Every four years, Bitcoin experiences a significant milestone known as halving. This event is one of the most crucial and unique occurrences in the cryptocurrency landscape. It's built into Bitcoin's code and shapes its supply, profitability for miners, and long-term investment thesis.

The next Bitcoin halving is anticipated to occur at block 1,050,000, which is projected to happen around March or April 2028.

Historically, halvings have preceded major price rallies, but they are not a guarantee of immediate gains. This guide breaks down what halving means, how countdowns work, implications for mining, price, investors, and what to watch ahead of 2028.

What Is Bitcoin Halving and Why Does It Exist?

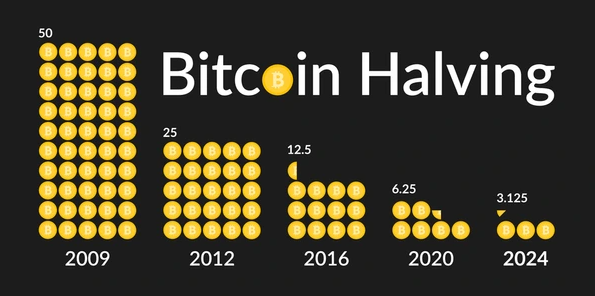

When Bitcoin (BTC) launched in 2009, miners received 50 BTC per block for validating and adding a block to the blockchain. The protocol comes with a rule: every 210,000 blocks (approximately every four years), the reward is halved (known as a "halving").

This mechanism serves three purposes:

Scarcity enforcement: By reducing issuance over time, Bitcoin mimics finite resources (like gold) and resists inflation.

Predictability: Unlike fiat currencies, where money supply can expand unpredictably, BTC's issuance schedule is fixed and transparent.

Miners' incentive transition: As rewards shrink, miners increasingly rely on transaction fees and network economics rather than issuance.

The halving process will continue until all 21 million bitcoins have been created, a milestone projected for the year 2140.

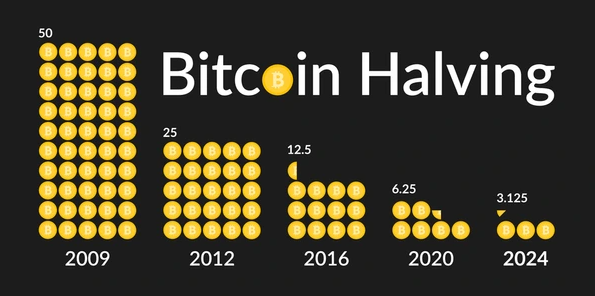

Historical Bitcoin Halving Timeline

| Halving # |

Block height |

Reward before |

Reward after |

Approximate date |

| 1st |

210,000 |

50 BTC |

25 BTC |

Nov 28 2012 |

| 2nd |

420,000 |

25 BTC |

12.5 BTC |

Jul 9 2016 |

| 3rd |

630,000 |

12.5 BTC |

6.25 BTC |

May 11 2020 |

| 4th |

840,000 |

6.25 BTC |

3.125 BTC |

Apr 20 2024 |

| 5th (expected) |

1,050,000 |

3.125 BTC |

1.5625 BTC |

~Mar–Apr 2028 |

2012 Halving

Block reward cut from 50 to 25 BTC.

Bitcoin price post-halving: Rose from $12 to $1,100 in a year.

Aftermath: First major bull run.

2016 Halving

Reward cut from 25 to 12.5 BTC.

Price: Approximately $650 at halving, reached a high of over $19,000 by the close of 2017.

Aftermath: Led to massive retail interest and the ICO boom.

2020 Halving

Reward cut from 12.5 to 6.25 BTC.

Price at halving: Approximately $8,600, reached a high of over $68,000 in late 2021.

Aftermath: Sparked the rise of mainstream adoption and institution-led rally.

2024 Halving

On April 20, 2024, the reward was reduced to 3.125 BTC.

Immediate Effect: Short-term market volatility, followed by a recovery and sharp rally later in 2024.

Set the stage for the upcoming 2028 event.

2028 Halving (Upcoming)

Expected to occur between March 24 and April 4, 2028, at Block 1,050,000.

Miners receive 1.5625 BTC for each new block instead of 3.125 BTC.

The daily supply of new Bitcoins has decreased from 450 BTC to approximately 225 BTC, assuming a block time of 10 minutes.

By 2028, it is estimated that around 97% of Bitcoin's 21 million cap will have been mined, leaving roughly ~480,000–500,000 BTC yet to be issued. After that, new issuance slows dramatically as block rewards are halved, with full issuance projected only by around 2140.

Network security: Miners increasingly rely on transaction fees as subsidies shrink.

Countdown to the 2028 Bitcoin Halving: When and What to Watch?

Estimated date

Present trackers project the next halving to occur between March and April 2028, with some anticipating it as soon as March 24, 2028, or potentially later.

