Paypal stock fell hard after its latest earnings report because the market did not like what it heard about 2026, and it did not like what it inferred from a sudden leadership reset.

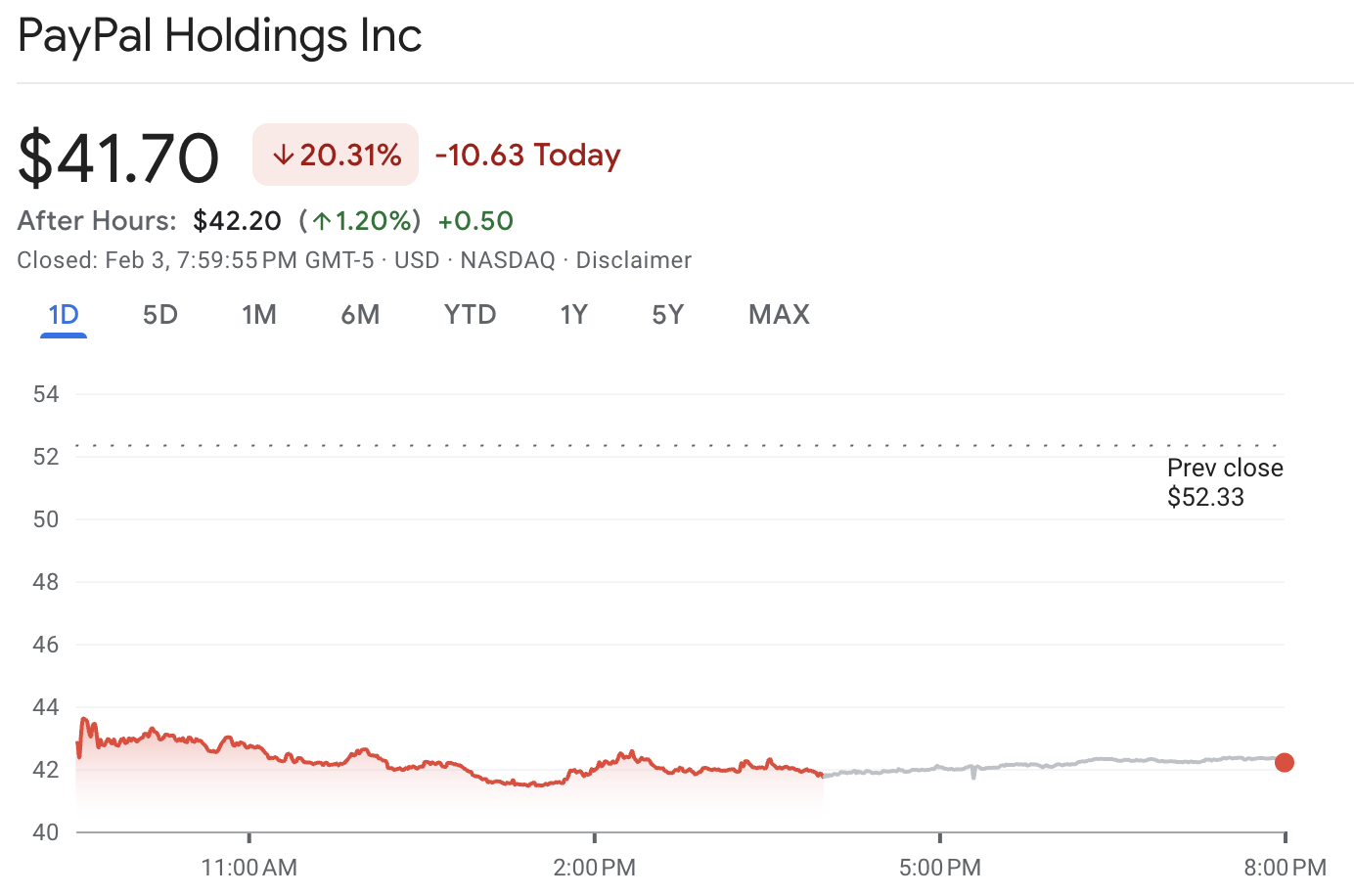

