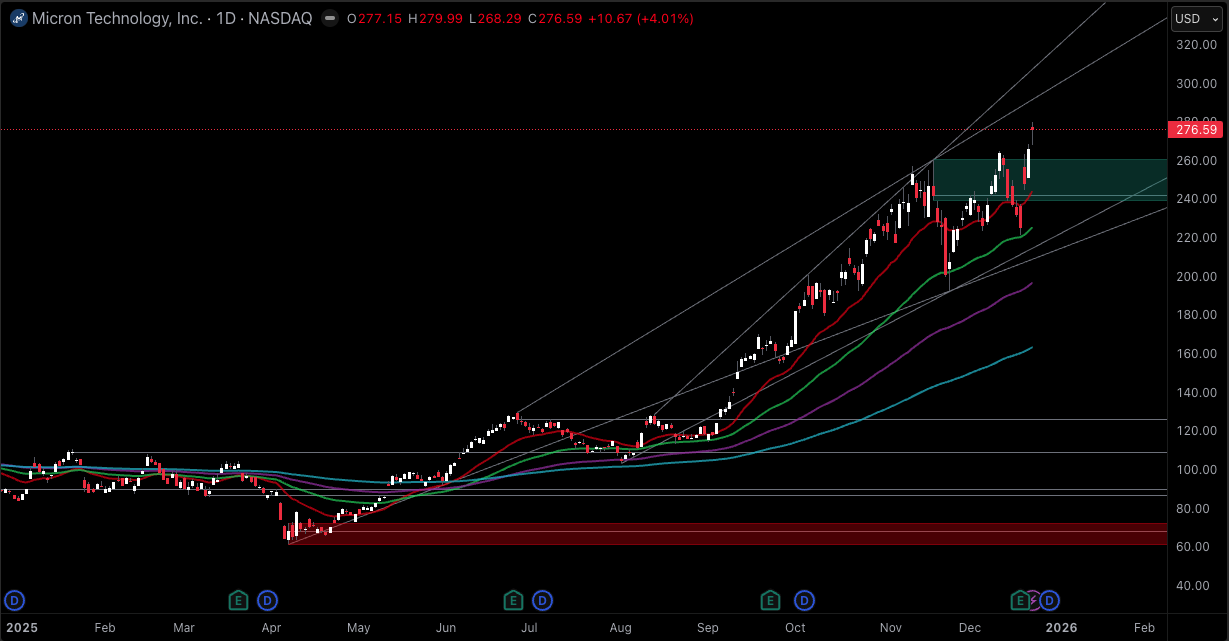

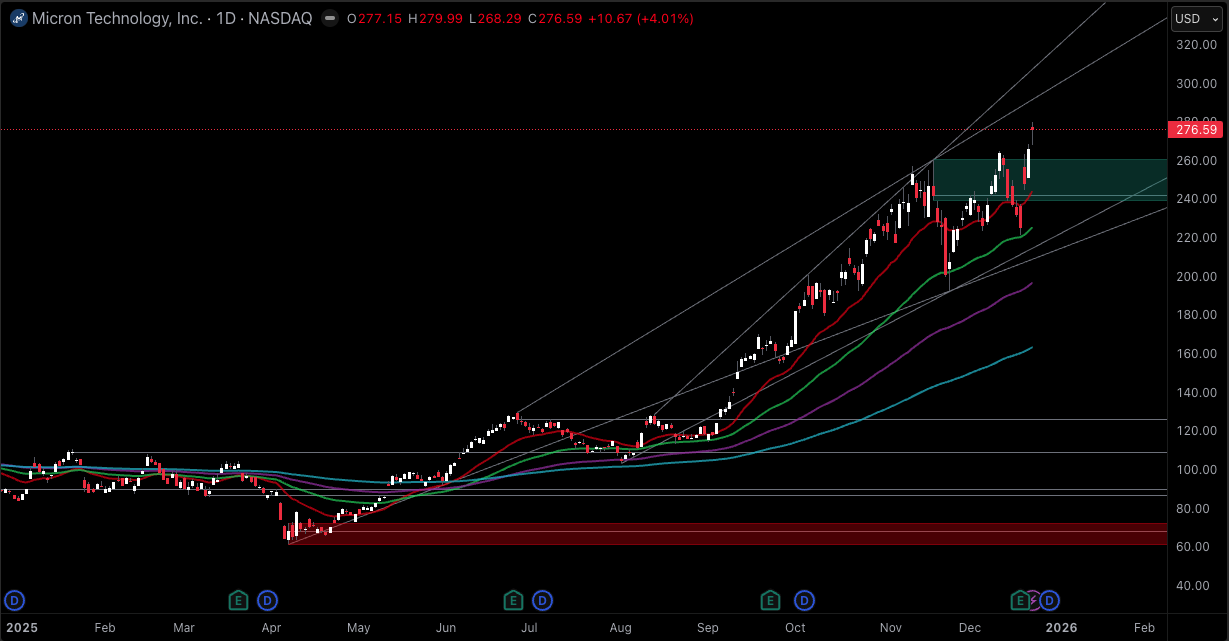

Micron stock is trading around $276.59, up roughly 4% on the session, after setting a record closing high recently. In plain terms, MU stock is not just higher, it is making new highs at a pace that forces the market to reprice it, not slowly revalue it.

The performance numbers explain why it has everyone’s attention. Over the last five sessions, MU stock is up about 16%. Over roughly one month, it is up about 33%. Year to date, it is up about 229%, which is the kind of move you usually only see when earnings expectations are being revised sharply higher.

So why is Micron stock going up? Because the market is paying for two things at the same time: tighter memory supply and stronger pricing, especially for high-end memory tied to AI servers.

Micron’s latest outlook reinforced that story, with management pointing to tightness in high-bandwidth memory and a profit forecast that came in well above expectations, which is exactly the mix that keeps buyers stepping in even at record levels.

Key Takeaways For Micron Stock

MU Stock is trading around $276.59, after setting a record high of $279.99 recently, confirming a clean break into price discovery.

The rally is being powered by AI data center buildouts that are pulling forward memory demand, especially high-bandwidth memory (HBM), while supply remains constrained.

Micron’s latest results and guidance justify the market’s excitement: FQ1 revenue was $13.64 billion with non-GAAP EPS of $4.78, and FQ2 guidance calls for $18.70 billion revenue and $8.42 EPS.

Price action is stretched, but not irrational: MU is well above key moving averages, and volatility has expanded, which typically comes with late-stage momentum runs.

