PayPal is not being valued like a fast-growing fintech right now. It is being valued like a payments network operating in a tougher, more crowded market, where pricing power is questioned and every basis point of margin is fought for. That is why the stock can deliver respectable results and still struggle to hold gains.

In the PayPal Stock Forecast for 2026, the central issue is whether PayPal can prove it still controls a premium part of the checkout experience, not just a large part of payment volume.

If the business shows stronger profit per transaction and steadier operating discipline, PYPL stock has a clear route to re-rating. If not, the share price may stay anchored, supported by cash generation but limited by skepticism.

PayPal Stock Price Today: What Investors Are Pricing In

In recent trading, PayPal stock has traded around $59.86, which puts PayPal’s equity value near $64.1 billion and leaves the stock on a trailing P/E of about 13 on this snapshot.

Most telling is the range investors have lived through over the past year: PayPal’s own stock page shows a 52-week high of $93.25 and a 52-week low of $55.85, a wide swing that reflects how quickly confidence has faded and returned.

At roughly $60, the market is effectively pricing in three things:

Cash generation is expected, so the downside case is not “zero,” but valuation stays anchored.

A growth premium is not being paid upfront, because investors want evidence that profitability can improve with scale.

The PayPal Stock Forecast for 2026 hinges on earnings quality, meaning whether the business can expand margin dollars, not simply process more volume.

That framing fits the latest operating picture. In 3Q 2025, PayPal reported net revenues up 7% to about $8.4 billion and TPV up 8% to $458.1 billion, alongside transaction margin dollars up 6% to about $3.9 billion.

The numbers show the engine is running, but the share price action suggests investors are still waiting for clearer proof that stronger activity translates into stronger margins on a consistent basis.

What’s Driving PayPal’s Earnings Mix Into 2026

A useful way to think about PayPal’s 2026 setup is by how the platform’s growth engines affect profitability.

1) Branded experiences and checkout

Branded checkout is where pricing power tends to be strongest because it is tied to consumer choice and merchant conversion. In PayPal’s earnings presentation, branded experiences TPV was up 8% on an FX-neutral basis, while branded online checkout TPV was up 5% FX-neutral.

For a PayPal stock forecast, branded checkout matters because it typically supports better economics than lower-take-rate processing.

2) PSP and enterprise processing flows

PayPal’s presentation also highlights PSP TPV up 6%, including Enterprise Payments at “mid-single-digits” growth.

This is important, but it comes with a catch: processing scale can lift revenue and volume while diluting take rate. That makes margin metrics more important than raw TPV.

3) Venmo and monetization

Venmo revenue grew 20% and Venmo TPV grew 14% in the same quarter.

For bulls, Venmo is the bridge between engagement and monetization. For bears, it is a reminder that strong growth still needs to translate into durable margin dollars.

Margin Watch: The Numbers That Decide The PayPal Stock Price In 2026

PayPal reports transaction margin dollars (TM$*), a metric designed to track the core profit pool from payments after volume-based costs. In 3Q’25, TM$ increased 6% to $3.871 billion.

PayPal also reports TM$ excluding interest on customer balances to reduce rate-driven noise. That version rose 7% to $3.550 billion.

The plumbing behind those margins matters more than the headline:

Transaction expense rate: 0.89% in 3Q’25 (flat versus 2Q’25)

Transaction loss rate: 0.09% in 3Q’25 (higher than earlier periods shown in the same table)

The presentation notes higher transaction loss provisions, including an impact from a temporary service disruption in August.

In plain terms, the 2026 debate is about whether mix and loss rates cooperate. If branded experiences and Venmo monetization grow without a matching rise in losses or processing costs, TM$ can compound. If growth skews toward lower-margin flows or loss rates drift higher, the PayPal stock price can stay capped even with improving revenue.

Operating costs are the other half of the margin equation. In 3Q’25, PayPal’s non-transaction related expenses were $2.303 billion, up 6% year over year.

2025 Guidance As The Launchpad For A 2026 Valuation Framework

Any serious PayPal stock forecast for 2026 should start with what the company is guiding right now.

PayPal’s earnings presentation raised FY’25 guidance to:

FY’25 TM$: $15.45 billion to $15.55 billion (5% to 6% growth), with 6% to 7% growth excluding interest on customer balances

FY’25 non-GAAP EPS: $5.35 to $5.39

FY’25 free cash flow: $6 billion to $7 billion

FY’25 share repurchase: around $6 billion

The same guidance slide also quantifies the sensitivity to interest on customer balances, showing the FY’25 TM$ outlook includes an impact from lower interest on customer balances.

