Economics studies how societies allocate scarce resources. This broad field is divided into two main branches: microeconomics and macroeconomics.

Understanding the difference between microeconomics and macroeconomics is essential for interpreting news headlines, evaluating government policy, running a business, or making informed investment and career decisions.

This guide offers a clear, structured overview of both branches, highlights their differences and interactions, and explains their importance in understanding modern economies.

Microeconomics: The Economics of Individual Decision-Making

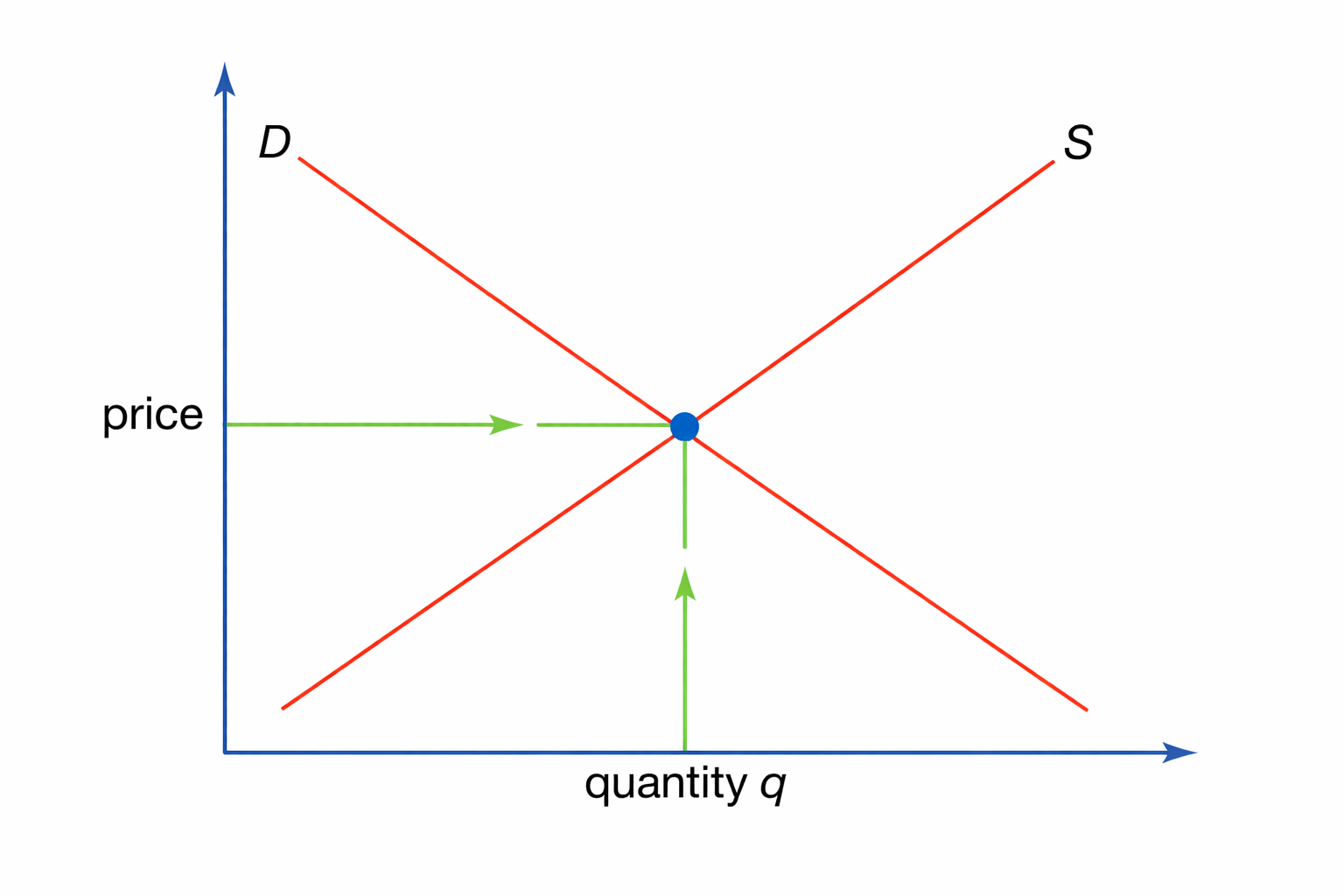

Microeconomics focuses on the smallest units of the economy, individual consumers, workers, firms, and specific markets. It examines how these agents make decisions, how they interact with one another, and how prices and quantities are determined in particular markets.