The main risk is not a headline. It is the cycle: any sign that supply is catching up, or that pricing power is fading, can change the tape quickly.

Why Micron Stock Is Going Up: The Fundamentals

1) AI data centers are pulling memory into a structural shortage

The single most important driver is demand intensity. Micron has been explicit that customers’ AI data center buildout plans have pushed demand forecasts higher, and that industry supply remains short of demand for the foreseeable future.

HBM is the pressure point. Micron highlights a key industry constraint that many equity investors underestimate: HBM consumes far more manufacturing resources than standard server DRAM, citing a 3-to-1 trade ratio with DDR5 that becomes even more demanding in newer HBM generations.

In plain terms, even if wafer starts rise, the mix shift toward HBM can still keep overall supply tight, because the same factory footprint produces fewer “equivalent” bits of mainstream memory.

2) Pricing power is now visible in the income statement

Micron’s latest financials show the key change. The company reported FQ1 non-GAAP revenue of $13.64 billion, gross margin of 56.8%, and non-GAAP EPS of $4.78.

More importantly for MU Stock sentiment, guidance moved the goalposts. The company guided FQ2 revenue to $18.70 billion (± $400 million), gross margin to 68.0% (± 1.0%), and EPS to $8.42 (± $0.20).

That is why MU can rally even after a huge run. When margins expand and guidance resets higher, valuation debates pause, because the “E” in P/E is moving faster than the price.

3) DRAM strength is doing the heavy lifting, and the numbers confirm it

Micron’s own breakdown shows DRAM revenue of $10,812 million, up 20% quarter-on-quarter and 69% year-on-year, alongside NAND revenue of $2,743 million, up 22% both quarter-on-quarter and year-on-year.