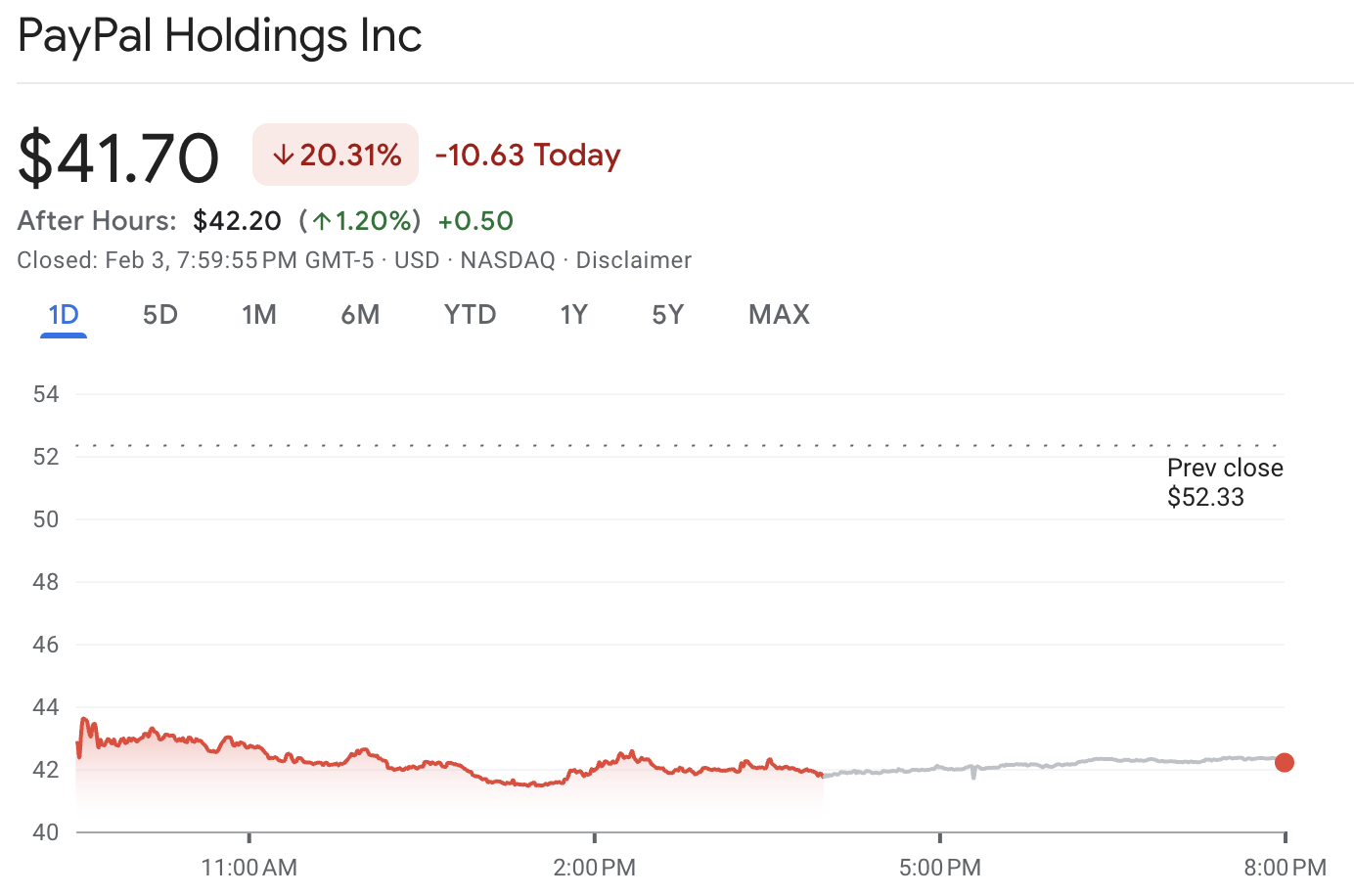

PYPL closed around $41.70 after dropping about 21% on the day, with an intraday low near $41.44, which pushed the stock back to levels last seen in 2017.