That matters for 2026 because a falling-rate environment can reduce that interest tailwind even if the core business performs well. In other words, the cleaner signal is usually TM$ excluding interest on customer balances.

Capital structure looks stable based on the latest quarter. PayPal reported $14.4 billion in cash, cash equivalents, and investments and $11.4 billion of debt as of September 30, 2025.

PayPal Stock Forecast 2026: Bull, Base, And Bear Scenarios For PYPL Stock

Forecasting PYPL is less about guessing a single price and more about mapping valuation to margin outcomes. The simplest structure uses two building blocks:

Earnings power in 2026 (shaped by TM$ growth, operating discipline, and buybacks)

What multiple the market is willing to pay (shaped by confidence in the durability of those margins)

Below is an illustrative scenario table that ties those drivers to a potential PayPal stock price range for 2026. It uses FY’25 non-GAAP EPS guidance as the anchor and stresses different paths for margin capture.

| Scenario |

What Changes by 2026 |

2026 EPS Range (Illustrative) |

P/E Range (Illustrative) |

Implied PayPal Stock Price Range (Illustrative) |

| Bull |

TM$ ex-interest remains strong, branded checkout stabilizes, loss rates stay contained, buybacks continue reducing share count |

$6.30 – $6.80 |

14× – 16× |

$88 – $109 |

| Base |

TM$ grows at mid-single digits, operating expenses remain disciplined, buybacks support per-share growth |

$5.80 – $6.30 |

12× – 14× |

$70 – $88 |

| Bear |

Mix shift pressures margins, loss rates drift higher, reinvestment reduces operating leverage |

$5.10 – $5.70 |

9× – 11× |

$46 – $63 |

These are scenario ranges, not price targets. The key point is the transmission mechanism: if margin dollars rise faster than expenses, the multiple can expand. If that link stays weak, the stock can keep trading like a value name with a capped multiple.