That matters because MU Stock is a pricing and mix story:

DRAM tends to drive profitability when the cycle is tight.

HBM is a margin and visibility product, because it is sold into higher-value data center platforms with longer planning horizons.

4) Supply is not catching up quickly, and the industry is saying it out loud

Micron says tightness in DRAM and NAND is expected to persist through and beyond calendar 2026, citing cleanroom buildout lead times and the sheer scale of demand.

IDC is also pointing to below-normal supply growth expectations for 2026, with projected DRAM and NAND supply growth below historical norms.

This is the macro setup MU Stock bulls want: demand accelerating, supply constrained, and capital expansion slower than in prior cycles.

5) Capital spending is rising, but it is targeted to the bottleneck

Micron plans to raise fiscal 2026 capex to around $20 billion, primarily to support HBM supply capability and advanced DRAM node ramps.

Capex increases are a double-edged sword in memory. They support growth, but they can also plant the seeds of oversupply later. The market is currently rewarding Micron because supply is tight now, and management is framing capex as necessary just to keep up, not to flood the market.

6) The market is chasing confirmation from analysts and targets

After Micron’s recent results, several major outlets highlighted a wave of upward revisions and higher price targets tied to tighter memory pricing and HBM demand.

This is not the core reason MU Stock is up, but it amplifies the move. In late-cycle rallies, analyst target revisions often become a momentum accelerant, because they provide institutional buyers “permission” to add at higher levels.

