Global index trading has become a convenient choice for Pakistani traders who want exposure to the world’s biggest equity markets without opening offshore stock accounts or analysing hundreds of individual shares.

Index CFDs track widely followed benchmarks such as the NASDAQ-100, S&P 500, DAX, and Nikkei 225, which react quickly to major macro events like inflation releases, central bank decisions, and earnings seasons.

EBC Financial Group offers index CFDs across major US, European, Asian, and Australia benchmarks, with defined contract sizes, minimum trade sizes from 0.1 lots, and leverage available up to 100× (subject to the product and entity rules).

Why Pakistani Traders Are Trading Indices

Broad market exposure: One trade gives exposure to dozens or hundreds of companies, reducing single-stock risk.

Sector access: NASDAQ-100 (NASUSD) offers heavy exposure to technology, cloud, semiconductors, and AI leaders, which is useful if you want concentrated tech exposure without picking single stocks.

Hedging & diversification: Indices let you hedge local portfolio risk or diversify into USD-, EUR-, GBP- or JPY-denominated assets.

Can You Trade NASDAQ and Global Indices from Pakistan?

Yes, Pakistani traders can legally trade NASDAQ and other major global indices through regulated international CFD brokers that accept clients from Pakistan and operate under recognized global regulatory frameworks.

A professional broker should provide more than just market access. It should offer a trading environment built on security, transparency, and performance. This includes:

Strong protection of client funds through robust operational and compliance standards

Transparent pricing with no hidden costs or surprise fees

Fast and reliable execution, even during volatile market conditions

Direct access to major global indices, including US, European, and Asian benchmarks

Professional-grade trading platforms equipped with advanced charting, analysis, and risk-management tools

Why Choose EBC Financial Group for Index Trading

EBC positions index CFDs offering around access to major global indices, published contract specifications, and leveraged trading up to 100x depending on the product and rules, while also maintaining a library of trading tools and indicators designed to support analysis and timing.

EBC also accepts clients from Pakistan and references local funding support in Pakistan-focused educational content, which matters for traders who want fewer operational frictions from signup to active trading.