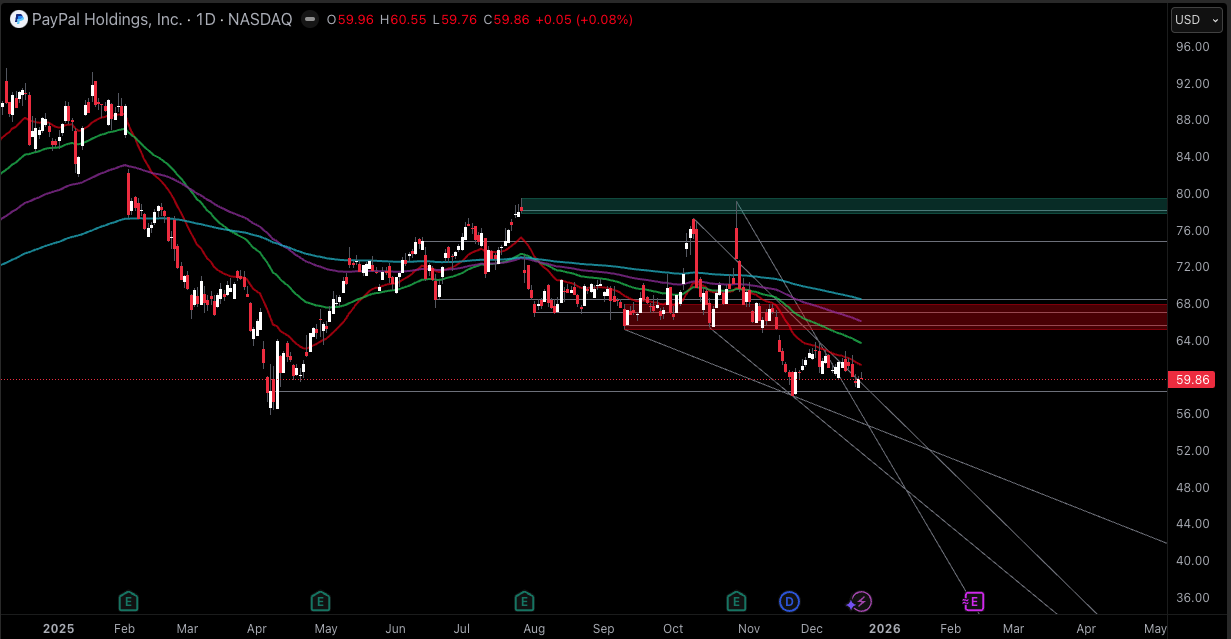

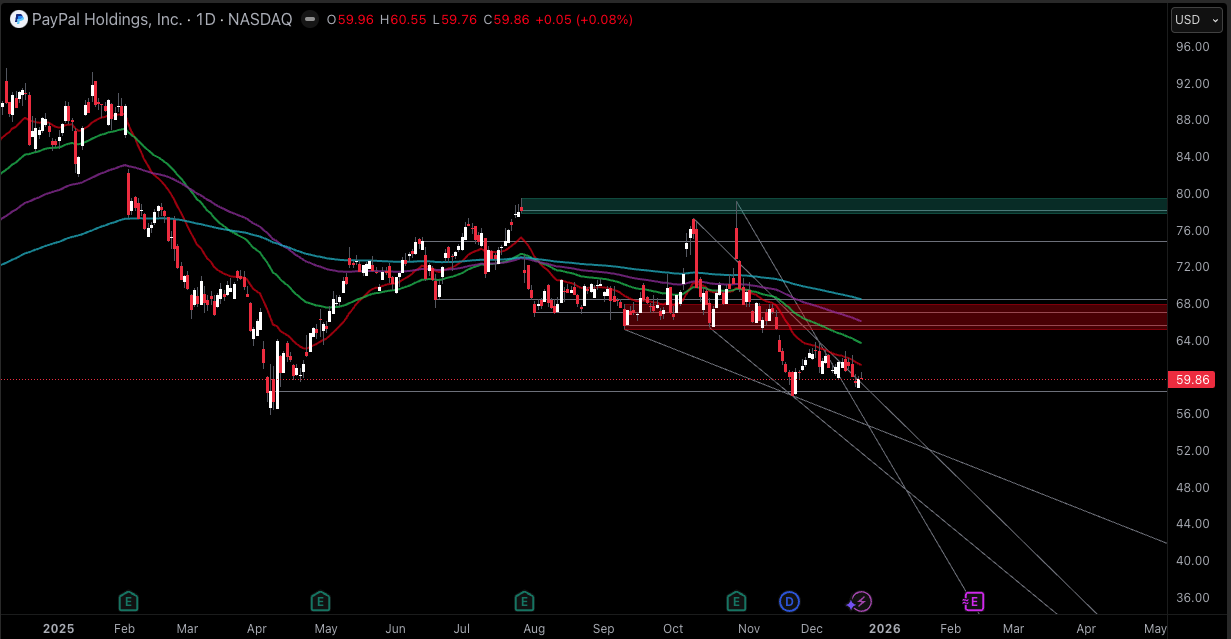

Technical Backdrop: Where PYPL Stock Needs To Improve To Change Sentiment

Technical analysis doesn’t replace fundamentals, but it helps explain positioning and trader behavior around support and resistance.

The technical snapshot shows:

With PYPL stock trading near those moving averages and RSI sitting below the midline, the chart reads as fragile momentum rather than a confirmed rebound.

Levels That Tend To Matter Into 2026

| Level Type |

Price Zone |

Why It Matters |

| Support 1 |

$55.85 |

52-week low area and a clear “line in the sand” for bulls |

| Support 2 |

$52.00 |

Psychological support and a likely risk-off flush target if guidance disappoints |

| Resistance 1 |

$63.50 |

First meaningful supply zone where rallies often stall without new catalysts |

| Resistance 2 |

$70.00 |

Sentiment pivot; a sustained break would likely trigger a broader rerating debate |

| Pivot |

$59.50 – $60.00 |

The current battleground; holding above keeps the bounce thesis alive |

If the PayPal stock price cannot hold above long-term averages during strong quarters, it usually means investors want clearer margin upside before paying up.

Catalysts That Can Reshape The 2026 Outlook

Buybacks and capital return

The guidance for roughly $6 billion of FY’25 repurchases is large relative to PayPal’s current market cap, so per-share math can improve even with moderate revenue growth.

BNPL balance sheet strategy

In September 2025, PayPal announced a two-year agreement for funds managed by Blue Owl to purchase about $7 billion of U.S. BNPL receivables, while PayPal remains responsible for underwriting and servicing. This kind of externalization can reduce balance-sheet intensity and smooth credit risk through the cycle.