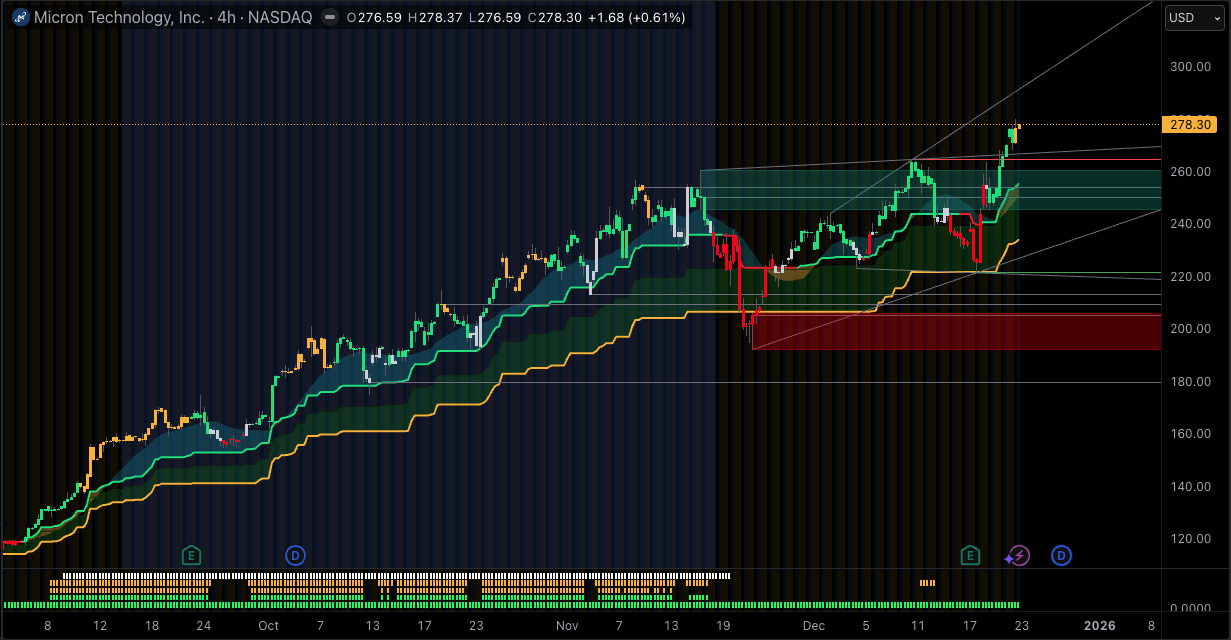

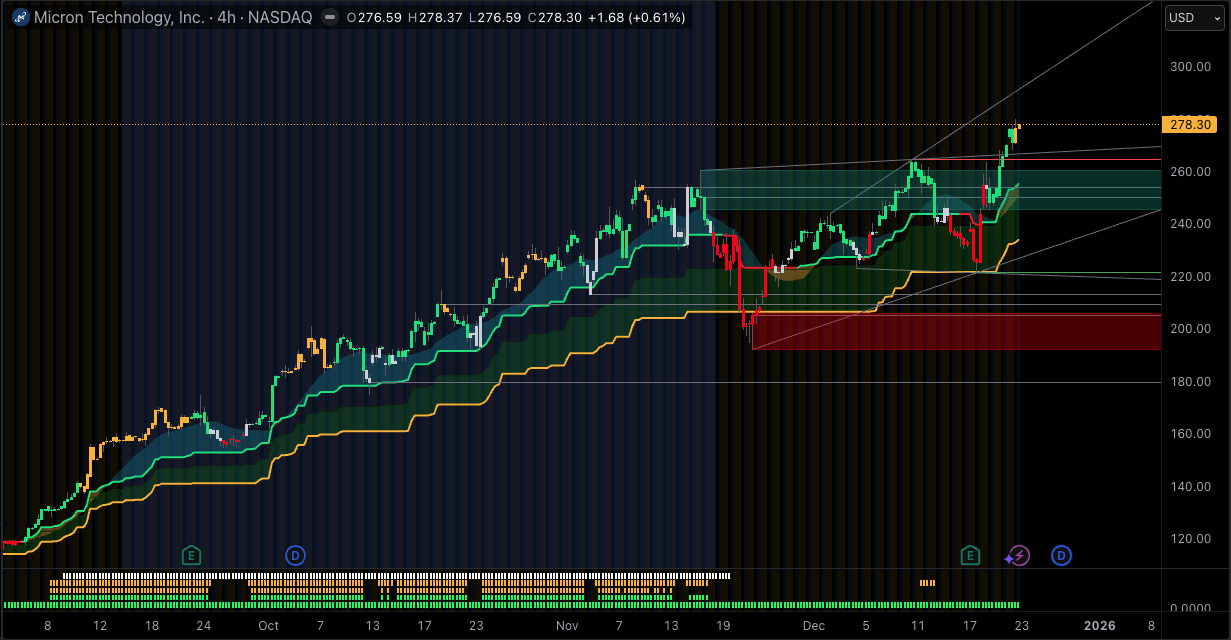

Technical Dashboard: MU Stock Indicators And Signals

| Indicator / Level |

Latest Value |

Signal / Comment |

| Last price |

$276.59 |

Price discovery phase, with buyers actively defending pullbacks. |

| 50-day moving average |

$229.27 |

Strong short-term trend as long as price remains well above this level. |

| 200-day moving average |

$142.33 |

Steep long-term uptrend, indicating the move has been fast and extended. |

| RSI (14, daily) |

65.04 – 70.89 |

Momentum is elevated, ranging from strong to near-overbought across feeds. |

| MACD (12,26) |

8.04 |

Trend remains positive; momentum traders typically stay long until rollover. |

| ATR (14-day) |

15.60 (5.64%) |

Large daily ranges signal late-stage breakout conditions; risk control is critical. |

| Key resistance |

$281.62 / $286.66 / $293.32 |

Overhead targets where profit-taking often accelerates. |

| Key support |

$269.92 / $263.26 / $258.22 |

Levels that separate a healthy pullback from a trend break. |

MU Stock Price Trend: Is The Uptrend Still Healthy?

Historical data shows roughly +16.46% over 5 sessions and +33.38% over 20 sessions, with year-to-date performance around +228.65%.

That combination matters because it tells you the rally is not creeping. It is accelerating.

Technically, the structure is still bullish, but it is also stretched:

MU is far above its 50-day and 200-day averages, which is classic momentum behavior during “re-rating” phases.

Volatility has risen, with ATR and measured daily ranges expanding, which often signals a market where dip-buyers are active but fast money is also taking profits into strength.

Resistance and support are now more important than chart patterns. When a stock is making new highs, the market uses levels to manage risk, not narratives.

MU Stock Outlook: What Matters Next

The Upside Case

MU Stock can keep working higher if three things remain true:

Memory pricing stays firm as contracts reset higher.

