With President Donald Trump signalling a Friday-morning reveal of the next Fed chair, markets face a binary event that can reprice the “policy credibility premium” in a single session. The next Fed chair is no longer a slow-burning Washington story. It has become a catalyst for front-end rates, with real-time spillover into the US dollar, the curve shape, and equity duration.

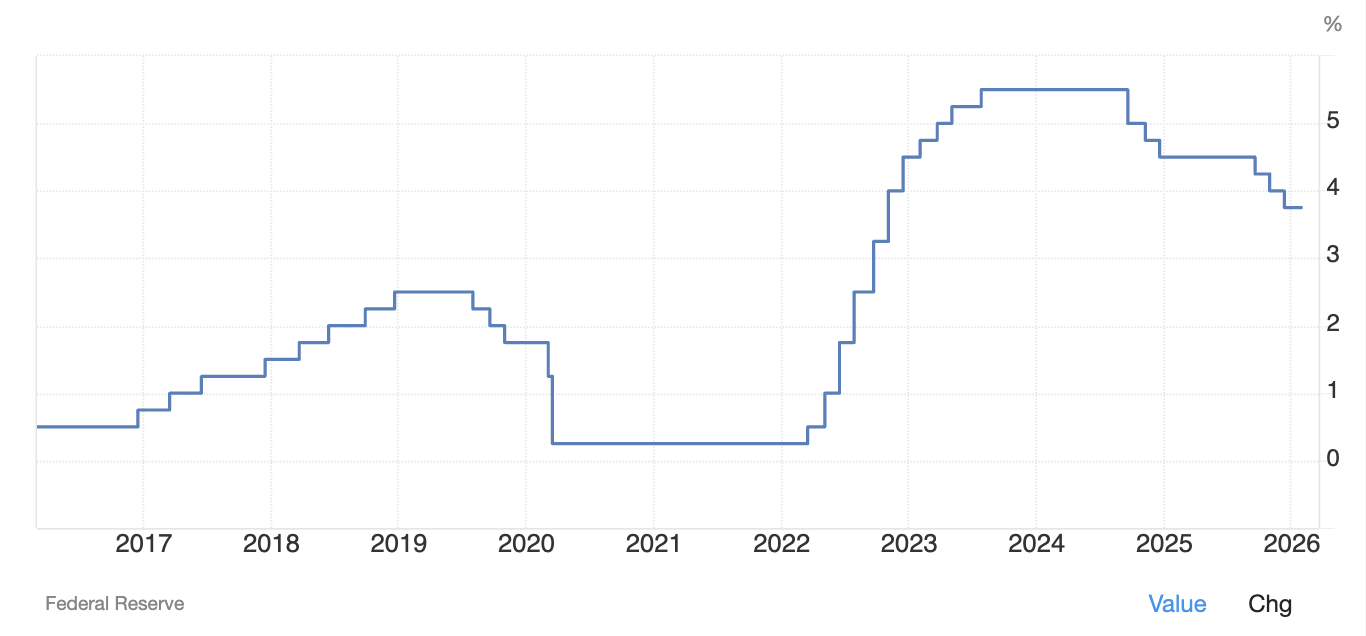

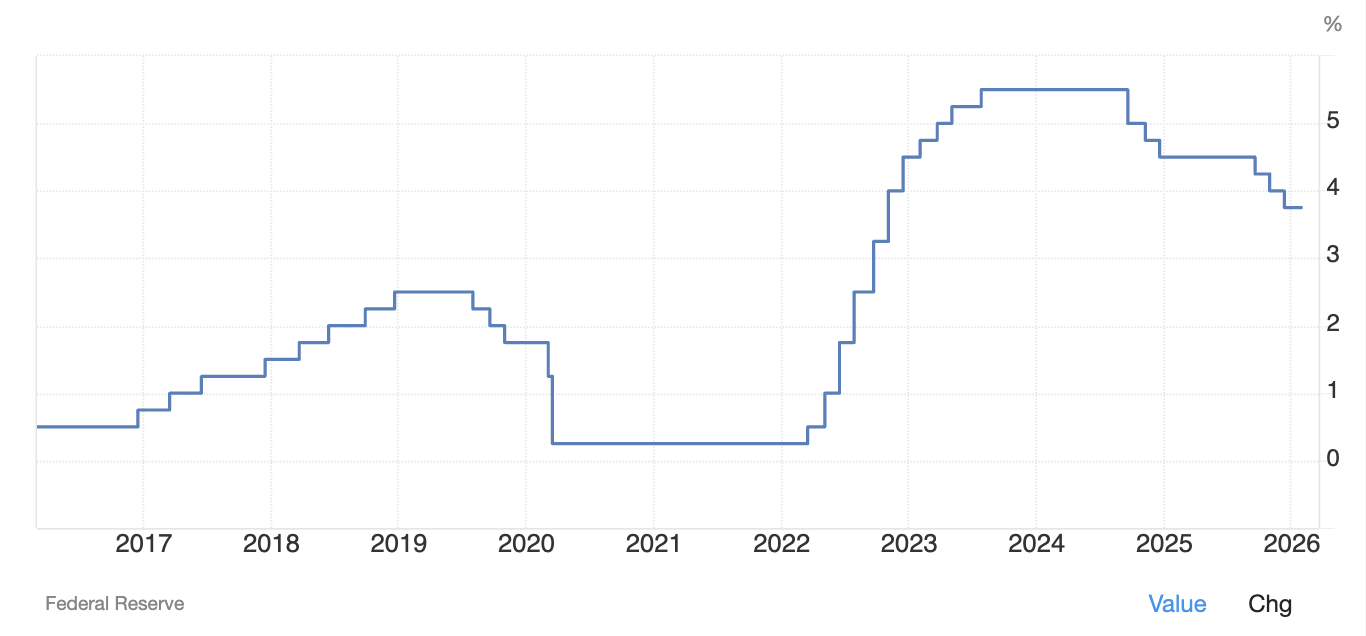

The timing matters because the Federal Reserve has paused after prior easing, holding the benchmark rate at 3.50 per cent to 3.75 per cent. That leaves positioning unusually sensitive to perceived dovishness or independence risk.

When policy is close to neutral, the marginal impact of leadership expectations rises, and traders tend to express it first through the US 2-year proxy, the US Dollar complex, and the most rate-sensitive equity factors.

Key Takeaways

Macro: With policy held at 3.5 per cent to 3.75 per cent, the market’s base case is “cuts later, not now,” so a dovish-leaning nominee risks a sharper repricing in the front end than in long duration.

Fundamentals: The nomination’s market impact is less about personality and more about the implied reaction function: tolerance for sticky inflation versus willingness to cut into a still-resilient growth backdrop.

Sector: Rate-sensitive equities can rally on “faster cuts,” but banks can split: curve steepening helps net interest margins, while credibility risk can widen credit spreads.

Risks: Independence optics are now a tradable variable, with Senate confirmation and ongoing political frictions capable of injecting event risk well beyond announcement day.

Positioning: The cleanest expressions are cross-asset: USD versus gold, front-end rates versus long-end term premium, and growth duration versus value cyclicals.

Why The Next FED Chair Matters More Than The Name