Microeconomics addresses incentives, constraints, and trade-offs. It explores questions like why coffee prices rise with demand, how firms decide production levels, and how minimum wage changes affect employment. These topics are specific but require detailed analysis.

Core Focus of Microeconomics

Microeconomics studies economic behavior at the individual and firm level. Its main areas of focus include:

Consumer behavior: How individuals allocate income across goods and services to maximize satisfaction.

Firm behavior: How companies choose output levels, pricing strategies, and production methods.

Market structures: How competition differs across markets, such as perfect competition, monopolies, oligopolies, and monopolistic competition.

Resource allocation: How labor, capital, and land are distributed across industries.

Microeconomics assumes that economic agents respond rationally to incentives, though real-world behavior may sometimes differ.

Key Concepts in Microeconomics And Formulas

Several core concepts define microeconomic analysis:

Total Revenue (TR): Price × Quantity.

Total Cost (TC): Sum of Fixed Costs (FC) + Variable Costs (VC).

Profit: Total Revenue - Total Cost (TR - TC).

Marginal Cost (MC): Change in Total Cost / Change in Quantity.

Price Elasticity of Demand (PED): % Change in Quantity Demanded / % Change in Price.

Average Total Cost (ATC): Total Cost / Quantity.

In summary, microeconomics explains the “how” and “why” of individual economic choices.

Macroeconomics: The Economics of the Big Picture

While microeconomics focuses on details, macroeconomics examines the overall economy using broad indicators to assess performance.

Macroeconomics addresses questions such as why economies grow or enter recessions, the impact of inflation, and the roles of governments and central banks.

Core Focus of Macroeconomics And Formulas

Macroeconomics focuses on economy-wide variables, including:

Gross Domestic Product (GDP): Consumption (C) + Investment (I) + Government Spending (G) + Net Exports (X-M).

Inflation Rate: [(CPI this year - CPI last year) / CPI last year] × 100.

Unemployment Rate: (Number of Unemployed / Total Labor Force) × 100.

Spending Multiplier: 1 / (1 - MPC) (where MPC is Marginal Propensity to Consume).

Key Concepts in Macroeconomics

Macroeconomic analysis relies on a different set of tools and frameworks:

Aggregate demand and aggregate supply: The total demand and supply in an economy.

Fiscal policy: Government spending and taxation decisions.

Monetary policy: Central bank actions affecting money supply and interest rates.

Business cycles: Periodic expansions and contractions in economic activity.

Open-economy dynamics: Trade balances, exchange rates, and capital flows.

Macroeconomics recognizes that economies may remain below full employment for extended periods, which can justify policy intervention.

Real-World Applications of Macroeconomics

Macroeconomics directly shapes national and global outcomes:

Governments use macroeconomic analysis to design budgets, stimulus packages, and tax reforms.

Central banks rely on macro indicators to adjust interest rates and control inflation.

Investors track macroeconomic trends to assess risk, returns, and market cycles.

Citizens experience macroeconomic outcomes through job availability, wage growth, and cost of living.

Difference Between Micro and Macro Economics: A Direct Comparison

The distinction between microeconomics and macroeconomics is most evident when compared directly. Microeconomics explains the parts, while macroeconomics explains the whole.

| Basis of Comparison |

Microeconomics |

Macroeconomics |

| Scope |

Individual consumers, firms, and markets |

Entire economy |

| Level of analysis |

Small-scale and specific |

Large-scale and aggregate |

| Key variables |

Prices, output, costs, utility |

GDP, inflation, unemployment |

| Main focus |

Resource allocation and efficiency |

Economic growth, stability, and cycles |

| Policy relevance |

Industry regulation, taxes, subsidies |

Fiscal and monetary policy |

| Time horizon |

Short to medium term |

Medium to long term |

Importance of Micro and Macro Economics in Trading and Investment

Successful trading and investing require understanding both the economic environment and asset-specific fundamentals. Macroeconomics sets the market context, while microeconomics determines relative performance within it.