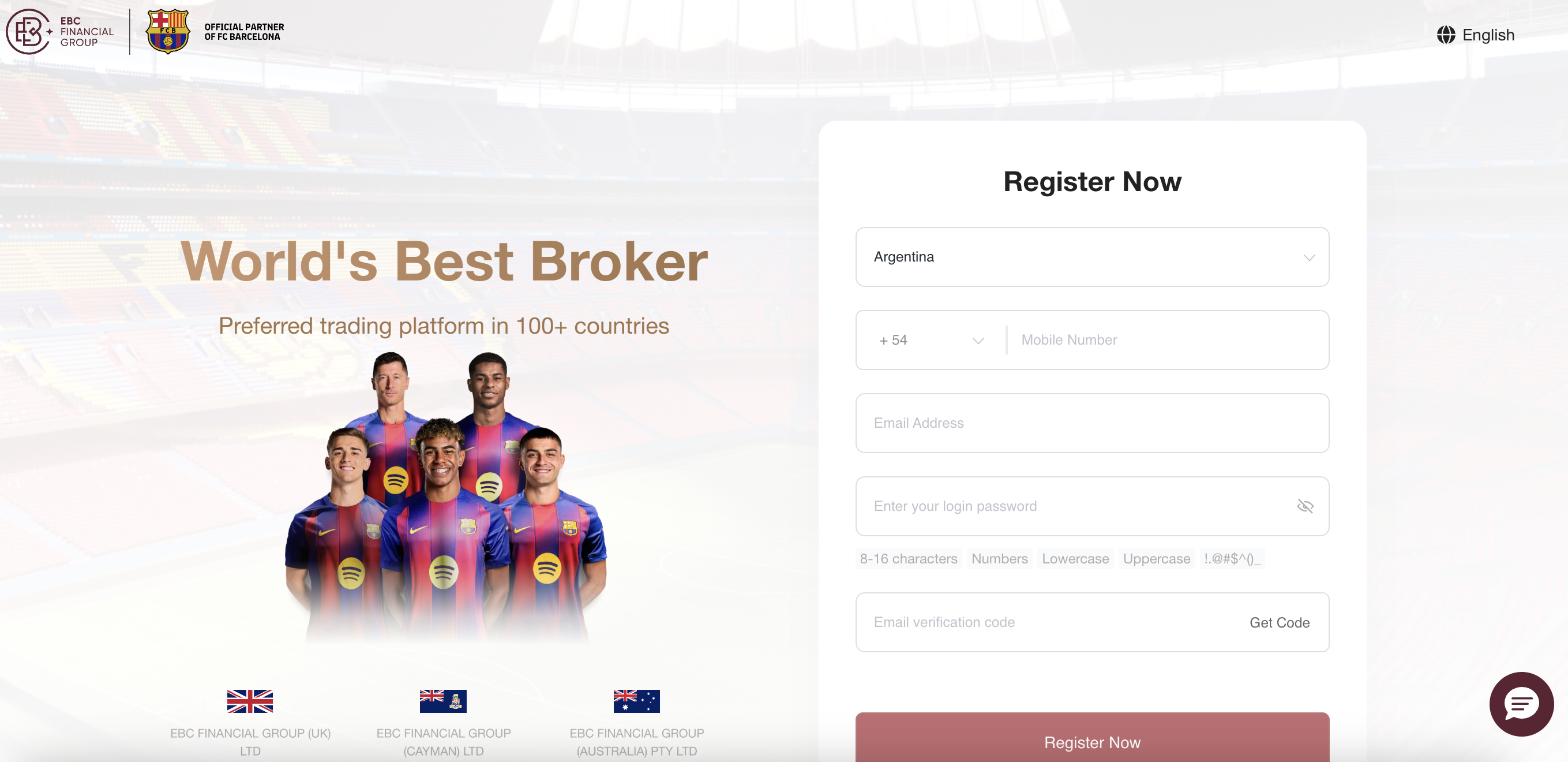

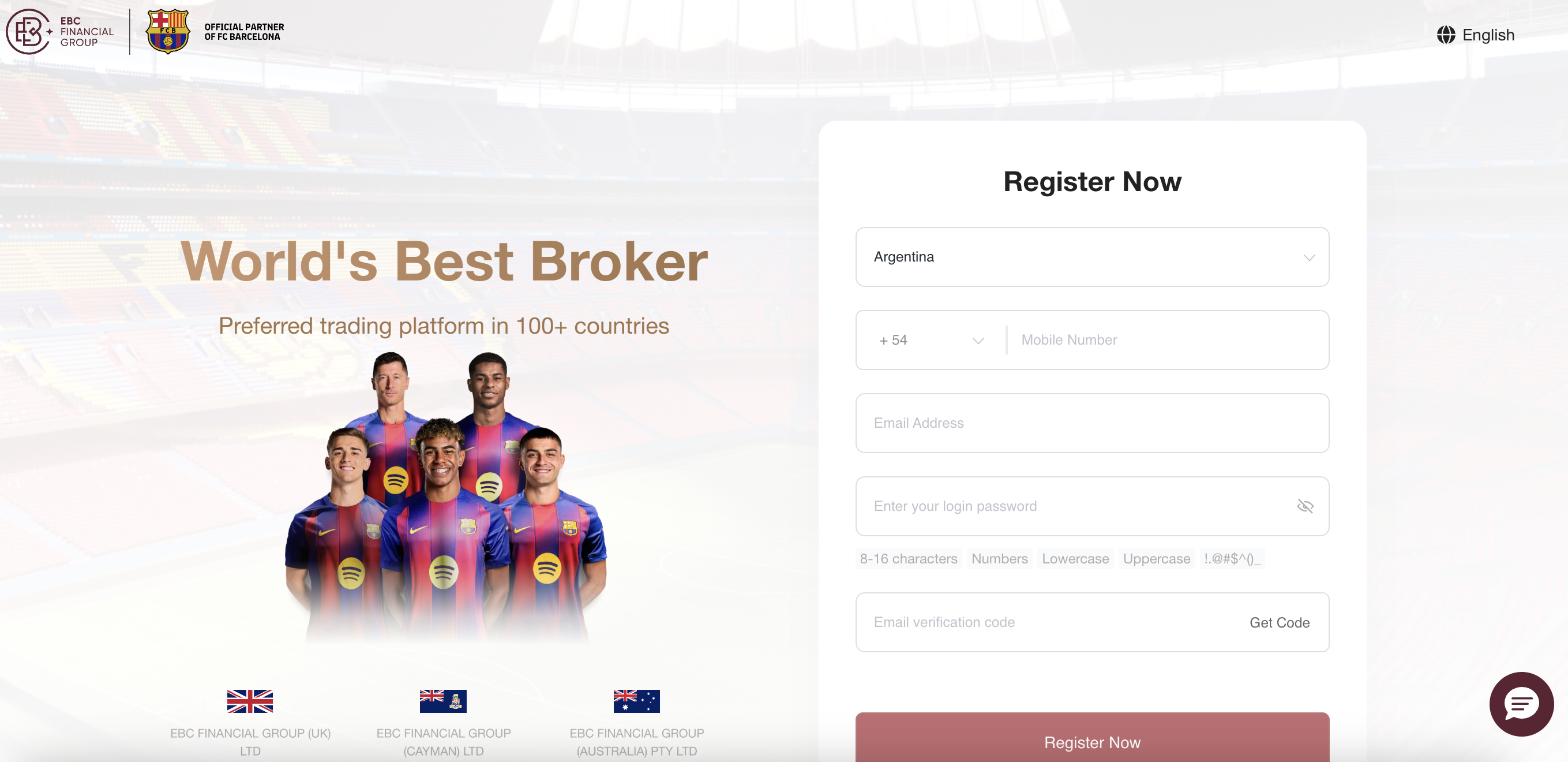

How to Trade NASDAQ & Other Indices from Pakistan with EBC

Open an Account: Register online with EBC Financial Group in just a few minutes. Choose between a Standard Account or a Professional Account, depending on your trading experience and strategy.

Complete Account Verification: Finish the standard KYC verification process to activate full trading features and ensure account security.

Fund Your Trading Account: Deposit funds using EBC’s supported payment methods (e.g. Crypto deposit, Bank transfer, wire transfer, Card deposit), with a smooth and secure funding process suitable for traders in Pakistan.

Select Your Preferred Index: Access a wide range of US, European, Asian, and Australian indices, including NASDAQ, S&P 500, DAX, FTSE 100, Nikkei 225, and more, from a single platform.

Analyze and Execute Trades: Use professional charting tools, technical indicators, real-time market data, and economic news to plan trades, manage risk, and execute with precision.

Indices Available on EBC Financial Group

| Region |

EBC Symbol |

Index (Common Name) |

Typical Use Case |

| US |

NASUSD |

NASDAQ-100 |

Tech-heavy exposure, higher beta days |

| US |

SPXUSD |

S&P 500 |

Broad US benchmark, macro-sensitive |

| US |

U30USD |

US Stock 30 (Dow-style) |

Old-economy tilt, trend days |

| US |

RUTUSD |

Russell 2000 |

Small-cap risk appetite gauge |

| Germany |

D30EUR |

DAX 30 |

Europe growth and industrial cycle proxy |

| France |

F40EUR |

CAC 40 |

French large-caps, Europe risk tone |

| Europe |

E50EUR |

Euro STOXX 50 |

Eurozone blue-chip basket |

| UK |

100GBP |

FTSE 100 |

UK large caps, global commodity tilt |

| Japan |

225JPY |

Nikkei 225 |

Japan equity benchmark, JPY-sensitive |

| Hong Kong |

