Australia GDP September 2025 Shows a Mixed but Interpretable Growth Pulse

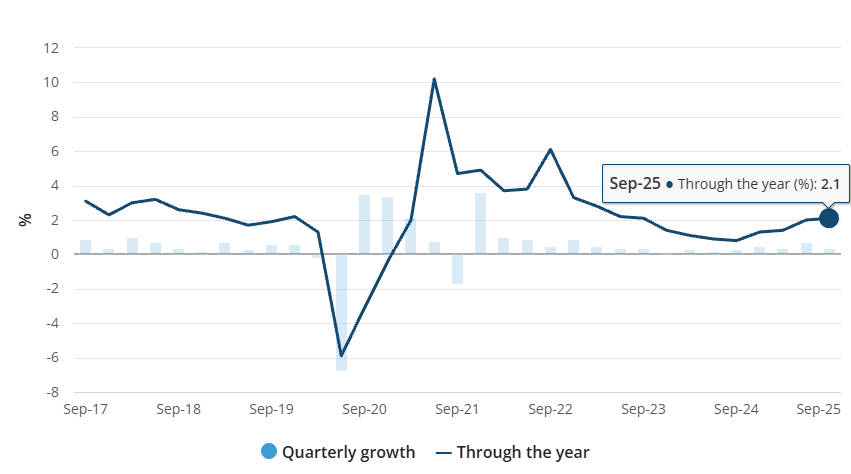

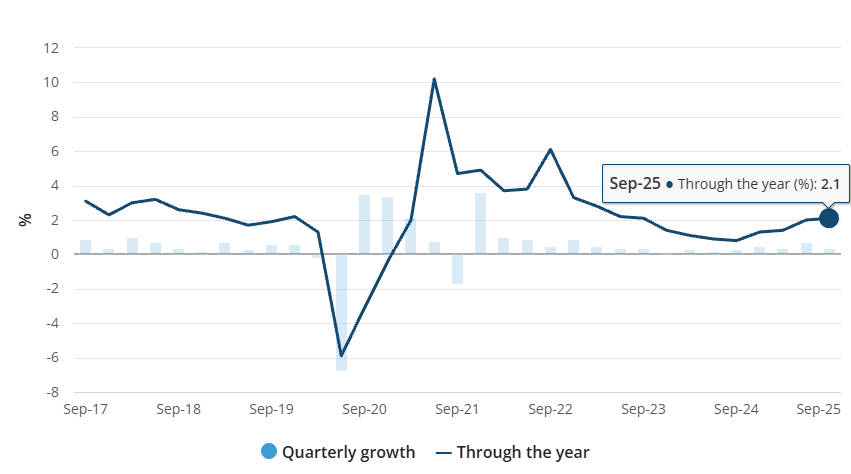

Australia's economy expanded by 0.4% in the September quarter, equivalent to 2.1% year-on-year growth. The headline number undershot many market forecasts but masks meaningful internal rotation.[1]

Domestic demand, notably business investment and household spending on essentials, carried the quarter while net trade and inventory adjustments weighed on output.

For traders and investors the release is less a simple growth beat or miss and more a map of where markets might re-weight risk: nominal activity and price measures point to persistent domestic price pressure, even as certain external components remain fragile. That combination shapes RBA expectations, AUD momentum and sectoral positioning.

ABS National Income Expenditure Product Report and Its Market Implications

Business investment as a structural positive. Machinery, equipment and data-centre related investment contributed materially to the quarter, suggesting a capex cycle that supports industrial suppliers and technology infrastructure stocks. Investors could overweight selected industrials and infrastructure exposure on conviction of sustained investment.

1. Net trade remains a headwind.

Imports outpaced exports and inventory drawdowns subtracted from GDP. Export-dependent miners and LNG exporters therefore remain vulnerable to weaker global demand; trade-sensitive commodities should be watched for directional cues.