Role of Macroeconomics in Trading

Macroeconomics explains market direction and regime. Key macro variables influence broad asset movements:

Interest rates: Affect equity valuations, bond yields, and currency strength

Inflation: Drives monetary tightening or easing, impacting risk assets.

Economic growth: Shapes earnings expectations and sector rotation

Liquidity conditions: Influence volatility and capital flows

Example:

When interest rates rise, equity multiples typically compress, and bond prices fall, while currencies with higher yields tend to strengthen.

Role of Microeconomics in Asset Selection

Microeconomics explains why some assets outperform others under the same macroeconomic conditions:

Pricing power: Firms that can pass on higher costs protect margins

Cost structure: Asset-light businesses adapt faster to demand shifts

Market structure: Dominant players outperform in concentrated industries

Balance sheets: Low leverage reduces sensitivity to rate hikes

Example:

During inflationary periods, companies with strong brand power often outperform peers that compete mainly on price.

How Traders Combine Both

Opportunities arise when macro and micro signals align:

Macro identifies the environment (tightening, easing, expansion, slowdown)

Micro identifies winners and losers within that environment.

Execution depends on timing, valuation, and risk management.

Example:

In a slowing economy with rising rates, traders may reduce broad equity exposure while favoring defensive sectors and firms with stable cash flows.

How Micro and Macro Economics Are Interconnected

Despite their differences, microeconomics and macroeconomics are not isolated disciplines. They are deeply interconnected.

Macroeconomic outcomes emerge from countless micro-level decisions. Aggregate consumption, for example, is the sum of individual household spending choices. Investment levels depend on firm-level expectations and cost structures. Inflation reflects price-setting behavior across millions of markets.

Conversely, macroeconomic conditions shape microeconomic behavior. High inflation alters consumer purchasing patterns. Interest rate changes influence firm investment and household borrowing. Recessions reshape labor market dynamics at the individual level.

Modern economic analysis emphasizes this two-way relationship, recognizing that a full understanding requires both perspectives.

Common Misconceptions About Micro and Macro Economics in Trading

Several misconceptions persist in trading, often leading to poor positioning and avoidable losses.

“Micro is less important than macro.”

Macroeconomic forces often set market direction, but performance differences result from microeconomic fundamentals. Even in strong macro conditions, weak business models underperform, while firms with strong margins and stable demand can outperform during downturns.

“Macro is just politics."

Market pricing reflects measurable economic variables such as interest rates, inflation expectations, liquidity, and growth prospects, rather than political narratives. Traders who rely on headlines instead of macro signals often misjudge market shifts and volatility.

“You only need one.”

Macro analysis without micro leads to broad, undifferentiated exposure. Micro analysis without macro results in good ideas executed at the wrong time. Consistent performance requires accurate timing, position sizing, and risk management.

Recognizing these misconceptions helps traders align economic signals with asset behavior, leading to better decision-making and more consistent results.

Frequently Asked Questions (FAQ)

1. What is the main difference between microeconomics and macroeconomics?

Microeconomics analyzes individual economic units such as consumers, firms, and specific markets, while macroeconomics examines the economy as a whole, focusing on aggregates like growth, inflation, and employment.

2. Which is more important for trading and investing?

Neither is more important on its own. Macroeconomics sets the market regime and directional risk, while microeconomics determines relative performance and asset selection. Consistent results require integrating both.

3. Can microeconomics explain inflation?

Microeconomics explains price changes in individual markets, such as supply shortages or increased demand. Sustained, economy-wide inflation, however, is a macroeconomic phenomenon driven by aggregate demand, monetary conditions, and expectations.

4. Why do markets sometimes fall even when companies report strong earnings?

Macroeconomic factors such as rising interest rates, tightening liquidity, or slowing growth can compress valuations across markets, overpowering positive firm-level fundamentals in the short term.

5. How do interest rates affect microeconomic behavior?

Changes in interest rates influence borrowing costs, investment decisions, consumer spending, and corporate financing structures, directly shaping firm behavior and household choices.

Summary

Microeconomics explains how individual choices and markets function. Macroeconomics shows how these choices combine to shape growth, inflation, employment, and economic cycles.

Each branch is incomplete on its own. Microeconomics without macroeconomics misses broader forces, while macroeconomics without microeconomics oversimplifies behavior. Together, they offer a practical framework for understanding economic and market outcomes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.