Last week's surprise downturn in the US services sector has sent tremors through financial markets, forcing investors to question whether the world's largest economy is losing momentum. As the July ISM Services PMI report missed forecasts and the Nasdaq slumped by 0.7%, the spotlight is now on whether US services data can do more than just spark a short-term selloff; could it actually point to the next macro trend for global markets?

US Services: Why This Data Matters

The services sector makes up roughly 70% of US GDP, with a huge impact on jobs, consumption, and overall economic activity. Unlike the often-volatile manufacturing data, US services numbers, especially from the Institute for Supply Management (ISM), provide a broad, timely snapshot of real economic health.

For July 2025, the ISM Services PMI dipped to 50.1, down from 50.8 in June and below the 51.5 consensus forecast. The threshold of 50 splits growth from contraction; the closer the number gets to or falls below 50, the greater the caution among market participants about the pace of US expansion.

Key Numbers to Note

-

Headline ISM Services PMI: 50.1 (vs 51.5 expected; June: 50.8)

-

Employment Index: 46.4 (down from 47.2), second month in contraction

-

Prices Paid: Shot up to a 2.75-year high of 69.9

-

New Orders: Flat at 50.3

Composite jobs growth across July: Only 73,000 (smallest since mid-2023)

Market Response: A Shot of Volatility

Markets wasted no time in pricing in the “shock value” of July's service sector wobble:

-

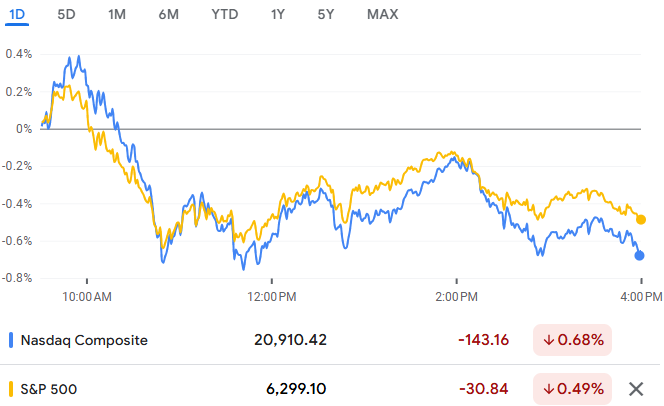

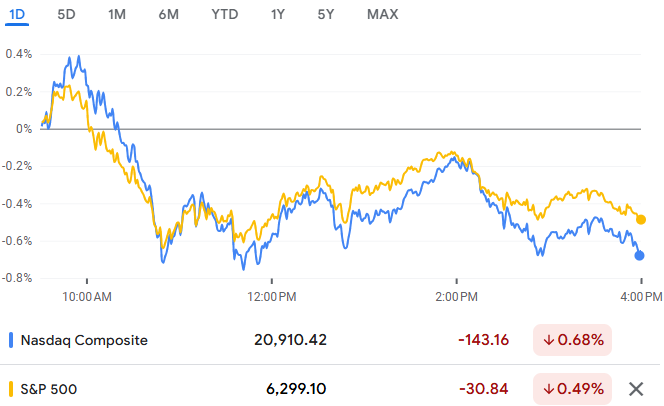

In the most recent session on August 5, 2025, the Nasdaq Composite fell 0.7%, led by declines in rate-sensitive and consumer tech stocks.

-

The S&P 500 dropped 0.5% just yesterday, as investors recoiled from growth-sensitive sectors like retail and travel.

-

The Dow Jones eased by 0.1%, showing defensive buying in staples and health care.

-

The US 10-Year Treasury Yield slipped to 4.18% as traders sought safer assets and bet on early Fed rate cuts.

-

The Dollar Index (DXY) edged up, reflecting safe-haven demand and shifting views on global growth.

-

Oil prices fell 2% as demand fears grew.

Gold was volatile, briefly up as investors weighed both risk aversion and mixed signals from rates and inflation.

Reading the Signals: Trend or Temporary Jolt?

1. The Case for a Lasting Trend

-

Broad-based slowdown: The services sector's near stall is especially concerning on the heels of July's jobs report, which posted only 73,000 new jobs, the weakest in two years, and accompanied by downward revisions for previous months.

-

Employment weakness: With the ISM's employment sub-index at 46.4, service sector job losses are now a pattern. This threatens overall payroll growth, consumer demand, and headline jobs numbers going forward.

-

Persistent input costs: The prices-paid component hasn't been this high in nearly three years, driven by renewed tariff pressures and supply chain disruptions. Sticky inflation alongside weak demand risks “stagflation” — slow growth with high prices.

