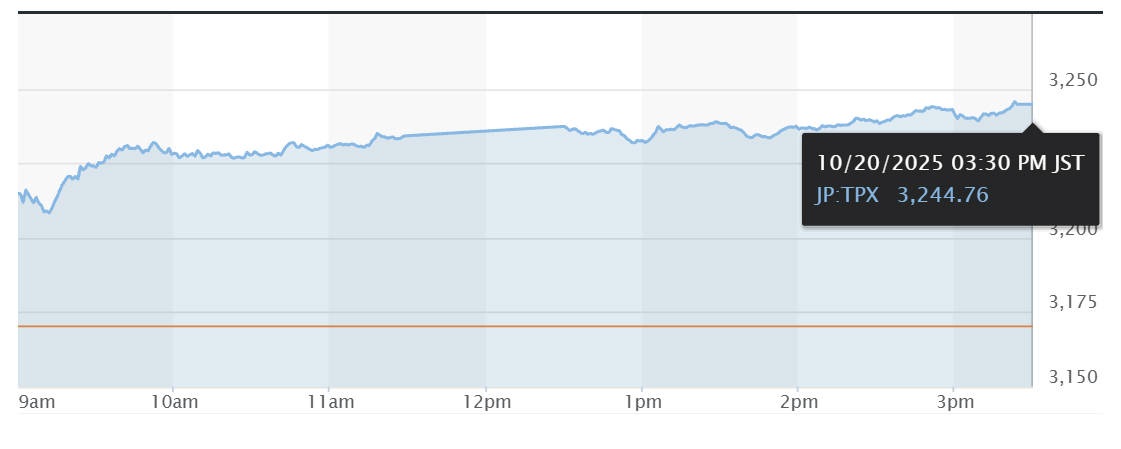

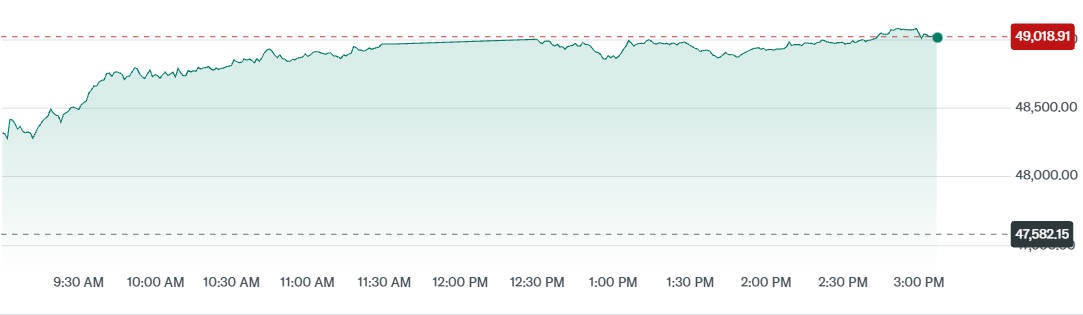

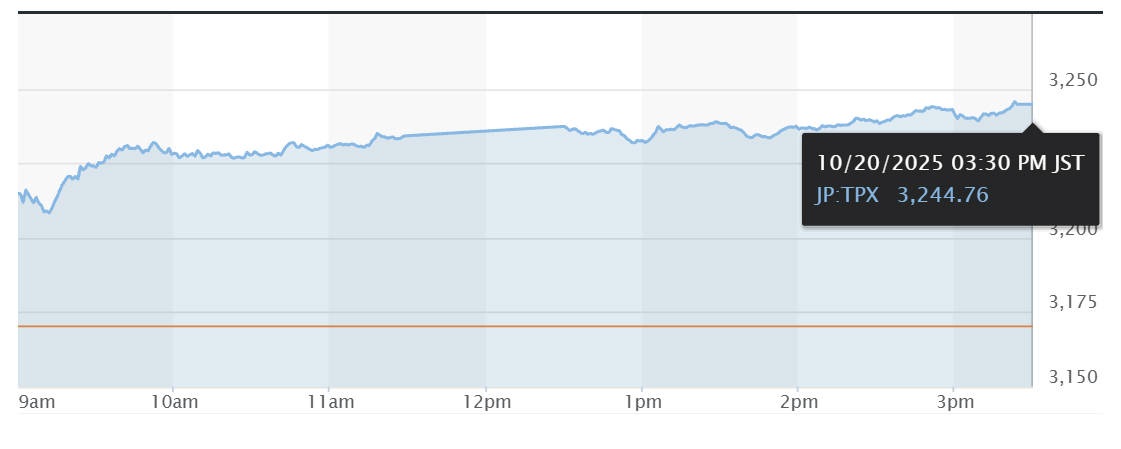

Nikkei 225 Historic Performance Overview: Breaking 49.000 Points

Trading volume exceeded 1.5 billion shares, reflecting strong investor participation. Exporters and technology stocks led the rally, with semiconductor and automotive sectors recording notable gains.