HSIHKD |

Hang Seng |

China/HK risk sentiment proxy |

| China |

CNIUSD |

China A50 |

China large-cap basket exposure |

| Australia |

200AUD |

S&P/ASX 200 |

Australia market exposure |

The Future of Indices Trading in Pakistan

The future of indices trading in Pakistan looks increasingly promising and growth-oriented as more traders seek access to global markets beyond local equities.

With rising awareness of global financial markets, improved internet infrastructure, and wider availability of international CFD brokers, Pakistani traders are steadily shifting toward trading major indices such as NASDAQ, S&P 500, DAX, and Nikkei 225.

Indices trading appeals to the new generation of traders because it allows them to trade entire economies, benefit from global trends, and manage risk more efficiently than trading individual stocks.

As technology, education, and access to professional platforms continue to improve, index trading is expected to become a core part of Pakistan’s retail trading landscape.

What to Look Out for When Trading Indices in Pakistan

If you are trading indices from Pakistan, three factors usually decide your results more than “which index is best”:

(1) when you trade (liquidity windows), (2) how you size risk (because indices can gap on news), and (3) what you are actually trading (contract size and point value). EBC publishes contract specifications such as contract size, trading hours, tick size, and minimum lot size, so you can plan positions with fewer surprises.

The most traded index for “big tech exposure” is typically the NASDAQ-100 (NASUSD), while the S&P 500 (SPXUSD) is often treated as the broad US risk benchmark. On EBC, NASUSD has a contract size of 10, while SPXUSD uses 100, which changes how fast P/L moves per point and why risk sizing must be instrument-specific.