Fed chairs rarely deliver instant policy shifts, but they can change the distribution of outcomes. Traders price not only the next meeting but the next mistake.

The chair shapes the committee’s internal balance, the communication function, and the tolerance for inflation overshoots. When markets suspect the bar for easing has moved lower, implied terminal rates fall, and the US Dollar typically loses carry support.

The bigger trade, however, is credibility. If investors begin to attach a risk premium to institutional independence, the curve can steepen in an uncomfortable way: front-end yields fall on “cuts,” while long-end yields rise on higher inflation expectations or term premium.

The bigger trade, however, is credibility. If investors begin to attach a risk premium to institutional independence, the curve can steepen in an uncomfortable way: front-end yields fall on “cuts,” while long-end yields rise on higher inflation expectations or term premium.

That split can be bullish for commodities and volatility while producing a choppier regime for equities.

The Interest Rate Baseline: Where Policy and The Curve Sit Today

The starting point is straightforward:

Fed funds target range: 3.50 per cent to 3.75 per cent

Treasury curve (latest update): front-end in the high-3s, long-end in the mid-to-high-4s

US interest rate snapshot

| Rate / Maturity |

Level |

| Fed funds target range |

3.50% to 3.75% |

| 3-month Treasury |

3.67% |

| 1-year Treasury |

3.50% |

| 2-year Treasury |

3.53% |

| 5-year Treasury |

3.80% |

| 10-year Treasury |

4.24% |

| 30-year Treasury |

4.85 |

When the 10-year sits well above the policy rate, the market is signalling either firmer long-run growth, higher long-run inflation risk, a larger fiscal risk premium, or all three. In that environment, a chair selection that raises doubts about inflation discipline can push the long end higher even if the front end rallies on “more cuts.”

