A crypto CFD is a derivative contract that lets you speculate on the price movements of cryptocurrencies without owning the underlying coins. It offers flexibility to go long or short and to use leverage, but it is higher risk than owning spot crypto due to volatility, leverage and counterparty exposure.

Below, this article will unpack how crypto CFDs work, the benefits and hazards, practical trading strategies, how to choose a broker, and why and how EBC Financial Group appears in this market.

What is a Crypto CFD?

A CFD, or contract for difference, is a derivative agreement between a trader and a broker in which the parties exchange the difference in the price of an underlying asset from the time the contract is opened to the time it is closed.

With a crypto CFD you take exposure to the price movement of a cryptocurrency such as Bitcoin or Ethereum, but you do not own the coin, nor do you take custody of private keys. CFDs allow traders to speculate on both rising and falling prices.

Because CFDs are derivative instruments published and priced by a broker, the terms of the contract, available leverage and the cost structure are set by the broker. That means trading conditions vary between providers and you should check the contract specifications carefully before trading.

How Crypto CFD Trading Works

1. Market access and instruments

Crypto CFDs typically cover major coin pairs such as BTC/USD, ETH/USD and increasingly a broader range of altcoins and crypto indices offered by brokers. The CFD mirrors the underlying market price, enabling traders to buy (go long) if they expect prices to rise or sell (go short) if they expect prices to fall.

2. Leverage and margin

Most CFD trades use margin, meaning you deposit a fraction of the position value to gain larger market exposure. Leverage multiplies both profits and losses. Some brokers advertise very high leverage for crypto CFDs.

For example, EBC Financial Group's product information shows leverage offerings up to 200 times on Bitcoin CFDs. Use of such leverage greatly increases risk and requires robust risk management.

3. Costs you should expect

Typical costs in crypto CFD trading include the spread (difference between buy and sell prices), overnight financing or swap fees for positions held past the trading day, and in some cases commissions. Because CFDs are a broker-mediated product, spreads and overnight charges vary substantially by provider.

4. Execution and platform features

Brokers provide the trading platform and execution. Platforms commonly offer order types such as market, limit, stop-loss and take-profit, plus tools for margin monitoring and account risk controls.

Some brokers also provide 24/7 crypto CFD markets because the underlying crypto markets operate round the clock. EBC states its crypto platform operates 24 hours a day, seven days a week.

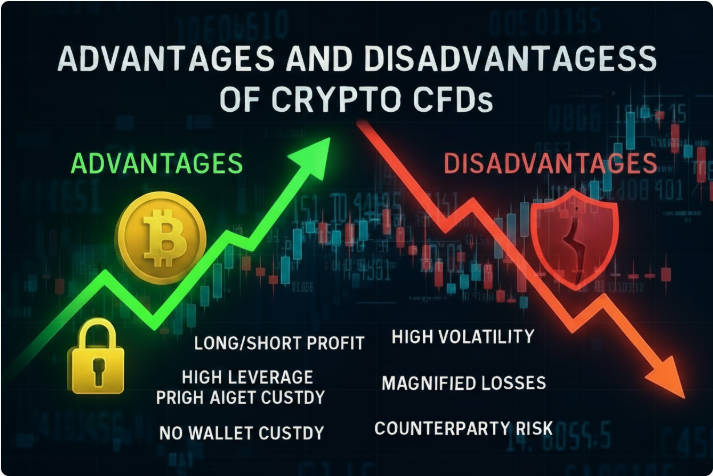

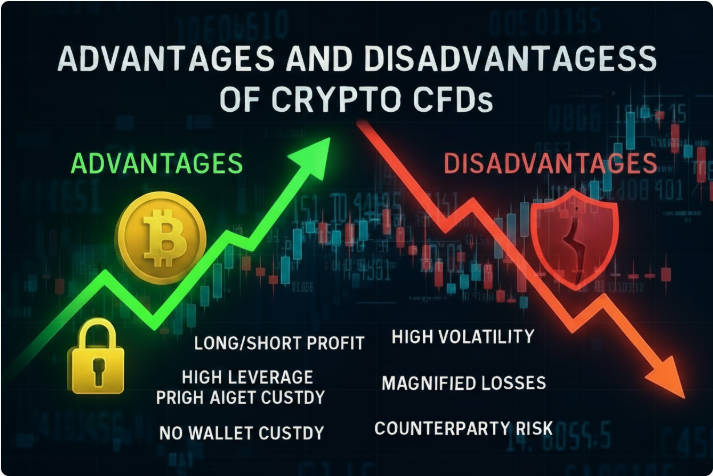

Key Advantages of Crypto CFDs

Ability to go long and short. CFDs allow profit from both rising and falling markets without owning the underlying asset.