The exact date depends on the average block time, which can vary (the target is ~10 minutes per block, but the real world is slightly different).

Blocks Remaining & Network Statistics

Current block reward: 3.125 BTC per block (after 2024 halving).

Target block height: 1,050,000

At present, there are ~ hundreds of thousands of blocks remaining until halving.

Why the Countdown Matters

Investor psychology: Numerous participants view halving as a trigger for price increases, potentially leading to pre-halving surges.

Mining economics: Miners plan ahead for a reduction in reward; margins get tighter, and the cost of production matters more.

Market timing & speculation: Traders and institutions might prepare before the halving, leading to heightened volatility both prior to and following the event.

Given that the 2028 date is still years away, this stage is more about strategic planning than immediate moving parts.

What Happens When Bitcoin Halving Occurs? Supply, Price and Miners

1. Supply Reduction & Inflation Rate

The reduction in block rewards decreases the number of new Bitcoins entering circulation. With fewer new coins available, the growth of their issuance slows down, which increases scarcity, assuming demand remains stable or continues to rise.

For instance, after the 2024 halving, the block reward will decrease to 3.125 BTC. After the 2028 halving, it will be approximately 1.5625 BTC.

This also gradually reduces the inflation rate for BTC.

2. Price Performance

Price behaviour after past halvings

After the 2012 halving, Bitcoin rallied 93x within a year.

After the 2016 halving, BTC surged 29x in the subsequent 17 months.

Following the 2020 halving, BTC achieved record peaks over $68,000, driven by institutional investments and widespread adoption.

According to some trackers, the typical peak occurs 12 to 18 months after the halving.

3. Mining Economics & Network Security

Miners bear the immediate cost: same operational costs (electricity, hardware) but half the reward. If BTC price doesn't adjust upward, some miners with high costs may shut down, reducing hash rate/supply capacity, which could affect network security or transaction speeds.

Furthermore, miners increasingly rely on transaction fees as the subsidy from issuance decreases over time, a structural shift.

Potential Scenarios for Bitcoin Halving 2028

Base

Halving happens around April 2028.

Price approaches the halving event with a moderate rally, stabilises for several months, and then experiences a secondary up-leg if demand continues to grow.

Post-halving, miners adapt, hash rate dips, then recovers, supply reduction helps price, but external factors (macro/regulation) moderate the impact.

Bull

Strong institutional adoption and favourable macro (weak USD, high inflation, regulatory clarity).

Pre-halving price significantly higher (say 12–18 months ahead), halving triggers media/market momentum, post-halving rally into new ATHs.

Mining cost structural improvement (renewables, efficiency) supports miner survival even at lower rewards.

Bear

Pre-halving momentum weak (macro headwinds, regulation pushback).

Halving already priced in; post-halving, there is a pullback or flat performance.

Mining costs are increasing, leading to a decline in hash rate, heightened network pressure, and a change in perception regarding BTC as a safeguard against inflation.

In such a scenario, the price might stagnate or decline around the event.

What Traders and Investors Should Focus On Ahead of 2028

Indicators to Watch

Hash rate & mining difficulty

Block reward trends & miner profitability

BTC issuance trends

Demand metrics

Macro environment

Regulatory environment & infrastructure

Strategy Considerations

Long-term holders ("HODLers"): View halving as a key part of Bitcoin's scarcity narrative. Adopt a systematic approach to accumulation (dollar-cost averaging) instead of trying to time the market.

Traders (short/medium term): Monitor volatility and positioning; pre-halving rallies may offer opportunities but also risk pullbacks (profit taking).

Mining & infrastructure investors: Evaluate cost curves, hardware efficiency, jurisdictional risks, and regulatory support as post-2028 economics tighten.

Position Sizing & Risk Control

Because the halving effect is uncertain and markets may already price it in, allocate only what you can afford to hold through major drawdowns. Avoid over-leveraging purely on the "halving will make price go up" assumption.

Frequently Asked Questions

1. Why Does Bitcoin Halving Matter for Investors?

Because halving reduces new supply (issuance), and if demand continues or grows, scarcity typically supports higher prices.

2. Is the Halving Itself a Guarantee of Price Rise?

No. While past cycles saw significant gains, many other factors matter (demand, macro, regulation).

3. When Exactly Is the Next Bitcoin Halving?

he next halving is estimated when block height reaches ~1,050,000, likely in March–April 2028.

4. Should I Buy Bitcoin in Anticipation of the Halving?

If you decide to invest, consider using dollar-cost averaging instead of trying to time a single market event.

Conclusion

In conclusion, the 2028 Bitcoin halving is a significant structural event as it enforces scarcity and is baked into Bitcoin's monetary model.

Thus, prepare early, size prudently, monitor relevant indicators, and remember that timing and execution matter. Whether you're a long-term holder, trader or miner, the next few years leading to 2028 will be a period of heightened interest and potential. Staying informed and disciplined will make the difference.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.