Imagine the world's reserve currency slowly losing ground, not due to a sudden collapse, but through the steady pull of shifting monetary policy, global capital flows, and structural imbalances. That's the story of the U.S. dollar (USD) right now.

Most analysts expect the U.S. Dollar Index (DXY) to remain in a sideways or slightly weakening pattern over the next weeks rather than stage a sharp rally.

A mix of imminent Federal Reserve rate cuts, rising U.S. fiscal risks, and cautious investor sentiment is capping the dollar's upside.

What Is the Current Dollar Landscape?

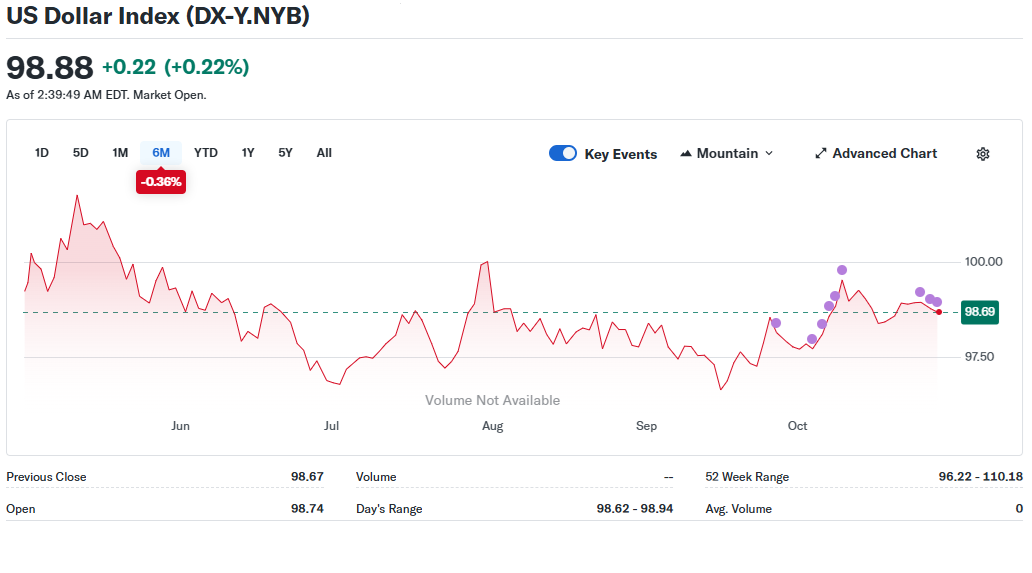

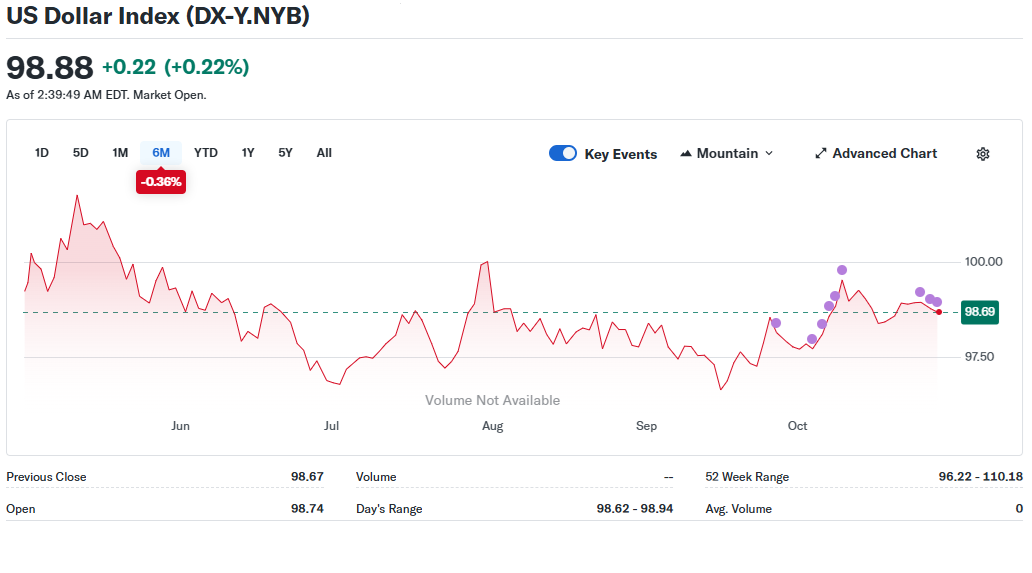

As of late October 2025, the U.S. Dollar Index (DXY) sits at approximately 98.9.

