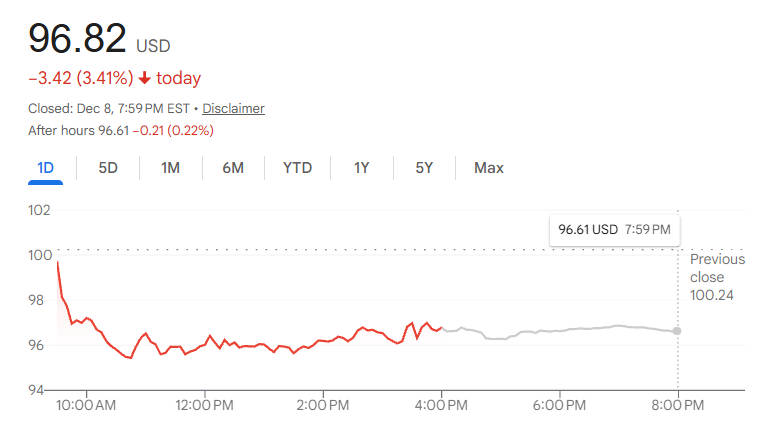

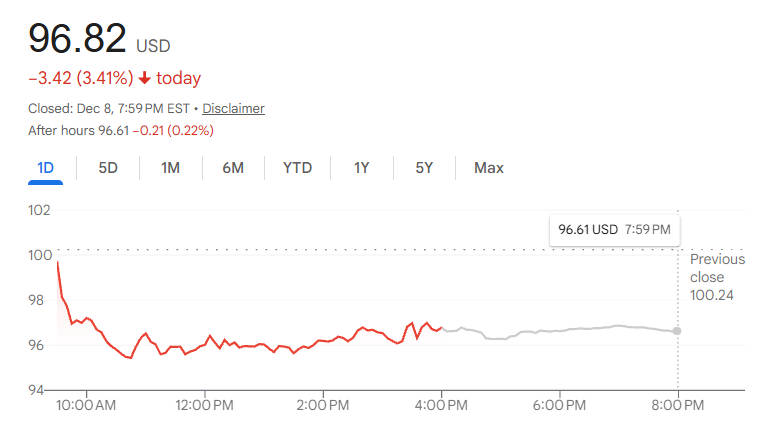

As of December 8, 2025, Netflix shares closed at $96.82, down $3.42 (–3.41%), a noticeable slide that reflects investor unease following the announcement that Paramount Skydance has launched a hostile all-cash bid for Warner Bros. Discovery (WBD).

This move threatens to derail Netflix's recent deal with Warner Bros and has created fresh uncertainty in the streaming and media sector.

What Changed: From Netflix's Deal to Paramount's Aggressive Counter

Just days earlier, Netflix announced an agreement to acquire Warner Bros' studios and streaming business. That deal was valued at roughly $82.7 billion, offering Warner shareholders $27.75 per share (a mix of cash and Netflix stock).

In contrast, Paramount came forward with an all-cash offer of $30.00 per share for the entire Warner Bros. Discovery company — including its streaming, studio, and cable/network assets. This values WBD at about $108.4 billion including debt.

Paramount argues its bid gives more cash and greater certainty, avoiding the volatility tied to stock-price fluctuations inherent in Netflix's deal structure.

Moreover, Paramount claims its offer would face fewer regulatory hurdles and could close faster — whereas combining Netflix and WBD raises serious antitrust concerns given their dominant streaming market share.

Why Netflix Stock Slid — Market & Analyst Reaction

Investors responded swiftly and negatively. The ~3.4% drop in Netflix's share price reflects several concerns:

Value uncertainty:

Netflix's deal depends partly on its own stock value and future performance, a risk many investors now see as bigger amid the bidding war.

Regulatory risk:

A Netflix–WBD merger could create a streaming giant controlling a large share of global SVOD subscribers, likely triggering antitrust scrutiny.

Integration and execution risk:

Netflix has never executed a large-scale acquisition. Combining two massive companies, with studios, streaming, cable, and networks, brings complexity, cultural integration challenges, and operational risk.

