Stock crash talk always gets loud after a few ugly sessions. This week has given investors plenty to worry about, particularly in the tech sector. On February 5, 2026, the S&P 500 fell 1.2% to 6,798.40, the Dow dropped 1.2% to 48,908.72, and the Nasdaq slid 1.6% to 22,540.59.

At the same time, volatility has picked up from its calm 2025 tone. The VIX, a standard measure of expected S&P 500 volatility, was 18.64 on February 4, 2026, which is higher than the quiet weeks but still far from panic levels.

The key point is simple. A crash in 2026 is possible, but it is not the only path. The economy continues to grow, inflation has decreased, and credit markets are not currently showing signs of stress.

What Counts as a "Stock Market Crash"?

Most investors use "crash" to mean a fast, disorderly drawdown, but markets are typically measured in thresholds:

Correction: About 10% down from a peak

Bear market: About 20% down from a peak

Crash: Usually a rapid decline with forced selling, often linked to a shock event

Bear markets have occurred frequently throughout history, but their causes differ, and their timing is difficult to predict, as markets often decline before the negative data becomes apparent.

Are We In A Stock Market Crash Now?

Not right now, based on the numbers that usually define a crash. Currently, the market is experiencing a rapid shift in confidence driven by technology rather than a full-blown market crash.

The concern is that weak sentiment may worsen if credit stress increases and economic data continue to disappoint, although the systemic signals are not yet alarming.