That split is the core trade. This is why the chair decision can produce a counterintuitive outcome: lower 2-year yields alongside higher 10-year yields, and a weaker US Dollar.

What Markets Are Pricing Into The Announcement

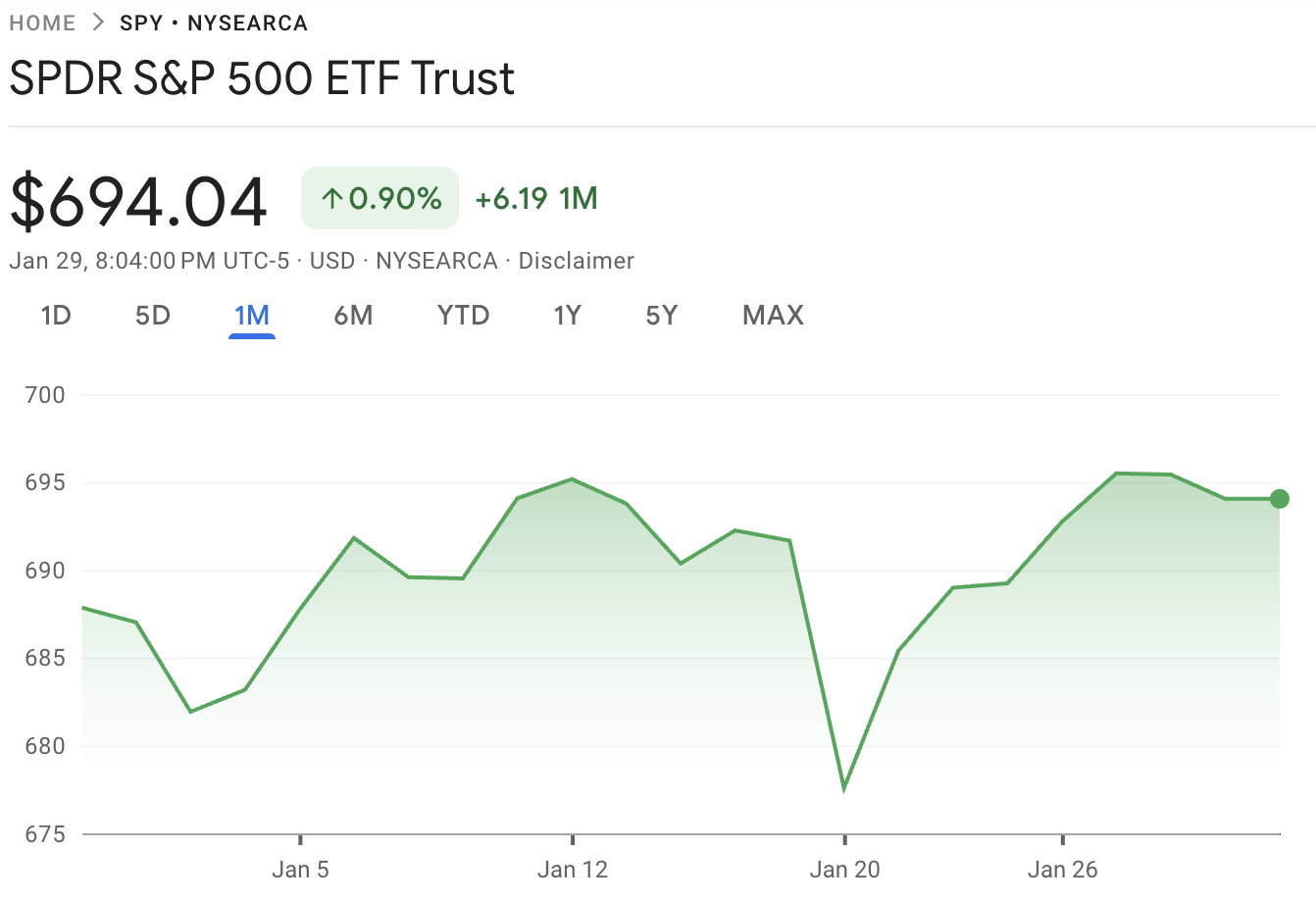