Better cash offer for WBD shareholders:

Because Paramount's all-cash offer comes with a higher upfront per-share price, some investors believe WBD shareholders might flip, threatening Netflix's deal altogether.

Additionally, given the elevated risk now baked into the equation, some analysts have reacted by lowering Netflix's price targets and re-evaluating whether the original merger makes sense.

The Stakes: Strategic, Regulatory & Industry Implications

This is potentially a major reshuffling of the entertainment industry and key stakes include:

Content dominance & IP libraries:

For Netflix, acquiring Warner Bros content (studios, franchises, HBO, etc.) was a bold play to shore up its content pipeline, giving it access to major franchises, films, and show libraries.

Winning the full company vs. partial assets:

Paramount's bid for the entire WBD, including networks and cable channels, might appeal to shareholders who prefer immediate cash and full liquidity instead of stock + future risk.

Regulatory and antitrust scrutiny:

Whether Netflix or Paramount wins, regulatory scrutiny will likely follow. For Netflix, combining its streaming service with WBD’s would potentially give it a massive share of SVOD and film-studio market.

For Paramount, the consolidation of cable networks, news channels, streaming and studios under one roof could prompt divestitures or delays.

Impact on competition, creators, and consumers:

Paramount argues its offer is "pro-consumer," preserving competition, supporting theaters, content creators and talent, while warning a Netflix-WBD merger could hurt pricing, reduce theatrical output, and concentrate power.

What Happens Next: Key Variables to Watch

Shareholders' decision at Warner Bros. Discovery:

The WBD board must review Paramount's tender offer and they have about 10 business days to respond. That decision could determine whether Netflix's deal stands or the bidding war heats further.

Regulatory scrutiny:

Even if shareholders accept one offer, antitrust authorities, in the U.S. and abroad, will likely examine the implications of major consolidation in content, production, distribution, and cable networks.

Break-fees and legal consequences:

If WBD accepts Paramount's bid instead of Netflix's, there may be substantial break-fees or lawsuits. Similarly, Netflix and Paramount must prepare for legal and regulatory challenges.

Industry-wide ripple effects:

The outcome could reshape which companies dominate streaming, content production, theatrical releases, and global distribution — impacting competitors, creators, theaters, and consumers alike.

Frequently Asked Questions

Q: Why did Netflix stock fall today?

A: Investors reacted negatively to the new all cash one hundred eight billion dollar bid from Paramount. The offer threatens Netflix's pending deal for Warner Bros and increases uncertainty around valuation, integration challenges and regulatory approval.

Q: What does Paramount's offer include compared to Netflix's?

A: Paramount's offer is entirely cash at thirty dollars per share for the full Warner Bros Discovery group including studios, streaming and cable networks. It provides more immediate liquidity than Netflix's combination of cash and stock.

Q: Why do some view Paramount's bid as safer?

A: Paramount argues a full cash offer reduces exposure to volatile stock movements, shortens the potential timeline to closing and avoids complex deal structures. This can make regulatory approval and final payout more predictable for shareholders.

Q: What are the main risks for a Netflix and Warner Bros merger?

A: The merger increases dominance in both streaming and content production which may attract regulatory scrutiny and antitrust concerns. Integrating two very large media organisations also brings cultural challenges, financial pressure and significant operational risk.

Q: What could happen to the entertainment industry if Paramount wins?

A: A combined Paramount and Warner Bros entity could reshape the sector by controlling major studios, streaming platforms, cable channels and networks. This consolidation may reduce competitive diversity but could also create stronger investment capacity for content creation.

Conclusion

Netflix's stock slide to $96.82 highlights how dramatically Paramount's $108B all-cash bid has reshaped the battle for Warner Bros. Discovery. The bidding war now threatens Netflix's strategic ambitions, intensifies regulatory pressure and raises execution risks. With shareholders and regulators preparing to weigh in, the fight for Warner Bros. has become a defining moment for the future of global streaming, and the outcome could redraw the entire entertainment landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.