US dollar moves, a surprise-leaning US inflation profile, and a fresh rate cut from the Reserve Bank of New Zealand are now setting the tone for AUD and NZD.

US price data has kept markets confident about further Federal Reserve easing, while the RBNZ has cut rates again but signalled its easing cycle is close to an end.

At the same time, Australian inflation has printed hotter than expected, pushing back RBA cut hopes and supporting the Australian dollar.

The result is a classic macro mix: a softer dollar, repriced rate expectations across the Antipodes, and sharp moves in AUD/USD, NZD/USD and AUD/NZD as traders adjust to a new relative rate story.

This article is for information only and is not investment advice.

Macro backdrop: US Inflation Cool Enough For Cuts, Firm Enough For Growth

US inflation is no longer the global shock it was in 2022, but it still anchors the dollar story. The latest official data show annual CPI running at 3.0% year on year in September, up slightly from 2.9% in August, with core inflation also at 3.0%.

Those numbers are close enough to the Federal Reserve’s target to keep rate cut expectations alive.

Softer-than-expected inflation prints in October helped cement market pricing for a further 25 basis point cut at the December FOMC meeting, after the Fed already lowered the funds rate to a 3.75 -4.00% range at the October meeting.

Fed cut odds near 80% for December, lower Treasury yields and a weaker dollar index have all supported high-beta currencies. Risk assets rallied as markets embraced a “soft landing plus gradual easing” narrative, and the dollar slipped against a broad basket of currencies.

For AUD and NZD, this means the starting point is no longer a relentlessly strong USD. Instead, traders are comparing local inflation and rate trajectories with a Fed that is already cutting. That relative story matters more now than the absolute US level.

RBNZ Cuts To 2.25% And Calls Time On The Easing Cycle

On 26 November, the Reserve Bank of New Zealand cut the Official Cash Rate by 25 basis points to 2.25%, taking it to the lowest level since mid-2022.

At first glance, a cut should weigh on the New Zealand dollar. Instead, NZD strengthened. NZD/USD jumped to around 0.5690, up more than 1% on the day, and the NZD trade weighted index also rose.

The key is the signal, not just the move:

The RBNZ has now delivered about 325 basis points of easing since August 2024 to counter a shallow recession and weak business confidence.

In the latest statement, the committee described this cut as likely the last in the cycle, emphasising that future moves will depend strictly on the medium-term inflation outlook.

The Bank’s projections show inflation drifting back toward 2% by mid-2026, with growth stabilising after several quarters of contraction.

Markets read this as a “hawkish cut”. Rate traders sharply reduced expectations for further easing through 2026, and local banks quickly trimmed mortgage rates, suggesting policy may now stay on hold for an extended period.

For FX, that combination of a final, well-telegraphed cut and a clearer endpoint to the easing cycle reduces downside risks for NZD. When set against a Fed that is still cutting, the relative rate gap can begin to stabilise or even move in favour of the kiwi.