The reason? It was driven by a combination of

Q4 revenue and adjusted EPS missing expectations

The 2026 outlook looking weaker than Wall Street expected

Growth in branded checkout slowed sharply

The CEO change added uncertainty

What PayPal Earnings Reported and Why the Market Still Sold It

| Metric |

Q4 2025 |

YoY change |

Why it mattered on the day |

| Net revenues |

$8.676B |

+4% |

Revenue growth was steady, but not strong enough to offset weaker outlook. |

| Non-GAAP EPS |

$1.23 |

+3% |

Missed consensus expectations cited by major outlets. |

| TPV |

$475.1B |

+9% |

Volume was solid, but investors worried about mix and competitive pressure. |

| Non-GAAP operating margin |

17.9% |

-9 bps |

Margin softness reinforced the idea that investments will weigh near term. |

| Free cash flow |

$2.19B |

Flat |

Cash generation held up, but the debate shifted to 2026 profitability. |

| Share repurchases (Q4) |

$1.5B |

n/a |

Buybacks supported the long-term story but did not fix the guidance problem. |

PayPal reported Q4 net revenues of $8.676 billion and non-GAAP EPS of $1.23, while noting that branded checkout execution "has not been where it needs to be."

Although the quarter appeared stable, notable underlying issues existed. Net revenues increased by 4% YoY, while total payment volume rose by 9% to $475.1 billion, indicating a solid payments platform at scale.

PayPal's stock fell because investors focused on what comes next rather than what just happened.

4 Main Reasons Behind PayPal's Stock Dropping Over 20%

1) A Weaker 2026 Outlook

PYPL's guidance was the center of gravity for the selloff. Management has projected a mid-single-digit decline in both GAAP and non-GAAP earnings per share (EPS) for the first quarter of 2026. They also expect a mid-single-digit decrease in FY 2026 GAAP EPS relative to FY 2025.

The company has clearly indicated that 2026 will be a year where diversified growth is counterbalanced by lower interest rates and the short-term effects of investments aimed at enhancing the customer experience and expanding checkout options.

| Period |

Metric |

Guidance language |

Prior-year comparison provided by PYPL |

| Q1 2026 |

GAAP EPS |

Mid-single digit decline |

$1.29 |

| Q1 2026 |

Non-GAAP EPS |

Mid-single digit decline |

$1.33 |

| FY 2026 |

GAAP EPS |

Mid-single digit decline |

$5.41 |

| FY 2026 |

Non-GAAP EPS |

Low-single digit decline to slightly positive |

$5.31 |

This is the heart of the problem. Investors were not positioned for a year in which profits could go backward while competition intensifies.

2) The Quarter Missed

| Metric |

Reported |

Expected (as reported) |

Market takeaway |

| Revenue |

$8.68B |

$8.77B to $8.79B |

Demand and mix did not land where analysts hoped |

| Adjusted EPS |

$1.23 |

$1.29 |

Profit delivery fell short at the wrong time |

As highlighted above, PayPal did not miss by a considerable amount, but the direction mattered. When a stock is trying to rebuild trust, even a slight miss can feel like a setback.

Why Did This Hit PayPal Stock?

PayPal needed a clean beat to support the idea that growth is stabilizing.

A miss keeps the focus on competitive pressure and execution risk.

It also makes investors lean harder on guidance, which was the second problem.

3) Branded Checkout Weakness

PayPal can grow in several areas, but branded checkout remains one of the most watched lines because it reflects consumer choice at the point of purchase.

PayPal itself pointed to weakness in branded checkout, citing pressure tied to US retail, international headwinds, and tough comparisons in high-growth verticals.

The earnings release provides clues to the tension inside the model:

Active accounts rose to 439 million, up 1.1%, but growth is incremental rather than accelerating.

Payment transactions per active account fell to 57.7, down 5% on a trailing 12-month basis.

Payment transactions increased by 2% to reach 6.8 billion. While this indicates growth, it does not represent breakout growth for a company expected to gain market share.

This is the subtle reason the market reaction felt harsh. PayPal stock no longer receives a valuation like an early-growth platform. It is being valued like a mature platform that must prove it can still defend its core checkout footprint while building new levers.

