PayPal stock (NASDAQ: PYPL) has taken a sharp turn in 2025, falling over 25% year-to-date and raising serious questions from investors and analysts alike.

Despite maintaining profitability and launching strategic initiatives, shares continue to slide, leaving many wondering: why is PayPal stock down in 2025, and can it recover?

In this article, we break down the real reasons behind the decline, examine the latest financial data, and explore what's next for PYPL through the end of the year and into 2026.

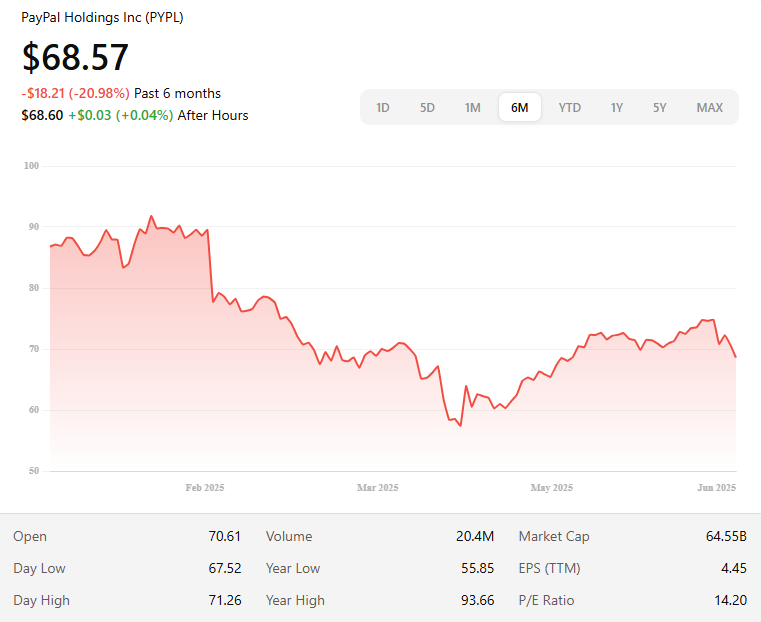

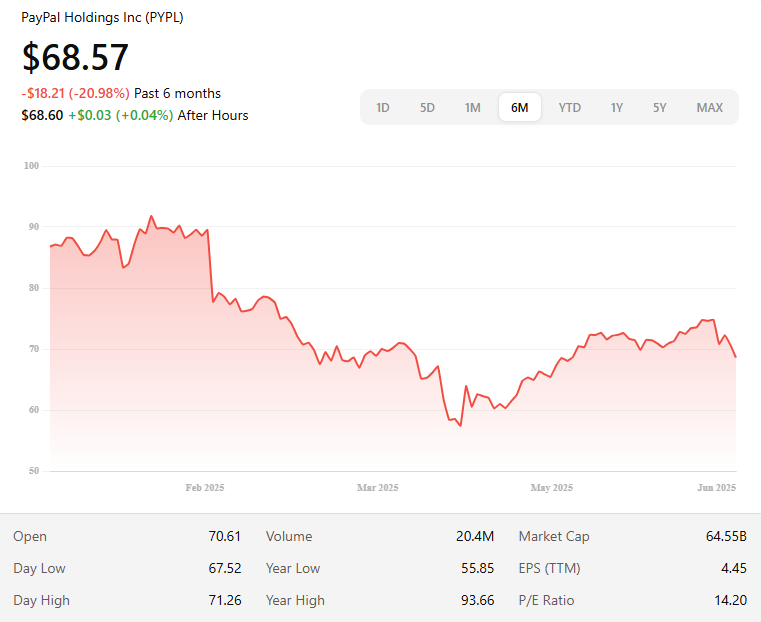

PayPal Stock Performance in 2025 So Far

PayPal's stock has steadily declined through the first half of 2025, falling from around $81.20 in early January to $68.57 by mid-June, representing a decline of ~15.6%.