Tracking TM$ excluding interest on customer balances

PayPal is explicitly steering investors toward TM$ ex-interest as a key performance lens. That metric rose 7% in 3Q’25, and FY’25 guidance implies continued mid-single-digit growth.

Risks That Could Keep The PYPL stock multiple compressed

Loss rates: The transaction loss rate was 0.09% in 3Q’25 and has moved higher versus earlier periods shown in PayPal’s own table. If that trend persists, it can offset improvements elsewhere.

Rate sensitivity: Interest on customer balances can be a tailwind when rates are high and a headwind when rates fall, which is why the ex-interest margin lens matters.

Engagement and activity metrics: Active accounts were 438 million in 3Q’25, while total payment transactions declined to 6.331 billion in the quarter. If activity per account stays soft, growth has to come more from monetization and product mix.

Earnings gap risk: The next earnings window is currently flagged around Feb 3, 2026 (some calendars mark it as unconfirmed), which matters because PYPL stock often reprices quickly when guidance changes the margin narrative.

Margin mix risk: Investors should keep watching the relationship between transaction margin dollars, operating income, and expense discipline. In 3Q 2025, transaction expense rate was 0.89% of TPV and transaction and credit loss rate was 0.11%, both key swing factors for profitability if the credit cycle or mix shifts.

Capital return expectations: The dividend initiation (declared at $0.14 per share quarterly) is supportive for perception, but it also raises expectations that free cash flow remains resilient while investment continues.

Macro sensitivity: PayPal stock price is indirectly tied to consumer spending trends, cross-border activity, funding costs, and the broader market’s appetite for rerating cash-generative growth stocks.

Frequently Asked Questions (FAQ)

1. What is the PayPal stock forecast for 2026?

A practical forecast uses scenarios tied to margin outcomes. If EPS reaches roughly $5.80 to $6.30 and the market applies a 12x to 14x multiple, the PayPal stock price could land around $70 to $88. Wider outcomes depend on TM$ and operating leverage.

2. Why do transaction margin dollars matter for PYPL stock?

TM$ tracks PayPal’s core profit pool after volume-based costs. It helps explain why TPV growth alone can mislead. PayPal also reports TM$ excluding interest on customer balances to reduce rate-driven distortion, which is useful when interest income swings with policy rates.

Is PayPal still generating strong free cash flow?

In 3Q’25, PayPal reported free cash flow of about $1.7 billion and guided FY’25 free cash flow to $6 billion to $7 billion. That cash generation supports buybacks and provides flexibility even if growth is uneven.

2. What Margin Metrics Matter Most For PayPal In 2026?

Two lines matter most for a 2026 outlook: transaction margin dollars and operating margin. In 3Q 2025, transaction margin dollars were $3.871B and GAAP operating margin was 18.1%. Those numbers signal the economic engine, and 2026 upside generally requires sustained improvement in operating leverage rather than one-off savings.

3. What price levels are important for the PayPal stock price right now?

The $56 to $60 region matters because it aligns with the lower end of the recent range and the 52-week low area. Resistance sits near the low $60s because the 50-day and 200-day moving averages are clustered around that zone.

4. How do interest rates affect PayPal’s margins?

Interest earned on customer balances can rise when rates are high and fade when rates fall. PayPal’s guidance explicitly references lower interest on customer balances as a headwind, so monitoring TM$ excluding that interest component can give a clearer read on underlying operating performance.

Conclusion

Right now, the market is basically saying: “PayPal is still a strong business, but prove the profits are improving.” That’s why PYPL stock can post decent numbers and still struggle to climb. Traders are not just looking for more sales or more payment volume. They want to see PayPal keep more money from each transaction.

So for 2026, the main question is this: Can PayPal grow its profit per transaction while keeping costs and losses under control?

If PayPal’s margin dollars keep rising steadily and costs don’t creep up, the PayPal stock price has room to recover because investors will likely pay a higher valuation again.

If margins stay “okay” but don’t improve much, PYPL can still hold up because it generates cash, but upside may be slower and smaller.

If costs rise, competition forces lower pricing, or losses increase, the PayPal stock can stay stuck or slip because the market won’t reward growth that doesn’t turn into profit.

For anyone new to trading, the takeaway is simple: watch profits, not hype. The best signs for PayPal into 2026 will be improving margin trends, steady expense control, and consistent cash flow. If those show up quarter after quarter, the stock doesn’t need a perfect story to move higher.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.