Leverage to increase market exposure. Margin trading lets traders control larger positions with smaller capital, though risk grows accordingly.

No wallet custody or private keys. Traders avoid technical custody issues, exchange hacks, or having to manage keys.

Access to regulated broker protections in some jurisdictions. Where brokers are regulated, retail clients may benefit from segregation of client funds or other protections, depending on the regulator and jurisdiction.

Hedging capability. CFDs can be used to hedge spot crypto positions without moving the underlying holdings.

Major Risks and Challenges of Crypto CFDs

High volatility. Cryptocurrency prices can move very quickly, producing large gains or losses. Volatility combined with leverage is particularly hazardous.

Leverage magnifies losses. With margin, losses can exceed your initial deposit unless the broker has negative balance protection. Always check margin call and liquidation policies.

Counterparty and broker risk. Because CFDs are contracts with a broker rather than ownership of an exchange-traded asset, you are exposed to the broker's solvency and execution practices. Regulation and the broker's operational quality matter here.

Regulatory uncertainty and jurisdictional limits. Some regulators restrict or ban CFDs for retail clients, or set strict leverage caps. The legal availability of crypto CFDs depends on local rules.

Costs and overnight financing. Spreads and financing charges for holding positions overnight can be significant and will erode returns if positions are held long term.

How to Pick a Reputable Broker

Selecting a broker is a critical step. Important criteria are licensing and regulation, transparent fees, clear margin terms, platform stability, execution quality and client support. Below is a compact, factual snapshot to help your evaluation.

| Selection factor |

Why it matters |

EBC Financial Group notes |

| Regulatory status |

Regulation provides oversight and, depending on jurisdiction, protections such as client fund segregation |

EBC Financial Group operates through multiple entities with regulatory relationships: EBC Financial Group (UK) Ltd is authorised by the UK Financial Conduct Authority (FCA), EBC Financial Group (Cayman) Ltd is regulated by the Cayman Islands Monetary Authority (CIMA) and the group also lists an Australian entity authorised by ASIC. Check the specific entity you will trade with for the applicable licence and terms. |

| Product offering |

Confirm the exact crypto CFD instruments, leverage and contract specs |

EBC's product pages indicate they offer crypto CFD products and advertise up to 200x leverage on Bitcoin CFDs, and 24/7 crypto trading. Confirm contract details on the trading agreement for the entity in your jurisdiction. |

| Fees and execution |

Low spreads and reliable fills matter for trading cost and slippage |

EBC promotes competitive pricing and DMA pricing on some liquidity products. Always review published spreads, overnight funding formulas and any commission table applicable to your account type. |

| Client protections |

Segregation of funds, negative balance protection and complaint handling are vital |

EBC's corporate materials emphasise regulated subsidiaries and group-level compliance. Specific client protections differ by regulated entity and jurisdiction; check the client agreement for details and the local regulator's register. |

| Platform & support |

Platform stability, order types and support hours affect live trading |

EBC lists multi-asset platforms and 24/7 crypto trading capabilities. Verify demos and test execution quality in practice. |

Recent developments and EBC's crypto offering

EBC has been expanding its crypto CFD offering and in October 2025 announced the addition of Bitcoin CFDs to its multi-asset portfolio, positioning the product as a regulated gateway for clients seeking crypto exposure via CFDs.

At the same time EBC markets high leverage options for experienced traders and 24/7 market access, which is consistent with the nature of the underlying crypto markets.

These product features make it important to verify margin rules, liquidation thresholds and whether the broker provides negative-balance protection.

Trading strategies and risk management

1. Common strategies

Day trading and scalping. Take short-term positions to capture intraday volatility. Requires fast execution and strict risk controls.

Swing trading. Hold positions for several days to play short trends, using technical analysis to set entries and exits.

Hedging. Use CFDs to offset downside in a spot crypto portfolio without liquidating the underlying asset.

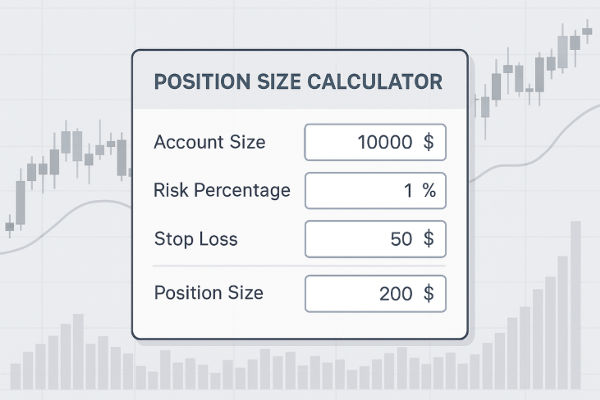

2. Essential risk controls

Position sizing. Define a fixed percentage of capital to risk per trade.