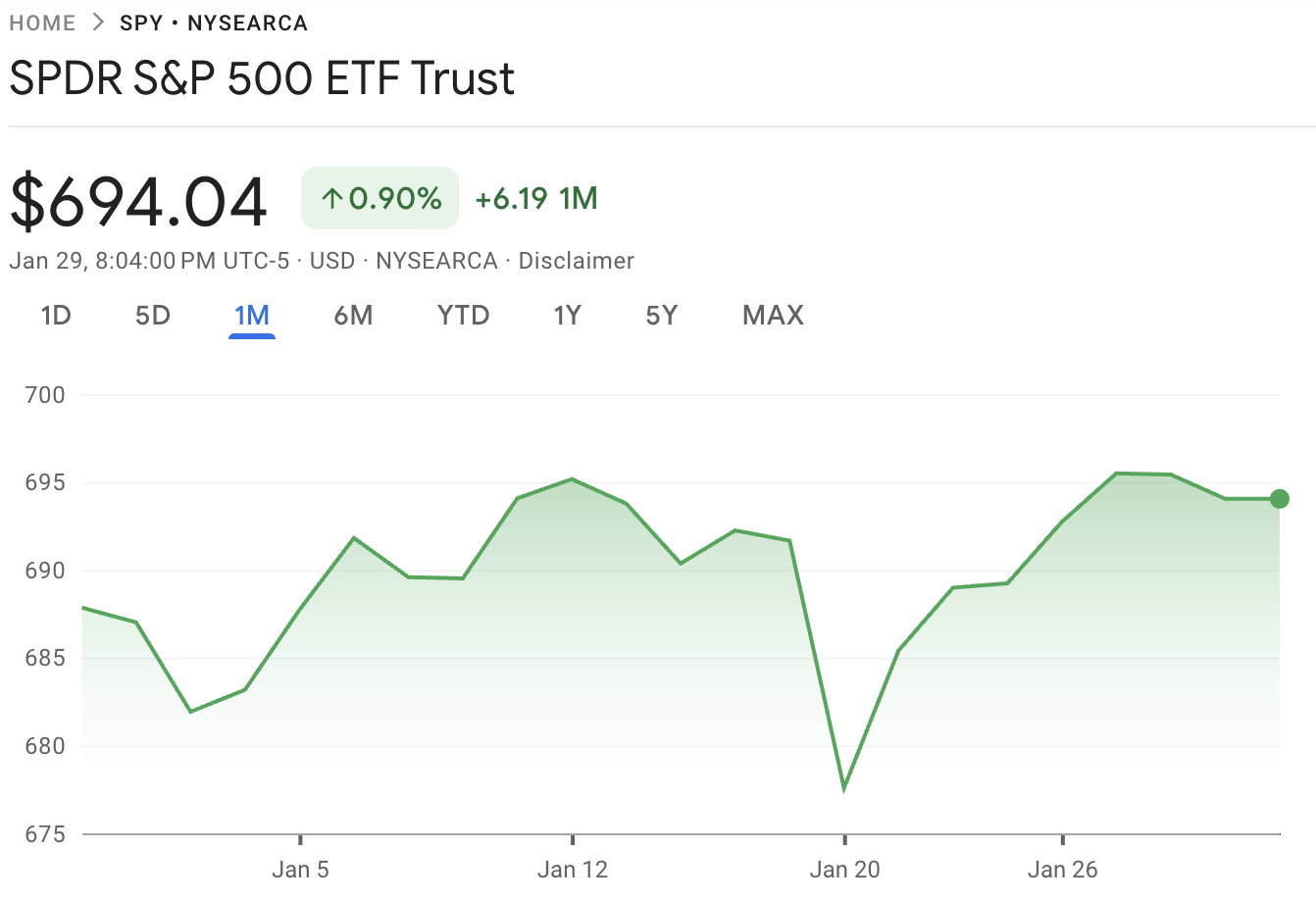

The current tape already reflects a market that is watching the policy path through tradable proxies. Below is a snapshot of widely used instruments for equities, USD direction, rates, duration, and hedges.