What the S&P 500 Is Telling Us This Week

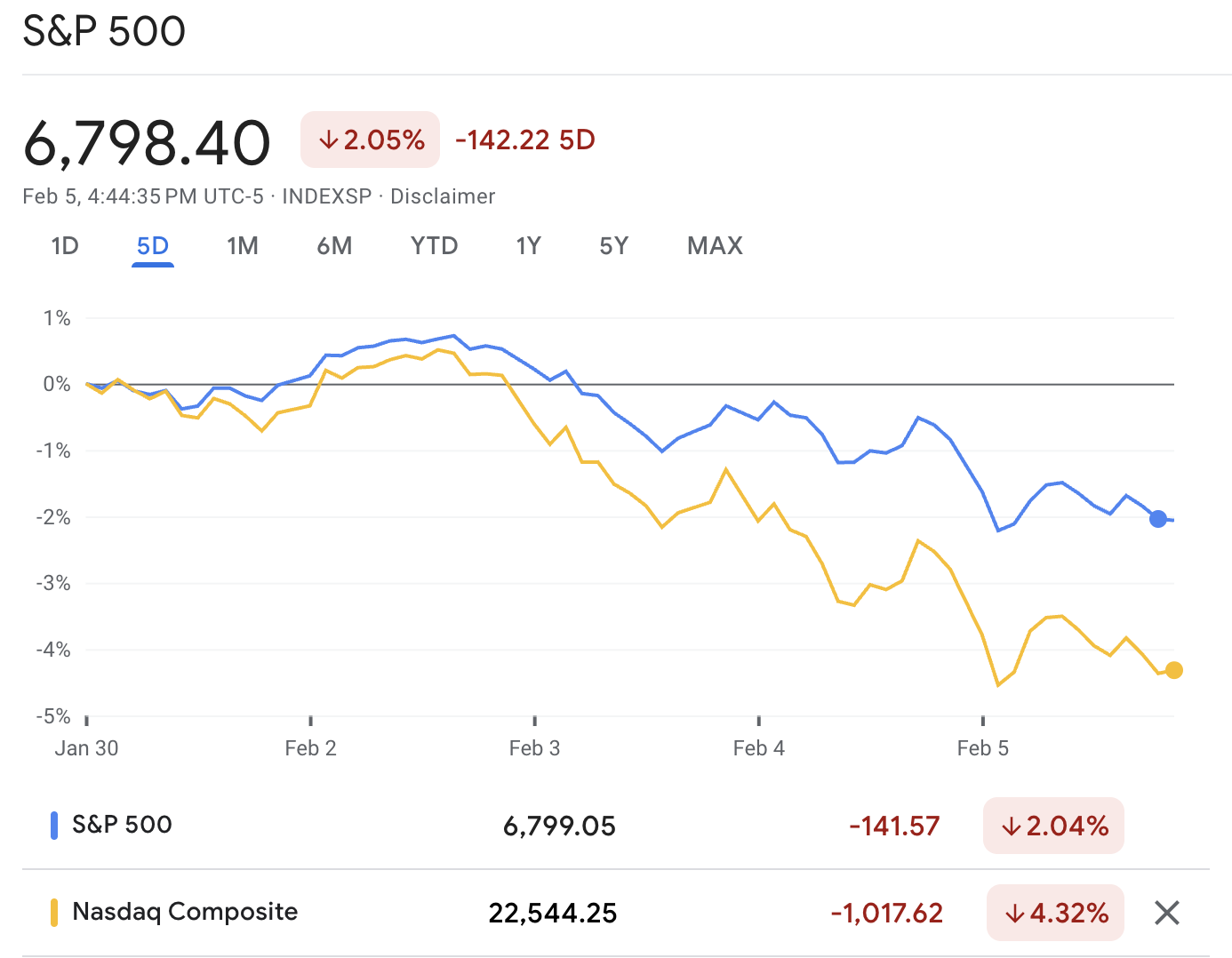

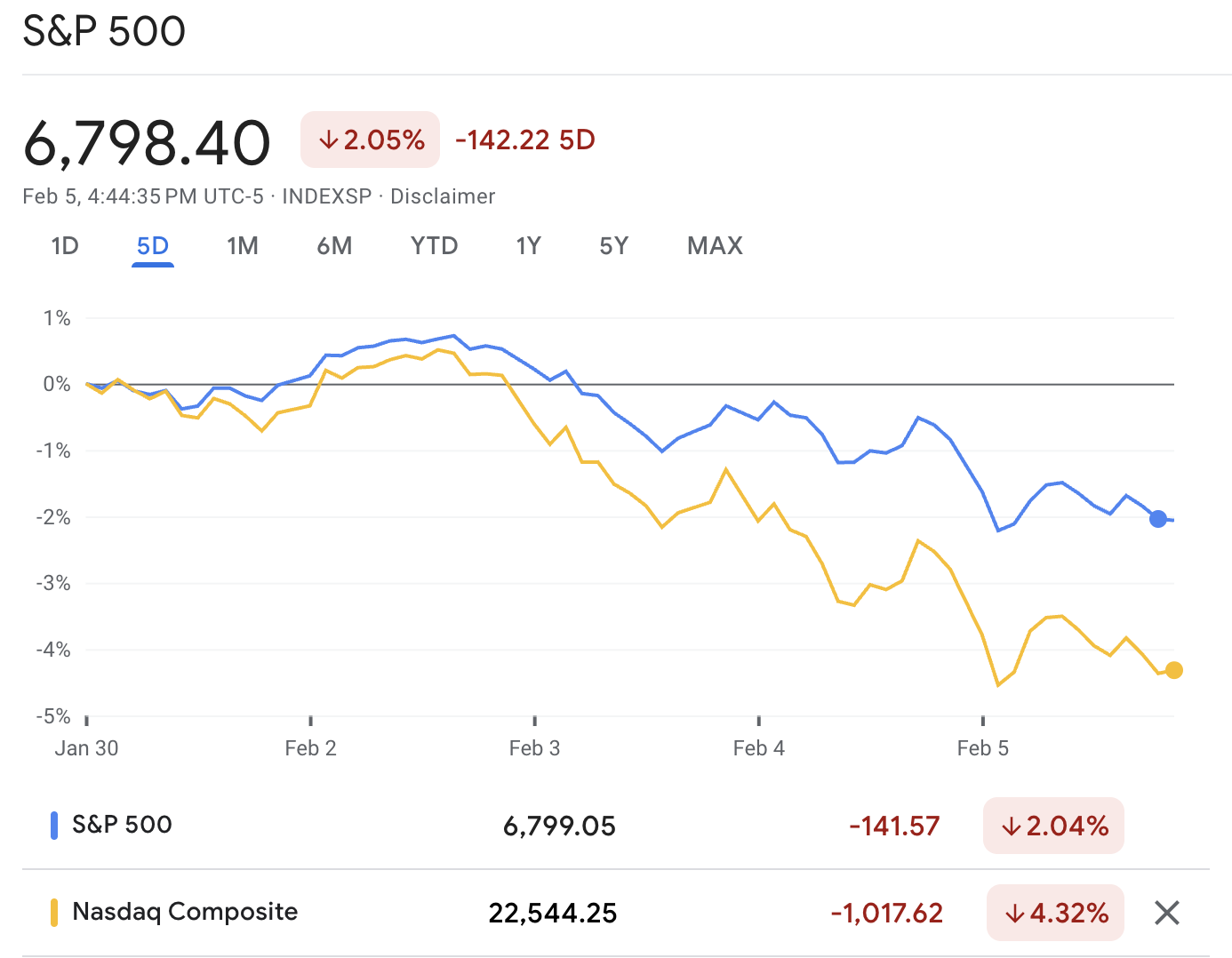

On February 2, 2026, the S&P 500 closed at 6,976.44, just below its all-time high.

However, by February 5, 2026, it had closed at 6,798.40 following a sharp selloff in the tech sector.

It represents a decrease of approximately 2.6% from the closing value on February 2.

This is painful, but it is not a correction, and it is not close to a bear market by the typical thresholds.

Volatility and Credit Conditions Do Not Look Like "Crash Mode" Yet

Two quick stress gauges help separate a scary selloff from a proper break:

VIX (fear gauge): 18.64 (February 4 close). That is elevated versus very calm markets, but it is not panic.

High-yield credit spreads (risk in corporate funding): 2.86% (February 4 close). That is still contained.

This week, significant market movements have primarily occurred in the technology sector.

For instance, the Nasdaq fell 1.6% on February 5 and was down 3.9% for the week, while the Dow was nearly flat for the week.

Crash Check: Where We Are Versus "Danger" Levels

| Indicator |

Where it is now |

What would look like crash risk |

What it means now |

| S&P 500 drop from recent peak |

~-2.6% (Feb 2 to Feb 5) |

Down 10% (correction) or 20% (bear) |

Weak tape, not a crash |

| VIX (volatility) |

18.64 |

Sustained 30+ often signals fear |

Caution, not panic |

| High-yield spreads |

2.86% |

Fast jump toward 5%+ |

Credit is calm |

Quick Answer: Is the Stock Market Going to Crash in 2026?

A market crash in 2026 is not guaranteed, and current data does not suggest a typical crisis setup. While the labor market is cooling, the unemployment rate remains at 4.4%, according to the latest BLS report. Additionally, inflation was 2.7% year-over-year in December 2025.