Use of stop-loss orders. Set stop-losses and respect them.

Limit leverage. Avoid maximum advertised leverage unless you fully understand its implications. Brokers such as EBC may offer high leverage but that does not mean high leverage is suitable for every trader.

Understand overnight financing. Factor swap or funding costs into any multi-day trade plan.

Practical example: opening a Bitcoin CFD trade

This example is illustrative and uses rounded numbers.

Account equity: 1.000 USD

Bitcoin price at entry: 50.000 USD per BTC

Desired exposure: 0.1 BTC = 5.000 USD notional

Required margin at 10x leverage: 500 USD (assuming broker margin requirement 10 percent)

Price moves up to 52.000 USD (4 percent increase). Profit on notional = 5.000 * 0.04 = 200 USD. Profit relative to your margin = 200 / 500 = 40 percent gain on margin.

Conversely, a 4 percent adverse move would be a 40 percent loss of margin. With higher leverage the percentage effect on margin increases proportionally. Always check margin maintenance and auto-liquidation thresholds.

Crypto CFD Versus Owning the Cryptocurrency

| Feature |

Crypto CFD |

Owning crypto (spot) |

| Ownership |

No, you hold a contract with a broker |

Yes, you hold the coin and private keys |

| Ability to short |

Yes |

Only via derivatives or lending on some exchanges |

| Leverage |

Common, set by broker |

Usually not available on spot wallets without borrowing |

| Custody risk |

Exposed to broker counterparty risk |

Exposed to wallet security and exchange risk |

| Staking / yield |

Not available |

Possible through staking or DeFi services |

| Trading hours |

Often 24/7 for crypto CFDs |

24/7 on exchanges |

| Regulatory protections |

Dependent on broker's jurisdiction |

Dependent on exchange and self-custody choices |

Snapshot of EBC Financial Group Regulatory Coverage and Product Notes

| Jurisdiction / Entity |

Regulator / License |

Notable points |

| EBC Financial Group (UK) Ltd |

Financial Conduct Authority, UK (FCA) |

FCA registration cited by EBC; trading under this entity benefits from UK conduct rules where applicable. |

| EBC Financial Group (Cayman) Ltd |

Cayman Islands Monetary Authority (CIMA) |

CIMA licensed; group announced CIMA licensing and expansion of regulated services. |

| EBC Financial Group (Australia) Pty Ltd |

Australian Securities and Investments Commission (ASIC) |

Listed as an Australian regulated entity, though EBC warns that not all products are provided by the Australian entity. Check the trading entity. |

| Product notes |

— |

EBC advertises 24/7 crypto CFD trading and up to 200x leverage on Bitcoin CFDs. Confirm entity-specific contract details before opening an account. |

When to use crypto CFDs and when not to

Use CFDs when you want to speculate on short to medium term price moves, require the ability to short, or want leveraged exposure without the technicalities of wallet custody. CFDs are also convenient where a regulated broker can offer a single, consolidated trading environment for multiple asset classes.

Avoid CFDs if you want long term ownership benefits such as staking, participation in on-chain governance, or if you prefer absolute control of your keys and assets. Also avoid CFDs if you cannot tolerate rapid losses caused by leverage and crypto volatility.

Conclusion

Crypto CFDs are powerful derivative tools that provide flexible exposure to the digital asset market without custody of the underlying coins. They enable shorting and leverage but bring increased counterparty, regulatory and leverage risks. Choosing a reputable, well regulated broker and understanding the contract specifications is critical.

EBC Financial Group is one of the multi-jurisdiction brokers offering crypto CFDs, advertising 24/7 trading and significant leverage; however, protections and contract terms vary by the legal entity you trade with, so verify the entity, read the client agreement and confirm margin and negative-balance policies before trading.

Frequently Asked Questions

Q1: What's the main difference between trading a crypto CFD and buying crypto?

With CFDs, you trade price movements via a broker without owning the coins. Owning crypto gives you custody, staking rights and on-chain access, while CFDs offer leverage and shorting flexibility.

Q2: Can I lose more than my deposit trading crypto CFDs?

Yes. Leverage can magnify losses beyond your deposit. Some brokers offer negative balance protection, but always confirm the coverage and margin rules.

Q3: Is trading crypto CFDs legal in my country?

It depends on your regulator. Some countries ban or restrict retail CFDs or limit leverage. Check both your local rules and your broker's terms.

Q4: How does my choice of broker, such as EBC Financial Group, matter?

Brokers set spreads, leverage and protections. EBC offers 24/7 crypto CFD trading and high leverage, but terms vary by entity, so verify its regulation and client agreement before trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.