Historical Context

The previous record high for the Nikkei 225 was 48.597.08. achieved on October 9. 2025.[2] The recent surge represents a 0.83% increase from the previous high, highlighting the market's robust momentum.

Primary Catalysts Driving the Nikkei 225 Surge

1. Political Developments

1) New Coalition Government:

Reports indicate that Japan's ruling Liberal Democratic Party (LDP) has secured a coalition agreement with the Japan Innovation Party (JIP), paving the way for Sanae Takaichi to become Japan's first female prime minister.

2) Policy Expectations:

Investors anticipate that Takaichi's administration will implement pro-market policies, including fiscal stimulus measures and maintaining accommodative monetary policies.

2. Economic Indicators

1) GDP Growth:

Japan's economy continues to show resilience, with recent data indicating steady growth, bolstering investor confidence.

2) Currency Movements:

The Japanese yen weakened against major currencies, particularly the US dollar, which is beneficial for Japan's export-driven economy.

3. Global Market Trends

1) Asian Market Rally:

Positive developments in other Asian markets, such as China's economic performance and easing US-China trade tensions, contributed to a favourable regional investment climate.

Sector and Industry Contributions to Nikkei 225's Rally

1. Export-Oriented Industries

1) Automotive Sector:

Companies like Toyota and Honda experienced significant gains, benefiting from a weaker yen that enhances the competitiveness of their products abroad.

2) Technology and Semiconductor Stocks:

Firms such as Sony and Tokyo Electron saw their stock prices rise, driven by strong global demand for electronic components.

2. Domestic Consumption

1) Retail and Consumer Goods:

While the rally was broad-based, sectors like retail and consumer goods showed more modest gains, reflecting ongoing domestic consumption patterns.

Investor Behaviour and Market Dynamics Behind Nikkei 225 Gains

Short- and Long-Term Implications for the Nikkei 225

1. Short-Term Outlook

1) Market Volatility:

While the immediate outlook is positive, investors should remain cautious of potential short-term volatility due to global economic uncertainties.

2) Policy Monitoring:

Close attention will be paid to the new government's policy announcements and their impact on market dynamics.

2. Long-Term Considerations

1) Structural Reforms:

The anticipated implementation of structural reforms under the new administration could lead to sustained economic growth and further market gains.

2) Global Economic Conditions:

Japan's economic performance will also be influenced by global economic trends, including trade relations and technological advancements.

Conclusion

The Nikkei 225's historic rise above 49.000 points signifies a pivotal moment for Japanese equities, driven by political clarity, economic resilience, and investor optimism.

As Japan embarks on a new political era, the market's performance will serve as a barometer for the effectiveness of forthcoming policies and their impact on the broader economy.

Nikkei 225 Key Metrics and Top Contributors

| Date |

Closing Value |

Daily Change |

Percentage Change |

| 9-Oct-25 |

48,597.08 |

1,200.00 |

2.50% |

| 20-Oct-25 |

49,000.23 |

403.15 |

0.83% |

Frequently Asked Questions

Q1: What is the Nikkei 225?

The Nikkei 225 is Japan's leading stock index, tracking 225 of the largest and most actively traded companies on the Tokyo Stock Exchange.

Q2: Why is surpassing 49.000 points important?

It is the first time the index has reached this level, marking a historic milestone and signalling strong investor confidence.

Q3: What caused the recent surge?

The rally was driven by political clarity with a new coalition government, robust corporate earnings, and increased foreign investment inflows.

Q4: Which sectors contributed most to the gains?

Export-oriented industries, technology and semiconductor companies, and major automotive firms led the index higher.

Q5: Does this mean the market will continue rising?

While the outlook is positive, short-term volatility is possible, with future moves influenced by government policies, global economic conditions, and currency fluctuations.

Sources:

[1]https://apnews.com/article/stocks-markets-rates-china-japan-trump-dcb8d28227c71f8bf0d565e910b73972

[2]https://www.japantimes.co.jp/business/2025/10/20/markets/nikkei-rally-ldp-jip-coalition/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.