While not catastrophic in percentage terms, the decline is significant given broader tech market resilience and PayPal's history of solid earnings. Here's what happened month by month:

| Month |

Closing Price (avg) |

Monthly Change |

| Jan |

$81.20 |

— |

| Feb |

$78.45 |

–3.4% |

| Mar |

$72.30 |

–7.8% |

| Apr |

$70.10 |

–3.0% |

| May |

$69.80 |

–0.4% |

| Jun |

$68.57 |

–1.8% |

January 2025 – Start of Caution

Opening Price: ~$81.20

Closing Price: ~$78.45

Change: –3.4%

January began with optimism as PayPal entered the year with expectations of stronger post-holiday spending. However, sentiment shifted quickly after management hinted at muted consumer demand during holiday periods and flat Q4 revenue despite reporting healthy net income.

Investors also reacted to January's merchant fee hikes, which drew criticism and highlighted PayPal's monetisation challenges amid rising competition.

February 2025 – Market Pullback on Guidance

Opening Price: ~$78.45

Closing Price: ~$72.30

Change: –7.8%

In February, PayPal reported its Q4 2024 results. While the company exceeded earnings-per-share (EPS) expectations, it fell short on revenue and provided a cautious outlook for the future. It disappointed investors who were looking for signs of renewed growth.

The stock dropped sharply after the earnings call, and analysts began lowering price targets due to the lack of revenue momentum.

March 2025 – Regulatory Fears Intensify

Opening Price: ~$72.30

Closing Price: ~$70.10

Change: –3.0%

In March, news broke of potential EU tariffs targeting U.S. digital service providers, including PayPal, Amazon, and Stripe. Though these measures were not immediate, they injected regulatory uncertainty into the stock's outlook. Combined with already-soft fundamentals, the stock continued its downward drift.

April 2025 – Flat Trading Despite Strong EPS

Opening Price: ~$70.10

Closing Price: ~$69.80

Change: –0.4%

In late April, PayPal's Q1 earnings report revealed strong profitability, with EPS growth driven by share buybacks and effective cost controls. However, revenue increased by only 1% year-over-year, which raises concerns.

The company also maintained full-year guidance rather than upgrading it, signalling no short-term growth catalysts. Investors saw this as a signal of stagnation, and the stock barely moved.

May 2025 – No Spark from Strategic News

Opening Price: ~$69.80

Closing Price: ~$68.57

Change: –1.8%

In May, PayPal announced advancements in its unified commerce platform, along with integrations among PayPal, Venmo, and branded checkout.

While this confirmed the execution of its long-term strategy, there were no concrete numbers or acceleration in user growth or merchant adoption. Consequently, the market's reaction was subdued, and the stock price slipped slightly.

June 2025 – Stuck in a Holding Pattern

As of mid-June, PayPal stock continues to hover just below the 200-day moving average (~$75) and remains vulnerable to further weakness if upcoming earnings or macroeconomic data disappoint. The lack of a clear growth catalyst keeps investors on the sidelines, with short-term sentiment leaning bearish.

Why Is PayPal Stock Down? 7 Key Reasons

1. Revenue Stagnation Despite Profitability

While PayPal continues to generate strong earnings per share (EPS) and impressive free cash flow—estimated at $6 billion for the year—its top-line growth has flatlined. Revenue in Q1 2025 increased just 1% year-over-year, missing Wall Street expectations and disappointing investors who expected more from a leading fintech platform.

The slowdown in total payment volume (TPV) growth is even more concerning, particularly in PayPal's core checkout business. In the tech industry, markets usually prioritise growth over profitability, and the sluggish revenue expansion has led to the perception that PYPL is more of a "value trap" than a growth opportunity.

2. Weak Forward Guidance & CEO Caution

PayPal's management has been notably cautious in earnings calls this year. Despite beating EPS estimates, they maintained a neutral full-year outlook, citing macro uncertainty and competitive pressure. This lack of bullish forward commentary contrasts with other tech names offering upbeat guidance, which only amplified investor scepticism.