4) The CEO Change Amplified the Downside Because It Changed the Narrative

A weak quarter can often be attributed to factors such as timing, product mix, or broader economic conditions. A CEO change arriving at the same time makes it harder for the market to treat a miss as "just a quarter."

PayPal announced that its board appointed Enrique Lores as President and CEO, effective March 1, 2026, replacing Alex Chriss, and appointed David W. Dorman as Independent Board Chair, effective immediately. The company stated Jamie Miller, the CFO and COO, will serve as Interim CEO until the transition date.

Most importantly, the board explained the decision in straightforward language. It stated the "pace of change and execution was not in line with the Board's expectations," following a detailed evaluation of the company's position relative to competition and the broader industry landscape.

Why Leadership Risk Hits a Stock Immediately

Investors usually assume a CEO transition increases near-term uncertainty, even when the incoming executive is experienced.

A board-driven reset signals that internal goals were missed, and it raises the chance that key projects will be re-scoped.

Guidance that is already soft becomes harder to "buy through" when accountability is being reset at the top.

That is why the CEO change did not cushion the stock. It contributed to the feeling that the turnaround is taking longer than the market was willing to tolerate.

What Matters Next: The Numbers That Could Calm the Market

If you are tracking whether PayPal stock can recover, focus on a short list of operating signals. These are the factors that commonly influence investor confidence from one quarter to the next.

| Metric to watch |

Why it matters |

What would help the stock |

What would pressure the stock |

| Branded checkout growth |

Core demand signal |

Re-acceleration from 1% pace |

Another weak quarter |

| Transaction margin trend |

Profit quality |

Stable or improving margins |

Margin compression |

| Active accounts and engagement |

Usage health |

Improving engagement trends |

Declining activity per user |

| Guidance consistency |

Trust signal |

Clear targets and steady updates |

Repeated guide-down risk |

The branded checkout slowdown is already in focus because it was highlighted in coverage of this quarter.

PayPal Stock Technical Analysis After the Earnings Gap

| Indicator |

Level |

What it implies |

| RSI (14) |

9.507 |

Oversold conditions are extreme, so short-covering rallies can appear quickly. |

| MA5 (simple) |

42.00 |

Near-term reference point for any bounce attempt. |

| MA20 (simple) |

49.00 |

First "bigger" resistance zone if the stock rebounds and sellers re-engage. |

| MA50 (simple) |

52.52 |

A longer-distance ceiling that reflects the pre-earnings regime. |

From a technical analysis perspective, PayPal is in a sharp downtrend on the daily chart after a major gap lower.

After a one-day drop of roughly 20%, technicals become less about forecasting and more about identifying where forced selling may slow and where rebound rallies may stall.

Daily technical reads flagged PYPL as "Strong Sell" on moving averages, with a very oversold 14-day RSI of 9.507, which reflects how extreme the selloff was

Pivot Points

| Support/Resistance |

Level |

| S3 / S2 / S1 |

40.88 / 41.34 / 41.66 |

| Pivot |

42.13 |

| R1 / R2 / R3 |

42.45 / 42.92 / 43.24 |

A typical post-gap pattern is a fast bounce that stalls below the pivot area, followed by a second test of the lows if buyers do not see better follow-through in guidance commentary and competitive messaging.

Frequently Asked Questions

1. Why Did PayPal Stock Fall After Earnings Today?

PayPal's stock fell after its fourth-quarter results missed expectations and it issued disappointing guidance. Additionally, the announcement of a CEO change heightened uncertainty as investors processed a weaker profit outlook.

2. Did PayPal's Q4 Results Actually Look Weak?

The top line grew 4% year over year, and TPV rose 9%. However, non-GAAP EPS was reported at $1.23, while revenue reached $8.676 billion, falling short of analyst expectations.

3. Is PayPal Stock Too Risky to Trade Right Now?

The stock is in a high-volatility phase, and technical indicators are signaling extreme oversold conditions.

Conclusion

In conclusion, PayPal stock fell after earnings because the market saw a mix of weaker results, softer guidance, and a CEO change that suggested urgency at the board level.

The next move will depend on whether PayPal can show that branded checkout trends are stabilizing and that profit expectations for 2026 are not sliding further.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.