That said, crash risk rises when three things happen together: earnings expectations fall, credit stress jumps, and investors rush to de-risk at the same time.

The Biggest Crash Triggers to Watch in 2026 Are:

A rapid rise in layoffs and unemployment forces down earnings estimates.

A sharp widening in high-yield credit spreads signals funding stress.

A volatility shock where the VIX pushes into true fear territory, often above 30.

A policy or geopolitical shock that hits growth and liquidity at the same time.

Stock Market Recent Market Performance

Stock Market Last Week

During the week ending February 5, 2026, the S&P 500 decreased by approximately 2%, while the Nasdaq fell by 3.9%.

Stock Market Year to Date

As of 2026, the S&P 500 has decreased by 0.7%, while the Nasdaq has fallen by 3%.

What Traders Are Seeing in Liquid Benchmarks

Large index ETFs also reflect the pullback. At the latest snapshot, SPY was around $677.62, QQQ was around $597.03, and DIA was around $488.91.

The message is that markets are under pressure, but the move still sits closer to a correction-style drawdown than a crash, unless it accelerates.

The 2026 Backdrop: Rates, Inflation, Growth, and Jobs

| Indicator |

Latest reading |

What would look dangerous |

| VIX (fear gauge) |

18.64 |

Sustained break above 30 |

| High-yield spreads |

2.86% |

Fast jump above 5% and rising |

| 10y Treasury yield |

4.29% |

Yield spike that hits valuations and credit |

| Yield curve (10y minus 2y) |

+0.74% |

Sharp steepening driven by recession fear |

| Unemployment rate |

4.4% |

Quick move toward 5% plus job losses |

| Inflation (CPI y/y) |

2.7% |

Re-acceleration that blocks rate cuts |

| Fed funds target range |

3.50% to 3.75% |

Rates stay high while growth weakens |

A real crash is harder to sustain when inflation is easing, and the central bank can respond.