Cross-asset pricing snapshot (January 30)

| Market proxy |

Ticker |

Latest |

What it proxies |

| S&P 500 exposure |

SPY |

$6926.59 |

Broad USD direction and carry demand |

| Front-end rates proxy |

SHY |

$82.92 |

Short-duration rates expectations |

| Belly duration |

IEF |

$96.00 |

Intermediate Treasury duration |

| Long-duration rates |

TLT |

$87.62 |

Term premium and long-end sensitivity |

| Gold hedge |

GLD |

$495.90 |

Inflation hedge and policy credibility risk |

| Regional banks |

KRE |

$69.03 |

Curve sensitivity and credit tone |

This mix hints at a market that is not in full panic mode. Commentary around bond-market calm suggests investors are not yet pricing a disorderly independence shock.

Still, the combination of a softer USD proxy and a firm gold hedge is consistent with a market that wants protection against a dovish surprise or credibility questions.

Stock Market Information For Invesco DB US Dollar Index Bullish Fund (UUP)

Invesco DB US Dollar Index Bullish Fund is a fund in the USA market.

The price is currently 26.59 USD, down 0.05 USD (-0.00%) from the previous close.

The latest open price was 26.57 USD, and the intraday volume is 1592485.

The intraday high is 26.7 USD, and the intraday low is 26.57 USD.

The latest trade time is Friday, January 30, 09:15:00 +0800.

Candidate Matrix: Policy Bias and Market Sensitivities

Reporting and market chatter have centred on four names: Kevin Warsh, Christopher Waller, Rick Rieder, and Kevin Hassett. The practical question for trading is how each profile changes odds around the cut path and the Fed’s communication posture.

Next FED Chair: Market Interpretation Grid

| Potential nominee |

Market shorthand |

Most sensitive markets |

Likely first reaction |

| Kevin Warsh |

Credibility hawk, reformist tone |

Long-end yields, USD, financials |

USD firmer, curve flatter if credibility premium rises |

| Christopher Waller |

Policy technician, committee continuity |

Front end, rates volatility |

Smaller repricing, focus returns to data dependence |

| Rick Rieder |

Market-practitioner dovishness |

Front end, equities, gold |

Front-end yields lower, risk assets bid, USD softer |

| Kevin Hassett |

White House alignment risk |

USD, long-end term premium |

Larger credibility debate, steeper curve risk |

Important Note: This is not a prediction of outcomes. It is a map of the most probable first-order reactions given how markets tend to translate leadership signals into rate-path probabilities.

How Will The Announcement Move Markets

The announcement is best treated as a volatility event with asymmetric spillovers. In algorithmic language, it is a regime-switch trigger: correlation matrices can flip quickly, spreads can widen, and stop placement needs to respect intraday range expansion.

| Scenario |

Rates (2-year) |

USD |

Equities |

Gold |

| Hawkish, independence-forward nominee |

Up |

Up |

Down or mixed |

Down or mixed |

| Dovish nominee |

Down |

Down |

Up |

Up |

| Politically aligned nominee perceived as credibility risk |

Mixed (can rise on risk premium) |

Mixed |

Down |

Up |

| Surprise nominee, unclear stance |

Volatile |

Volatile |

Volatile |

Volatile |

Scenario 1: “Dovish repricing” wins the tape

If markets interpret the nominee as likely to push for faster cuts, the initial impulse typically runs through the front end.

Rates: Short-duration and belly duration can rally first, with the 2-year proxy effect showing up in short Treasury ETFs before long duration fully follows.

FX: The USD can weaken as the carry advantage compresses, particularly against high-quality yield alternatives.

Risk assets: Equity indices may pop on the lower discount-rate impulse, but the follow-through depends on whether the curve steepens from the term premium.

Scenario 2: “Independence premium” dominates

If the story shifts from “cuts” to “credibility,” the curve can steepen bearishly.

Rates: Long duration can sell off even if the front end rallies, reflecting higher inflation compensation or term premium.

Gold: The hedge bid can strengthen if markets treat the outcome as structurally inflationary.

Equities: The rally narrows, favouring pricing-power sectors and real assets over long-duration growth.

Scenario 3: “Continuity” neutralises the event

A candidate perceived as technocratic and committee-aligned can quickly shrink the event window.

Rates and FX: Implied volatility mean reverts, and price action returns to data triggers such as inflation prints and payroll surprises.

Equities: Breadth improves if lower policy uncertainty reduces hedging demand.