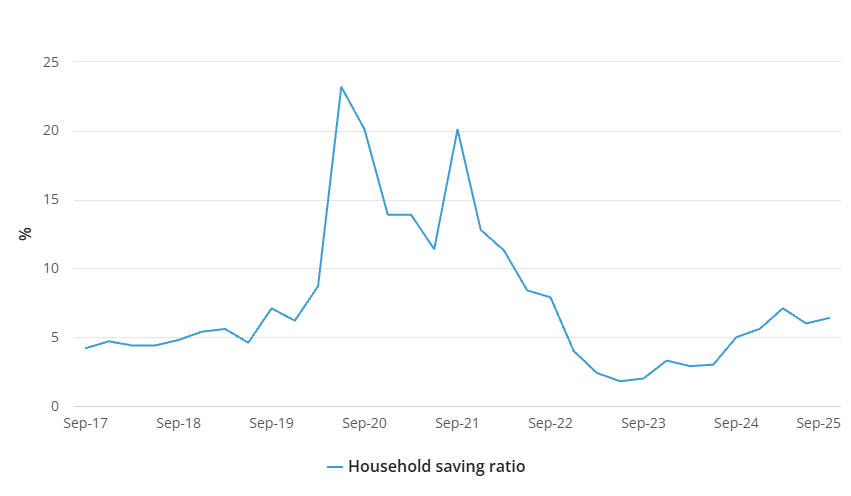

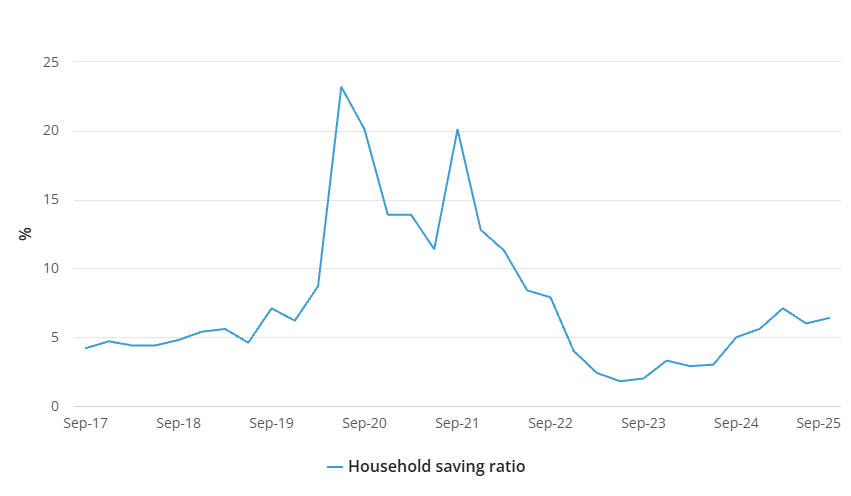

2. Household caution — higher saving ratio.

A lift in the household saving ratio indicates some consumer prudence. This dynamic suggests consumer discretionary names may struggle absent a clear uptick in wage growth. Defensive retail and staples may outperform in the near term.