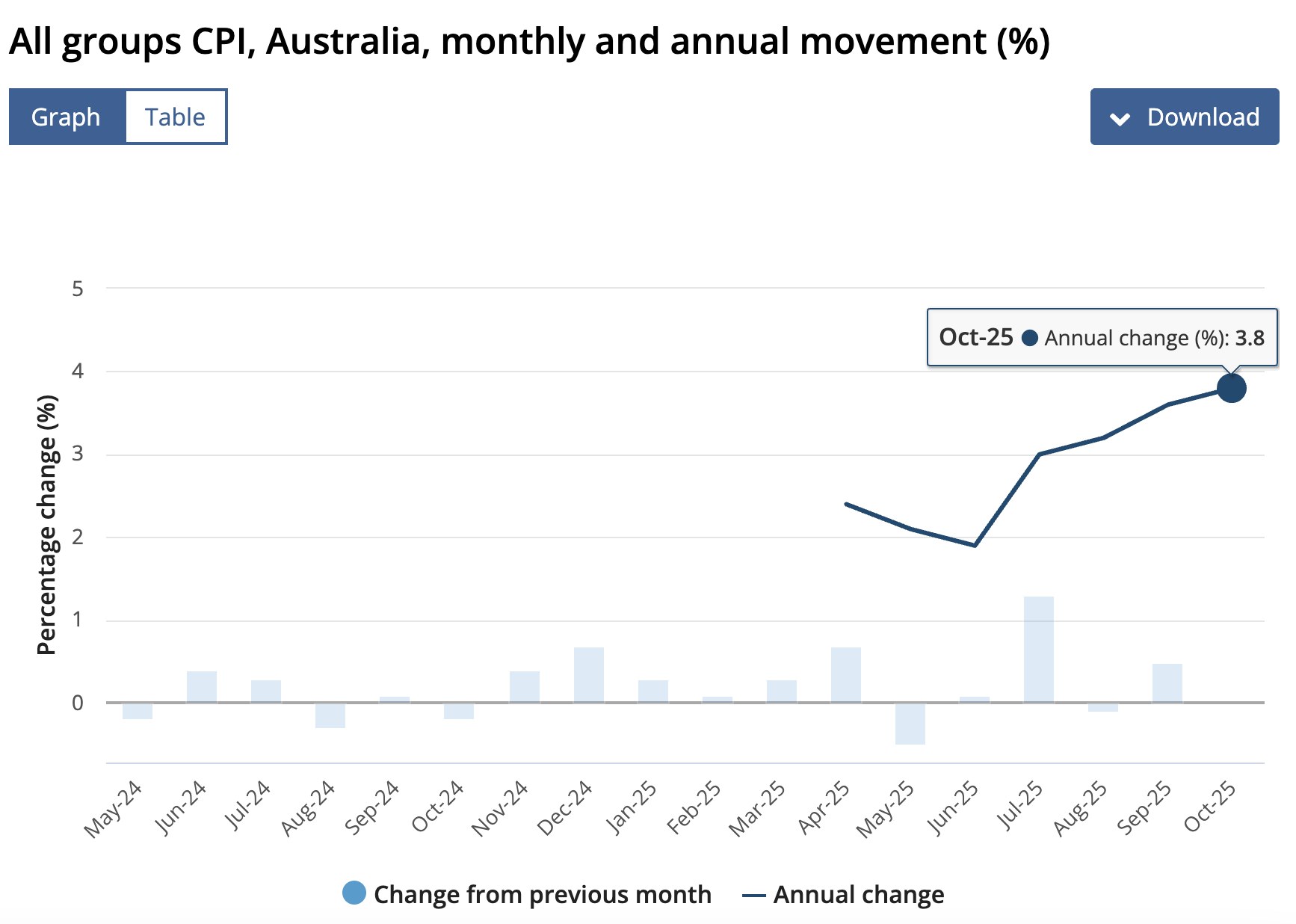

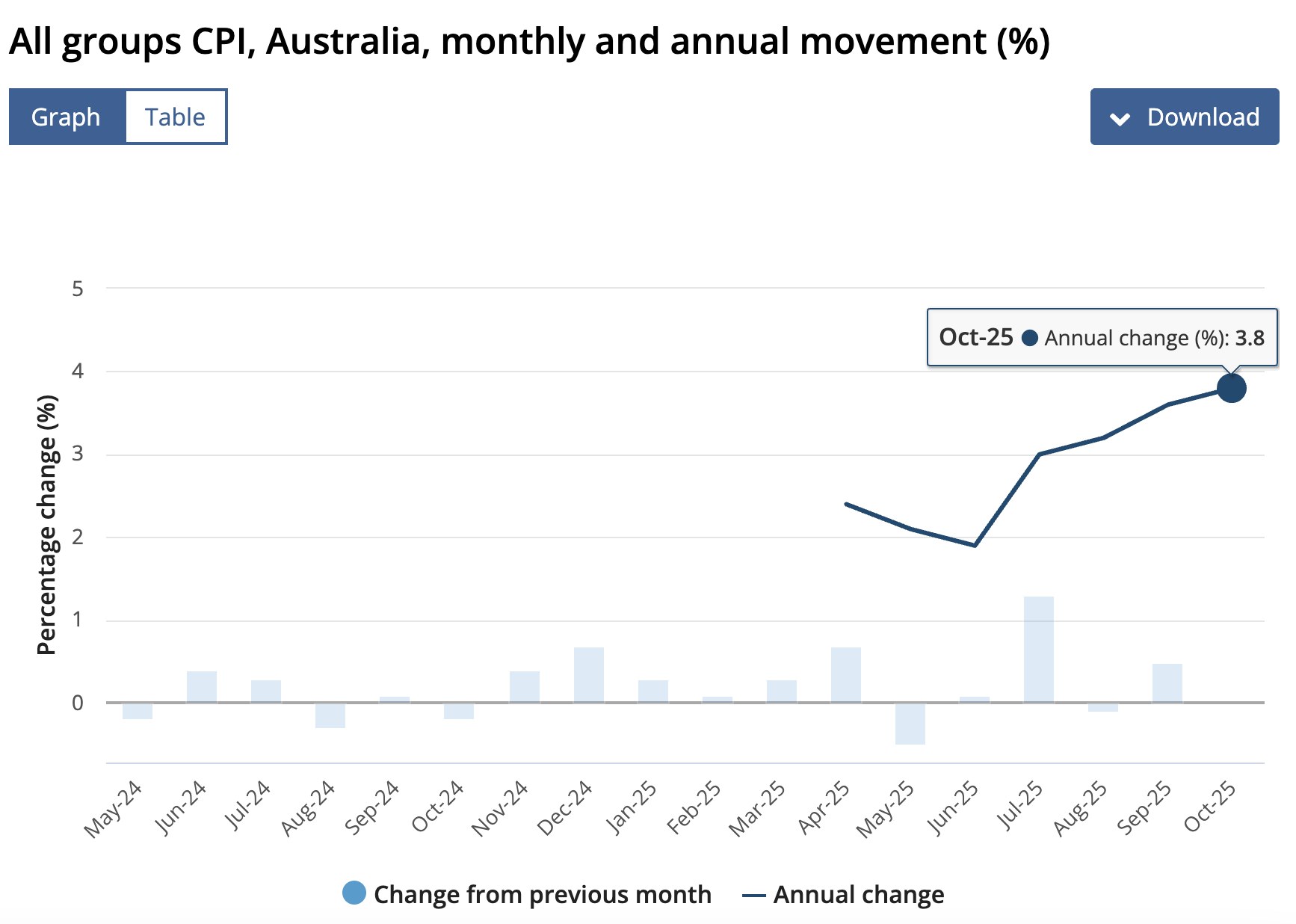

Australian Inflation Surprise Changes The AUD Story

At the same time, Australian data has flipped the RBA narrative. The October monthly CPI measure rose to 3.8% year on year, the highest in ten months and above consensus forecasts near 3.6%.

The trimmed mean measure watched closely by the RBA rose to 3.3%, above the 2–3% target band.

Price pressure was broad based, with services inflation near 3.9% and housing inflation close to 5.9%. Electricity prices surged by more than 30% as earlier rebates rolled off.

Markets responded quickly:

Odds of an RBA rate cut in the first half of 2026 dropped into single digits, and some analysts now talk about a renewed hike if monthly prints stay firm.

Australian bond yields moved higher, while the Australian dollar gained around 0.6% against the US dollar on the day of the release.

That inflation shock, combined with a softer US dollar, has allowed AUD/USD to climb back toward the upper part of its recent trading range.

How AUD and NZD Have Traded

To put the moves in context, here is a snapshot of where AUD/USD and NZD/USD stand as of 26 November 2025:

| Pair |

Spot (26 Nov 2025) |

7-day Range (approx) |

2025 Change vs USD* |

| AUD/USD |

~0.65 |

0.643 – 0.651 |

+4.5% |

| NZD/USD |

~0.569 |

0.558 – 0.569 |

+0.5% |

*Change based on full-year FX history data.

Two patterns stand out:

Both currencies are off their 2025 lows but still below the mid-year highs near 0.67 for AUD/USD and 0.61 for NZD/USD.

The kiwi has outperformed on a very short horizon. After the RBNZ cut, AUD/NZD fell toward 1.14 as NZD rallied more than AUD, even with the Australian inflation surprise.

That mix tells us the market is rewarding:

Clear signalling that an easing cycle is ending (RBNZ).

Domestic inflation that limits further cuts (RBA).

And a US backdrop where falling rate expectations are no longer a USD tailwind.

Technical picture: AUD/USD and NZD/USD

AUD/USD

On the daily chart, AUD/USD has broken above short-term resistance, trading around 0.65 and moving back above its 50-day moving average, which sits near 0.6466. The 5-day average is closer to 0.6505, showing how quickly the short-term trend has turned higher.

Key momentum signals:

The 14-day RSI is above 70, in overbought territory, indicating strong upside momentum but also a risk of consolidation.

MACD on the daily timeframe has flipped positive, confirming a bullish shift in medium-term momentum.

Indicative levels based on recent highs and lows:

Immediate support: 0.6450–0.6430 (recent swing lows from mid-November).

Stronger support: 0.6350 region, where buyers previously stepped in during October.

Near-term resistance: 0.6550–0.6600.

Major resistance: the September high around 0.669.

A sustained hold above the 50-day average keeps the short-term bias constructive. A daily close back below 0.6430 would warn that the post-inflation bounce is fading.