Rates Are Lower Than Their Peak, but Still Restrictive

The Fed's target range for the federal funds rate was 3.50% to 3.75% after the December 2025 decision.

Long-term rates are also still high enough to matter. The 10-year Treasury yield was 4.29% on February 4, 2026.

Inflation Is Cooler Than in Prior Years

The CPI rose 2.7% over the prior 12 months in December 2025.

Maintaining low inflation allows the Fed to cut rates if growth declines.

Growth Is Not Collapsing, but the Labor Market Is Softer

The latest official GDP report indicates that real GDP increased at an annualized rate of 4.4% in the third quarter of 2025.

For Q4 2025, the Atlanta Fed's GDPNow model estimate was 4.2% as of February 2, 2026. This is a model estimate, not a final government number, but it suggests growth momentum was still decent into year-end.

Jobs are the watch point. In December 2025, payrolls rose by 50,000, and the unemployment rate remained at 4.4%. The same release indicated that payroll growth in 2025 averaged around 49,000 per month, significantly lower than the levels seen in 2024.

The Main Reasons Stock Market Crash Fears Are Rising in 2026

1) Valuations Leave Less Room for Disappointment

When stocks are priced for good news, "slightly worse" can still hit prices hard.

FactSet's Earnings Insight puts the S&P 500 forward 12-month P/E at 22.2, above the 5-year average of 20.0 and the 10-year average of 18.8.

High valuations alone do not cause a crash, but they can exacerbate losses if earnings estimates begin to decline.

2) Rates Are Still High Enough to Bite

Even after cuts, policy is not "easy" by historical standards.

A federal funds range of 3.5% to 3.75%, with a 10-year yield above 4%, continues to exert pressure on interest-rate-sensitive sectors such as housing and specific areas of technology.

3) The Labor Market Is Starting to Look Fragile

The risk of a market crash increases when jobs change rapidly.

December's unemployment rate of 4.4% is not alarming by itself, but the hiring trend has slowed significantly.

Rising layoff announcements and weaker job openings can quickly change sentiment if they become a steady pattern.

4) Crowded Positioning Makes Selloffs Sharper

When leadership is narrow, a few large stocks can pull the whole index down.

That is why "tech down" can feel like "market down," even when other sectors hold up.

5) Policy Uncertainty Can Turn a Normal Pullback Into Something Worse

Markets can absorb bad news. They struggle with unclear rules.

Tariffs, regulatory surprises, and global security shocks can quickly hit risk appetite, especially when positioning is already cautious.

Three Realistic Stock Market 2026 Scenarios

| Scenario |

What it looks like |

What would confirm it |

| Soft landing pullback |

Volatile, but declines stay orderly |

Spreads stay contained, jobs soften slowly |

| Hard landing |

Earnings fall, layoffs rise, credit tightens |

Spreads widen fast, unemployment climbs |

| Inflation setback |

Yields rise again, valuations compress |

CPI re-accelerates, Fed turns cautious |

Frequently Asked Questions

1. Is the Stock Market Going to Crash in 2026?

It is possible, but the data does not yet show a straightforward crash setup. Credit spreads remain contained, and inflation is lower than in prior years, which can limit the risk of a prolonged, disorderly selloff.

2. Is VIX at 18 a Sign of Panic?

No. A VIX around 18 suggests higher caution than a very calm market, but it is not the kind of reading usually seen in major crisis moments.

3. Are Stocks Expensive In 2026?

Valuations look elevated versus recent history. FactSet's data shows the S&P 500 forward P/E around 22.2, which is above the 5-year and 10-year averages. That does not cause a crash, but it makes disappointment more painful.

4. Could the Fed Stop a Crash by Cutting Rates?

Lower inflation gives the Fed more room to respond if growth weakens. However, rate cuts are most effective when implemented before credit markets experience severe stress, rather than afterward.

Conclusion

In conclusion, the market appears more fragile in 2026 due to elevated valuations, heightened volatility, and investor skepticism about the pace at which AI investments generate cash flow.

At the same time, the conditions that often accompany a full crash are not fully in place yet in 2026. Credit spreads are not flashing a systemic warning, and official inflation and labor readings are not showing a sudden breakdown.

If you are trading markets in 2026, focus on the dashboard indicators and manage risk first. Markets can drop on surprises, but disciplined sizing and clear exit rules often matter more than getting the headline right.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.