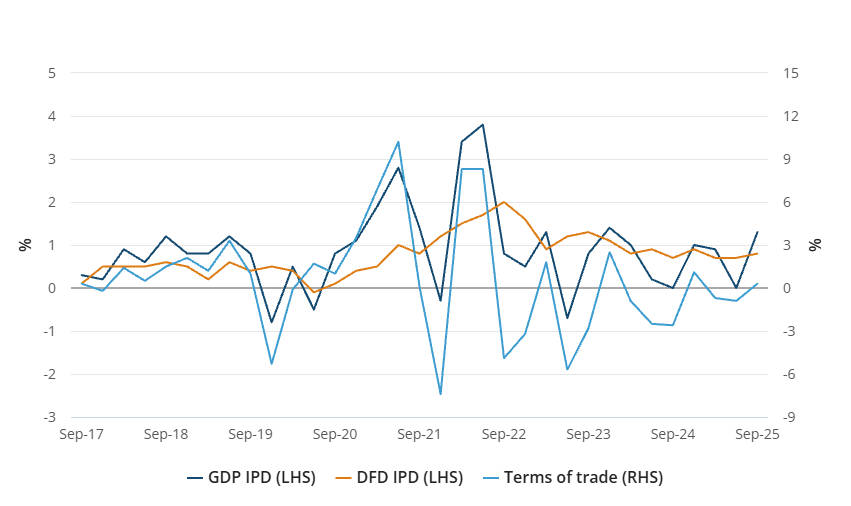

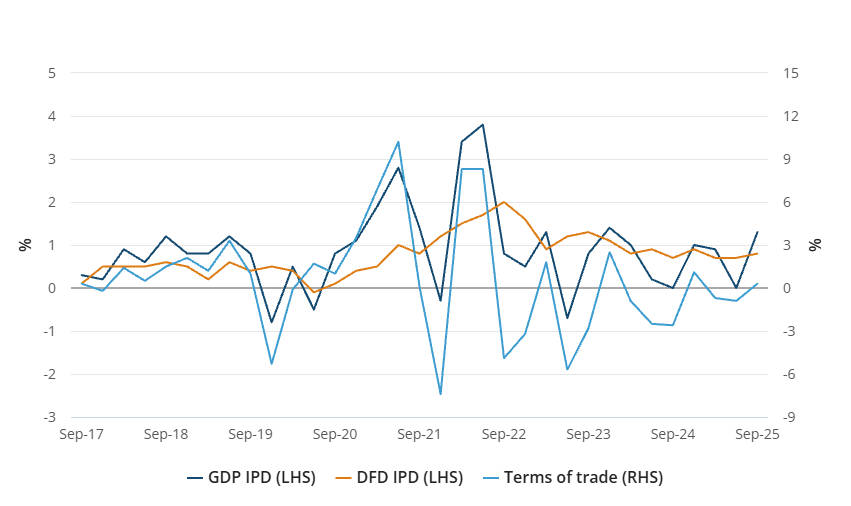

3. Nominal GDP and price momentum.

Nominal GDP rose 1.7%, and the GDP implicit price deflator(IPD) rose 1.3%, serving as a reminder that underlying price pressure persists and will influence the RBA's policy calculus. Fixed income and FX markets should price this nuance rather than the headline growth rate alone.

How to Trade RBA Expectations and the AUD

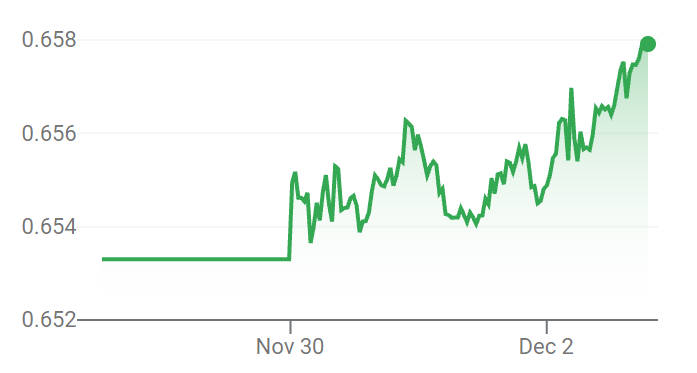

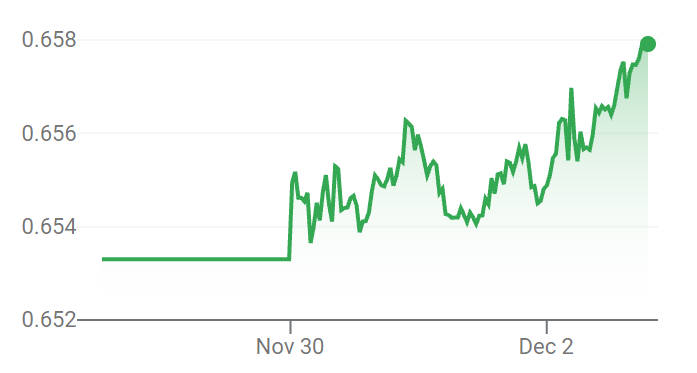

The Australian economy growth Q3 2025 update influenced rate markets immediately. Traders trimmed near-term rate-hike expectations following the softer headline print, but the underlying inflation-adjacent measures complicated the policy narrative.