Index CFDs are straightforward on the screen, but professional results come from respecting the mechanics behind the symbol.

1. Contract Size And Minimum Trade Size

EBC provides different contract sizes by index. For example, several indices use a contract size of 10(including NASUSD and U30USD), while SPXUSD and 225JPY are shown with a contract size of 100. The minimum contract size is 0.1 lot for index CFDs.

2. Leverage And Margin Reality

EBC states index CFDs can be traded with leverage up to 100x, within compliance and regulatory standards. Leverage is a tool, not a target. Many traders use lower effective leverage and focus on stable risk per trade (for example, risking a fixed % of account equity with a defined stop).

3. Dividend Adjustments (Often Ignored)

Index CFDs can have dividend-related adjustments depending on the product structure and ex-dividend dates. EBC explains how dividend adjustments may apply (example calculations are provided for SPXUSD).

If you hold positions across dividend events, it is worth understanding how your overnight P/L can be affected.

The Overlooked Edge: Pakistan Time Zones And Liquidity Windows

A common mistake is trading a “US index” during Pakistan daytime and expecting smooth movement. Indices tend to trade best when their underlying cash markets are active and when macro releases hit.

EBC’s index trading hours in UTC+3. Pakistan is UTC+5, so you can add 2 hours to convert the schedule. For many indices shown, the main weekly window is Mon 01:05 to Fri 23:59 (UTC+3), plus a daily maintenance break.

Index Trading Sessions and Market Timing for Pakistani Traders

One major advantage of index trading is round-the-clock opportunity.

| Trading Session |

Approx. PKT Time |

Major Indices Most Active |

| Asian Session |

6:00 AM – 3:00 PM |

Nikkei 225, Hang Seng Index |

| European Session |

1:00 PM – 10:00 PM |

DAX, CAC 40, FTSE 100 |

| US Session |

6:30 PM – 1:30 AM |

NASDAQ 100, S&P 500, Dow Jones Industrial Average |

Here is a trader-friendly way to think about it in Pakistan:

US Indices (NASUSD, SPXUSD, U30USD, RUTUSD): strongest movement tends to cluster in the Pakistan evening, especially around major US data releases and the US cash open.

Europe (D30EUR, F40EUR, E50EUR): more consistent volatility often shows up mid-afternoon to evening PKT, aligned with European cash trading.

Asia (225JPY, HSIHKD, CNIUSD): tends to be most active in morning to early afternoon PKT, aligned with Asian market hours.

(Exact activity peaks vary by day and news calendar, but the “cash-hours alignment” principle holds.)

Frequently Asked Questions (FAQ)

1. Can I trade NASDAQ and other global indices from Pakistan?

Yes. Traders in Pakistan can legally trade NASDAQ and other major global indices through reputable international CFD brokers that accept Pakistani clients and operate under recognized regulatory frameworks.

2. How much do I need to start trading with EBC Financial Group?

EBC Financial Group offers different account types with varying minimum deposit requirements. For most traders, the Standard Account can be opened with a minimum deposit of as low as $50, making it accessible for beginners.

3. What Minimum Size Can I Trade On Index CFDs With EBC?

EBC provides a minimum contract size of 0.1 lot for index CFDs. Always confirm the symbol’s contract size and tick movement, because risk per point differs across indices like NASUSD versus SPXUSD.

4. Is indices trading suitable for beginners in Pakistan?

Yes, indices trading can be suitable for beginners because it provides broad market exposure with diversification. However, new traders should start with proper education, a demo account, and disciplined risk management before trading real capital.

5. Which indices are most popular among Pakistani traders?

Some of the most actively traded indices include NASDAQ 100, S&P 500, Dow Jones Industrial Average, DAX 30, FTSE 100, and Nikkei 225; selected for their liquidity, volatility, and reaction to global news.

6. When Is The Best Time To Trade US Indices In Pakistan?

Most traders get the cleanest movement in Pakistan evening hours, when US markets are active and major US data releases typically hit. Aligning your trading window with the underlying market’s activity often improves liquidity and follow-through.

Summary

Trading NASDAQ and other global indices from Pakistan is no longer about “finding access.” It is about trading the right index at the right time, with position sizing that matches the instrument’s contract specs and volatility.

Success in indices trading depends on choosing the right broker, understanding market sessions, managing risk, and trading with transparency and reliable execution.

With professional platforms, access to major global indices, and convenient funding options, EBC Financial Group provides a structured and efficient gateway for traders in Pakistan who want to participate confidently in global markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.