The world of trading never stops reinventing itself. Once, traders watched stock tickers and shouted across exchange floors. Today, they analyse price flows that move faster than a blink, where opportunity and volatility coexist. At the centre of this new frontier stands Bitcoin, the most recognised digital asset in the world. And in 2025, the most efficient way to capture its movement may not involve holding it at all, but trading it through CFDs.

CFD Bitcoin bridges traditional finance and digital innovation, letting traders capture Bitcoin’s price moves without owning coins or managing wallets. It applies classic trading, buying when prices should rise and selling when they may fall, while offering modern speed, precision, and secure, continuous market access.

What Is CFD Bitcoin

A Contract for Difference, or CFD, is a financial product that allows traders to speculate on the price of an asset without actually owning it. When trading CFD Bitcoin, you are buying or selling based on whether you expect the Bitcoin price to move up or down. Your profit or loss is determined by the difference between the opening and closing prices of your position.

With CFD Bitcoin, you trade the price instead of owning or storing the coin. EBC Financial Group extends this by letting traders go long or short in real time, and all positions settle in fiat, avoiding wallet theft, lost keys, or blockchain delays.

EBC Financial Group offers CFD trading for Bitcoin and other major cryptocurrencies 24 hours a day, seven days a week. You can start with a small deposit of around six US dollars and a minimum trade size of 0.01 lot. This accessibility makes CFD Bitcoin suitable for both new and experienced traders seeking to participate in the world’s most active digital market.

Why CFD Bitcoin Fits the 2025 Trading Landscape

Bitcoin remains one of the most actively traded assets globally, with an average daily turnover exceeding 20 billion US dollars on major exchanges. In 2025, its relevance has grown even further as institutional adoption continues through regulated exchange-traded funds, and as retail traders embrace advanced derivatives like CFDs.

This year’s environment is defined by volatility. Bitcoin’s average daily range fluctuates between 2.5 and 3.5 percent, compared to around 1 percent for major equity indices such as the S&P 500. The CBOE Volatility Index, often seen as a proxy for global risk sentiment, remains elevated above its 10-year median, reflecting continued macro uncertainty and geopolitical risk.

In such a climate, instruments that allow both long and short exposure are essential. CFD Bitcoin fits this need perfectly. It gives traders the agility to act in real time, with tight spreads, efficient leverage, and no restrictions on directional bias.

EBC Financial Group’s infrastructure directly connects to more than 25 global liquidity providers, delivering exchange-level depth and execution speeds averaging 20 milliseconds. Combined with leverage up to 200x and true 24/7 trading access, it creates a high-performance environment for traders seeking precision and control.

How to Trade CFD Bitcoin

Trading CFD Bitcoin follows a simple but structured process:

1. Identify Market Direction

Analyse Bitcoin’s price chart, consider macroeconomic drivers, and determine whether you believe prices will rise or fall.

2. Choose Your Position

3. Set Parameters

Decide how much you want to risk. Set stop-loss and take-profit levels to manage outcomes.

4. Execute the Trade

Your trade is filled almost instantly. EBC Financial Group’s average execution speed of 20 milliseconds minimises slippage, even in fast-moving markets.

5. Monitor and Adjust

As the market evolves, you can modify your stops or take partial profits.

Example (Long Trade):

Bitcoin trades at 112,400 USD.

You open a long position, expecting an upward move.

Bitcoin rises to 113,200 USD.

The 800 USD difference, adjusted for trade size and cost, becomes your profit.

Example (Short Trade):

Bitcoin trades at 112,400 USD.

You open a short position, expecting a drop.

The price falls to 111,000 USD.

You close the trade and profit from the 1,400-point fall.

Because CFDs use leverage, even small movements can have magnified effects. Proper risk control is essential, which is why traders are encouraged to use protective stop-losses and avoid overexposure.

Advantages of CFD Bitcoin Trading

1. No Wallet or Private Keys Required

Trading Bitcoin CFDs eliminates wallet and private key concerns, giving price exposure without the risks of hacking or access loss.

2. 24/7 Trading Flexibility

Unlike traditional markets, cryptocurrency trading never stops. You can trade around the clock to respond instantly to global news or economic shifts.