HBM supply stays sold out and visibility remains strong.

Guidance keeps ratcheting up, especially margins and free cash flow.

Micron’s own demand commentary supports that setup, and the company is guiding to materially higher near-term profitability.

The Base Case

More likely after a vertical move is digestion. In practice, that often looks like:

Using published pivot levels, MU has nearby reference points at $269.92 and $281.62 that can frame that range behavior.

The Downside Case

This rally breaks if the market starts believing the cycle is turning:

A clear sign of easing shortages.

A surprise supply response from the industry.

Guidance that suggests pricing is topping.

Policy shocks, including tariffs, which Micron notes are not included in its guidance assumptions.

If momentum cracks, the first technical “tell” is usually losing support and failing to reclaim it. On the published levels, that puts focus on $263.26 and $258.22.

Key Risks And Catalysts Traders Should Watch

Catalysts

Next earnings and guidance update: MU is trading like a stock where guidance matters more than the quarter.

HBM and data center commentary: confirmation that tightness persists through 2026 is the narrative anchor.

Capex and capacity timelines: $20 billion capex plans will be watched for signs of discipline vs expansion.

Risks

Cycle risk: memory always mean-reverts eventually, and the first signal is usually pricing.

Volatility risk: ATR and daily ranges are large, making leverage mistakes expensive.

Expectation risk: with MU at record highs, “good” is often not enough. The market wants “better than good.”

Frequently Asked Questions (FAQ)

1. Why is Micron Stock going up?

Micron Stock is rising because AI data center buildouts are driving higher demand for memory, especially HBM, while supply remains constrained. Micron is also guiding to sharply higher revenue and margins, which pushes earnings expectations higher and supports a re-rating.

2. Is MU Stock overbought right now?

Some indicators are stretched. RSI readings vary by data source, ranging from the mid-60s to low-70s, which signals strong momentum and sometimes near-overbought conditions. That does not force an immediate reversal, but it raises the odds of sharp pullbacks.

3. What are the key support and resistance levels for MU Stock?

Published technical levels show resistance near $281.62, $286.66, and $293.32, while support sits near $269.92, $263.26, and $258.22. Traders often use these zones to judge whether a move is a pullback, a breakout, or a breakdown.

4. What is the next major catalyst for Micron Stock?

The next major catalyst is the next earnings and guidance update, especially commentary on HBM demand, pricing, and supply tightness through 2026. Micron’s current outlook already implies major sequential improvement, so the market will watch whether that trajectory holds.

5. What could stop the MU Stock rally?

The biggest threat is the memory cycle turning. If pricing power fades, supply ramps faster than expected, or guidance stops improving, the market can reprice MU quickly. Policy shocks also matter, since Micron notes potential tariff impacts are not included in guidance.

6. How does HBM change Micron’s earnings outlook?

HBM is a higher-value product tied to AI accelerators, and Micron notes it strains supply because it uses far more manufacturing resources than standard DRAM. That tightness supports pricing, improves mix, and can lift margins, which is why investors treat HBM visibility as earnings visibility.

Conclusion

Micron stock is near $276.59 and sitting at record highs after a run of roughly +229% year to date. That kind of move does not come from “better sentiment” alone. The market has repriced MU stock because the earnings outlook has changed, driven by tight memory supply and surging demand for high-end AI memory, especially HBM. The recent guidance shock is a big part of why buyers have stayed aggressive even at new highs.

From here, MU stock is less about whether AI is real and more about whether the pricing and supply story stays tight enough to keep upgrading earnings expectations.

Micron has pointed to supply constraints lasting beyond 2026 and is planning major investment to expand capacity, which tells you demand visibility is strong, but it also reminds you how quickly the cycle can change once supply finally catches up.

For traders and investors, the mindset matters. At all-time highs, MU stock can keep trending higher longer than most people expect, but the pullbacks can be fast and sharp because positioning gets crowded.

If the next updates keep confirming tight supply, firm pricing, and higher margins, the trend can extend. If pricing cools or guidance stops stepping up, this is the kind of chart that can give back weeks of gains in a handful of sessions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.