The “Powell question” can amplify uncertainty

Jerome Powell’s term as chair ends May 15, 2026, but his term as a governor runs to Jan 31, 2028. If he stays on the Board, markets may price “dual-centre” messaging risk and slower internal alignment, which can keep term premium and volatility elevated.

Where Order Flow Tends To Show Up First

In practice, the first clean read often comes from three places.

USD complex: A break in the one firm that the market is repricing terminal and real-rate expectations, not just headlines.

Curve proxies: When intermediate duration outperforms long duration, the market is leaning “cuts without credibility damage.” When long-duration bonds underperform, the term premium rises.

Hedges: A firm gold tape alongside a softer USD can signal that traders are buying insurance, not just chasing risk-on momentum.

Process and Constraints: Senate, the Fed board, and the Powell Question

The Fed chair is chosen from among the sitting governors and requires Senate confirmation, serving a four-year term separate from the 14-year governor term. That matters because the nomination can be a two-stage trade: headline-day repricing, then confirmation-path repricing.

Jerome Powell’s chair term ends May 15, 2026, while his term as a governor runs to January 31, 2028. If Powell were to remain on the board, it could complicate the internal optics of “shadow leadership” and alter how markets interpret the new chair's forward guidance.

Politics also enters through confirmation math and institutional friction. Reporting has pointed to Senate pushback dynamics tied to broader disputes and investigations, which can extend uncertainty well beyond the initial announcement.

What To Watch After The Announcement

The fastest way to validate the market’s interpretation is not the nominee’s biography. It is the next set of measurable signals.

First 30-90 minutes after the headline, watch out for:

Fed funds/SOFR futures: Do implied cuts pull forward or get pushed out?

2-year yield vs 10-year yield: Is it a clean rally, or a steepening twist?

DXY / USD majors: Does the dollar confirm “easier policy” or “risk premium”?

Banks vs. Nasdaq: Steepeners tend to help banks; term-premium shocks hurt duration.

Frequently Asked Questions (FAQ)

1) When will Trump announce the next FED chair?

Trump has indicated a Friday-morning announcement window for the nominee, which markets are treating as the near-term catalyst for rates and FX repricing. Timing clarity matters because liquidity conditions can differ sharply between pre-market headlines and regular-session price discovery.

2) When does Jerome Powell’s term end?

Powell’s term as chair ends on May 15, 2026, while his term as a governor runs until January 31, 2028. That separation creates a meaningful tail risk: Powell can leave with the chair transition or remain on the board, changing internal dynamics and market optics.

3) What is the current US interest rate?

The Fed’s policy rate is the federal funds target range, currently 3.50 per cent to 3.75 per cent, and it was held steady at the most recent decision. This range anchors money-market pricing and strongly influences the 2-year Treasury.

4) Can the next FED chair change interest rates immediately?

Not unilaterally. Policy is set by the FOMC, and the chair is first among equals, shaping the agenda, communication, and coalition-building. Markets still move quickly because traders price the expected reaction function, not just formal votes.

5) Why does the next FED chair move markets immediately?

The chair influences the distribution of future policy outcomes. Markets reprice the expected path of cuts, the tolerance for inflation overshoots, and the probability of policy error. That repricing typically first transmits through front-end rates, then FX, and finally duration-heavy equities.

6) Why would the 10-year yield rise if markets expect rate cuts?

Because the 10-year embeds long-run inflation risk and term premium. A dovish chair signal can pull down the 2-year while simultaneously raising inflation premia, steepening the curve and pushing the 10-year higher, even as near-term cuts get priced in.

Conclusion

The next Fed chair decision is a trading event because it forces markets to price a new policy distribution rather than a single rate move. In the current setup, where policy is already at 3.50 per cent to 3.75 per cent, and the Fed has paused after easing, even small shifts in perceived reaction function can produce outsized moves in the USD complex, curve shape, and hedge demand.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

1) Federal Reserve Implementation Note

2) FOMC Opening Statement

The bigger trade, however, is credibility. If investors begin to attach a risk premium to institutional independence, the curve can steepen in an uncomfortable way: front-end yields fall on “cuts,” while long-end yields rise on higher inflation expectations or

The bigger trade, however, is credibility. If investors begin to attach a risk premium to institutional independence, the curve can steepen in an uncomfortable way: front-end yields fall on “cuts,” while long-end yields rise on higher inflation expectations or