This level reflects a roughly 5% decline year-on-year, indicating dollar softness remains intact.

Key drivers behind this include:

Monetary policy divergence: Markets anticipate at least two more Fed rate cuts by the end of 2025, diminishing the yield advantage previously held by U.S. assets.

Fiscal pressure: Concerns over America's budget deficit (projected above 6% of GDP) and rising Treasury issuance weigh on sentiment, with $1.8 trillion deficit estimates from the Congressional Budget Office.

Global capital rebalancing: Investors from Asia and Europe are modestly diversifying away from dollar holdings toward local-currency and gold assets.

Why the Dollar Is Under Pressure (And Why a Rebound Isn't Impossible)

Listed are the main forces shaping USD's near-term outlook:

1. Fed Policy & Real Yields

The Federal Reserve is expected to deliver another 25-basis-point rate cut, potentially lowering the federal funds rate to 3.75–4.00% this week.

According to the CME FedWatch Tool, the probability of a 25-bps cut exceeds 96%.

2. Global Risk Sentiment and Safe-Haven Flows

Although the dollar usually gains during risk-off periods, the dynamics of global risk are intricate. Some safe-haven flows are shifting toward gold, the yen or francs rather than the USD.

An unexpected risk event might still boost the dollar for a short time, but the underlying support factors are diminishing.

3. U.S. Fiscal & Trade Dynamics

The U.S.'s expanding deficit and elevated government debt create long-term headwinds. Additionally, if other significant economies start to loosen monetary policy or bounce back sooner, the dollar's relative strength could diminish even more. [1]

4. Technical Support & Market Positioning

Technical models indicate that the DXY encounters resistance near ~99.0, with support in the ~97.0–97.5 range. The market's positioning remains tilted toward short-USD.

Will the Dollar Rate Increase Near-Term? Expert Predictions

Here are plausible paths for the dollar over the next 4–8 weeks, assuming current conditions hold:

| Month |

DXY Open |

DXY Range |

DXY Close (Proj.) |

% Change Est. |

| Oct 2025 |

97.83 |

97.06 - 100.13 |

98.54 |

+0.7% |

| Nov 2025 |

98.54 |

96.62 - 101.27 |

99.28 |

+0.8% |

| Dec 2025 |

99.28 |

97.52 - 101.09 |

99.31 |

≈0.0% |

Dollar Technical Outlook: Support and Resistance

Key Pairs to Watch:

EUR/USD: Mildly bearish USD tone; possible move toward 1.17.

USD/JPY: Intervention risk above 150.

GBP/USD: Neutral-to-mild USD weakness bias.

What Investors & FX Traders Should Watch

1. Fed Funds Futures

2. U.S. 10-yr Treasury Yield and Real Yield

3. DXY & Major Cross Rates (EUR/USD, USD/JPY)

Why It Matters: Shows dollar strength and weakness dynamic

Watch For: EUR/USD above 1.17, USD/JPY below 150

4. Global Risk Sentiment and Equity Flows

5. Fiscal & Trade News

Frequently Asked Questions

Q1. Will the U.S. Dollar Rise in the Next Week?

Unlikely. Unless a major surprise (hawkish Fed, risk shock) hits, the dollar is more likely to drift or weaken in the coming week.

Q2: How Much Can the Dollar Rise After the Fed Meeting?

Analysts estimate modest gains of 0.5%–1.5% on the DXY index, with volatility around key announcements.

Q3: Does the Fed Rate Cut Always Weaken the Dollar?

Historically, not always. Sometimes, rate cuts lift the dollar shortly by clarifying policy stance or boosting market confidence.

Q4: Is the U.S. Dollar Still a Safe-Haven Currency?

Yes, but structural issues reduce its safe-haven edge compared to the past.

Q5. How Long Could This Dollar Weakness Last?

Analyst consensus suggests possible weakness or sideways movement through Q4 2025 and into early 2026 unless a significant shift occurs. [2]

Conclusion

In conclusion, the U.S. dollar is not positioned for a strong rally in the immediate weeks ahead. The likelihood leans toward a sideways movement or slight drop, considering the expected Fed rate cuts, changes in global flows, and positioning biased toward a weaker USD.

That doesn't mean the dollar cannot surprise. A hawkish turn, inflation spike or shock event might spark a rebound, but trading on that outcome carries risk.

Currently, the better approach might be to watch support (~97.0 on DXY) and take advantage of pullbacks instead of pursuing a dollar rally.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/business/dollar-faces-prolonged-weakness-amid-fed-rate-cuts-2025-10-01/

[2] https://cambridgecurrencies.com/usd-forecast-2025/