Fed under pressure: Market bets for a Federal Reserve rate cut at the next meeting have surged to over 90%, up from 40% before the data. Such a pivot in expectations is rare and underscores how seriously investors are taking the trend risk.

2. The Argument for a Short-Term Blip

-

No outright contraction: The headline services number (50.1) is still marginally in expansion territory. Some analysts argue that seasonal swings, data quirks, or idiosyncratic hits to hospitality and travel in July may explain the dip.

-

Retail resilience: Consumer spending remains reasonably robust in some areas — auto, e-commerce, and healthcare sub-sectors posted solid results in July.

-

Global context: Outside the US, Eurozone, and Asian services readings remain mixed but not alarmingly weak, suggesting that the downturn might be more localised or amplified by domestic policy and tariff friction.

Fed patience: Despite political pressure and surging rate cut odds, the Fed has so far resisted an aggressive pivot, emphasising the need for more data before moving decisively.

Connecting the Dots: Why Markets Care Deeply

US financial markets are particularly sensitive to the ISM Services PMI for the following reasons:

-

Sector breadth: Services span industries from finance to hospitality to health, amplifying the report's reach and predictive value.

-

Labour market lead: Service sector hiring (or firing) often foreshadows shifts in the broader employment data, which in turn drives Fed policy and market rates.

-

Consumer sentiment: Services activity is closely tied to consumer confidence and disposable income, the engine of the US (and global) economy.

Policy inflection: If services continue to stall or contract, the Fed will face intense pressure to cut rates, even if inflation remains sticky due to tariffs or supply constraints.

Policy and Political Overhang

-

Tariffs making costs stickier: President Trump's new baseline tariffs have driven up input prices for both goods and services firms, as cited by dozens of companies surveyed by ISM. With the “prices paid” index at 69.9, multinationals are signalling that cost pressure is here to stay.

-

Leadership churn adds uncertainty: With recent changes at the Bureau of Labor Statistics and speculation about reshuffling at the Federal Reserve, investors worry about “policy signalling” and whether economic data will be politicised or management will shift unexpectedly during an economic soft patch.

Election-year backdrop: Investors know that in this environment, every data release and policy comment is being filtered through the lens of upcoming US elections and the temptation for quick fixes.

Global Reflections: “When America Sneezes...”

The US remains the key global trendsetter:

-

EUR/USD fell 1.3% in reaction to the weak US data, compounded by trade and growth worries in Europe.

-

Asian markets opened lower after the ISM miss, as traders recalibrated exposure to export-sensitive and commodities-driven names.

Oil and metals: Prices fell globally as growth-sensitive commodities react to shifts in US demand expectations.

The Sector Heatmap: Who's Winning, Who's Wobbling?

| Sector |

Latest Move |

Comment |

| Tech (Nasdaq heavy) |

-0.7% (Aug 5 session) |

Sensitive to growth and rate outlook |

| Travel & Leisure |

-1.1% |

Weak on consumer fears |

| Energy & Industrials |

-0.6% |

Hit by lower oil and commodity prices |

| Staples & Healthcare |

+0.2% |

Gained as defensive “safe havens” |

| Financials |

-0.3% |

Mixed, follow rates and yield curve |

| Small Caps (Russell 2K) |

-0.8% |

More vulnerable to domestic softness |

Looking Forward

Short answer: The July ISM Services wipeout has “reset the baseline.” Even if it does not mark the start of a recession, the data has now recalibrated both investor psychology and market structure. The risk, as seen in recent rate cut pricing and defensive sector buying, is that further weak services and jobs numbers could drive a lasting trend toward lower yields, a softer dollar, and shifting stock sector leadership.

Here's what to watch in the weeks ahead:

-

Further ISM and PMI prints: If August data shows a pattern of continued stagnation or worse, markets will strongly signal a trend change.

-

US non-farm payrolls: Weak jobs numbers will reinforce the downtrend in services and likely pull the Fed into action.

-

Corporate guidance: As Q2 earnings season wraps up, watch for management commentary on demand, hiring, and cost outlook, especially from consumer and travel firms.

Fed and political responses: Policy direction, now very “data-dependent”, could turn quickly, especially with November's election looming.

Final Verdict

The US services sector is flashing yellow, and possibly red, for markets. Whether this spells the start of a new bear trend or merely a brief detour will depend on the next few rounds of economic data and central bank action. For now, investors should brace for more volatility and keep a close eye on sector rotations, policy surprises, and any signs that weakness is spreading beyond services.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.