3. Leverage Up to 200x

Leverage amplifies your exposure, allowing control of larger positions with smaller deposits. Used responsibly, it enhances capital efficiency and allows for strategic diversification.

4. Lightning-Fast Execution

EBC Financial Group’s execution speed of 20 milliseconds means trades are filled with minimal delay, a critical factor during periods of high volatility.

5. Low Entry Barrier

You can begin trading with as little as six US dollars and 0.01 lots, making CFD Bitcoin accessible to traders of any experience level.

Market Context and 2025 Trends

The Bitcoin market in 2025 is being shaped by three major dynamics: institutional participation, macroeconomic shifts, and regulatory maturity.

Institutional Influence: ETF holdings now exceed one million Bitcoin globally, while more than 200 asset managers worldwide include crypto-linked derivatives in their portfolios. This institutional engagement has increased liquidity and improved price stability.

Macroeconomic Drivers: Interest-rate cycles continue to influence crypto sentiment. When central banks signal rate cuts, Bitcoin often rallies as traders seek higher-yielding alternatives. Meanwhile, inflation moderation across advanced economies has reduced risk aversion, keeping crypto markets active.

Regulatory Progress: The UK’s Financial Conduct Authority and the EU’s Markets in Crypto-Assets Regulation (MiCA) have introduced comprehensive rules for crypto derivatives, requiring transparent leverage limits and capital standards. This has made trading CFD Bitcoin safer and more transparent for retail and institutional participants alike.

How to Start Trading CFD Bitcoin with EBC Financial Group

Step 1: Register an Account: Begin by registering your details through the EBC platform. The process is quick, secure, and compliant with global standards.

Step 2: Verify Your Identity: Complete a simple verification process that takes just a few minutes.

Step 3: Fund Your Account and Begin Trading: Deposit funds using your preferred payment method and start trading immediately.

EBC’s dedicated customer service team is available to assist throughout this process, ensuring new users can navigate tools, features, and market data confidently.

Trading Platforms and Tools

EBC Financial Group supports both MetaTrader 4 and MetaTrader 5, two of the most widely used platforms in the world. These systems offer advanced charting tools, algorithmic trading with Expert Advisors, and real-time analytics.

The platforms are available on desktop, web, and mobile, providing flexibility and access at all times. You can manage multiple asset classes within the same account, with unified risk and margin management.

EBC also provides a transparent order book view, showing live bid and ask volumes across several levels. This visibility allows traders to assess liquidity and identify potential slippage before placing trades.

Managing Risk in CFD Bitcoin

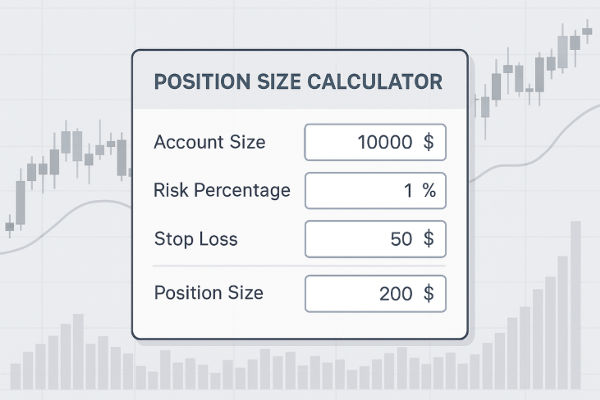

CFD Bitcoin trading offers opportunity, but it also carries inherent risk due to leverage and volatility. Effective risk management is therefore non-negotiable.

Use Stop-Loss Orders: Define your maximum loss before entering a trade.

Control Position Size: Keep risk per trade small, ideally no more than 2 percent of account capital.

Apply Take-Profit Orders: Lock in profits when targets are reached.

Watch Volatility: Adjust trade sizes when Bitcoin’s price range expands.

A 2024 study by CoinMetrics found that the average one-hour volatility of Bitcoin remained around 0.75 percent. In CFD trading, this means positions can shift rapidly. Maintaining tight controls on exposure is critical for longevity.