In times of market stress—where interest rates are high and investors are risk-averse—confidence and clarity from management become vital. PayPal's guarded tone left analysts unsure whether the company expects growth to reaccelerate or stagnate further.

3. Intensifying Competitive Pressure

Fintech has become an increasingly crowded space, and PayPal now faces stiff competition from tech giants and emerging players alike:

Apple Pay continues to expand aggressively in point-of-sale and digital wallets.

Zelle and Cash App have taken a bite out of Venmo's market share in peer-to-peer payments.

Buy Now, Pay Later (BNPL) startups are pulling users away from PayPal's Pay Later offering, especially in international markets.

In early 2025, PayPal increased its fees to address margin compression, but this decision may have backfired. The higher costs have alienated both merchants and users, who now have many alternatives.

4. Negative Merchant Reaction to Fee Hikes

In January, PayPal increased merchant transaction fees—from 3.49% to 4.99% on its Pay Later product, and similar hikes across card-based services. The market's immediate reaction was negative: PYPL dropped 5% the week after the change as merchants publicly criticised the move.

While fee adjustments may have boosted short-term revenue, they risk damaging long-term platform loyalty—particularly from small businesses that are price-sensitive and critical to PayPal's network effect.

5. Regulatory Uncertainty and Political Risk

PayPal is also caught in a growing web of regulatory and political friction. Digital services taxes in Europe, rising scrutiny over fintech fees, and looming U.S. stablecoin legislation (which affects PayPal's PYUSD project) all add to the fog.

In March 2025, PayPal was briefly caught in the headlines over proposed EU tariffs on U.S. digital platforms. Though largely symbolic, the negative attention sent the stock lower and highlighted its vulnerability to geopolitical risk.

6. Execution Risk in Strategic Pivot

PayPal is undergoing a broad transition—from a digital wallet provider to a comprehensive commerce platform. It includes:

A new unified checkout experience across Venmo, PayPal, and merchant services.

Investment in AI-powered fraud tools and personalised commerce features.

Continued rollout of PYUSD, its stablecoin, aimed at payments and remittances.

While strategically sound, these bets carry execution risks. Investors are in a "wait and see" mode, and any delays or misfires—especially regarding Venmo monetisation or PYUSD adoption—could further dampen sentiment.

7. Weak Sentiment Across Fintech and Tech

Finally, PayPal's decline must be viewed within a broader context: fintech stocks are under pressure across the board. Rising interest rates have made high-growth names less attractive. With the Federal Reserve holding rates above 4% and consumer spending slowing, digital payment volumes have come under strain.

As investors rotate into safer, dividend-paying sectors like energy and healthcare, growth stocks like PayPal have fallen out of favour—even when fundamentals are intact. Until macro conditions improve or fintech sentiment recovers, PayPal may continue to face valuation headwinds.

Will PYPL Continue Dropping in 2026?

H2 2025 Forecast (July–December)

Analyst targets range between $70 and $82 by year-end 2025, contingent on Q3 performance and macro recovery. If PayPal shows meaningful branded checkout gains or Venmo monetisation uptick, the stock could retest the $75–78 level. However, absent that, it may remain stuck near current levels ($68–70).

Base Case: $72–75

Bear Case: $60–65

Bull Case: $80+

2026 Outlook

2026 could offer recovery if:

Interest rates ease, and consumer confidence returns.

Digital payment growth rebounds globally.

Strategic innovations (e.g., PayPal stablecoin, embedded finance) gain traction.

Sustained earnings and revenue growth could push the stock back toward $85–95 levels—still well below pandemic highs but a significant rebound from current valuations.

Conclusion

In conclusion, PayPal's 2025 stock decline is not due to a lack of profitability or cash generation. Rather, it reflects persistent revenue fatigue, cautious guidance, tough competition, regulatory headwinds, and weak fintech sentiment.

PayPal has a strong balance sheet and a robust innovation pipeline. While it is not a collapse, the company must demonstrate its ability to reaccelerate growth to regain investor trust.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.