NZD/USD

NZD/USD has seen an even sharper move. Spot is near 0.569, after a daily range of roughly 0.562–0.570.

Technical indicators are stretched:

The 14-day RSI is in the high-70s, flagging overbought conditions.

Multiple oscillators and trend indicators now show “buy” or “strong buy” signals, with ADX near 49 indicating a strong trend.

Key zones from recent price action:

Immediate support: 0.5620–0.5615 (today’s intraday lows and prior resistance).

Stronger support: 0.5530 -0.5550, close to the November low and not far above the 2025 trough near 0.5525.

Near-term resistance: psychological 0.5700.

Major resistance: the July high around 0.6100.

With momentum this strong, dips toward 0.5620 may attract buyers, but overbought readings mean that fresh long positions need careful risk management.

What Traders Are Watching Next

Several themes will guide AUD and NZD from here:

Fed path and US data. A confirmed December cut followed by cautious forward guidance would likely keep the dollar on the back foot, especially if inflation remains close to 3% and growth slows only gradually.

Australian inflation and RBA communication. Another upside surprise in monthly or quarterly CPI, or any hint that the RBA is starting to consider renewed tightening, would be supportive for AUD.

New Zealand growth data. With the OCR now at 2.25%, the RBNZ will watch whether lower mortgage rates and a weaker past currency path translate into stronger activity.

Any sign that growth is failing to stabilise could reopen talk of further cuts, while firmer data would validate the “hawkish cut” narrative that supports NZD.

China and global risk sentiment. As usual, Chinese activity and commodity demand remain important for both AUD and NZD, even though the immediate drivers are now more about rates than pure growth.

Trading AUD And NZD With EBC Financial Group

With these macro and technical drivers in play, AUD and NZD offer active trading opportunities across spot FX and CFDs.

With EBC Financial Group, traders can:

Trade AUD/USD, NZD/USD and AUD/NZD alongside major indices, commodities and other FX pairs from a single account.

Use advanced charting tools to track key support and resistance levels discussed above.

Apply stop loss and take profit orders to manage risk around data releases and central bank meetings.

Access market commentary, webinars and educational resources to understand how macro data flows into FX pricing.

Trading leveraged products involves a high level of risk and may not be suitable for all investors. You can lose more than your initial investment. Always consider your objectives and risk tolerance, and seek independent advice if needed.

Frequently Asked Questions (FAQ)

1. Why did AUD and NZD move after the latest US inflation data?

US CPI around 3% and softer recent inflation surprises have strengthened expectations for another Fed rate cut in December. Lower US yields and a weaker dollar help high-beta currencies such as AUD and NZD, especially when local stories are supportive.

2. Why did NZD rise even though the RBNZ cut rates?

Markets had fully priced a 25 basis point cut, and the RBNZ signalled that the easing cycle is probably ending, with future moves depending on medium-term inflation. That “hawkish cut” message reduced expectations for further easing, which supported NZD.

3. How important is Australian inflation for AUD/USD now?

Very important. The latest CPI print at 3.8% year on year and a trimmed mean at 3.3% have pushed back RBA cut expectations and even opened the door to renewed tightening if inflation stays sticky. That keeps rate differentials from moving too far against AUD.

4. Are AUD/USD and NZD/USD overbought after the recent rally?

Daily RSI readings above 70 for both pairs suggest overbought conditions and the risk of consolidation or pullbacks. At the same time, MACD and trend indicators remain positive, showing that the underlying uptrend is still intact for now.

5. Can I trade AUD and NZD with EBC Financial Group?

Yes. EBC Financial Group offers trading in AUD and NZD pairs via CFDs and spot FX, alongside global indices, commodities and other currencies. Always remember that leveraged trading carries significant risk and may not be suitable for every investor.

Conclusion

With US inflation settling near 3% and the Fed easing, AUD and NZD are now driven more by relative rate paths than broad dollar strength.

Australia’s hotter CPI has delayed RBA cut expectations, while New Zealand’s final 25 bp move to 2.25% signals a likely pause. These shifts have lifted AUD/USD and NZD/USD off their lows and pushed AUD/NZD lower as the kiwi outperformed.

Both pairs still show solid upside momentum, though stretched conditions suggest room for brief consolidation. Any pullbacks toward support may attract buyers as long as the macro backdrop holds.

The focus now turns to upcoming US data, RBA and RBNZ signals, and how inflation trends evolve across the three economies, the key drivers of AUD and NZD volatility in the weeks ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.