If price momentum stabilises or intensifies in upcoming CPI or wage releases, the RBA may adopt a firmer stance. Conversely, a clear decline in services inflation would weaken the case for further tightening.

Currency markets reflected the same nuance. The AUD initially softened on the growth miss, yet its broader direction continues to hinge on external commodities, particularly iron ore, and on Australia's relative yield advantage. A strategy that adjusts exposure based on upcoming data rather than reacting to a single headline level may outperform.

Australia GDP September 2025 and Corporate Earnings Outlook

The Australia GDP September 2025 data offers clear guidance for interpreting upcoming earnings seasons.

1. Investment-led momentum supports industrials.

Continued business spending suggests stable demand for construction inputs, engineering firms and technical equipment suppliers.

2. Export-oriented companies face uncertainty.

The subdued performance of net trade and fragility in global demand could pressure margins for miners and LNG names unless commodity prices recover or inventories rebuild.

3. Banks remain sensitive to household dynamics.

A rising saving ratio combined with moderate credit growth will influence deposit spreads and lending volumes, shaping net interest margin expectations ahead of full-year results.

Understanding these compositional details enables investors to anticipate which sectors will revise guidance and which will show relative resilience.

ABS National Income Expenditure Product Report and Quantitative Indicators

Several quantitative indicators embedded in the ABS National Income Expenditure Product report can help refine market positioning without explicitly signalling trading instructions.

1. AUD-to-iron-ore correlation:

A four-week rolling view typically reveals whether commodity trends are leading or lagging currency movements.

2. Two-year bond yields vs. price indicators:

Shifts in the GDP implicit price deflator often correspond with changes in short-term yield volatility.

3. Sector contribution heatmap:

Viewing the quarter through a contributions lens helps highlight which industries are gaining momentum relative to their longer-term trend.

Australian Economy Growth Q3 2025 and Forward Catalysts

The Australian economy growth Q3 2025 print is only one step in a series of data points that will direct markets into year-end. Traders and investors should monitor:

monthly trade figures for export stabilisation

the next CPI and wage data for confirmation of price pressure

RBA commentary for clues on risk appetite and yield curve shape

China-linked commodity demand, especially for iron ore

LNG price movements and their effect on energy earnings

These events together will determine whether the economy's internal resilience can offset external softness as Australia enters Q4.

Frequently Asked Questions

1. What are the key Australia GDP September 2025 figures?

Real GDP grew 0.4 percent quarter-on-quarter and 2.1 percent annually. Nominal GDP rose and the GDP implicit price deflator increased, indicating that domestic price momentum remains relevant for monetary policy decisions.

2. Why did GDP come in weaker than expected?

Inventory reductions and imports rising faster than exports weighed on overall output, offsetting the strength in domestic demand. This mix produced a softer headline figure despite several pockets of underlying resilience.

3. How does the data affect the RBA outlook?

The modest growth miss tempered immediate expectations for policy tightening, but rising price indicators mean the RBA will closely monitor CPI and wage results before committing to a firm policy direction.

4. Which sectors appear better positioned after the report?

Industrials tied to business investment show constructive momentum, while consumer staples may outperform amid cautious household behaviour. Export-heavy companies face greater sensitivity to commodity prices and external-demand trends.

5. What should investors watch over the next few weeks?

Key catalysts include inflation data, wage figures, the next ABS trade release, RBA communications and commodity price movements. These inputs will guide expectations for growth, earnings and currency performance.

Conclusion

Understanding the types of monetary policy is essential for traders who want to anticipate liquidity shifts, interest rate cycles, and market volatility with greater precision. Whether central banks adopt an expansionary stance to stimulate growth or a contractionary approach to curb inflation, each decision sends clear signals across currencies, equities, bonds, and commodities.

By tracking policy tools, monitoring forward guidance, and aligning positions with macroeconomic momentum, traders can navigate changing economic environments with stronger conviction and a more disciplined strategy.

[1]https://www.abs.gov.au/statistics/economy/national-accounts/australian-national-accounts-national-income-expenditure-and-product/latest-release

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.