CFD Bitcoin vs Traditional Bitcoin Ownership

Owning Bitcoin directly requires wallet management, blockchain transactions, and custody security. With CFDs, those operational complexities disappear. Traders gain access to price movement without managing coins or blockchain logistics.

CFDs also allow short positions, meaning traders can profit when the market falls. This flexibility makes CFDs more adaptable to varying conditions, compared to long-only ownership strategies.

Since CFDs are regulated products, they operate under strict financial frameworks. EBC Financial Group’s adherence to multi-jurisdictional regulations ensures compliance, capital adequacy, and client protection, which unregulated exchanges may not guarantee.

Institutional and Market Insights

Institutional traders are increasingly active in the Bitcoin derivatives market. In 2025, more than 40 percent of professional trading desks use CFD-style instruments to manage crypto exposure. This has driven improvements in liquidity and execution consistency.

EBC Financial Group’s liquidity model mirrors these institutional structures, drawing prices from over 25 providers to deliver real-time aggregation. During high-impact events, such as Federal Reserve announcements or crypto ETF adjustments, the system maintains stability and accurate price discovery.

The firm’s infrastructure, built around HUB aggregation and low-latency routing, ensures consistent execution even during periods of extreme volatility, such as Bitcoin’s 2025 mid-year correction, when the market temporarily dropped 8 percent before recovering.

Practical Trading Example

Imagine Bitcoin trading at 60,000 USD after a week of consolidation. Positive macro news, such as lower inflation and higher ETF inflows, sparks optimism. You notice a bullish technical signal on your MT5 chart a crossover on the moving averages with strong volume support.

You open a long CFD Bitcoin position at 60,200 USD with leverage of 20x, placing your stop-loss at 59,500 and your target at 61,800. Over the next three days, Bitcoin rises steadily, reaching your target. The 1,600-point gain represents a successful trade, with defined risk and disciplined management.

The same principles apply in bearish conditions. If sentiment turns negative due to regulatory changes or profit-taking, you can short CFD Bitcoin and profit from falling prices, without owning any crypto assets directly.

The Future Outlook for CFD Bitcoin

The long-term outlook for CFD Bitcoin is closely tied to the evolution of digital finance. As tokenisation expands and blockchain infrastructure becomes integrated into traditional banking systems, the demand for liquid, leveraged exposure will continue to rise.

Bitcoin remains the benchmark for crypto sentiment, but its use as a trading instrument is evolving. With higher institutional liquidity and advanced execution technology, CFD Bitcoin is becoming the preferred choice for traders who value control, speed, and transparency.

Artificial intelligence and automation are also reshaping trading behaviour. By late 2026, more than half of all retail CFD trades globally are expected to include some AI-driven signal or automation. EBC Financial Group’s low-latency system and deep liquidity architecture are well aligned with this shift.

FAQs About CFD Bitcoin

Q1. What is a Bitcoin CFD?

A Bitcoin CFD allows traders to speculate on Bitcoin price movements without owning the coin. Profits or losses depend on price changes between opening and closing a position.

Q2. Do I need a wallet to trade CFD Bitcoin?

No. You trade Bitcoin’s price directly through a regulated platform, removing the need for a wallet or private keys.

Q3. Why choose EBC Financial Group?

EBC combines deep liquidity, ultra-fast execution, 24/7 access, and global regulatory standards to offer a secure and efficient CFD trading environment.

Conclusion

Learning how to trade for CFD Bitcoin in 2025 is about balancing precision, discipline, and opportunity. Bitcoin remains the heartbeat of the digital market, and CFDs transform that pulse into a tradable pattern. They allow traders to harness volatility, apply leverage intelligently, and access professional-grade execution without the complexities of direct ownership.

EBC Financial Group delivers the tools and infrastructure that make this possible. From a minimum deposit of six US dollars to institutional liquidity sourced from over 25 providers, the platform combines speed, depth, and accessibility. Traders can execute 24/7 with millisecond precision and manage all asset classes within a single account.

The future of trading lies not in prediction but in preparation. CFD Bitcoin gives traders the ability to react with confidence, adapt to volatility, and capture opportunity within a secure, regulated framework.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.